Startup Valuation Methods – How to Value Your Startup?

A startup valuation is the process of estimating the value of a startup based on its tangible and intangible assets.

Ever wondered how Angels and Venture Capitalists evaluate the viability of a startup? How much do they invest? Or how do startup founders know the size of investments they qualify for? This is the world of startup valuations. With the increasing number of startups, and the rising competition in the business world, valuing the startup has become necessary for strategizing, raising funds, and deciding the right path forward. Startups are basically new ventures that are still in the process of developing and gaining a foothold in their respective markets, while valuation is a process of determining the worth of a startup. But what’s the best way to value a startup? Well, there are several methods used to value a startup. With proper planning, execution, and research, valuation can be done in a fair, objective, and efficient manner. In this article, we’ll discuss the different methods of valuing a startup.

Startup Valuation

A promising startup is founded on a brilliant idea that aims to fill a gap in market needs. From its inception, a startup goes through several stages of growth and expansion towards realizing its true market potential. But no progress is possible without timely financial investments. Investments in turn cannot happen unless the startup is estimated for what it is worth based on its current status and future potential. Startup valuation methods thus are the foundation for attracting the much-needed funding for a startup.

What is a Startup valuation?

A startup valuation is the process of estimating the value of a startup based on its tangible and intangible assets. Analysts focus on its future growth potential as well. Investors and founders use various metrics to arrive at a near-exact estimation. But it is important to realize that a valuation for startups is a tricky process. A lot is based on projections and industry benchmark comparisons, especially in the case of startups in the pre-revenue stage.

A startup is a founder’s baby. Naturally, founders tend to overestimate their valuation and demand higher investments. While pitching to investors, one must note that a high valuation for startups must be complemented with a promising growth potential. As far as investors are concerned, they are looking for their next highest ROI. A high value startup without a realistic growth plan will fall short of their expectations. Plus, startup valuation figures must grow exponentially with every funding round. A high flying first round followed by a downsized funding round does not reflect well on a startup’s performance.

Why is it important to estimate the value of a startup?

Investments are the lifeline of every startup. Engaging any resource to enrich the company will come at a cost that a startup in its early stages is not equipped to bear. The next logical step is to approach investors for the required funds. An investor will fund a startup only if they see a scope of big profits in owning their equity. The Valuation of startups thus is the baseline used by investors to evaluate startup funding proposals.

Startup valuation methods vary with their stage of development. Different qualitative variables and statistical analytics are applied based on the position of a startup in its lifecycle. Before moving further into the nuances of startup valuation, let us look into the 4 basic stages of a startup and the extent of investment one can expect at each stage:

- Stage I – This is the ‘seed’ stage when a startup is still an idea backed by a talented founding team all set to take it further. In some cases, they might have managed to create a prototype as well. But a seed-stage startup will not have assets and minimal or no revenue. They have just bootstrapped themselves into the market. A typical seed-stage investment is in the range of $250,000 – $2,000,000.

- Stage II – Otherwise referred to as the ‘Round A’ or ‘Series A’, a startup by now definitely has a prototype and has generated some revenue in sales. With a Minimum Value Product (MVP) and some early adopters, investments at this stage are around $2,000,000 – $15,000,000.

- Stage III – This stage is also known as the ‘Round B’ or ‘Series B’. By this stage, a startup has proved its business viability and aims to expand profits based on established business models. Investments backing stage III startups are in the range of $15,000,000 – $50,000,000.

- Stage IV – Otherwise known as the ‘Series C’ round, a startup by now is generating multi-million dollars in revenue. A scale-up at this stage will either lead to an acquisition or IPO. Advanced metrics and valuation models are required at this stage to estimate the startup valuation.

As we see, startup valuation methods vary based on the stage of business development. Founders must strive to get it right from the start as every stage is a stepping stone to the next. Founders must be well equipped with suitable strategies to justify their company valuation before approaching investors. Apart from evaluating their own company, a keen understanding of competitors and industry benchmarks is also required to arrive at a justifiable valuation.

Difference between startup valuation and mature business valuation

Valuation models for startups differ from those used for mature businesses simply because of their limitations with tangible data. Mature businesses are publicly listed and have considerable statistics supporting their operations, investments, reliable decision-making capacity, and revenues. Their performance reflects stability and makes it easy for investors to analyze their profit potential. The value of such companies can be easily estimated using the EBITDA formula that calculates the value based on the company’s earnings before interest, taxes, depreciation, and amortization.

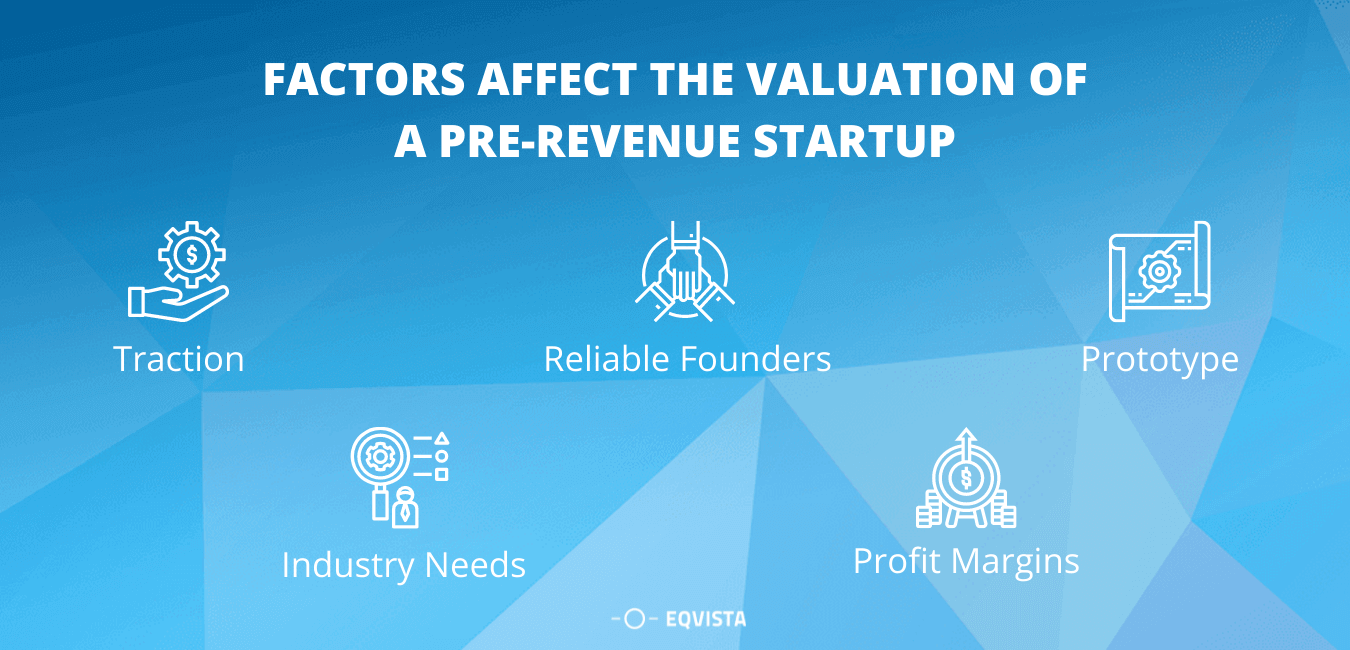

However, startup valuation methods for a pre-revenue company cannot involve just one linear formula. It demands a comprehensive judgment of several factors, most of which are determined by market forces. Let us take a look at some aspects that affect the valuation of a pre-revenue startup:

- Traction – Since a startup does not have much to show in revenue, investors look for product adaptability. The more users, the better. Brownie points for lower cost of customer acquisitions. Needless to say, a dynamic cost-effective marketing strategy is important at this stage. Investors are more likely to fund if they are convinced about the startup’s growth potential on a limited budget. It simply indicates a higher ROI for the investor. Hence, a viable, scalable, cost-effective business idea increases the startup valuation.

- Reliable founders – The startup founding team is the face of the company. The merit of the product/service aside, investors look for an experienced founding team with diverse skill sets equipped to holistically grow the company. For instance, a tech startup with a promising patent will need strong marketing inputs to create a brand out of it. Similarly, founders with prior entrepreneurial experiences are an asset. Thus valuation for startups will be higher if they have a skilled, committed, and experienced founding team.

- Prototype – This is a game-changer. No matter how great a business idea is if the startup has managed to create a prototype with early adopters to show, their valuation increases considerably.

- Industry needs – Startup marketplace is presently dominated by AI and tech industries. This is where the money is. Investors tend to value a startup higher if they are catering to a profitable industry. Similarly, the demand for the product/service also matters. If there are more providers of the same product and lesser investors, the market will be highly competitive resulting in a lower valuation of a startup in this sector.

- Profit margins – Investors have a primary agenda – quick profits. Despite all the above four factors showing a high, unless the business as a whole promises a high-profit margin, the valuation of a startup will decrease.

Now that we have seen how the valuation of startups depends on its stage in the business lifecycle, in the next section we will discuss another aspect that is vital while evaluating any startup. Founders, and more importantly investors, have to be mindful of these criteria before deciding on their investments.

Pre-Money Valuation vs. Post-Money Valuation

Results from startup valuation methods sway investor decisions. An expert valuation indicates the investor’s equity percentage on funding a startup. In the initial stages, the returns will be small, but eventually when the startup goes public or is acquired, even the smallest equity percentage will fetch a massive return. For ease of calculations, startups are considered in two stages, pre-money and post-money.

What are the pre-money and post-money valuation of a startup?

Pre-money valuation is the value of a startup before the present round of funding, while the post-money valuation is the startup value after it will receive a fresh funding round. It is important to note that the post-money valuation shows an increased equity value of a startup, not its actual bank balance. The post-money valuation is comparatively easier to calculate as:

For example if the investment dollar amount is $2M and the investor’s demand is 10%, the post-money valuation for the startup will be $2M / 10% = $20M. However, the balance sheet will show an increase of $2M in cash.

In continuation to the example above, the pre-money valuation in this case will be $20M – $2M = $18M

Further, to understand the per-share value at pre-money valuation:

As we see, apart from factors such as competitors, industry benchmarks, and scalability, investors will consider the pre-money and post-money valuation metrics as an important component of their various startup valuation methods discussed in brief in the next section.

Common Startup Valuation Methods

Despite several qualitative indicators, unless the startup reaches a mature stage in business, there is not much data available to base calculations on. Especially for a startup in the pre-revenue stage, a lot of it is estimated projections. However, here are some common startup valuation methods that come handy at different stages in the lifecycle of a startup.

Venture Capital Method

This is one of the methods to arrive at the pre-money valuation of a pre-revenue startup. In this startup valuation method, first the terminal value is estimated. Terminal value is the expected value of the startup during the harvest year, the year when the investor plans to exit. From this point, the pre-money valuation is calculated using the following formula:

Scorecard Valuation Method

Otherwise known as the Bill Payne valuation method, this is a common valuation model for startups used by Angel investors for pre-revenue startups. The idea is to find the average valuation of all pre-revenue startups in the target company’s market and compare it to the pre-revenue valuation score of the target company.

Here is the scorecard with its corresponding value:

- Management team 0 – 30%

- Size of the opportunity 0 – 25%

- Product/Technology 0 – 15%

- Competitive environment 0 – 10%

- Marketing/Sales channels/ Partnerships 0 – 10%

- Need for additional investment 0 – 5%

- Others 0 – 5%

For example, if the target company’s score is x, the assigned factor for

- The management team will be 0.3*x.

- Size of opportunity will be 0.25*x

…and so on. The total score of the target company is the total of all the 7 factors. Finally, this value is compared with the average pre-money valuation of all pre-revenue companies in the target company’s industry.

Comparables Method

This is quite a simple and straightforward startup valuation method. It involves choosing a reference metric from a similar company in the market and comparing the target company’s value with it. For example, if a competing business is valued at $2,000,000 and they have 100,000 early adopters of their prototype, this means that each prototype is valued at $20. Investors will use this as a benchmark to value the target company.

Risk Factor Summation Method

This valuation model for startups aims at risk assessment of the target pre-revenue startup. It is similar to the scorecard method and uses the following 12 elements to evaluate its risk status:

- Management

- Stage of business

- Funding/capital risk

- Manufacturing risk

- Technology risk

- Sales and Marketing risk

- Competition risk

- Legislation/political risk

- Litigation risk

- International risk

- Reputation risk

- Potential lucrative exit

The following values are assigned to each of these elements

- -2 ………….Very negative

- -1…………..Negative for scaling the startup and carrying out a successful exit

- 0 ……………Neutral

- +1………….Positive for scaling the startup and carrying out a successful exit

- +2………….Very positive

The pre-revenue startup valuation will increase

- By $250,000 for every +1

- By $500,000 for every +2

And the pre-revenue valuation will decrease

- By $250,000 for every -1

- By $500,000 for every -2

Cost-to-Duplicate Method

This startup valuation method as the name suggests is based on the idea that a company is worth only as much as it takes to duplicate it. This valuation tool considers only the tangible assets of a startup at the time of the valuation and estimates how much it would cost to replicate all of it.

Discounted Cash Flow Method

This method of valuation for startups estimates the future cash flow of a pre-revenue startup. Based on this, the investor’s ROI is calculated. Furthermore, financial analysts apply high discount rates to neutralize the risk factors based on their assumptions about the business and emerging market trends. This is not a very reliable method as a lot of the projections are based on assumptions.

Valuation by Stage Method

This method addresses the basics of how startup valuation works. It is based on the business stage of the startup and provides a range of possible investments at each stage. Further along a company is in its lifecycle, the more stable it is, the lesser the risk of investments. Here is a brief of possible investments based on the company stage:

- Company value estimated – $250,000 – $500,000

- Promising business plan – $500,000 – $1M

- A promising business plan backed by a strong management team – $1M – $2M

- Has a prototype/viable technology/final product – $2M – $5M

- Has built strategic partners and built a strong customer base – $5M and above.

The Book Value Method

Otherwise known as the asset-based valuation method, this valuation model for startups considers only tangible assets of the company, similar to the cost-to-duplicate method. Since such valuations use statistics of the startup’s current status, it is mostly used to evaluate startups going out of business.

Start Your Company Valuation on Eqvista

As we see, valuations for startups is a critical process required to attract investors as well as to value the brilliance and vision of founders. The expert valuation team at Eqvista understands this and is well-equipped to partner with you in the valuation procedures. We offer a complete package of 409a valuations to help you get a better understanding of your startup’s worth and set you up to offer equity compensation to your employees.

Our unique, sophisticated captable software additionally enables you to issue and manage company shares, handle company valuations, and cap table analysis, all with a simple user interface. Here are some more resources you might find useful.

FAQs

To better understand startup valuation, we have answered the frequently asked questions from most new businesses:

What is the best valuation method for startups?

Well, there is no one fit answer to this question. Each method has its own approach to estimating the worth of the startup. Based on the stage of the startup, the industry, the market and other factors, the best method to use can vary. One of the best practices is to use a combination of multiple valuation methods, and thus the best valuation method for startups is the one that fits their strategy the most.

What are the 5 valuation methods for startups?

Essentially, there are more than 5 valuation methods for startups. However, the top 5 methods on your list include the venture capital method, scorecard valuation method, comparable company method, risk factor summation method, and cost to duplicate method. These are the commonly used valuation methods. But it is recommended to go ahead and research further to find the one that works best for you.

How do you calculate startup value?

The calculation for the valuation of a startup depends on the valuation methods you use. Each of the methods has its own approach and processes for calculating the worth of a startup, and the process and calculations between each method are different. Don’t worry, Eqvista’s online valuation calculator is here to help you! Eqvista’s online startup calculator offers a simple, intuitive and interactive way to calculate the value of your startup. The software is designed to be user-friendly and easy to use. A combination of all the valuation methods is used in the software to produce an accurate value.

When should you not use DCF?

Since the calculation of the Discounted Cash Flow (DCF) is based on the projected values, early-stage startups with no history or track records can present a less accurate value. DCF typically works on estimated future cash flows, which can be biased if the relevant data is inaccurate or unavailable. In such situations, a discounted cash flow analysis can make the values inaccurate. Therefore, it is recommended to only use DCF when the startup is in the later stages of its life cycle.

Is DCF the best valuation method?

Generally, the DCF method is considered as the accurate and optimal method to determine the value of a startup. However, there are some startups that do not have a history of cash flows, and thus they can present an inaccurate value using DCF. Again, the best method for every startup is different and depends on the stage it is at, the requirements, its size, the industry and the factors related to it. The most reasonable way to determine the value of a startup is based on multiple methods.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!