How to Issue Shares and Stocks?

Keep reading to understand all about the differences between stocks vs. shares and how to issue shares in a company.

The difference between shares and stocks can sometimes get mixed up when it comes to finance. While stock is a more generic term used for the stock market, the term shares are more specific to company ownership and company funding.

Understanding Shares and Stocks

There is a difference between stock and shares, but it is usually considered as the same in the financial markets. Normally, both these words are used interchangeably to refer to financial equities, mostly the securities that denote ownership in a company. These days, the difference between the two has more to do with the syntax and is derived from the context in which they are used. Let us understand each of them separately and then look at their differences to get a better idea.

What are shares?

A share is the smallest and single denomination of the stock of a company. To put it simply, shares normally represent units of stock. By now, you might have heard of common and preferred stock. Well, these two represent the different classes of stock in a company.

Basically, these different classes of the company’s stock have different privileges and rights. They also trade at different rates. Common shareholders have the privilege to vote on the company personnel and referenda, and preferred shareholders do not have the rights to vote but they have a higher priority in getting paid first in the case of a buyout or company bankruptcy. Both of these types of shares pay dividends. Some companies normally customize their classes of stock to meet the needs of the investors, and name these classes of shares as “A”, “B”, and so on. They also get different voting rights and privileges. For instance, one class of share would be held by a group of people who would have 10 votes per share.

What are stocks?

To understand stock, let us confine ourselves to the equity market. You might have already heard investment professionals using the word stock with companies. Well, this is for publicly traded companies. And they normally refer to stock like value stocks, small or large-cap stocks, food-sector stocks, energy stocks, blue-chip stocks and so on. In all these cases, the categories do not refer much to the stock themselves as to the corporations that issued them. Some also refer to preferred stock and common stock, but they are not types of stock but types of shares.

So, when people talk about the stock of a company, they are referring to common stock. Common stock represents the ownership in the company and is the kind of stock that people usually invest in. In fact, most of the issued stocks are in this form. Common shares represent a claim on profits, which is given out in the form of dividends and confer voting rights.

What are some major differences between shares and stocks?

When a company is planning to raise funding, it can issue stock or it can borrow some money. The stocks are the securities that represent the ownership of the company. A few stocks pay annual, quarterly, or monthly dividends, which is a part of the profits earned by the company. And when a company issues stock, each of the units of the stock is considered to be a share. This means that one share of stock is equal to one unit of ownership in the company.

Here are some of the main differences between shares and stocks:

- Stocks are a collection of shares of a company or a collection of shares of multiple companies.

- Shares are the smallest unit that refers to the ownership of the company.

- Stock is a simple aggregation of shares in a company, while shares represent a part of the ownership in the company.

- Shares are issued at a premium, discount, or at par. It is known as stock when the shares of a person are converted into one fund. And when a company gets listed as a public company, it is basically changing its shares into stock.

Here are the differences between stocks and shares:

| Stocks | Shares | |

|---|---|---|

| Meaning | Stocks represent the ownership of the company. | Shares are the owner of one particular company. |

| Denomination | Two different stocks of the company can or may not have the same value. | Two different shares in the company can have the same value. |

| Possibilities of original issue | No | Yes |

| Nominal Value | There is no nominal value associated with the stock. | There are some nominal values associated with the shares. |

| Numeric Value | Stocks do not have a defined number. | Shares have a definite number known as a distinctive number. |

| Paid Up Value | Stocks are always fully paid up by nature. | Shares are either partially paid up or fully paid up. |

| How much is it preferred? | The preference is higher in terms of transfer as they can be infractions. | The preference is lower in terms of transfer as they cannot be infractions. |

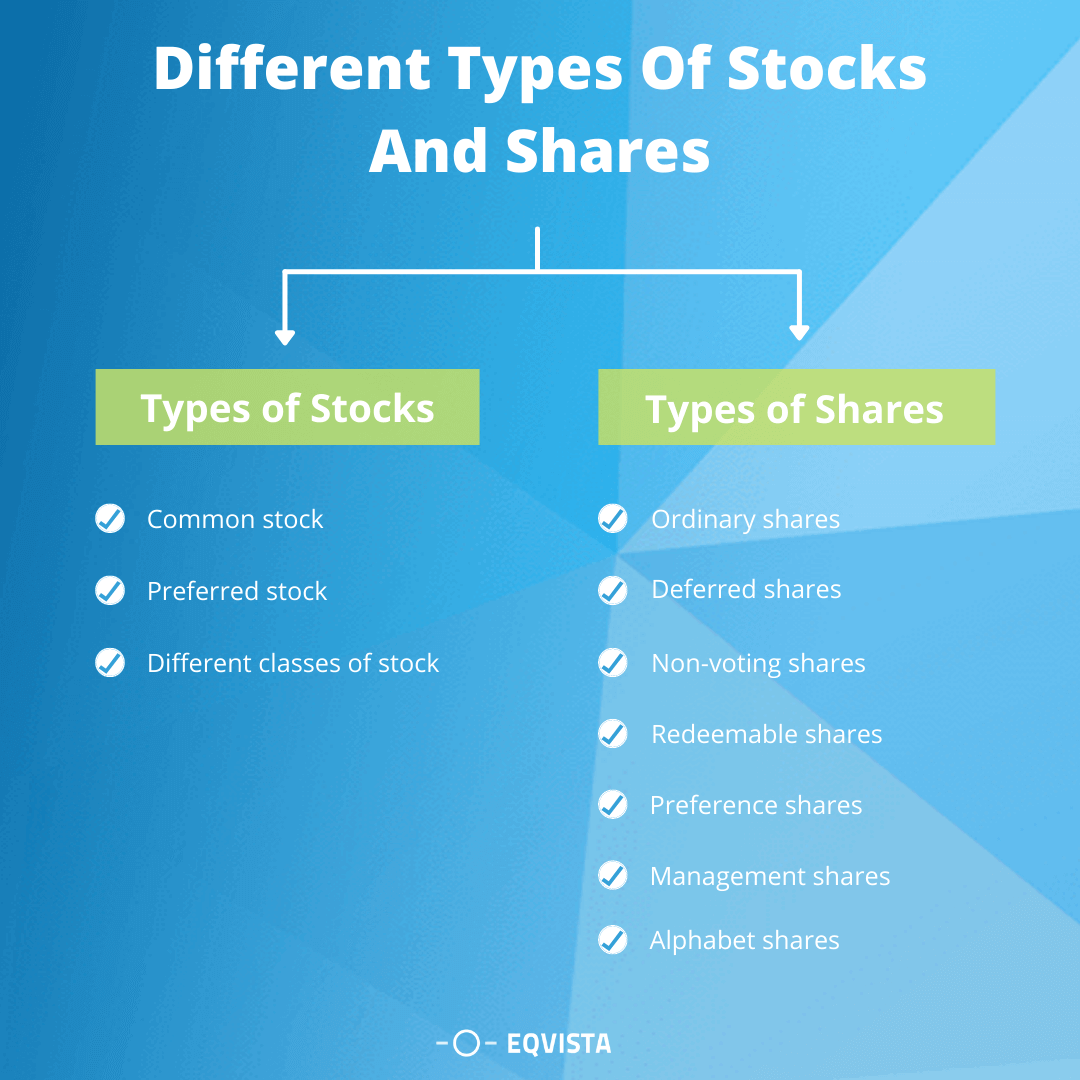

Different Types of Stocks and Shares

From the above table you now know that stocks and shares, although used by many to refer to the same thing, are not the same. Plus, there are different types of each as every class has different rights and responsibilities. Let us talk about both the types in detail below:

Types of stocks

Talking about stock, there are mainly two kinds, although companies can customize their classes of stock. Each of these has been explained below:

Common stock

Common stock is, well, common. Basically, when a person talks about stocks in general, they are talking about this kind of stock. The common shares represent the ownership in the company and claim on a part of the profits. As time goes by, the common stock yields higher returns than any other investment. But this return comes at a cost, as the common stock comes with a great risk. In case the company liquidates or goes bankrupt, the common shareholders would not get money until all the bondholders, creditors, and preferred shareholders are paid.

Preferred stock

This type of stock represents some degree of ownership in a company. But preferred stock does not have any voting rights, although it depends on the company. Preferred shares guarantee that the investors would be paid a fixed dividend, unlike the common stock where the variables are not guaranteed.

Preferred stock also has another advantage where if the company goes bankrupt, the preferred shareholders would be paid first before the common stockholders. But keep in mind that they are paid only after all the debt has been cleared with the creditors. The preferred stock may also be callable, which means the company has the right to buy back the shares at any time or for any reasons. Due to its nature, some people consider preferred stock more like debt and less like equity.

Different classes of stock

Preferred and common stock are the two main forms of stock as mentioned above. Nevertheless, it is also possible for companies to customize the different classes of stock. The reason companies do this is they want the voting power to remain with a few specific people only. Due to this, different classes of shares are given different voting rights. These classes of stock are normally named as “Class A”, Class B”, and so on based on the number of classes available in the company.

Types of shares

Just like stocks, companies also have different types of shares that come under different classes. They include:

- Ordinary shares – Most companies have just one type of share, which is called ordinary shares. It represents the basic voting rights and the equity ownership of the company. These shares normally have one vote per share and each share offers equal rights to dividends. They also offer the rights to distribute the assets of the company in the event of a sale or winding-up.

- Deferred shares – This share allows the company to issue shares that do not pay a dividend until all the classes of shares have received the minimum amount of dividend. And when the company is winding up too, the ones who own this share would get something only after everyone has got their share.

- Non-voting shares – The name says it all. These shares do not offer any voting rights in the company. It just means that the holder would get a part of the company’s profits but isn’t a part of the general meetings in the company. These types of shares are normally given to the family members or employees in the company, and the main shareholders are able to retain control of the company while growing the number of shareholders in the company.

- Redeemable shares – Redeemable shares is another one of the types of shares that can be purchased back from the person by the company at any time in the future. The date of when the company will buy back is either pre-determined or at any time the company wants, based on the agreement. Even though the shares are redeemable, the ability to redeem shares is subject and limited to the specific statutory requirements.

- Preference shares – These shares are also called preferred shares as they get the rights to receive a determined amount of dividend every year. But these dividends are received before the ordinary shareholders, and the amount is usually a percentage of the nominal value. And these shares do not have any voting rights, or normally have one vote per share, based on what the company wants.

- Management shares – The management shares offer the shareholders extra voting rights at the general meetings. This can be 2 votes per share or even 5 votes per share, which again depends on the company. These shares are used to enable the directors of the company to retain control over the company in case there are a lot of shares being issued to outside investors.

- Alphabet shares – One type of shares is alphabet shares and they are basically a subclass of ordinary shares. It permits the company to alter the rights of the shares for the shareholders. Even though each class of shares can be offered a descriptive name, such as redeemable shares, non-voting shares and so on, it is normal to just label the share classes with alphabets like A, B, C, based on the subgroups the company has. So, this kind of share class allows the company to enhance or restrict the rights of the shareholders.

Issuance of Stocks

From the above you have understood that a company can issue two kinds of stock, namely common and preferred stock. Even though a part of the authorized capital of the company is not issued, the shareholders can vote on the amount of capital they want to keep in the reserve, and record the transaction in the equity section of the company’s balance sheet.

How to issue stock in a company?

Let us talk about the steps involved to issue stock in a company:

- Board Approval: Once there is a plan to issue shares or any kind of securities to someone, this plan is taken to the board for their approval. This is important as it would help avoid headaches and unnecessary costs down the line of ratifying and cleaning up the capitalization records of the company.

- Get Paid: The next step is to see if the security is offering the company a good value in return. The payment can be monetary, or through services or property. In addition to this, the payment of the stock does involve a lot of tax issues, and a lawyer can help choose how to be paid for issuing shares.

- Prepare Needed Documentation: After that, you will need to get the right documentation for the issuance of the security. Each document type will be different based on the agreement and the type of security. The main idea is to have all the needed documentation signed, maintained securely and accessible. It would help you in the due diligence process in a financing round or sale of the company. For instance:

- If it’s a stock option, the documentation would include the board approval and an independent third-party valuation for obtaining the value of the share. Then the copy of the stock plan, an option grant and a fully executed option notice would be needed as well.

- If it’s a preferred stock, the documentation needed include the board approval, a stock purchase agreement, a suite of ancillary agreements which includes the stockholder consent.

- Securities Filing: This is done by the company mentioning the steps and the risks involved in the investment made by the investor. The document has to be filed by the company to comply with the federal and state security laws.

- Issuing Certificates: Although a public company doesn’t issue actual certificates, private companies have to do it. The new trend is to issue electronic certificates to the shareholders online.

Issued Shares

Issued shares are the authorized shares sold to and held by the company shareholders. They include the stock a company sells to outsiders to raise funds and the stock given to the insiders as part of their compensation package. The number of issued shares is always recorded in the balance sheet of the company as the owners’ equity or the capital stock.

The issued shares are included in the calculation of the market capitalization where these are multiplied by the current share price. It is also used to calculate the earnings per share, also known as EPS. These figures help in measuring the value of the company and its performance. Just to make it clear, the authorized shares are approved by the board of directors or founders in the corporate filing paperwork, while issued shares are decided as sold by the ownership for cash.

Issued shares vs Outstanding shares

You know what issued shares are, but what are outstanding shares? These are the shares currently owned by the shareholders of the company. This category can include share blocks and restricted shares as well. The outstanding shares are important for calculating the metrics of a company. For large companies, issued shares and outstanding shares are normally the same. But outstanding shares can never be more than the issued shares. Once the company buys shares back, the shares would no longer be considered as outstanding shares, even though they are considered to be issued shares.

How to issue shares in a company?

Put in simply, here are the steps to issuing shares in a company:

- Figure out if you need to issue shares to raise capital.

- Determine the benefits of issuing the shares.

- Consider all the disadvantages to it.

- Analyze all the other possible alternatives to issuing shares.

- Calculate the amount of capital needed.

- Check the authorized shares available that can be used for the issuance process.

- Figure out whether you should issue common or preferred shares.

- Get the total number of shares to issue based on the amount you need to raise.

- Follow the federal and state security laws before you issue the shares.

- Outline the share agreement and complete the transaction.

Share certificate

When you issue shares in your company, you need to give the person something called a share certificate or stock certificate. It is a documented proof of shareholding in a company. This document can be a physical or an electronic one. It is issued to the shareholder and would have the sign of the corporation on it. This certificate would act as the legal proof that the person owns a specific number of shares of that company.

It also acts as a receipt of the share purchase. Nevertheless, the share certificate merely contains details of the shareholder and number of shares they own, and is not the stock itself. This means that one investor can hold multiple share certificates for different classes of shares they own. This certificate has to be issued within two months after the grant date of the shares. And just like currency notes, the companies use intricate designs on their certificates to restrict fraudulent replications.

Issuing Shares On Eqvista

Eqvista is a cap table software that allows you to issue shares online and keep track of them easily. The application has been created to make the complete process easier for entrepreneurs. You will be able to record all the transactions and view them in real-time.

Here is how you can issue shares to various people through Eqvista:

How to issue shares to founders on Eqvista?

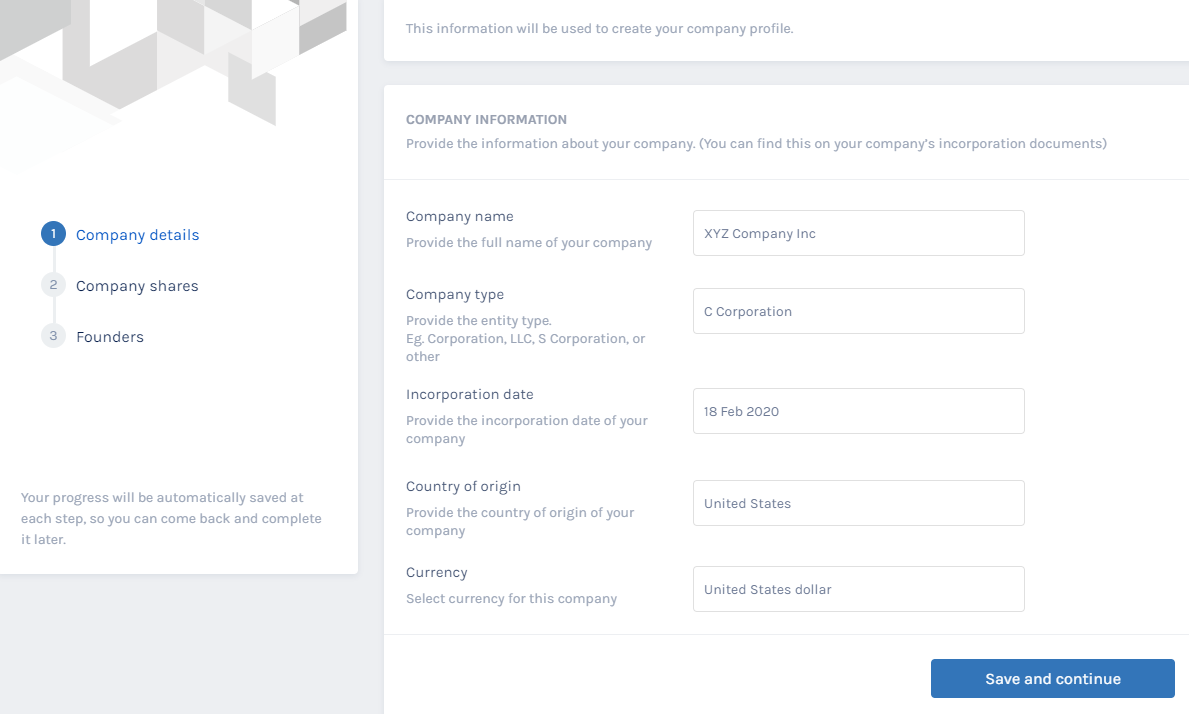

Let us look at how you can issue shares to a founder on Eqvista. Before you begin, sign up for an account on Eqvista. After this, you will need to create a company profile and issue shares to the founders.

Step 1: The first step to create a profile includes adding the details of the company. Once done, click on the button “Save and Continue”.

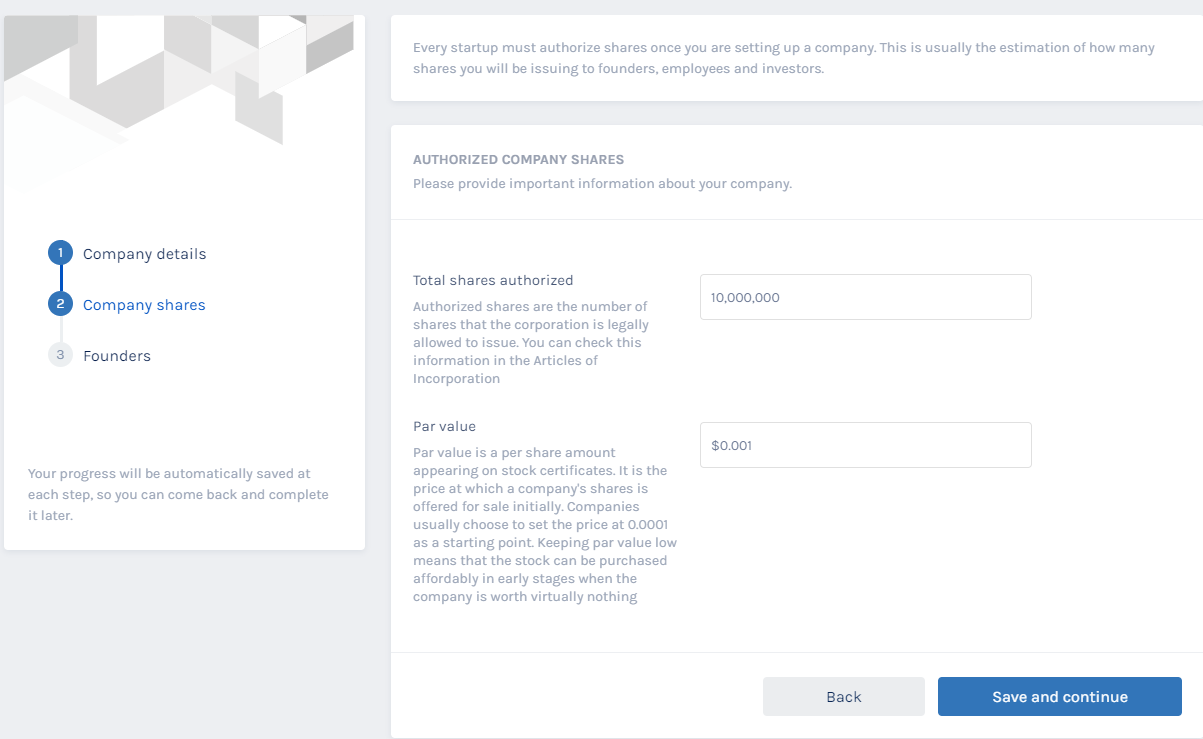

Step 2: Add in the total authorized number of shares that the company has and the price of it in the second step.

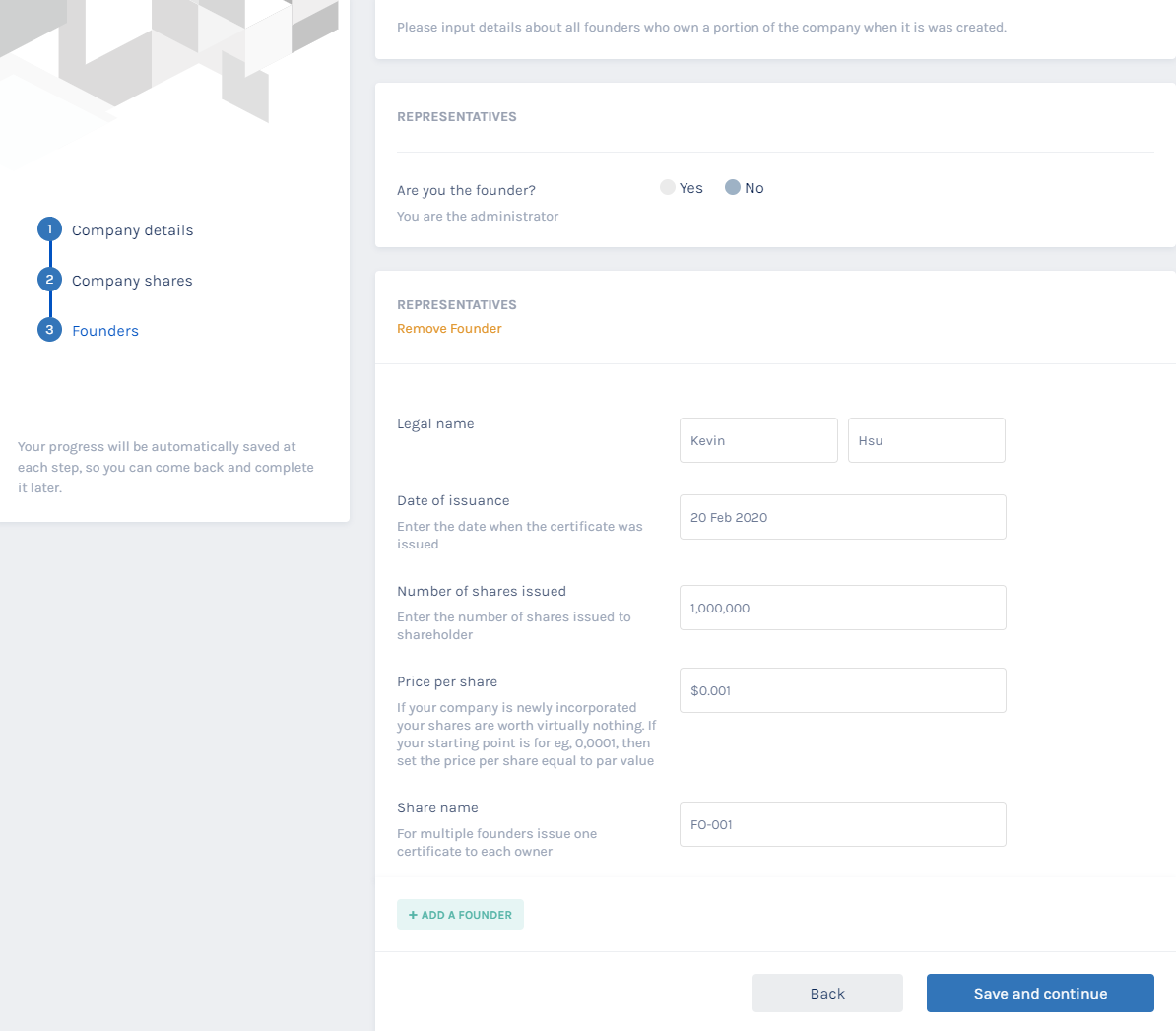

Step 3: In the third step, add the founder details and issue shares to each founder. You can add more than one founder by clicking on the button, “Add a founder”. Once done, click on “Save and Continue”. With this, your company will be formed and the shares would be issued to the founders.

And just like this, you can issue shares to the founder in the company. To understand this more in detail, check out the support article!

How to issue shares to Investors on Eqvista?

Once you have your company set up and the founders have been added, now its time to issue shares to your investors. First, go to the dashboard of the company.

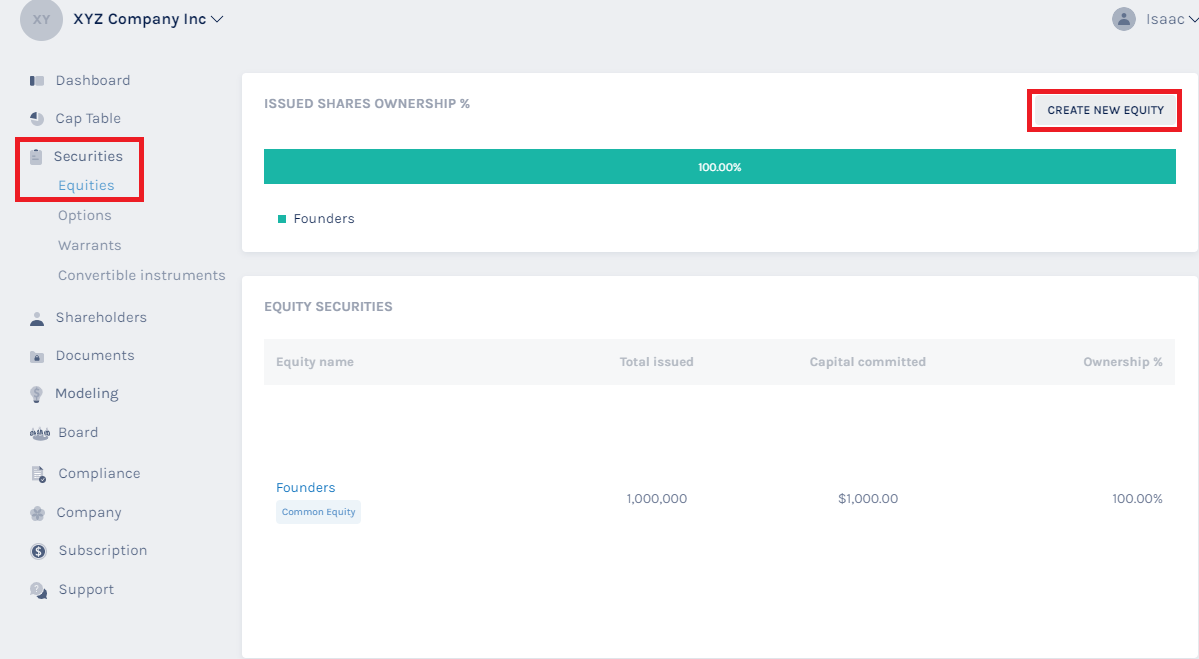

Step 1: Before you can issue shares to your investors, create a new equity class. For this, click on “Securities” and from the drop down menu click on “Equities” from the left side menu on the dashboard. Here click on “Create New Equity”.

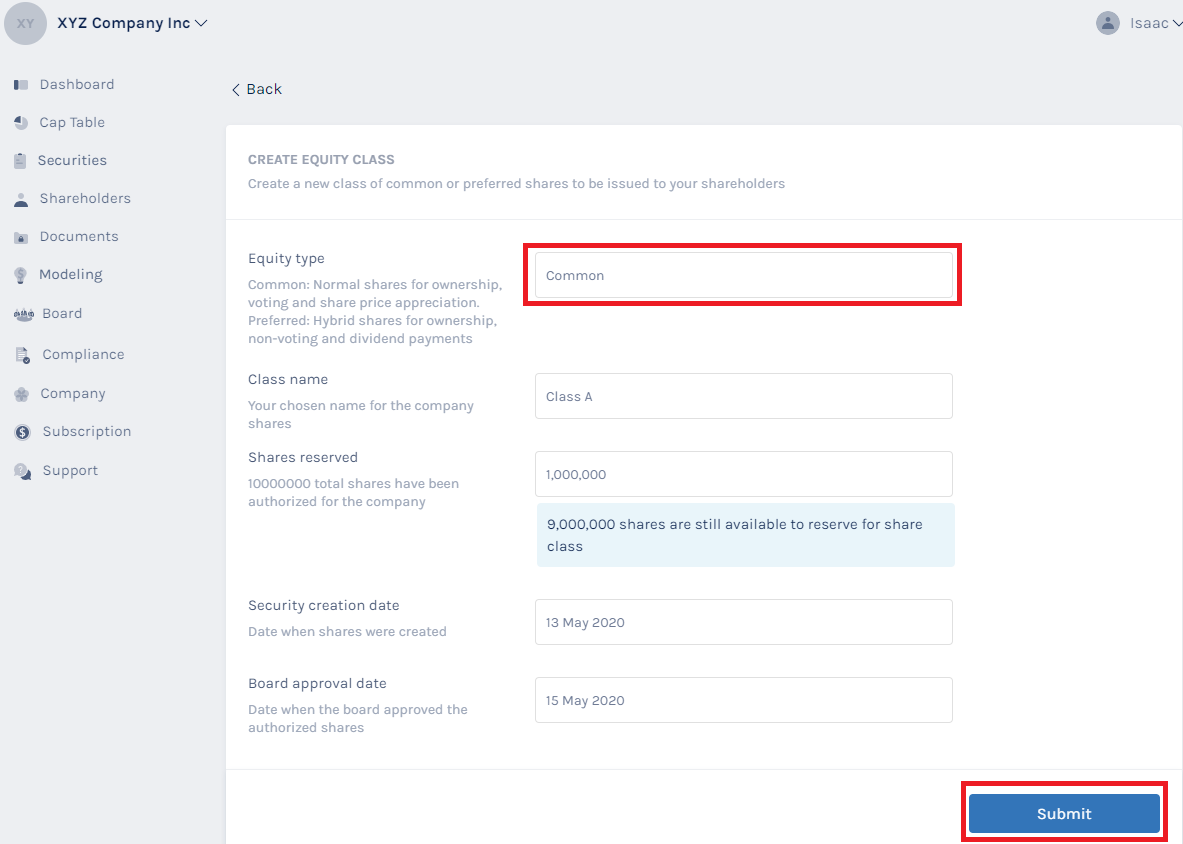

Step 2: You will be redirected to the next page to select the equity type. We selected “Common” in this example. As soon as you do this, the rest of the options show up. Fill in the details of the equity class and click “Submit”.

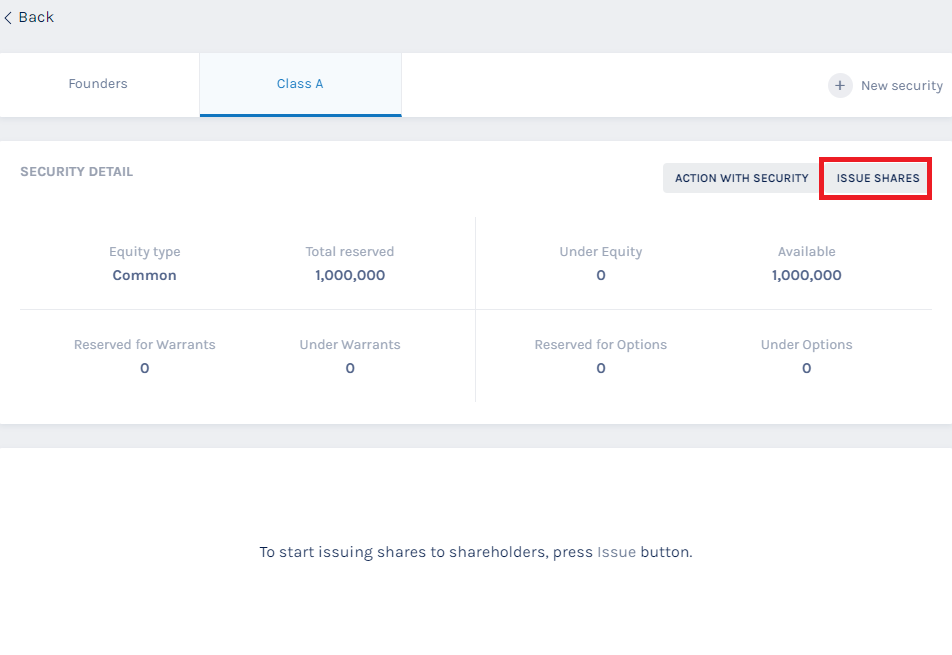

Step 3: From here, you will reach the page of the equity class. On the top right hand side, you will see an option that says “Issue Shares”. Click on this to begin the process of issuing shares to the investor.

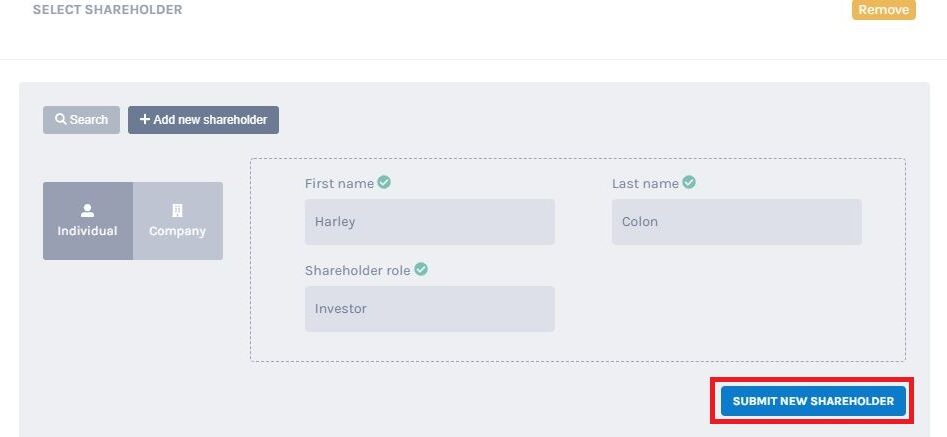

Step 4: Once here, select your chosen equity class, and click on “add new grant”. Now, let us assume that you have not added the details of the shareholder yet. In this case, click on the option “Add a shareholder”, add in the details, and click on “Submit new shareholder”.

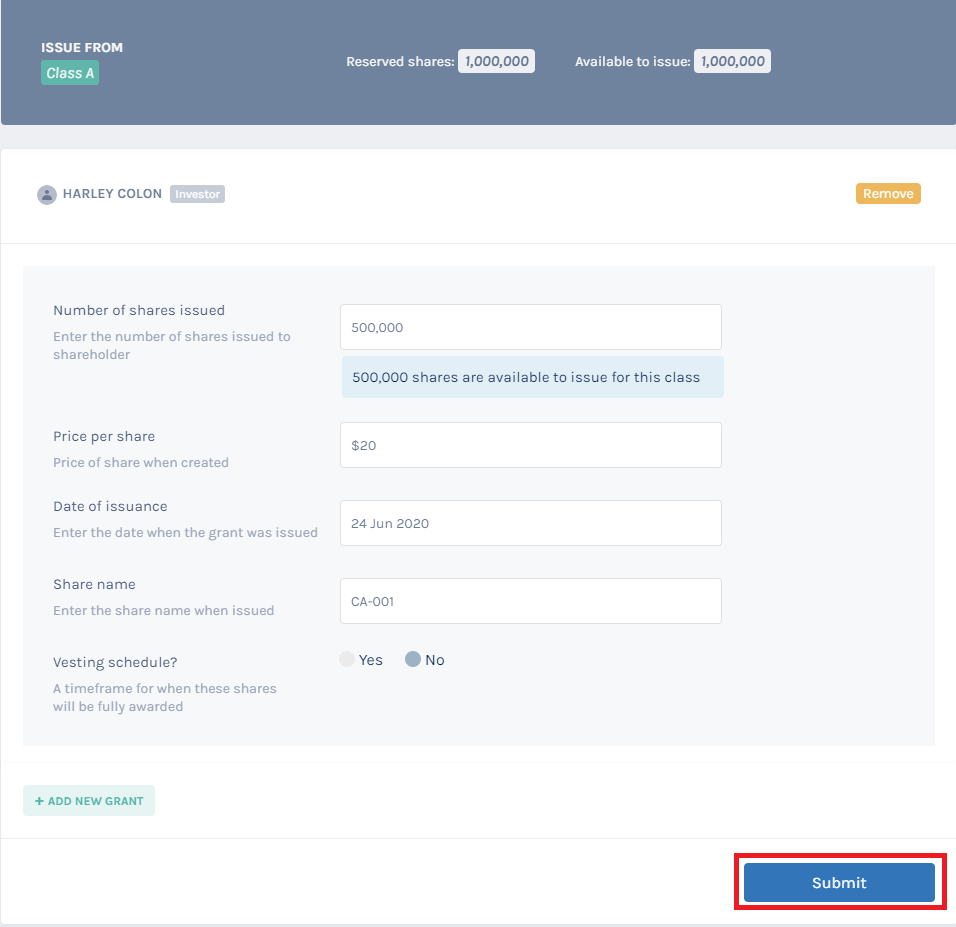

Step 5: Once you do this, you will reach the page where you can issue the shares to this investor you just added. Fill in the details needed and click on “Submit” as shown below.

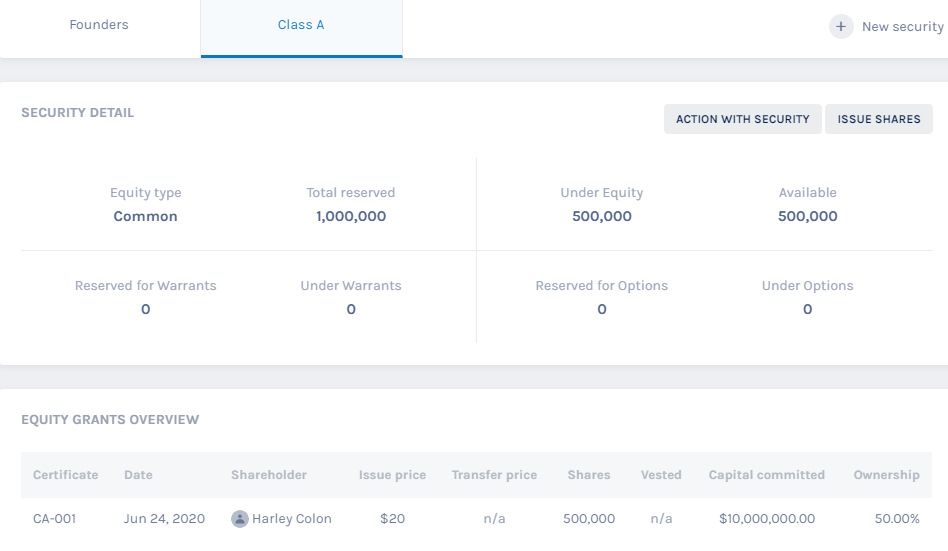

Step 6: Once complete, you will be redirected to the share class where you can view all the investors and share grants under this class.

And just like this, you can easily issue shares to an investor using Eqvista. To learn more about the process, check out the support article here!

How to issue shares to employees on Eqvista?

The process of issuing shares to employees is the same as the investors. The only difference here is that you might need to add a vesting schedule. Let us assume that you have an equity class ready and you have clicked on “Issue shares” to begin the process of issuing the shares to the employee. But before you can do that, you will need to create the vesting schedule that you will use in the issuance process.

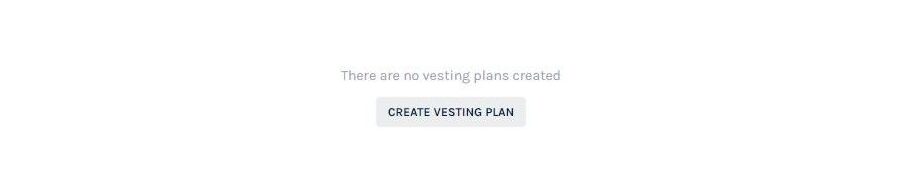

Step 1: From the dashboard of the company profile, go to “Cap table” and then “Vesting and Plan” on the left side menu. You will reach the following page. Here click on “Create Vesting Plan”.

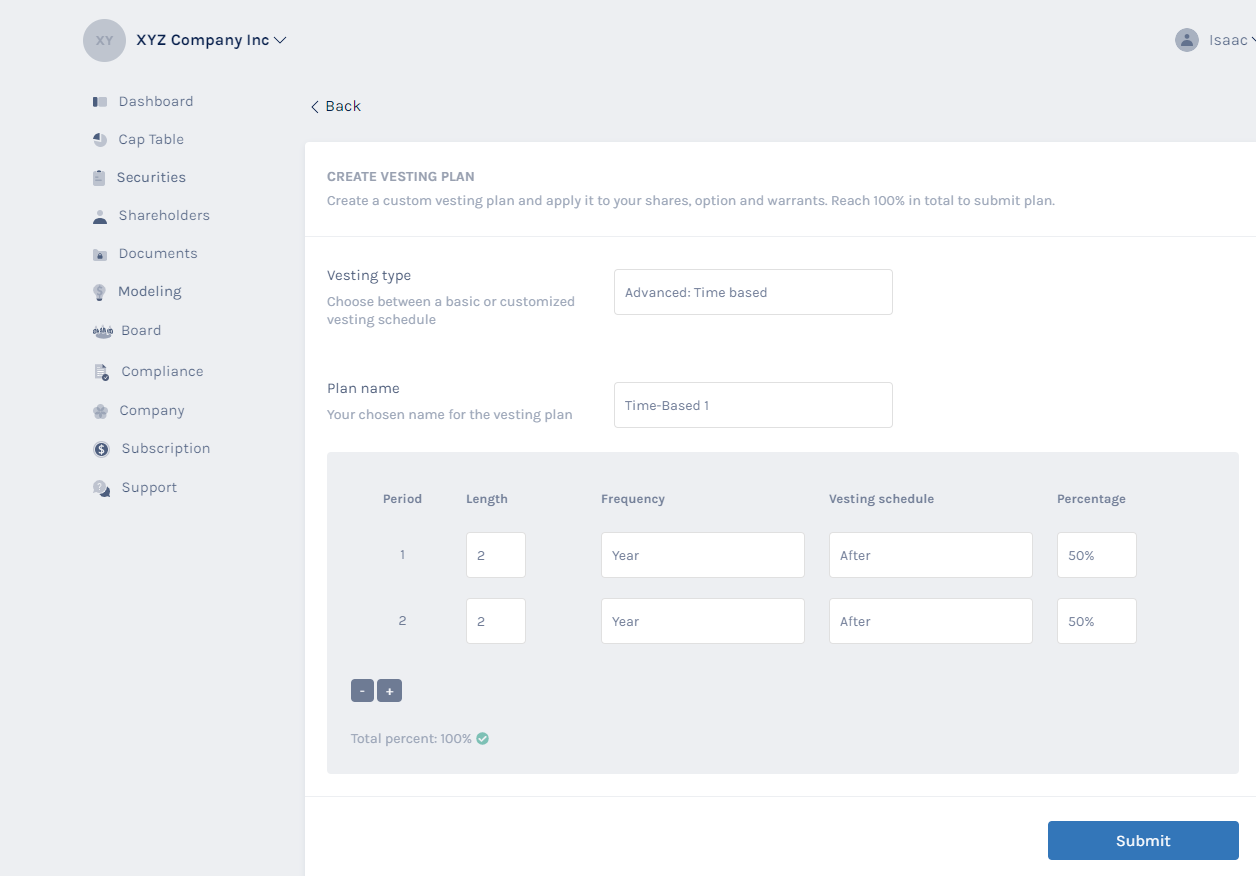

Step 2: Select the type of vesting plan you want to create from the options available. Here, we selected a time-based vesting schedule. Once you do this, the rest of the options appear. Fill in the details and click on “Submit”.

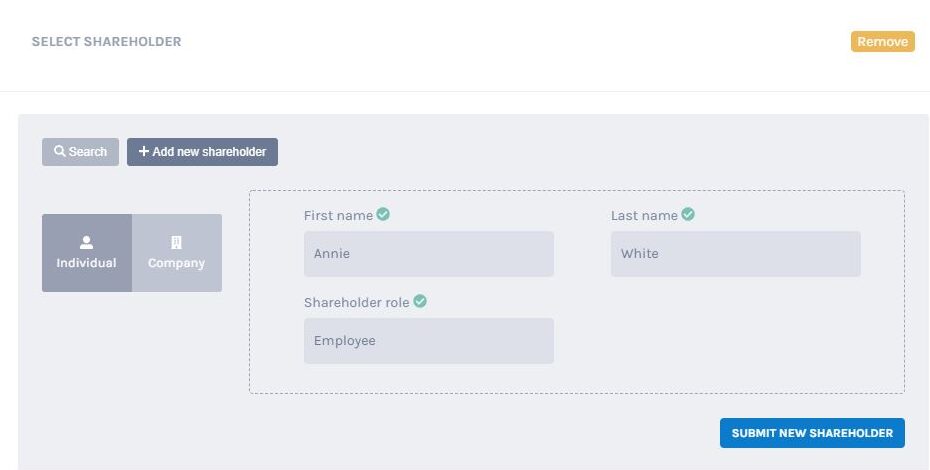

Step 3: From here, you can get back to issuing shares to the employee by going to the equity class page and clicking on “Issue shares”. You will then have to select the equity class you want to issue the shares from. Once done, you will have to add the details of the shareholder (assuming you didn’t). In that case, click on “add new shareholder”. You will get the option to add the person details as shown below.

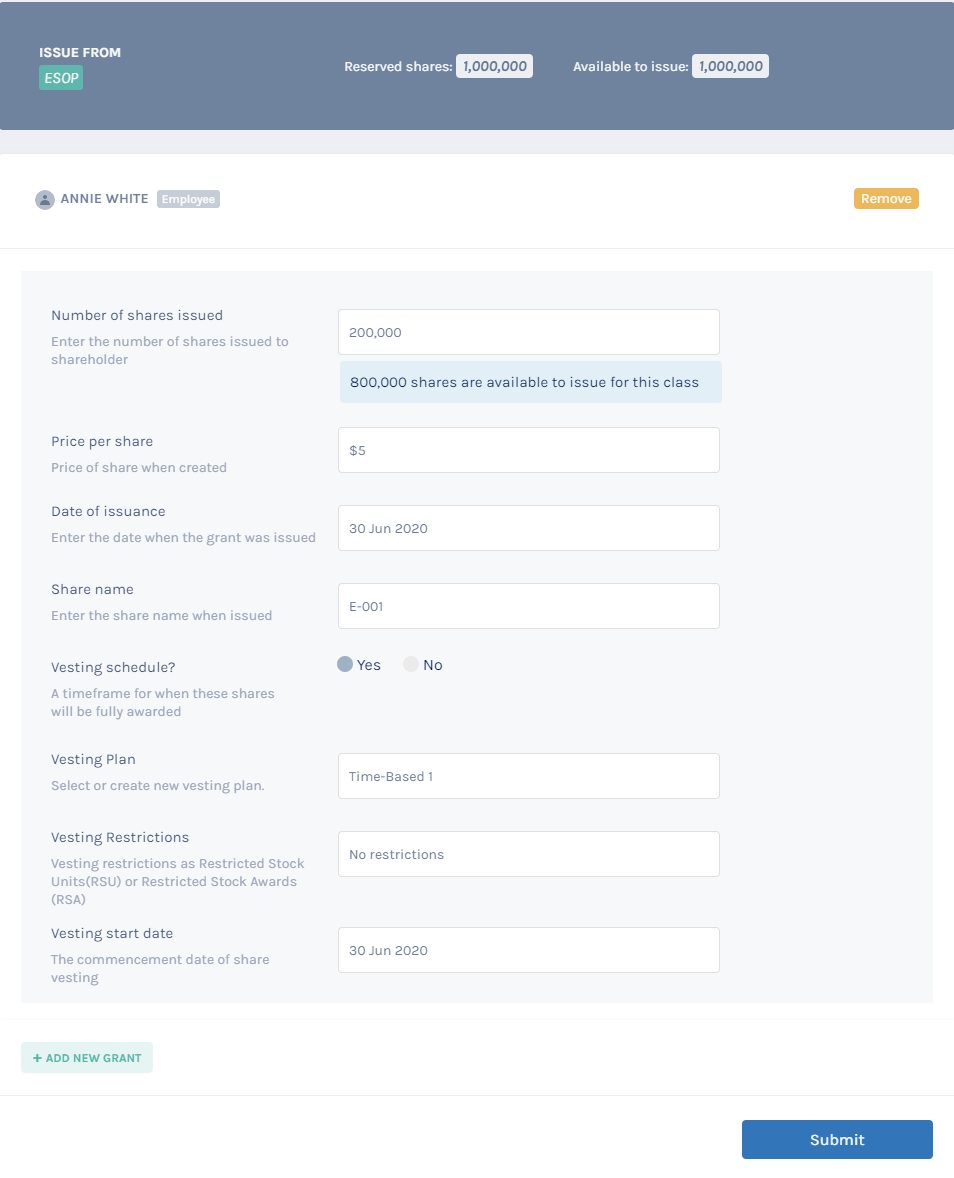

Step 4: Once you have added the shareholder’s details, you will reach the following page where you need to add the details of the issuance. For the option “vesting schedule”, click on the option “Yes” and select the vesting plan you just created and add the additional details for the issuance. As soon as you have added all the details, click on “Submit”.

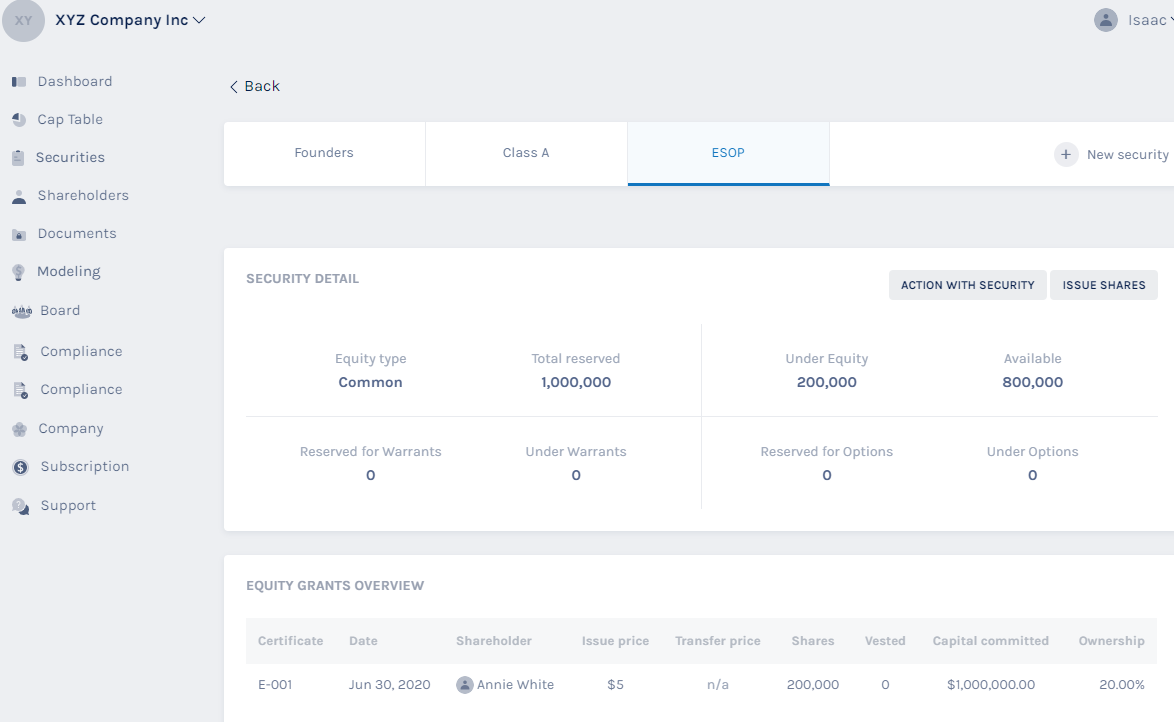

Step 5: You will then be redirected to the page where you can see the equity class and the issuance you just made as below.

And just like this, you can easily issue shares to employees using Eqvista in your company. To understand the process in-depth, check out the support article!

Issue Shares and Phantom Stocks with Eqvista

Eqvista can help you issue shares, keep track of them and manage everything all in one place. All the equity transactions can be easily recorded on Eqvista and the additional tools like round modeling and the waterfall analysis can help you make smarter financial decisions about your next company funding.

Everything is recorded in real-time and you can add shareholders to see their shareholdings. Check out the application here to begin using it today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!