409a Valuation

Get your company’s valuation performed by Eqvista,

one of the leading 409A valuations providers.

UNLIMITED 409A VALUATION STARTING AT $990

All clients will be given unlimited 409A valuations for 12 months performed by NACVA certified valuation analysts.

STARTUP

$990/yearSeed stage

$1,290/yearSeries A

$1,990/yearSeries B

$2,490/yearCustom

By QuotationOur 409a valuation pricing tiers are based by funding rounds, but may vary depending on other factors including: total revenue, number of employees and capital structure. e.g. A closely held company with sales of $5 million, 50 staff, and no previous funding, may be equivalent to a Series B company. Tell our staff more information for an accurate quotation.

If you’re interested in getting a 409A, please feel free to contact us.

15,000+

Companies

Trust us

15

Valuators

in the Team

$1B

Monthly Client

Asset Valuation

409a Valuation Based on Startup Stages

A startup begins with an idea, and with hard work and determination, take steps to grow and become a functioning company. Each of these steps means that the company has reached a new value and stage of growth. For each company stage, 409A valuation providers can help you get your company’s value.

The different stages of a company include:

- Startup – This is for new or startup companies in business less than one year. Pre-revenue companies or those startups developing their product and services and looking for a company valuation of their fair market value for issuing new shares. Limited to companies with under $100k in revenue.

- Seed Stage – This is the very first funding stage in a company. It is called seed funding as it is the first official equity funding stage and represents the capital the company needs to kickstart the business. The amount usually ranges from $10,000 to $2 million in this round.

- Series A – As soon as a business establishes itself and creates a track record, they can get Series A funding to grow their business more and work on their product base. In this funding round, the average amount offered is from $5 to $30 million.

- Series B – At this stage, the company is developed and running successfully. The Series B round helps take the company to the next level where they can expand their market reach. The amount of capital typically offered in this round ranges from $30 to $60 million.

- Series C – Companies that reach the Series C round are usually already very successful and look for capital to acquire other companies, develop new products, or expand into new markets. Many companies also use this round to boost their valuation to eventually go public and have an IPO.

However the funding rounds do not end here. Some companies take on more funding from investors to keep growing and expanding, with Series D, Series E, Series F rounds and so on. While other companies take on little to no funding and work to grow their company internally. Eqvista offers 409A valuation services for every funding stage in a business.

Get Your Company 409a Valuation from Experts

It is not only cost-effective but easy to get an independent 409A valuation.

- Straightforward Process – Discuss your company, answer some questions, and share the needed documents. Review the draft report and then get your complete 409a valuation report.

- Professional Appraisers – Our team has extensive experience from small companies to large corporations.

- Dependable Results – Our 409A valuation reports are prepared by expert appraisers that comply with safe harbor standards and utilize widely accepted valuation practices.

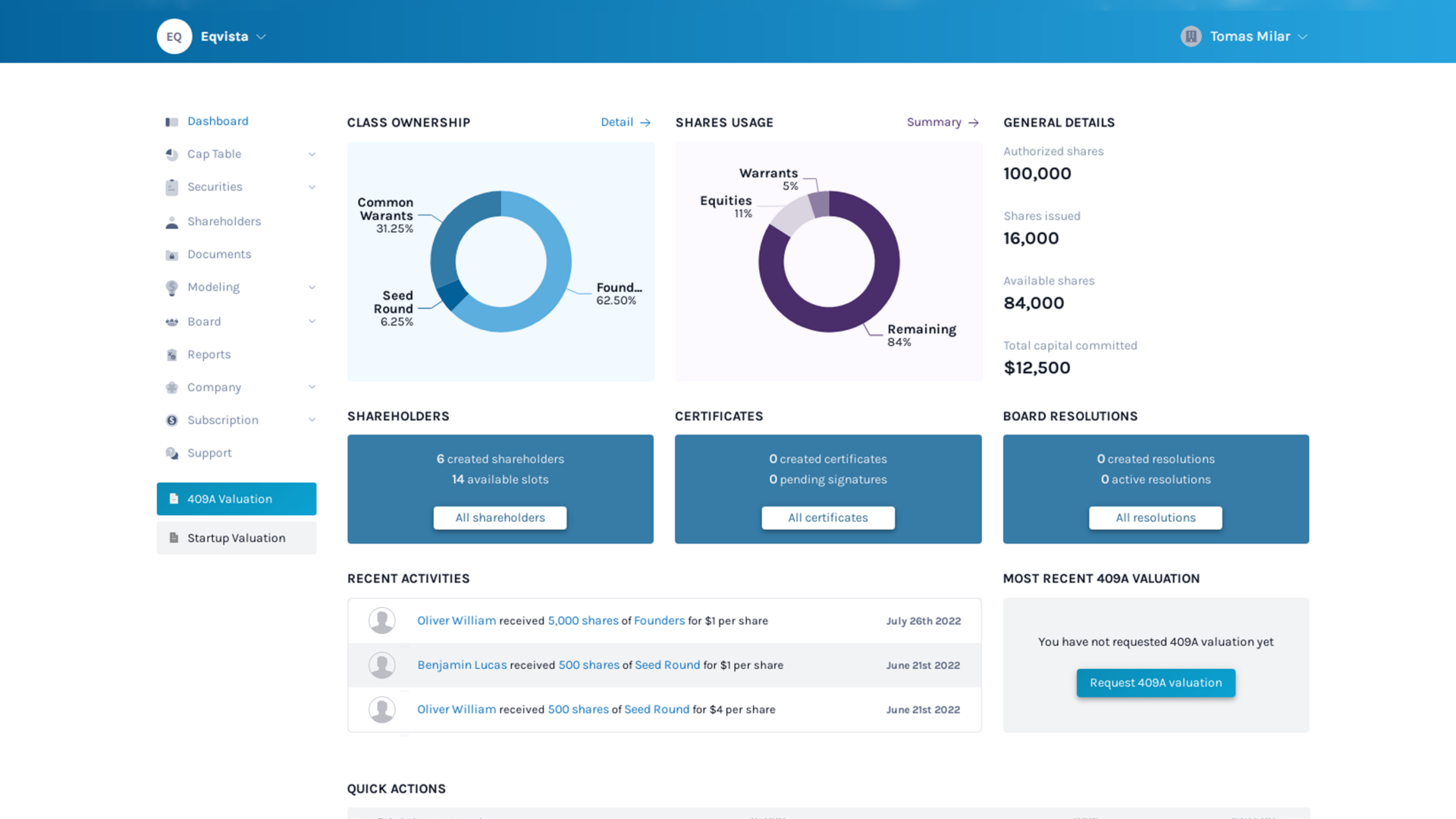

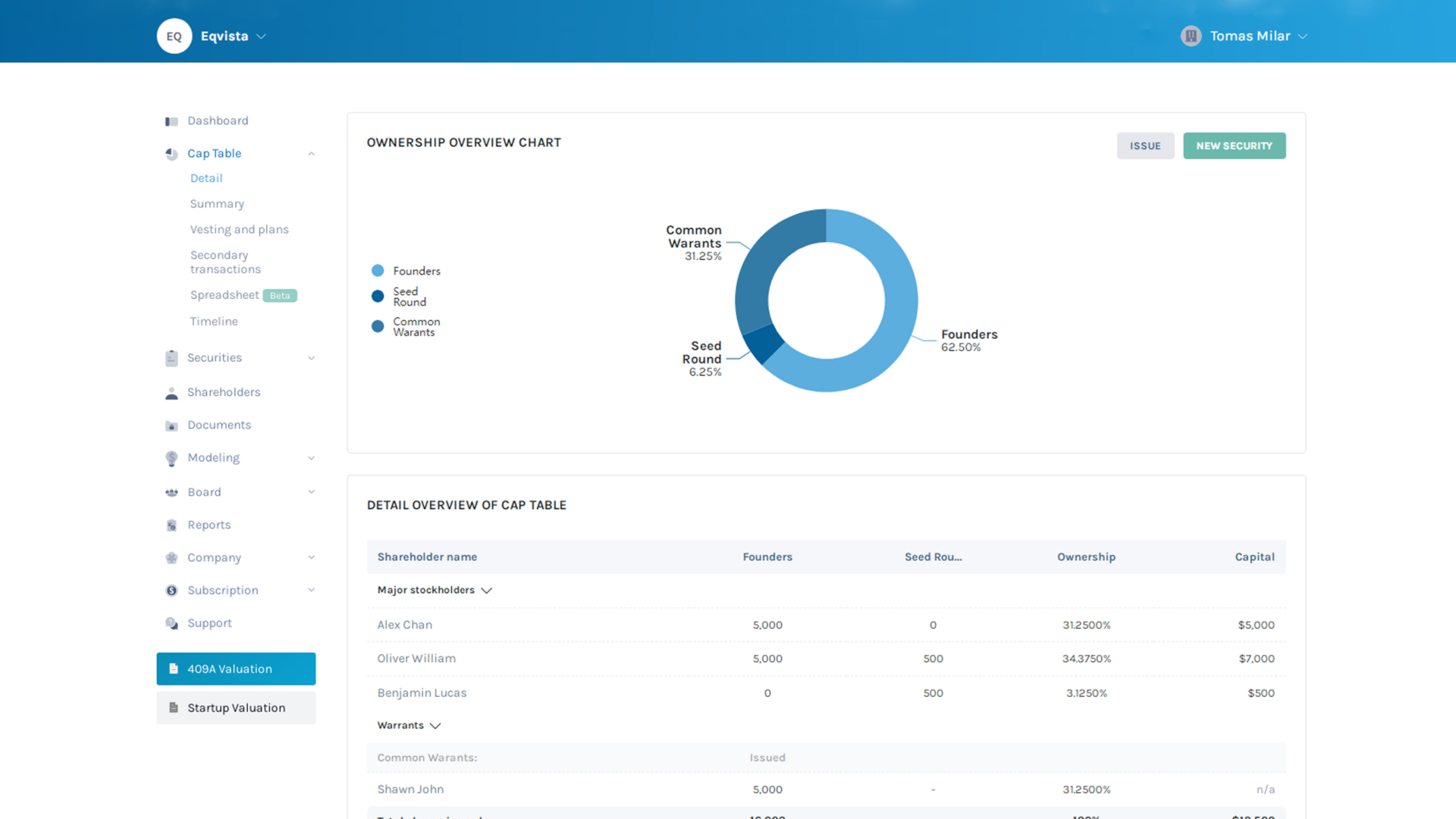

Sample of Eqvista 409a Valuation Report

Here we have included a sample of our 409a valuation report of a mock company for viewing purposes.

Our 409a valuations are fully customized, with easy to understand charts and tables about your company information. We focus on providing high quality valuation reports that are understandable for our clients. Our reports are often over 50+ pages for a 409a valuation, so you can be sure your company valuation is accurate and audit defensible.

What is a 409a valuation?

A 409A valuation is a process for appraising your business to determine the cost of the company stock, resulting in a valuation report. This report is a legal requirement for the companies that are about to issue deferred compensation to their employees.

The IRC (Internal Revenue Code) section 409A makes sure that the appropriate federal income taxes are paid by employees for the compensation they get. It also offers the company a safe harbor status, reducing the chances of an audit by the IRS.

Why is a 409a valuation important?

409A valuation services are important as it ensures that the company is complying with the federal tax code. It offers the company an acceptable fair market value and safe harbor status. This would help the company avoid any IRS audits, which can lead to penalties for both the company and the employees who received the equity compensation. A 409A valuation also offers the company’s investors and management a gauge on the financial standing of the company.

Purpose of a 409a Valuation

A 409A valuation is needed by companies about to issue equity compensation to their employees. Equity has to be issued at fair market value (FMV) obtained through a company valuation to avoid adverse tax liabilities, which includes varying state tax penalties and a 20% federal income tax penalty.

A 409A valuation needs to be done when there is a material event in the company, including, but not limited to:

- Issuance of employee stock options for the first time.

- The last 409A valuation is past 12 months

- A significant change in the business plans or operations.

- Turnover of key employees in leadership positions.

- Raising a round of funding.

- Protect your corporation with safe harbor status as per the IRC.

- Keep the company’s resources for growing the business.

- Avoid any lost compensation and financial penalties for your company and its employees.

Eqvista has certified specialists to perform 409a Valuation

Eqvista is a nationally recognized expert in offering defensible 409A valuations for a wide range of companies of every size, industry, and stage. We are NACVA certified, and have a team of highly experienced specialists that handle each case dedicatedly. Our team has the needed certifications, knowledge, and experience to give you the best and most accurate valuation report. Clients come to us when they need high-quality appraisal and business valuation services that are accurate and offer safe harbor status.

Eqvista has performed business valuations for many companies in various sectors and industries. Our specialized team uses the best methodologies and has a proven approach to get your company’s valuation. It works for all business structures, including sole proprietorships, partnerships, LLCs, S corporations, and C corporations.

Why choose Eqvista for your 409a valuation needs

- Unlimited 409A valuations for 12 months with no extra charges

- Highly-trained and experienced team of analysts

- NACVA certified valuation team that provides you support throughout the process

- Worked with a multitude of companies across various sectors and industries

- Affordable pricing for high-quality valuation reports

Get High-Quality 409a Valuation Reports Here!

Reduce your exposure to risk by getting a 409A valuation provider for valuing your company! Eqvista is one of the leading providers for 409A valuation services and we are more than happy to assist you and your company. Here’s a few reasons why you should have your valuation done by us:

- Our expertise – Our team is built of experienced valuation analysts who have performed valuations for companies of all stages and sizes. For each valuation, a dedicated in-house analyst handles everything from getting your information to sharing updates and answering your questions throughout the process.

- Our process and time frame – The 409A valuation services by us are cost-effective, audit-ready, accurate, and completed in a short period of time. A dedicated member would stick with you throughout the whole process. This will allow you to focus on your business, instead of worrying about the company valuation.

- Our prices – Not only do we offer high-quality 409A valuation reports, but we offer them at affordable prices. We know how important it is to get a 409A valuation and it can be costly, which is why our prices are super affordable in order to help your company with its valuation needs.

Trusted by over 15,000 companies

NEED A 409A VALUATION FOR YOUR COMPANY?

Eqvista has got you covered for your 409A valuation needs. Contact us to discuss your case today!