What is Equity Management?

We will explain and give you a broader understanding of equity and equity management.

People might look at giving their employees equity as a benefit, but it is more than that; it’s an investment in your company. Equity is not only an additional incentive, it’s a good way to attract employees to your company and also most importantly, retain your most valuable staff.

Equity in Business

One of the objectives of equity management is to draw new members to the organization along with satisfying the current employees. While adhering to all the principles, equity management has to allow growth while maintaining cooperative profitability.

What is equity in a business? Why is it important?

Typically, equity is referred to as owner’s equity or shareholder’s equity. In the case where the company has to be liquidated, after the sale of all the assets and debt paid off, equity refers to the amount of money the company shareholders will receive.

Additionally, shareholder’s equity can also represent the company’s book value and the pro-rata ownership of the company’s shares. Being one of the essentials to assess the financial health of the company, equity is a common piece of information that is employed by analysts. It can be found on the balance sheet of the company’s financial records.

What is shareholders equity?

Another way to calculate shareholder’s equity is by adding the share capital and retained earnings then subtracting treasury shares from it. With the help of preference and common shares, the shareholder’s equity shows the amount the company has financed. Other names for shareholder’s equity is stockholder’s equity, net worth, or share capital. The main two important sources of the shareholder’s equity are:

- The money initially invested and all investments made in the company

- The retained earnings of the company

Using this formula it can then be calculated:

The equation where you have to compute the share capital and then determine the retained earnings is called the investor’s equation.

Types of Equity

In corporations, there are two types of equity that need to be managed, allocated and unallocated shares. The key responsibility of equity management is to understand them both in such detail down to their workings to find the right balance between them.

Allocated equity or issued shares

In proportion to the member’s cooperative use, allocated equity is one recorded in the books. Including equity credits, membership stock, and common stock, a company can have many categories of allocated members.

Only redeemable for estates membership stocks corresponds to the initial investment made to join the corporation. A majority of the corporations have transitioned from stock certificates to a stock credit system. The cooperative books keep track of the balances of the shares. This helps prevent any issues that come with physical stock and loss of stock certificates. Additionally, some corporations also may keep more than one class of stocks.

Unallocated equity or unissued shares

Allocated equity is the equity that has not been assigned to a members account. They are also called unissued shares, permanent equity, or unallocated reserves. This may come from different sources such as the capital from random events such as the sale of assets, subsidiaries organized as LLCs, non-member businesses, or earned net income. Boards of corporations also allocate part of the profit generated from member operation to the unallocated equity.

In the equity structure, the board should determine the amount of unallocated equity. This acts as a “cushion” fund to the organization. If a corporation fails to hold unallocated equity, whenever the company faces a loss, they will be compelled to write down the value of the member’s stock. Since this does not need to be redeemed it is also called permanent capital. An advantage of retained earnings in this form is that no pressure is formed for equity redemption in the coming years.

Equity Management

Corporations face different challenges because of their equity structure. The majority of the company’s equity is derived from retained profits, unlike in investors owned firms. Corporation equity is also different and unique as it is generally not sold or bought, only redeemed at face value by the organization. Due to this, the board should run the structure through decisions to return the profits to members by creating additional equity and deciding to redeem the outstanding equity.

What is equity management?

The process in which you create and manage owners in the company is called equity management. It may seem simple, but it gets complicated with steps such as tracking, communicating with stakeholders, staying compliant, consulting your board of directors, and reporting changes in ownership to updating documents.

Move to electronic shares

Shares represented in a form of the electronic ledger are called digital shares or electronic shares. They are identical to paper shares, the only difference is that it is electronically recorded. This shift reduces the risk of loss of shares and other issues that came with paper shares.

What’s the role of equity administrators?

The equity administrators are the ones responsible for overlooking the equity system and processes. They are responsible for these areas:

- Shareholder management: Updating your employees and investor stakeholders on the growth of the company is one part of managing equity. With more knowledge about your company, they are more likely to invest. Keeping them in this loop requires technology and time. Additionally, regular investor updates are a must after issuing electronic certificates. These updates should consist of key metrics, customer wins, hires, and the company’s trajectory. When needed alongside update management can also ask for an introduction or additional funding.

- Record and track company equity transactions: It is essential to keep a record and track all the shares of the company. This is also in the main tasks that the admin needs to address.

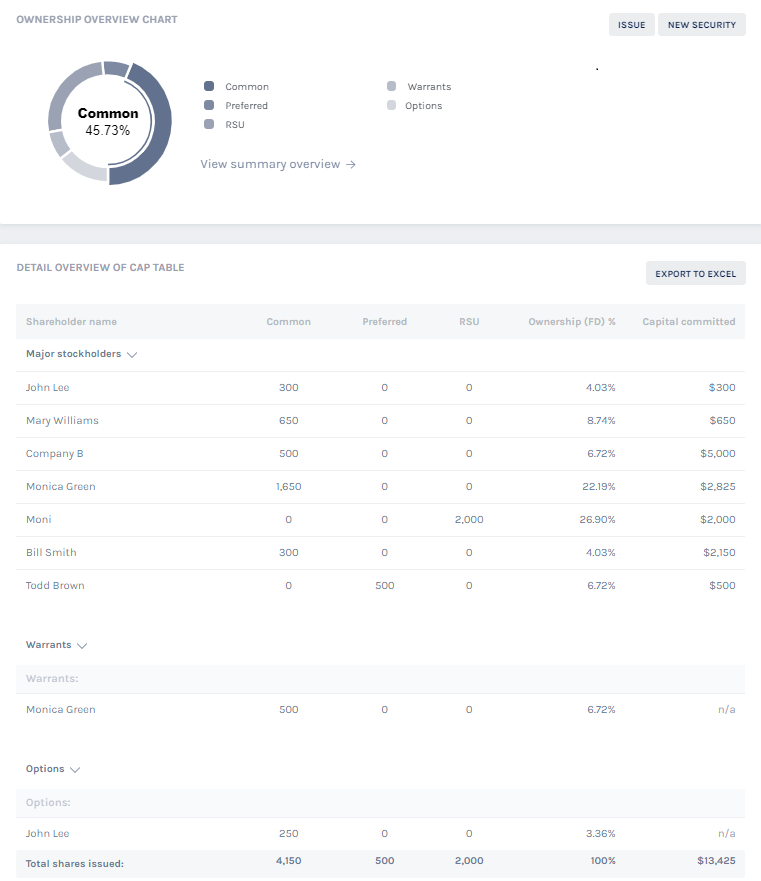

- Cap table management: The capital table is a record of all the organization’s securities such as warrants, convertible notes, equity grants, and stock. They also state who owns them. The cap table gets more complicated as the company keeps issuing securities. The equity admin is responsible for issuing the board approved equity to processing exercises and stakeholders. They also maintain the table by updating it after every finance, liquidity, or material event. Additionally whenever changes are made they send the updated copy to the stakeholders.

- Company valuations (409a valuation): If your company wants to offer equity then you need to get an appraisal done called a 409A valuation. This helps you qualify for an IRS safe harbor. The main aim of this is to determine the fair market value of the common stock of your company. This sets the price of each stock. Generally, you will need to get an appraisal done every 12 months or when a material event happens.

- Maintaining compliance: The equity admin has the responsibility of enforcing the set rules when they issue and report equity. They should also abide by the GAAP rules. In the U.S they will have to also follow ASC 718. When reporting an employee stock-based compensation on an income statement, this is a set of accounting standards that they will have to abide by. If your corporation issues equity to its international employees, then they will also have to address the IFRS and adhere to its rules and regulations.

Equity management in Secondary Market

Managing liquidity options with everyone’s equity is a part of equity management. Traditionally it was not easy for employees to sell their private shares, but companies are making it easier for them after realizing its value. They can either sell their shares to a secondary person or hold a tender offer. This gives the employee the chance to sell the share back to the company or to an investor. Both of these transactions bring complicated paperwork and costs. This is for the admin to bear. Additionally, they will also have to update the cap table each time there is a new owner.

Equity Management Software

Encompassing different processes, people, and tasks, equity management is not simply updating the cap table. As the company raises more money to complement their growth, things become more complicated. This is why using one equity management team is essential. With Eqvista, the cap table will automatically update after grants are issued. All transactions are regularly updated. Using this you can reduce the excessive time wasted on preparing the complicated tables yourself.

Why use equity management software?

You should use one equity management software because:

- It will lead the charge in creating more owners.

- The platform keeps you organized, which will result in less waste of time and a rise in potential investors.

- With one platform, all the data is automatically updated and connected saving time and money.

- Ready any time. Anytime you need the information, it is ready without delay.

Good equity management is a critical aspect of your company’s success.

How Eqvista helps?

As mentioned above, Eqvista is a great cap table and equity management platform that you can use for your company. The best thing about this advanced software is that it is FREE to use during the initial stages of your company. This means that until you have more than 20 shareholders in your company, Eqvista is FREE to use. You will get all the help you need when using the app. Try it out here today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!