Complete Guide to Cap Table

A cap table is a tool used for startups or new businesses to show the ownership of the company.

A cap table is a tool used for startups or new businesses to show the ownership of the company. This normally includes common shares, preference shares, options, warrants, convertible notes, and many others. It would have an effect on the founders, investors, employees and other third parties. These transactions would ultimately allow you to determine who owns the shares, how many shares each person holds, and dilution of share price over time.

Cap Table: What type of shares are there for a company?

Generally there are two types of shares that most people involved in a deal with; common shares and preference shares.

- Ordinary shares represent the ownership of a company, and shareholders with common shares are able to vote on important policies and exercise their rights as the owners. However, they normally do not receive a fixed dividend and have less preference if the company goes into liquidation following a bankruptcy.

- Preference shares on the other hand normally are for investors. These preference share normally have a fixed dividend, however preference shareholders often do not have any voting rights. They do have preference over common shareholders in the event of liquidation of assets for a company going through bankruptcy.

Other factors that affect the Cap Table

Once you know the two main types of shares, the next step is to understand the other factors and transactions that affect the cap table. These transactions are issued by the company and all can have an effect on the number of shareholders and overall share distribution.

A few of these include:

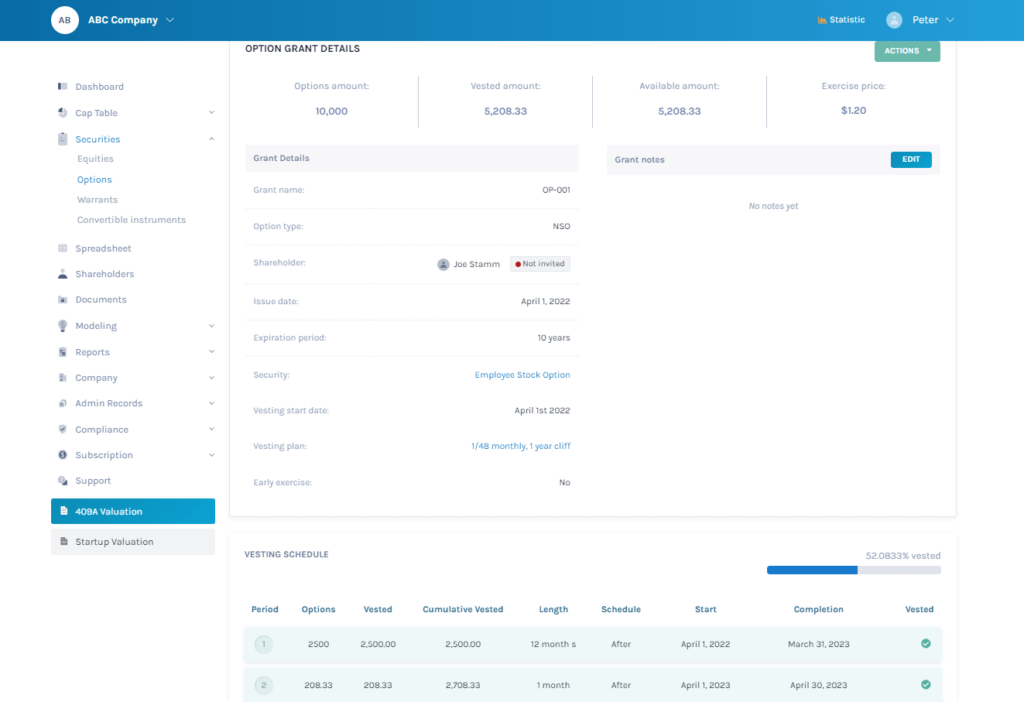

- Options are a type of contract between the company and a receiver that gives them the option to either buy or sell shares at a fixed price before a certain date. These normally are issued to investors, founders, or as an award to employees for their services. An option should include the grant date, receiver, number of shares, cost, strike price (fixed price), vesting start date and exercise date (if any). These options may affect the overall cap table of the company if the option contracts are exercised.

- Warrants are similar in nature to options, however a warrant is issued directly by the company, whereas options may be issued by a separate investor holding shares. As warrants are issued directly, a company may provide these to initial investors for further investments or to build confidence. A warrant would also include the grant date, receiver, number of shares, cost, strike price (fixed price), vesting start date and exercise date (if any). As similar to options, they would affect the cap table once exercised.

- Convertible-securities (debt that converts into equity) are normally bonds or company loans that can be converted into shares at a later date. These types of securities offer the holders a choice on their security, in terms of direct financial gains through interest and loan payments or company ownership.

- Restricted stock are unregistered shares that are normally issued to people inside the company, such as to the executive or directors. These types of shares are non-transferable and must adhere to special SEC (Securities Exchange Commission’s) regulations when traded. These are normally issued as a form of employee compensation, as they often are fully vested after certain conditions are met, such as continued employment or achievement of certain goals.

- Restricted stock units (RSU), as similar to restricted stock, also offer a type of employee compensation when certain performance goals are met. However, they differ in that these employees are not initially issued shares until the vesting is complete, in a similar nature to options rights. This can be advantageous for the company in certain situations, as it does not immediately dilute the share number, as is easier in terms of the bookkeeping and possible taxation effects until the stock units are converted to shares.

These are some of the factors that are issued by companies that affect the cap table and shareholdings, but there are many others as well.

Managing the Cap Table

At first your cap table will be relatively simple, with a list of the founders and their shareholding. This organized table will clearly show who the founders are, the number of shares they have, and what percentage they own of the company. It will also include the number of outstanding shares.

The first few rows of your table should include:

- Total authorized shares: Total number of allowable shares

- Total issued shares: Total number of shares issued to shareholders

- Unissued shares: Total number of shares not yet issued

- Names of founders: Names of the initial founders

- Ordinary shares held: The common shares held by each initial founder

- Preferred shares held: The preferred shares held by each initial founder

The next rows of your table may include:

- Seed round & Series A, B, C: This would include the investments received and shares issued

- Employee stocks: Any shares, options or warrants issued to your employees

- Award stock: The restricted stocks and restricted units based as awards based on staff performance

Other forms of financing that may affect the shareholding and dilution of share price may include warrants, convertible notes and transfers. These additional items will add complexity to the shareholdings, so it’s better to keep things organized and recorded. You may also choose to store the company documents for these forms of financing in the cap table.

Steps to make a cap table

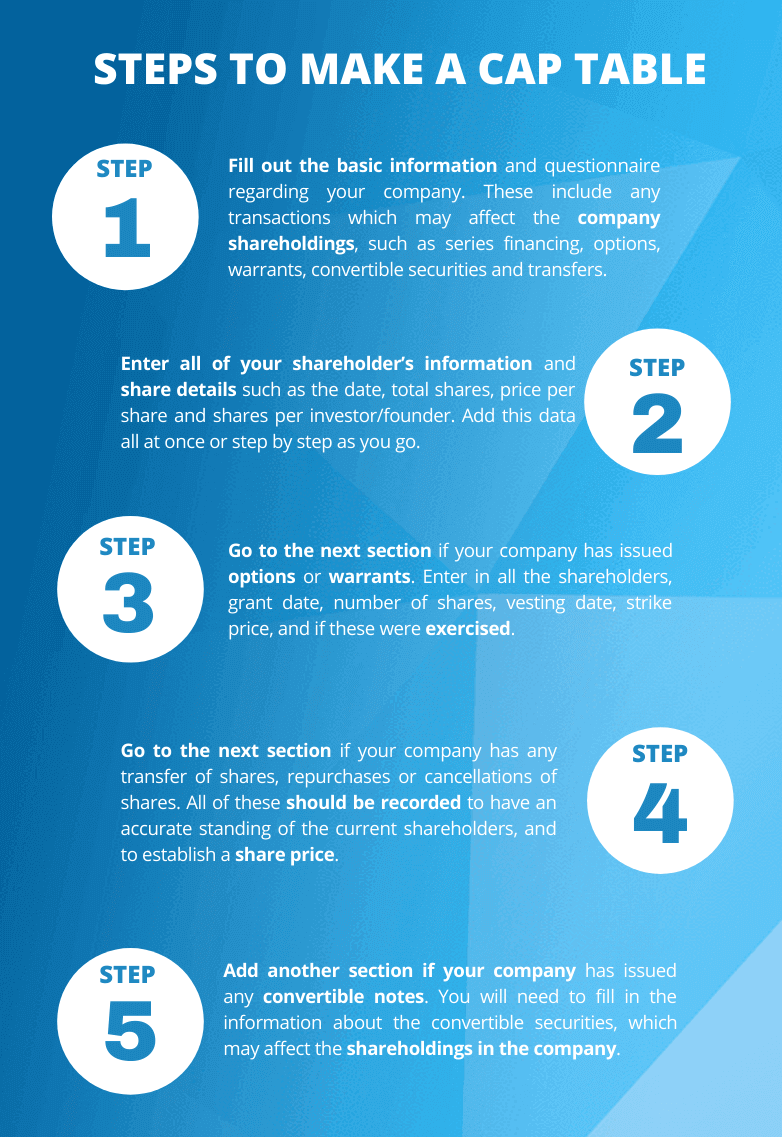

In order to take advantage of our pre-made cap table, follow these steps to complete the information for your company.

1) Gather all the necessary company documents

You’ll need to extract information from these files to fill in the cap table. Here’s a list of the documents you may need:

- Articles of Incorporation

- Shareholders Agreement

- Option Agreement (if any)

- Signed agreements of warrant, SAFE, KISS, Convertible note (if any)

- Any other related documents optioning to purchase

2) Prepare the framework for the cap table

You can create your own framework, where the most common structure is to list stakeholders’ names on the Y-axis and securities on the X-axis.

3) Fill out the cap table file

Here’s the information you’ll need to extract from company documents and input into the cap table file:

- Stakeholder’s name

- Security type and class (common stock, preferred stock, options, warrants, etc.) owned by the company

- Number of shares each stakeholder holds in each class

- Capital committed for each shareholder

- Authorized shares amount for each securities plan

4) Necessary calculations and checks

You need to calculate ownership percentage (if not listed in your company documents). If willing, you can calculate fully diluted shares.

Lastly, please verify that the total issued shares for each securities class do not exceed the authorized amount. Check if the total capital committed aligns with the actual situation.

Once completed, you’re good to go!

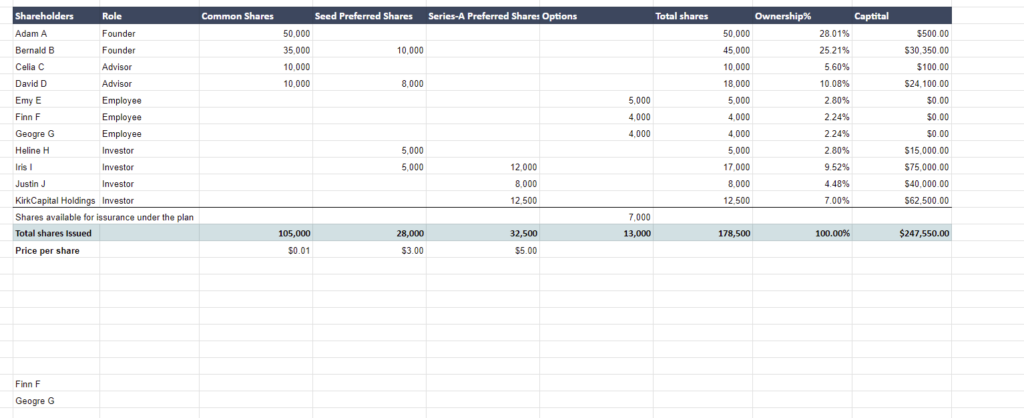

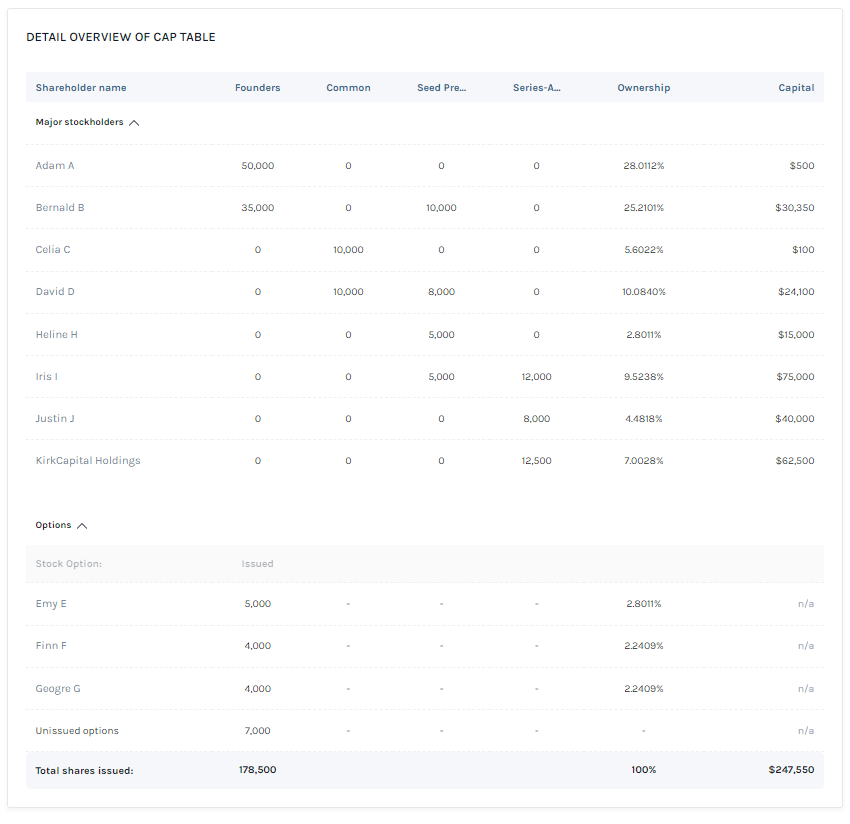

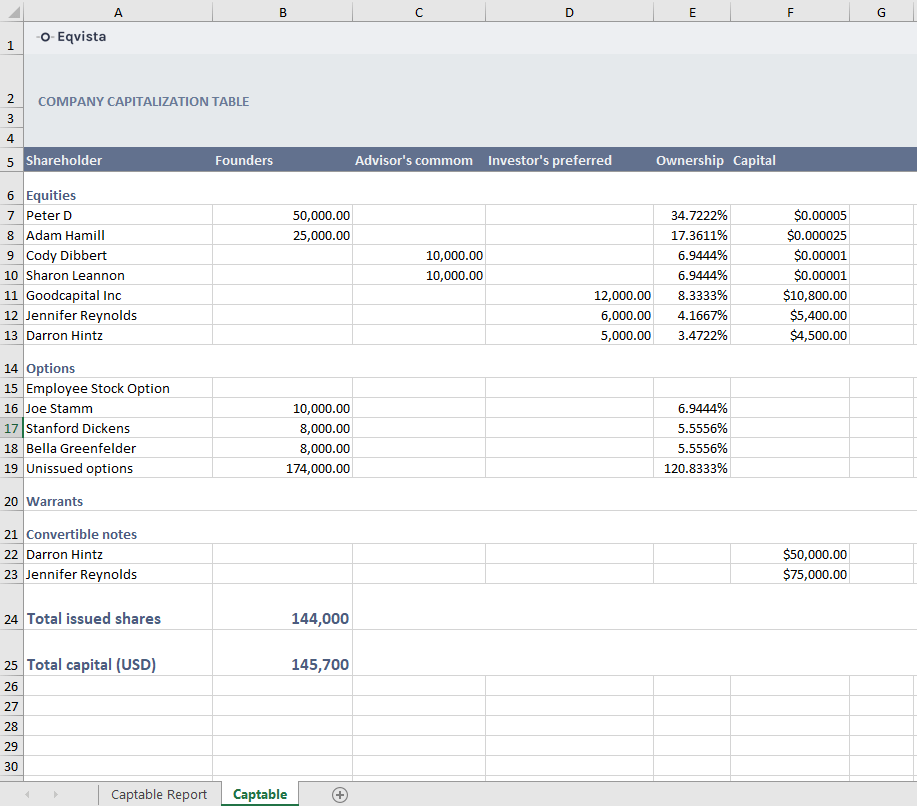

This is the same information on the Eqvista Format:

If you wish to include more detailed data, you can also add the price per share for each grant.

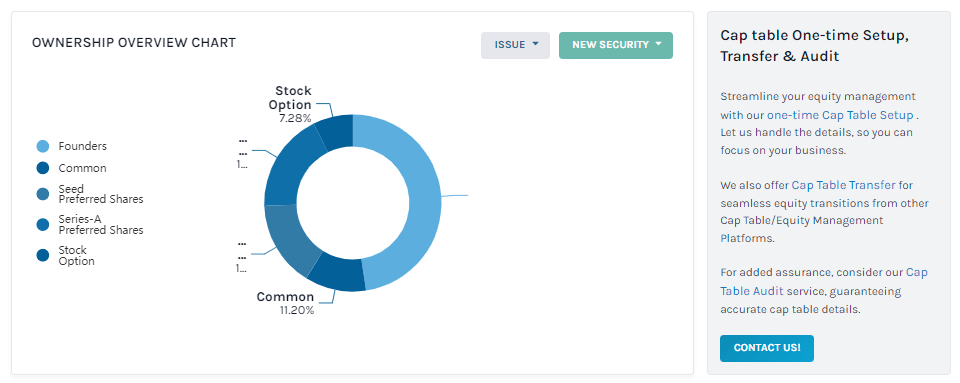

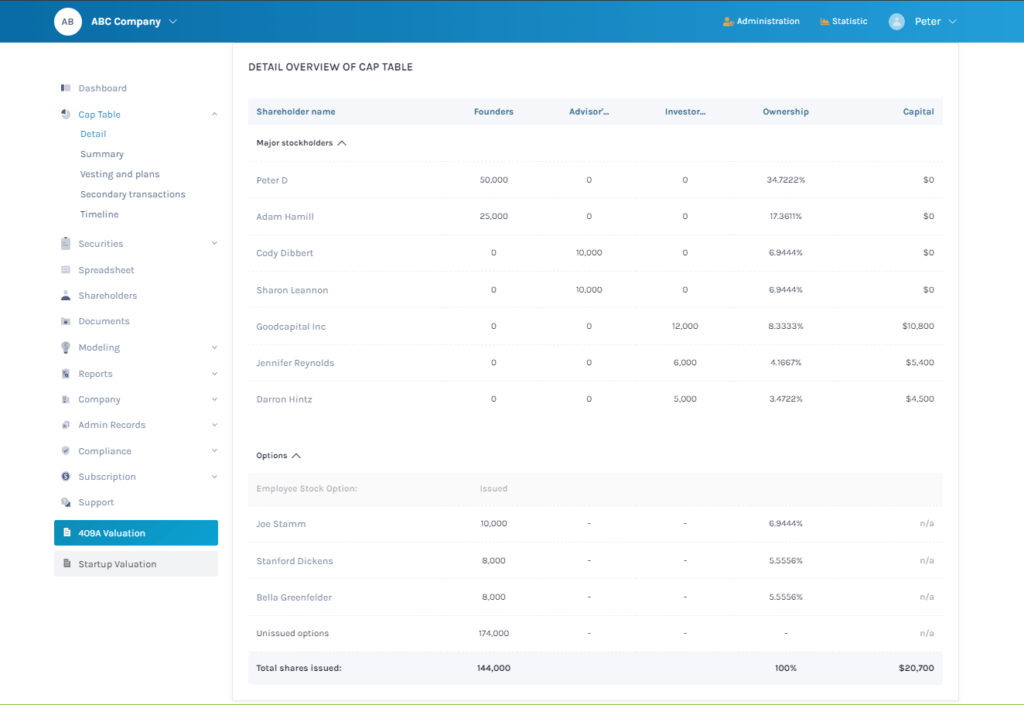

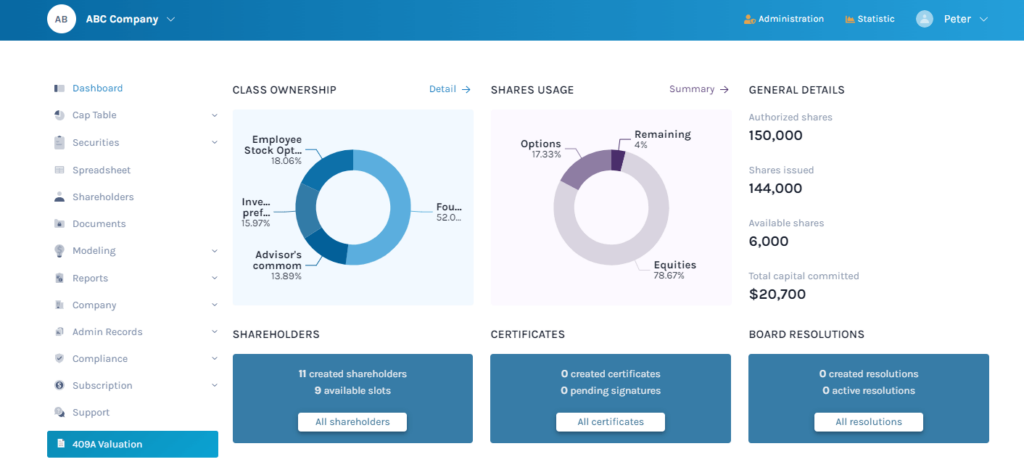

After you have entered in all of your information, all of the data from these tabs will be integrated into the cap table. Here you can see all of the shareholders of the company, their capacity, their particular share transactions, number of shares held and percentage of ownership.

All of this information should give you a clearer idea of the overall ownership of the company, and the makeup of the shareholders. This data will automatically update when you make any changes to the previous tabs.

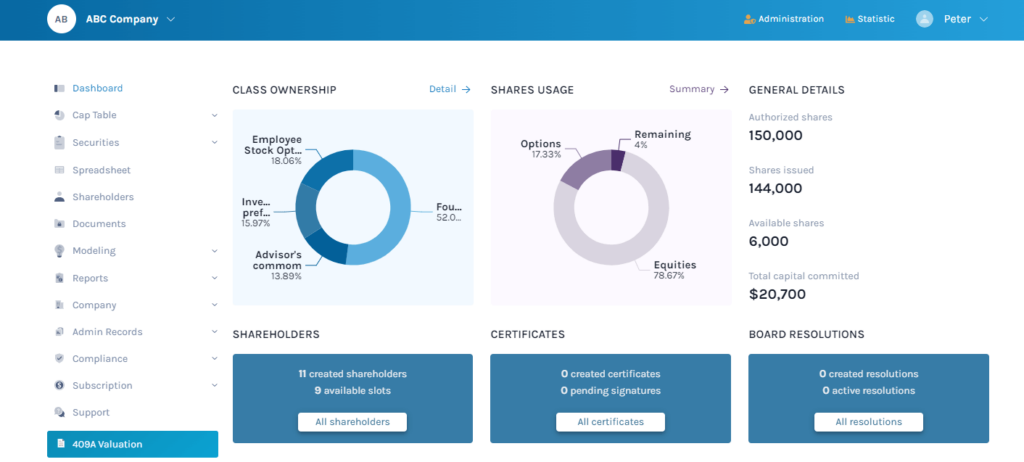

STEPS TO MAKE A CAP TABLE USING THE EQVISTA PLATFORM

We have created a step-by-step process with examples of the most common situations when creating a cap table using Eqvista’s Cap Table Management software. These cap table examples focus on the two scenarios on our platform:

- Adding data with the Freemium version

- Adding data from the spreadsheet with a Premium subscription

How to update the Cap Table

Once you have your company running for some time, you will need to update the cap table with each new financing or transfer of shares among your shareholders. This could include the issuance of new options for employees, sale of shares from a shareholder, or retirement of an old employee.

Having an updated cap table is not only useful for your organization, but also for outside investors and venture capitalists to get more information when investing in your company. This will provide them confidence in an accurately recorded set of documents. It also serves as a form of legal records of your important documents and transactions, and will prove useful in tracking possible gains and tax obligations near the year end.

What are the uses of a Cap Table?

A cap table is vital for tracking equity ownership, fundraising, employee equity, exits, decision-making, and record-keeping.Below you can read the detailed uses of cap table with example.

- Tracking Equity Ownership – A cap table is used primarily to track the equity ownership of all shareholders, including founders, investors, employees, and others holding shares or options. Keep an accurate and up-to-date cap table to avoid legal and financial issues. Use dedicated software like Eqvista to automate updates and ensure compliance as the company grows.

- Facilitating Fundraising – Before investing, venture capitalists closely examine a company’s cap table to understand capital structure. A well-organized cap table builds confidence in potential investors. This allows potential investors to easily understand the company’s structure, ensure compliance, and identify growth opportunities.

- Managing Employee Equity – Cap tables help companies manage and allocate employee equity grants as compensation packages. Startups can effectively manage their employee equity, comply with regulations, and provide transparency by keeping an accurate and up-to-date cap table.

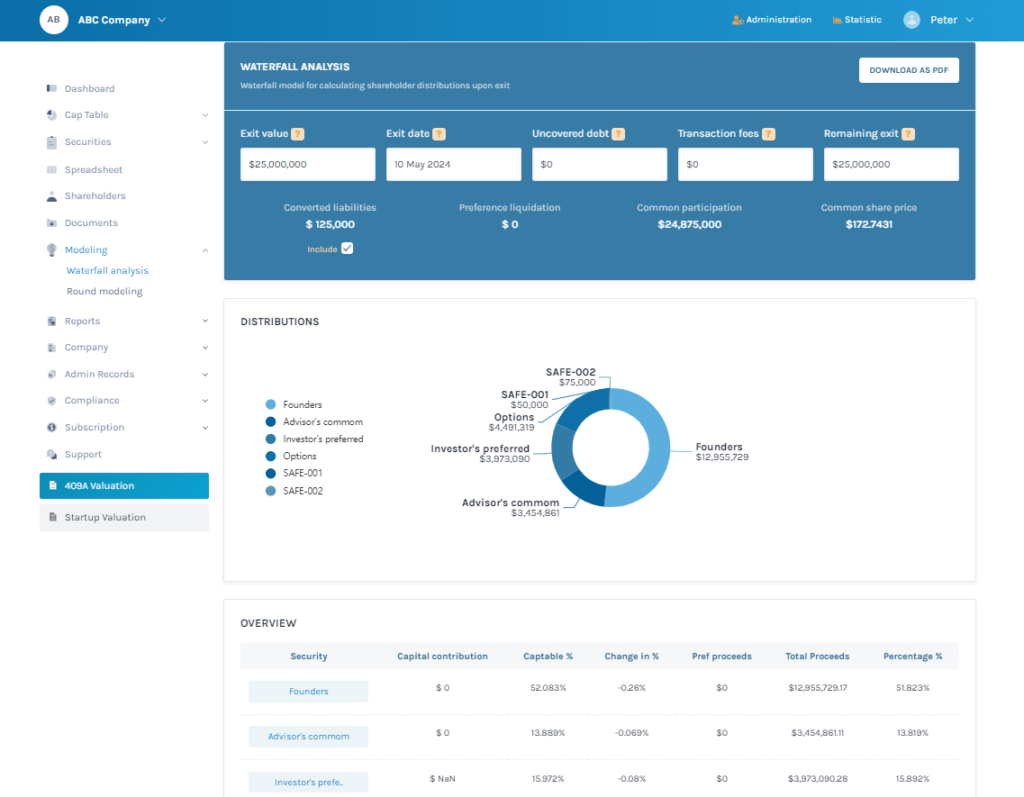

- Valuation and Exit Planning – Cap tables determine a company’s valuation during funding rounds or acquisitions. They are also essential for calculating payouts to shareholders during an exit event like an acquisition or IPO. An organized and transparent cap table is essential for startups looking to value their company and accurately plan for a successful exit. It provides clarity, facilitates negotiations, and helps model different scenarios to optimize outcomes for all stakeholders.

- Maintaining Records – Cap tables are a comprehensive record of all equity transactions, including share issuances, purchases, conversions, and option grants, ensuring compliance and transparency. A well-maintained cap table is essential for accurate record-keeping, compliance, stakeholder transparency, and future fundraising and growth facilitation.

Reporting Compliance

Cap tables ensure tax compliance, adherence to securities regulations, and accurate financial reporting for startups and growing companies. Maintaining an accurate and up-to-date capitalization table is crucial for ensuring compliance with various tax and regulatory requirements.

Below are some of the common regulations:

- Rule 701 – Rule 701 is a valuable exemption for private companies to issue equity compensation while balancing disclosure requirements to protect recipients. It is essential for startups to manage their capitalization tables. Failure to comply with the Rule 701 limits and disclosure requirements can result in penalties from the SEC. Disclosure Requirements of Rule 701: Companies can issue up to $10M worth of securities in 12 months under Rule 701. If a company exceeds $10 million in securities issued under Rule 701 in 12 months, it must provide additional disclosures to recipients.

- ASC 718 – ASC 718 provides comprehensive guidance on accounting for stock-based compensation, ensuring transparency and consistency in how companies recognize and report the costs associated with equity-based incentive plans. Compliance with ASC 718 is crucial for public companies to ensure accurate financial reporting and adherence to generally accepted accounting principles. ASC 718 requires extensive disclosures in financial statements, including the: Nature and terms of share-based payment arrangements, Method used to estimate fair value, and Effect of compensation costs on the income statement.

- ISO $100K – The ISO $100K limit is an IRS regulation restricting the number of incentive stock options that can be treated as qualified ISOs for an employee in a given calendar year. Startups need to carefully track and manage ISO grants and vesting schedules to ensure compliance with the $100K limit, which helps to avoid unintended tax consequences. Disclosure requirements of ISO $100K: The ISO $100 K limit is a regulation that states an employee cannot treat more than $100,000 worth of ISOs, which first become exercisable in a calendar year, as qualified ISOs for preferential tax treatment. ISOs that exceed the $100,000 limit in a calendar year are treated as non-qualified stock options for tax purposes.

- 83(b) Election – 83(b) election is a strategic tax choice that helps tax savings for startup employees and founders by allowing them to pay taxes on restricted stock upfront before it appreciates. Still, it carries risks if the stock doesn’t gain value.83(b) election applies to RSAs and stock options subject to vesting schedules. Disclosure requirements 83(b) Election: The employer must file the 83(b) election form with the IRS within 30 days of receiving the restricted stock or exercising the stock options. The employee must provide their employer with a copy of the election form filed 83 (b). Employees should retain a copy of the field 83(b) election form and proof of mailing or delivery to the IRS for their records.

WHY IS THE CAP TABLE IMPORTANT?

A cap table is a practical tool for startups and private companies. It helps maintain transparency, make informed decisions, ensure compliance, manage equity incentives and prepare for future transactions or exits.

Here, we stated the importance with the help of an simple example:

Tracking Equity Ownership

A cap table serves an important purpose in managing a company’s equity and provides a clear overview of who wins what percentage of the company.

For example, a startup has two co-founders, John and Marc, who initially own 50% equity. The cap table would show:

| Shareholder | Shares owned | Ownership percentage |

|---|---|---|

| John | 5,000,000 | 50% |

| Marc | 5,000,000 | 50% |

| Total | 10,000,000 | 100% |

Managing Dilution from Funding Rounds

When a company raises funding, new investors receive equity, diluting existing shareholders. The cap table tracks this dilution.

For example, if the startup raised a $1M seeds round at a $4M pre-money valuation , issuing 2M new shares to investors, the new cap table would be:

| Shareholder | Shares owned | Ownership percentage |

|---|---|---|

| John | 5,000,000 | 41.67% |

| Marc | 5,000,000 | 41.67% |

| Seed investors | 2,000,000 | 16.66% |

| Total | 12,000,000 | 100% |

Employee stock option pool

The cap table reserves shares for an employee stock option pool, even if unissued.

For example: With a 2M share option pool, the cap table becomes:

| Shareholder | Shares owned | Ownership percentage |

|---|---|---|

| John | 5,000,000 | 35.70% |

| Marc | 5,000,000 | 35.70% |

| Seed investors | 2,000,000 | 14.30% |

| Option pool | 2,000,000 | 14.30% |

| Total | 14,000,000 | 100% |

Exit Planning

The cap table allows founders to evaluate different exit valuations and terms to understand how proceeds will be distributed. During major events like acquisitions or IPOs, the cap table determines how shareholders distribute proceeds based on ownership percentages.

For example the company owned by John and Mark , Litech Ventures, is being acquired for $100M. This allows modeling different exit scenarios. An example can be as follows:

Cap Table for $100M Acquisition scenario

| Shareholder | Security Type | Shares owned | Ownership percentage |

|---|---|---|---|

| Founders | Common stock | 10,000,000 | 40% |

| Angel Investors | Preferred stock | 5,000,000 | 20% |

| VC Firms | Series A preferred | 7,500,000 | 30% |

| Employee pool | Options | 2,500,000 | 10% |

| Total | – | 25,000,000 | 100% |

Understandably, keeping track of all the details can be overwhelming. However, it’s crucial to ensure that everything is correctly organized to avoid any issues down the line. We understand that selling a company can be stressful, so investing in good cap table software like Eqvista is highly recommended.

Not only will it help you save time, but it can also save you money in the long run!

Create and Manage Your Cap Table

As your company goes through multiple funding rounds and issues new securities, cap tables become increasingly complex, making it essential to maintain them accurately to avoid disputes and legal issues.

Eqvista is cap table management software designed for startups and companies. It offers analytical capabilities, regulatory compliance, and premium features like unlimited companies and users, electronic certificates, compliance services, and onboarding services. The best part? The core cap table management software is free!

Get ready to experience a new level of simplicity and convenience with Eqvista! This game-changer is for those who want to manage their cap table without breaking the bank. By leveraging Eqvista’s cap table management capabilities, we assure you that companies can efficiently manage their equity, maintain accuracy, ensure compliance, and make data-driven decisions throughout their growth journey.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!