Equity valuation – Everything you need to know

All the techniques and tools used by investors to get an estimate about the company’s value is known as equity valuation.

Thinking of getting some outside funding for your company? If you are at the stage where you are looking to outside investments to fund your company, then it’s high time to consider getting an equity valuation performed to find out the fair market value of your business.

Let’s dive into what an equity valuation is and the different equity valuation models.

Equity Valuation

All the techniques and tools used by investors to get an estimate about the company’s value is known as equity valuation. According to accounting standards, assets minus liabilities are the book value of shareholder’s equity in the balance sheet. However, equity valuations are used to find an estimated value for a company.

This method is based on an assumption that the security value, that is the stock or equity, is driven by the underlying fundamentals of the firm at the end of the day. To put it simply, an equity valuation is the value of equity which determines the overall net worth of the company.

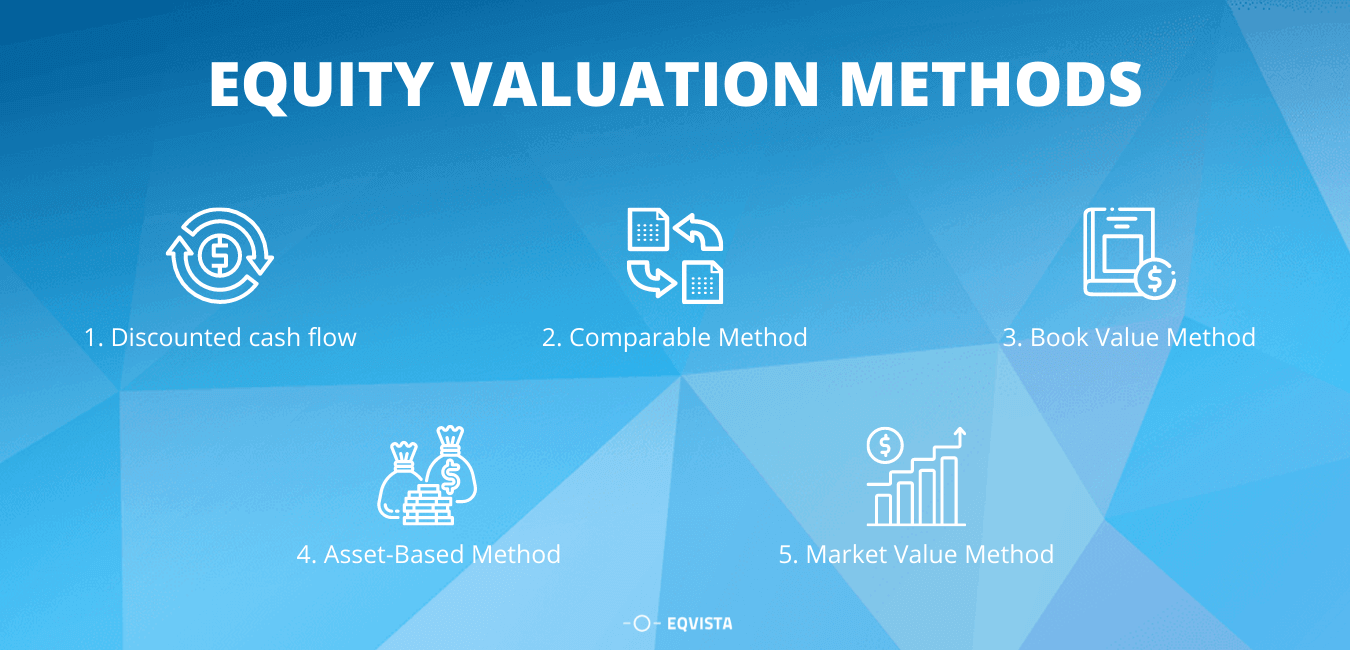

Equity Valuation Methods

There are various methods of equity valuation that determine an estimate of equity, being:

#1 DCF or Discounted cash flow method

DFC or Discounted cash flow is an equity valuation method based on future cash flows to estimate the current investment value. Based on future projections about how much money will be earned, the discounted cash flow analysis is a method used to estimate the value of that investment today. This method applies to both business owners wanting to make changes in the business and investors for financial investments.

How does it work? Well, the purpose of discounted cash flow analysis is to determine the amount to be received as an investment after adjusting the time value of money. The concept of the time value of money is based on the assumption that the value of the dollar today is higher than the value of the dollar in the future because you can invest the dollar now.

As a result of this concept, where an investment is made with the expectations of gaining a return in the future, the discounted cash flow analysis applies appropriately. For instance, with an assumed annual interest rate of 4%, $2 in the savings account worth will be $2.08 in a year. The same way if a $1 payment is not made for a year, the present value of it will be $1.92.

To conduct a discounted cash flow analysis, the investor needs to make some estimates of the future cash flows and the ending value of the investment, asset, or other equipment. An appropriate discount rate should be estimated by the investor, and this rate will depend on the investment or project concerning the same. If the project is complicated or the investor is unable to estimate the future cash flows, this method will not be applied as the value in question will be incorrect. In such cases, the investor should choose an alternative model to determine the value.

#2 Comparable method

The comparable approach is based on the theory that an equity’s value should show a similarity to other equities. In the case of stock, this can be determined by comparing your firm to its competitors, or those firms that run a similar business as you do. Any discrepancies in the value between similar firms could be an opportunity. The hope here is that the equity is undervalued, which means you can buy equity and hold it until the value rises. The opposite could also be said, as the investor is presented with the opportunity to short the stock or profit from the positioning of one’s portfolio from the decline of its value.

There are two types of comparable approaches. The first and more common one used looks at the market comparables from its peers and rival firms. The common market multiples are: enterprise multiple, price to earnings, enterprise value to sales, price to free cash flow, and price to book. The analyst looks at the margin levels and compares them with other firms to get broader knowledge on how the firm compares to its peers/rivals. An investor can make an argument that if there are improvements in a company that has averages below its rivals will mature and make a turn for the better with significant increases in the value.

In the second comparables approach, we look at the market transactions in which similar firms or those within the same division were acquired by private equity firms, rich investors, or rivals. An investor can estimate the value of the equity using this approach. When combined with market statistics, it can be used to compare a firm with its key rivals and the multiples can be a rational estimate for the value of a company.

#3 Book value method

The book value method is the price paid for that asset minus depreciation. The loss of value in an asset (depreciation) can include many aspects such as wear and tear of machinery and equipment over a period of time.

In companies where the growth is minor and there might be less residual value, the book value method will be used. For example, looking at the banking sector during times of financial crisis and stress, investors look at the book value, not at the potential money the bank would make in the future. This is because the book value is the “break-up” value of these firms.

#4 Market value method

This method of valuation is done by comparing your company to the firms similar to yours that have recently been sold in the market. The market value method can be used to estimate the value of a portion of property or estimating the value of a closely held company. Unlike the other methods, the value estimated can only be held appropriately if there are a considerable number of firms that are similar to yours to compare to.

Furthermore, you can use this method to find estimates on the value of business ownership interest, security, and intangible assets. While using this approach, it analyses the sale of each asset similar to their own and further adjustments are made to minimize the difference. Regardless of the asset, adjustments are made and some of those adjustments are the quantity, quality, and size.

Despite it being easy to measure the value of companies sold publicly on the basis of their share price in the US, less than 1 percent of companies are traded publicly. This leads to issues and challenges for those who are looking to find a fair price in the market for a privately-held asset. There are two major methods for valuation under this approach.

- The Guideline Transaction Method (uses prices of related companies sold recently)

- The Guideline Public Company Method (uses the price of similar companies sold recently)

For example, we would like to know the value of a young cybersecurity company. An analyst would scan the cybersecurity companies recently sold or those that have recently gone public. They would then look for certain clues such as if the company is in the same business, are targeting the same customer, if they rely on relatively same procedures to keep the customers safe, and if they have similar revenues.

#5 Asset-based valuation

The asset-based method adds all assets of the firm together. This method of valuation is usually done on the basis of a going concern or on a liquidity basis. This approach mainly focuses on the net asset value or the fair market value of the firm. You need to calculate the net assets and subtract the net liabilities from it to give you the amount that it will cost you to recreate the firm. You will be left with little to no room to decide which of the firm’s assets and liabilities is to be added in the valuation of the company and also how you are going to measure the worth of each of them.

There are also two other methods with which you can evaluate the assets. The market approach looks at the businesses similar in the market and at their worth, and the earnings approach in which you estimate the amount of money that the business may earn in the future.

In the asset-based approach, the actual value can be significantly higher than the total of all the assets recorded in the business. For example, in the balance sheet of a company, they may not include assets to the firm such as the methods of conducting business and the products developed internally. This is because the only assets recorded in the balance sheet are those that the firm has paid for.

This means that if there are such significant assets in the firm, it will not be recorded in the balance sheet. Also, there are companies that offer or sell special services and products on which you cannot put an appropriate value. There is nothing like it, so putting a price on it can prove to be hard.

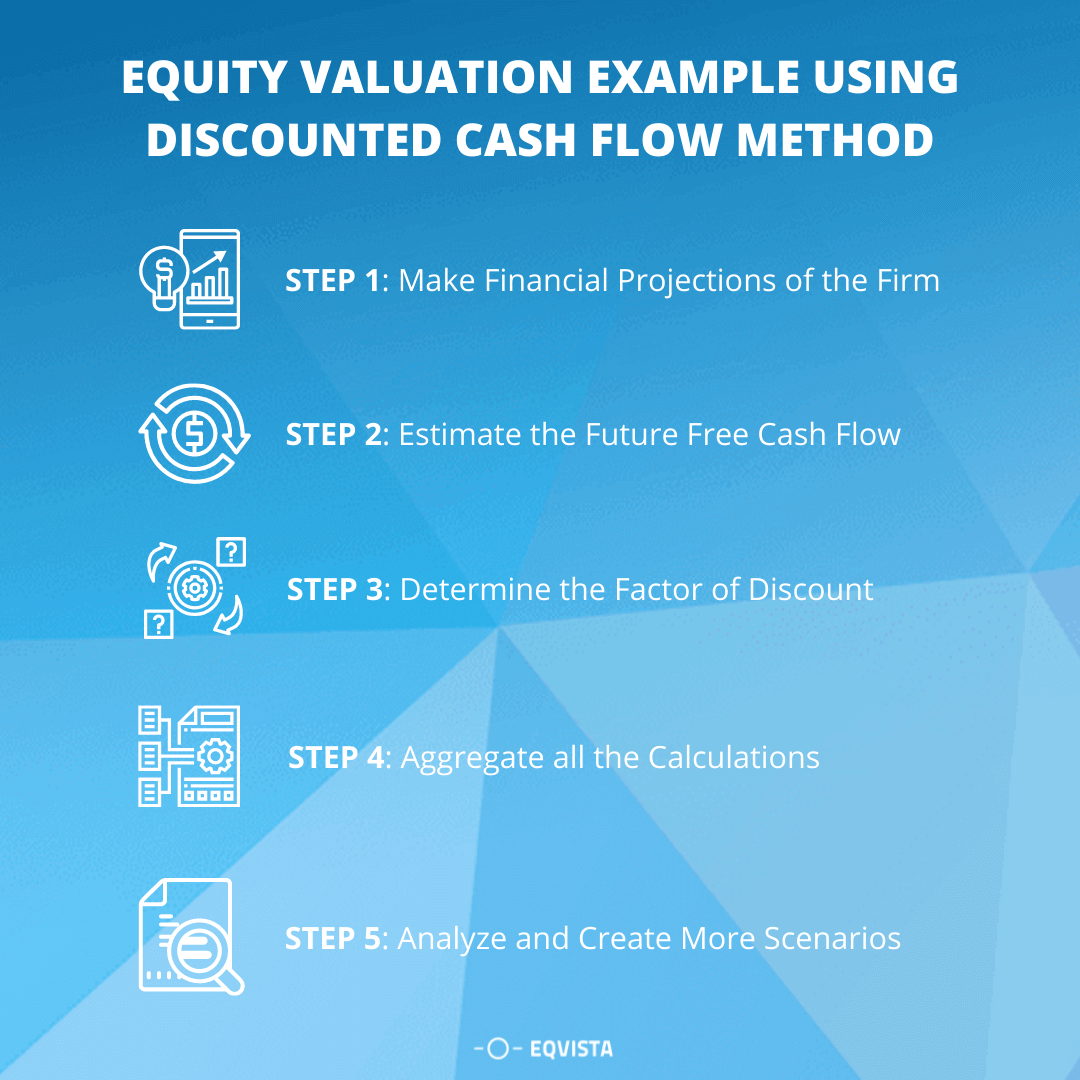

Equity Valuation Example using Discounted Cash flow Method

Before we can take an example to understand the Discounted Cash flow method better, let us see the steps to get the output. For this, you will have to follow some steps, as below.

Step 1: Make financial projections of the firm

To use the discounted cash flow method to evaluate the company, you will need to estimate the future financial performance. The calculation needs to be done with some figures that you will find in your financial model; they are projected revenue streams, expenses, costs, and investments of the coming years. All these will come together to give you a prognosis of the financial statement and the key performance indicators of the company.

Step 2: Estimate the future free cash flow

The future cash flows can also be seen as the financial achievements of the firm in the future. This will be used to determine the company’s value now. In the DCF method, free cash flow is used as they are always corrected as investments are made to keep the company running in the short term. This also means that it is always ready and represents everything accurately.

Step 3: Determine the Factor of Discount

You need to calculate the WACC (Weighted Average Cost of Capital). The formula for is:

The higher the percentage, the higher the risk, which in turn means a low valuation of the company and vice versa. With the WAAC value, you then calculate the discount factor.

Alongside calculating the net present value of the certain future date, you also need to calculate the value of generated cash flows after the initial period, which is called the “terminal value”.

Terminal value = Free cash flows after the initial period / (WACC – growth rate)

Step 4: Aggregate all the calculations

You need to add the net present value of all the cash flows, and after doing so, you will get an estimated value of your company according to the DCF approach.

Step 5: Analyze and create more scenarios

To confirm and reduce uncertainty, you need to create more scenarios changing the amounts of assets or liabilities depending on the scenario. Then analyze it to see the best and worst scenarios.

And just like this, you will get the needed output using the discounted cash flow method for equity valuation. Now, let us take an example and use these steps to see the outcome.

Equity Valuation Example

Let us say that a company had a cash flow in the previous year of $10 million. To determine the company’s growth rate, you will have to compare last year’s cash flow with the earlier ones. You can then use the growth rate from this comparison to then estimate how much the company will grow in the future.

The company is estimated to grow 5% in the first five years, and 3% thereafter, which will be used when calculating the terminal value. The company discount rate is 6%. With all these numbers, you have the three necessary elements that would help you complete the Discounted Cash Flow analysis as below:

| Year | Cash Flow | Growth Rate | Future CF | Discount Rate | PV |

|---|---|---|---|---|---|

| Year 1 | $10 million | 1.05 | $10 million | 1.06 | $9.905 million |

| Year 2 | $10.5 million | 1.05 | $11.025 million | 1.1236 | $9.812 million |

| Year 3 | $11.025 million | 1.05 | $11.576 million | 1.191016 | $9.719 million |

| Year 4 | $11.576 million | 1.05 | $12.155 million | 1.262476 | $9.627 million |

| Year 5 | $12.155 million | 1.05 | $12.762 million | 1.133822 | $9.537 million |

| Terminal Value | $12.762 million | $438.190 million | 1.133822 | $327.411 million | |

| Total | $376 million |

Whereas the terminal value is calculated as:

Add in the values as shared in the formula:

Discounted cash flow($millions) = ($10/1.06) + ($11.025/1.06^2) + ($11.576/1.06^3) + ($12.155/1.06^4) + ($12.762/1.06^5) + ($438.19/1.06^5)

= 9.905 + 9.812 + 9.719 + 9.627 + 9.537 + 327.411 = $376,043,641

Therefore as per the discounted cash flow analysis, the value of the company would be $376,043,641.

Get Your Company Valuation with Eqvista

Equity valuation is something that has to be done by a professional. Eqvista offers company valuation services along with our cap table application. We are an expert team of valuation specialists who can help you prepare 409a valuation reports for your company. Our professionals would use your cap table made on our software to prepare the reports.

To create your cap table for FREE on Eqvista to track and manage all the shares in your company, check out our app here!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!