409A Valuation for Different Funding Stages

Learn how 409A valuations differ across funding stages like Seed, Series A, B, and C, reflecting growth, risk, and compliance needs.

How do startups determine the value of common shares when they grant stock options, which are important for attracting top talent? Using the 409A valuation is the only way to grant tax-free stock options to employees of a privately held company. In spite of the fact that it’s been around for 15 years, the 409A valuation still leaves many people scratching their heads as to how it works. It has changed from an assortment of now-outdated techniques and wide ranges to a set of established, well-defined methodologies and inputs that are better understood.

409A valuation and Funding stages

The 409A valuation is a method used in determining the fair market value of your company’s common stock. The share price of the product you offer to anyone who is given common stock will be determined by this valuation.

Understanding startup funding stages

The vast majority of successful startups have raised money through multiple rounds of outside funding, with the exception of a select few that are able to do so with little or no outside help.

We’ll look at what the different funding stages are, how they work, and how they differ.

- Pre-Seed Funding – Funding for a new company begins at such an early stage that it is rarely counted as part of its total funding. When a company is in its infancy, the founders are said to be in the “start-up stage”. The most common “pre-seed” funders are the founders themselves, as well as close friends, supporters, and family.

- Seed Funding – The first stage of equity investment is known as seed funding. It typically represents the first official money that a business venture or enterprise raises. A startup’s first steps, such as market research and product development, are made possible with the help of seed funding. A company’s final products and target market can be determined with the help of seed funding.

- Series A Funding – Series A funding can be an option for a company that has established a track record and is looking to expand its user base and product offerings. Investors in Series A funding are looking for more than just great concepts. Instead, they’re on the lookout for businesses that have great concepts but also a solid plan for turning those concepts into a thriving, profitable enterprise.

- Series B Funding – Series B rounds are all about scaling up businesses beyond the startup stage. Investors aid startups by broadening their customer base. The company will use the Series B funding to expand in order to meet this level of demand. Other venture capital firms that specialize in later-stage investing have joined Series B, which makes it different.

- Series C Funding – Those who make it to Series C funding sessions are already doing well. These businesses are always on the lookout for new sources of funding to aid in the development of new products, the expansion into new markets, or even the acquisition of other businesses. The goal of a Series C round is to double an investor’s capital.

Why Do Startups Need Seed/Series Funding?

Seed funding helps a business get off the ground before revenue is generated. It’s a good option for new businesses and those in growth mode because it offers much-needed financial assistance upfront.

It can cover infrastructure, marketing, development, and even initial hiring costs. Any business needs investment, and seed funding is the first drop. Failing due to a lack of necessary working capital or cash reserves is one of the most common reasons for startups to fail.

Other reasons why seed funding is critical include:

- Make up for a lack of resources.

- Minimizes entrepreneur risk

- Involves strategic partners in decision-making

- Working capital availability

- Scaling up and accelerating growth

How can founders get funding for their startups?

Every business needs valuation since it determines how much stock an entrepreneur must provide an investor in exchange for cash. In exchange for a seed investment, a firm with a higher valuation must give fewer equity or shares to an investor. Startup valuation is important for both entrepreneurs and investors since it helps them estimate the return on their investment.

Factors that Influence the Valuation of a Company at Seed Stages

After seeing how a faulty value may make or break a sale, the next natural issue is determining startup valuation. But first, let’s look at the aspects that affect a company’s valuation:

- Market reputation – Before moving through with the valuation round, founders must ensure a positive market image. An investor’s first consideration is the founder’s image and skill.

- Traction of a company – This is one of the key tenets affecting seed-stage valuation. Traction is the quantitative proof that a startup is getting momentum. Traction is the most crucial factor motivating investors to invest in a firm.

- Business idea or prototype – The creation of a prototype is a crucial factor that might impact the choice of an investor. Always have a working prototype on hand before going in to pitch to investors.

- Revenue – Without question, revenues are critical for any business because they simplify the valuation process for investors. So, if a product has already hit the market and is generating revenue, it may sway an investor’s choice in favor of that firm and serve as a closer deal.

- Distribution channel – It is extremely likely that perhaps the product/service will still be in the early phases of any startup. As a result, founders must be wary of the distribution channel they choose, as it can directly impact the company’s valuation.

- Market size and industry – If the startup belongs to a thriving industry, it is quite likely that investors will pay a premium. This means that it is crucial to choose the proper sector as it will boost the worth of a commercial business.

When organizations enter a new market or create a market through a creative company concept, founders have two responsibilities ahead of them. First, persuade investors, then persuade customers that their business concept is brilliant.

409A valuations for Seed Companies

Startup Company Valuation is the process of determining the startup’s value. Important for startups and entrepreneurs, the valuation process determines how much equity they must provide an investor in exchange for financing.

It also depends on an investor’s willingness to pay a premium to enter a deal. Sometimes, an entrepreneur seeking funding is so desperate that they undervalue their company to obtain funds. Founders want a high valuation, whereas investors want a low valuation with a great ROI. Below are 409A valuations for different funding stages.

409A valuations for Series A

Early-stage companies have a 12-month safe harbor to grant options at the 409A strike price. The exception is when those companies achieve a value inflection point, such as new funding, necessitating a new valuation.

Series A funding requires a valuation of a startup. Unlike seed-stage enterprises, companies seeking series A money can disclose more information to help investors make informed selections.

The valuation method also shows how well a company and its management employ resources to generate future profits.

409A valuations for Series B

A normal valuation for a business seeking financing could be from $30m to $60m. Owners must show that their strategic planning can generate revenue and become a market leaders.

Later-stage organizations should include their auditors and legal counsel in the discussion to determine an acceptable frequency of valuation. This is typically linked to a desire to leave. When a company is considering an IPO in the next 12-18 months, the cadence often increases to quarterly.

409A valuations for Series C

Corporations seeking funding should have a 409A valuation between $100 and $120 million. Founders must show that their business strategy can generate revenue and become a market leader.

409A valuation and VC valuation for a startup

Compliance professionals conduct 409A values that are point estimates at the bottom end of a defensible valuation range. VC values are the market value agreed upon by entrepreneurs and venture capitalists (VCs).

How is a 409A Valuation Defined and Why is it Required?

As said earlier, the 409A valuation is a method used in determining the fair market value of your company’s common stock. A 409A value is mandated by law. A 409A valuation is required to be in compliance. Non-compliance can be disastrous. The IRS can penalize you for undervaluing stock options.

What is VC Valuation and Why is it Required?

Venture capital valuation is a business valuation is a method of valuation by which venture capitalists and investors evaluate a startup. This method usually depends on the view of the investor because they would want a high exit or a good reward for their risk.

It is required for start-ups to process a VC valuation because no venture capitalist would invest without the valuation. Startups would definitely require funding to launch or even grow.

How does VC Valuation Differ from 409A Valuation?

A 409A valuation is typically lower than a VC valuation. The VC values also won’t stand up to IRS inspection. A market-driven valuation is fantastic, but it has numerous flaws. VCs value based on gut instinct. The VC technique also implies that all firm shares are worth the same.

However, 409A valuations are quite distinct. They provide an IRS-acceptable valuation. But keep in mind that these are often low valuations. In general, a 409A valuation has no impact on a VC valuation.

Which 409A Valuation Methodologies Help Secure Safe Harbor Status?

If you secure safe harbor status, you need not go out of your way to prove that your valuation for issuing stock-based compensation was fair. Instead, the IRS presumes that it was a fair valuation. If they suspect something, they must prove that the valuation was grossly unreasonable and not the other way around.

Under the provisions of Section 409A, you can secure the safe harbor status by using the following methodologies:

Illiquid startup presumption

This methodology can be used by an illiquid startup, i.e. a private company less than 10 years old that does not expect to go public in the next 180 days or be acquired in the next 90 days. This method involves a company insider establishing an initial value based on the available financial information, comparable company transactions, preceding equity transactions, and any other material information. Then, a discount is applied for the risks involved and the illiquidity of the equity.

Example

Suppose you need to value your startup called InnovateTech and since it does not have a significant revenue or assets, you take the market approach. So, you identify 3 similar companies that were bought or sold in recent times, adjust their valuations for any differences, and take the average.

| Company name | Valuation | How is it different from InnovateTech? | Adjustment in valuation | Adjusted valuation |

|---|---|---|---|---|

| TechStart A | $10 million | Less technologically advanced than InnovateTech | #ERROR! | $10 million + 10% = $11 million |

| InnovateNext B | $8 million | No significant difference | No adjustment | $8 million |

| FutureTech C | $12 million | Better market presence | -15% adjustment for a larger market presence | $10.2 million |

| Average adjusted valuation | $9.73 million |

Since your startup is not as liquid as the 3 startups mentioned here, you will need to apply an illiquidity discount that typically ranges from 20% to 30%. For our purposes, we will apply an illiquidity discount of 25%.

So, the valuation of InnovateTech = $9.73 million X (1 – 0.25)

= $9.73 million X 0.75

= $9.73 million X 0.75

=$7.3 million

So, the 409A valuation of InnovateTech can be set to $7.3 million.

Binding formula presumption

This involves establishing a predetermined formula in the company’s governing documents that specifies how equity will be valued. The formula must be reasonable and applied consistently.

Example

Suppose your company, HealthTech Solutions, always uses a revenue multiple of 3x to set the valuation whenever its equity is sold. Let us assume that your company had an annual revenue of $10 million. Then, the valuation for your company can be calculated as:

| Annual revenue | $10 million |

|---|---|

| (X) Revenue multiple | (X) 3 |

| 409A valuation | $30 million |

So, the 409A valuation for HealthTech Solutions will be $30 million.

Independent appraiser presumption

If a valuation is performed by a qualified and independent appraiser, it will be enough to secure safe harbor status for a certain period. Of all the methodologies, this happens to be the most cost-efficient and convenient one.

A valuation performed using any of the mentioned methodologies will secure safe harbor status for 12 months or until a material event occurs, whichever is earlier.

Example

Suppose your company TechStartup Inc engages Eqvista for 409A valuation. The process would have the following steps:

- Your company sends an engagement letter to Eqvista outlining the scope of work, fees, and timeline.

- We will request various documents like financial statements, capitalization tables, business plans, and any recent transaction documents. Based on the documents received, we will initiate an analysis of your industry, the market, and your company.

- Now, we will choose the appropriate approach for the 409A valuation of your company. We will choose from income, market, and asset-based approaches. We may also choose to take the weighted average of valuations from a combination approach.

- We will determine the amount of value to be allocated to each class of equity shares.

- We will prepare a detailed report containing an executive summary, company overview, description of the valuation methodology, financial analysis, and valuation conclusion.

- Now, you can review the report, and provide any feedback which we will incorporate and finalize the 409a report.

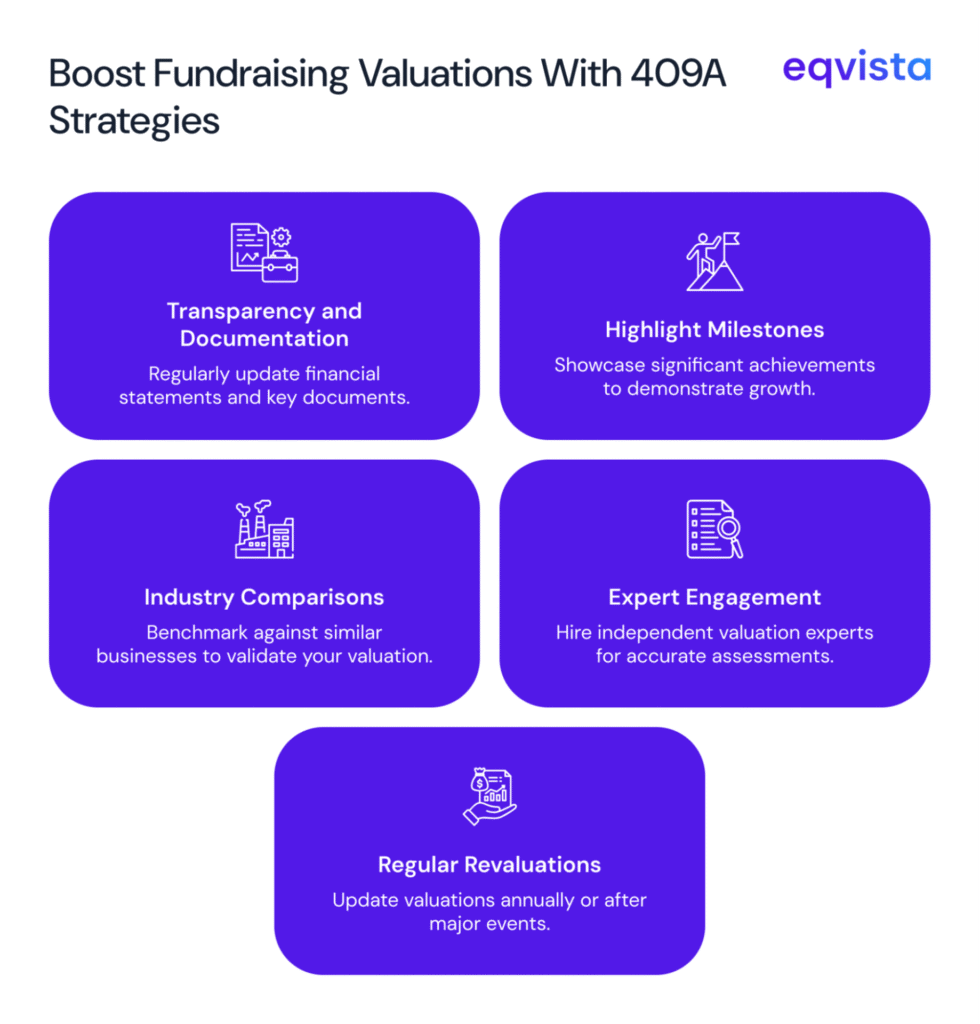

Strategies to Boost Fundraising Valuations Through 409A Valuations

The relationship between 409A valuations and fundraising success has become increasingly critical in today’s challenging funding environment. Here are some 409A valuation-related strategies to boost your fundraising valuations:

Complete Transparency and Detailed Documentation

An accurate and comprehensive financial documentation can help provide a reliable 409A valuation. Research consistently demonstrates that comprehensive financial documentation significantly impacts investor confidence and valuation outcomes. Financial and nonfinancial information as well as sectoral and technological differences influence startup equity valuation, according to a global analysis of venture capital investments.

Companies with transparent, well-documented financials achieve valuations 15-25% higher than those with incomplete documentation, as investors perceive lower risk and greater management competence.

Highlighting Milestones and Achievements

Milestone achievement and documentation serves as strong evidence of execution capability and market validation. The ability to generate profit boosts investor confidence and supports future growth for the startup. Startups that systematically document and present milestone achievements see average valuation premiums of 20-30% compared to companies that cannot demonstrate clear progress markers.

Such factual information must be shared with whoever you hire to get the 409A valuation. This can elevate your 409A valuation, and any multiple applied to it will further amplify your fundraising valuation.

Leverage Industry Comparisons

Market positioning through comprehensive industry analysis provides crucial context for valuation justification. According to Crunchbase, the number of SaaS funding rounds and funds raised have both gone intensely down over the last five years in the US, making sector-specific benchmarking essential for accurate valuation positioning.

Industry comparisons involve analyzing peer companies within the same sector or with similar business models. These comparisons provide relative measures of your company’s performance and potential. Conforming your valuation to industry standards makes for a more compelling case for your valuation metrics.

The Service Market for 409A Valuations is globally distributed, with North America leading the market, accounting for 45% of the share in 2024, indicating the mature state of valuation services and the importance of benchmarking.

Engaging Experienced Valuation Experts

Experience is everything when it comes to valuations. An experienced valuator understands the nuances of your industry. Independent experts like Eqvista will help you get an objective and accurate assessment of your company’s value, enhancing the credibility of your 409A valuation.

We accomplish this by implementing several different methods of valuation in arriving at the FMV, including DCF analysis and market comparisons. Thus, you get a valuation that fairly represents your concerns but also ensures tax compliance. Our endorsement instills confidence in potential investors about the legitimacy and accuracy of your valuation.

Regular Updates and Revaluations

Maintaining current valuations is crucial for both compliance and fundraising readiness. Recently, Instacart significantly reduced its own 409A valuation—from $39 billion to $24 billion —demonstrating the importance of realistic, market-aligned valuations. Keep in mind that a 409A valuation is done primarily to ensure tax compliance when private companies issue stock-based compensation. A 409A valuation is needed within a time frame of 12 months, or upon every material event. Following this rule will make your company tax-compliant and show potential investors you are not naive about the tax implications of your actions.

Companies that maintain current valuations and can demonstrate consistent methodology show 25-35% higher success rates in fundraising processes, as investors perceive better governance and market awareness.

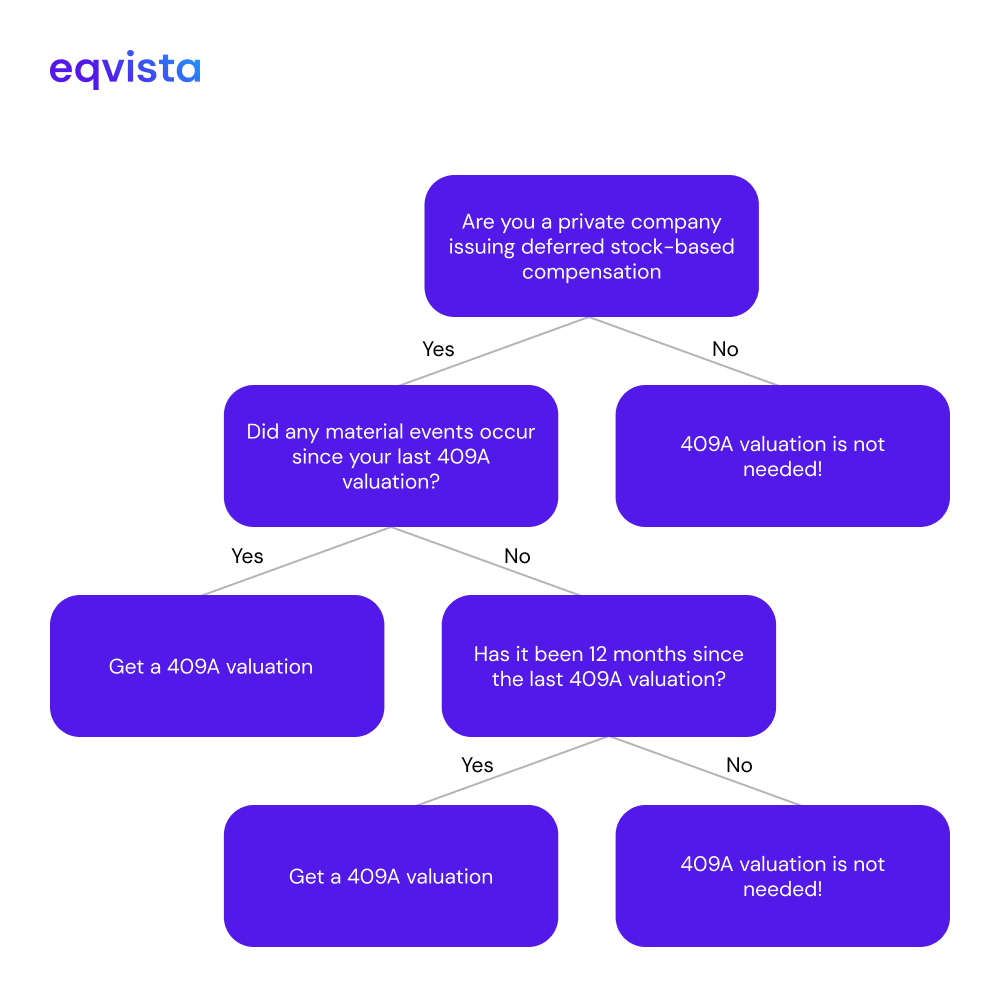

How Frequently Do You Need 409A Valuations at Different Stages?

If you recall, private companies can secure a safe harbor status if they use the prescribed methodologies to get a 409A valuation every 12 months or after material events. So, the frequency of 409A valuations depends on how frequently material events occur for a startup.

Case study for understanding the frequency of 409A Valuation

Let us assume that you are the founder of a startup called Selma Solutions. Currently, Selma Solutions is at the pre-seed stage. Right now, you will be developing your product and researching your target audience’s preferences and needs. Selma Solutions will not focus on signing big contracts or generating revenue. So, material events may not occur at the pre-seed stage. Hence, a 409A valuation every 12 months will suffice.

When Selma Solutions secures seed funding, it will count as a material event. So, you will need a 409A valuation before you can issue stock-based compensation again. Even after securing seed funding, material events may be rare for Selma Solutions because its focus may still be on product development.

If Selma Solutions can produce a minimum viable product (MVP) and find the right market for it, it may secure Series A funding. This, too, is a material event. From this stage until going public or being acquired, Selma Solutions may experience a high growth period, i.e. there will be a myriad of material events like signing significant new contracts, improving financial performance, and major equity transactions. After every such material event, Selma Solutions will need a 409A valuation.

You can understand if you need a 409A valuation through the following decision tree.

FAQs About 409A Valuation During Different Funding Stages

Before getting started with a 409A valuation, there is important information to take note of. We have gathered the following frequently asked questions and answered them for your benefit:

What are the different stages of startup fundraising?

For a startup, the lifecycle of fundraising can be split into various stages depending on the financial requirements, the maturity of the business, and other aspects such as launching the product or service, reaching the target market and more. Typical stages that a startup goes through are as follows:

- Pre-Seed Funding – The first and the initial funding for developing the idea.

- Seed Funding – Turning an idea into an actual business.

- Series A Funding – Expanding the user base by reaching the target market

- Series B Funding – Scaling the business and its operations to the next level.

- Series C Funding – Developing new products and expanding to new markets.

How does venture capital valuation differ from 409A valuation?

As a matter of fact, 409A valuations are performed by experts and analysts that are estimated at the low end of a defensible valuation. While venture capital valuations are the market value that is attributed entirely to a company.

In addition to this, VCs may not consider 409A valuation as a factor of calculation or input for their valuation; on the other hand, at the time of determining 409A valuation, experts always consider the venture capital valuation.

What happens if the 409A valuation goes down?

It is part of the standard procedure for a company to conduct an annual review of its 409A valuation. However, if the 409A valuation goes down, it might be a sign of trouble. For current employees, they can pay less to exercise their options, while for new recruits, a lower 409A valuation means a lower base price for equity.

As a result, 409A valuation determines the tier of the option grants, which in turn affects the fair market value of equity at an early stage. Therefore, it is important to understand the importance of 409A valuation and how it determines whether the equity is fairly priced.

Need Experts’ Help for a High-Quality 409A Valuation for Your Company?

In conclusion, it is important to remember that If you don’t use one of the allowed techniques, you may not be within the 409A safe harbor. Penalties for employees and stockholders might be significant.

For expert advice, Eqvista is here to offer professional 409a valuation services for your business needs. Our mission is to provide your business with advice and help to grow and manage business activities professionally. Contact us to learn more.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!