DCF Valuation – All you need to know

Discounted cash flow (DCF) is a valuation method that uses predicted future cash flows to determine the value of an investment.

Discounted Cash Flow (DCF) is one of many valuation methods available for your business. DCF valuation determines the value of your business based on its expected future cash flows. This method is often used to evaluate potential investment opportunities. While it is the most widely used method in determining the intrinsic value of a company, DCF valuation has its disadvantages since it relies on estimating future cash flows.

We discuss in detail what is DCF valuation, how it works, why it is needed, the pros and cons of this valuation method, and how the DCF valuation is calculated.

DCF valuation

Discounted cash flow (DCF) is a valuation method that uses predicted future cash flows to determine the value of an investment. DCF analysis aims to determine the current value of an asset based on future forecasts of how much money it will generate. This pertains to decisions made by investors in firms or securities, such as acquiring a company or purchasing a stock, as well as capital budgeting and operating expenditures decisions made by business owners and managers.

What is the Discounted Cash Flow (DCF) valuation?

Discounted cash flow (DCF) is a method of calculating the value of an investment based on its expected return or future cash flows. The hurdle rate is the weighted average cost of capital, which means the investment’s return must beat the hurdle rate. Although DCF is the gold standard for valuing privately owned businesses, it can also be publicly applied to list stocks as a litmus test. It can be used for both acquisitions and asset purchases by business owners.

A stock’s price can be estimated using a valuation technique. The act of valuation itself aids in determining the company’s ‘intrinsic value’. The DCF approach evaluates a company’s ‘perceived stock price’ while considering all future cash flows. DCF valuation is done by building a forecast on financial statements, calculating the terminal and present value.

Purpose of DCF valuation

A DCF valuation predicts how much money an investor would get from an invested, adjusted for the time value of money. The time value of money means that a certain amount of money today is worth more in the future because it can be invested.

Therefore, DCF helps a person in determining whether an investment would be fruitful or not. If the value calculated was found to be higher than the current cost of the investment, then the investment opportunity will benefit you.

What is the DCF valuation used for?

The goal of a DCF valuation is to calculate how much money an investor would get from a given investment after accounting for the time value of money. Because money may be invested, the temporal value of capital assumes that a dollar today is worth more than a dollar tomorrow. An asset’s value is just the total of all future cash flows that have been risk-adjusted. The timing of future cash flows and the likelihood that they will materialize significantly impact the price an investor is ready to pay for an asset now.

Here are some ways a DCF valuation is used:

- To value a complete business

- To value a project or investment within a company

- To value a bond

- To value shares in a company

- To value an income-producing property

- To value the benefit of a cost-saving initiative in a company

- To value anything that produces (or has an impact on) cash flow

Pros of DCF Valuation

The use of accurate statistics and the fact that it is more objective than other ways of assessing an investment are the key advantages of a DCF valuation:

- Extremely Detailed – To arrive at a value, it uses exact data that incorporate crucial assumptions about a firm, such as cash flow estimates, growth rate, and other indicators.

- Determines a Company’s Intrinsic Value – It is more objective than other methods in that it calculates value without considering subjective market sentiment.

- Doesn’t Require Comparables – DCF analysis does not use market value comparisons to similar businesses.

- Considers Long-Term Values – It evaluates a project’s or investment’s earnings throughout its economic life, taking into account the time value of money.

- Allows for Objective Comparison – DCF valuation enables you to examine a variety of firms or investments and arrive at a consistent and objective valuation for each.

Cons of DCF Valuation

A discounted cash flow valuation has its limitations. It requires collecting a large quantity of data and relies on assumptions that can be incorrect in some circumstances:

- Significant Data Required, including revenue and expense projections – Large quantity of financial data is required in order to do a DCF valuation. Gathering the necessary data such as revenue and expense projections, may be time-consuming and challenging.

- Complexity – The study might become unduly complex due to the data required for the discounted cash flow formula.

- Details Could Lead to Excessive Confidence – People may have more faith in the final valuation than they should since they employ precise data and projections to complete a discounted cash flow analysis. It’s important to remember that the assessment is still based only on future projections.

DCF valuation calculation

The DCF valuation is calculated by using a specific formula which is as follows:

Where:

- CF = Cash Flow in the period

- r = Interest Rate or Discount Rate

- n = Period Number (time)

The quantity of money moving in and out of the company is referred to as cash flow in the calculation. The interest and principal payments make up the cash flow of a bond.

The required rate of return for investors to receive the money they are receiving is known as the discount rate. A discount rate is the interest rate on a bond. In the formula, r stands for the discount rate, which can be a simple percentage such as the interest rate, or the weighted average cost of capital, which is commonly used.

The weighted average cost of capital is the cost of financing a company’s assets. It takes into account a company’s average working capital cost after taxes. The period of time is denoted by n. A business owner can utilize as many cash predictions as they wish – five years, ten years, or even longer.

Components of DCF analysis

There are various components of discounted cash flow analysis that are used widely. These are as follows:

- Free Cash Flow – The growth or decrease in the quantity of money a firm, organization, or individual has is referred to as cash flow (CF). The phrase is used in finance to indicate the amount of money created or consumed over a specific period. There are several different forms of CF, each with its own set of vital applications in business and economic research. This guide will go through each one in-depth.

- Discount rate – The discount rate is typically a firm’s Weighted Average Cost of Capital (WACC) for business appraisal purposes. Investors use WACC since it shows the required rate of return on investment in a company. The discount rate on a bond is the same as the interest rate on the asset.

- Terminal value – The predicted value of a business beyond the stated projection period is known as the terminal value. It’s an essential aspect of the financial model because it accounts for a significant portion of its total worth. The DCF terminal value formula has two approaches:

- Perpetuity Method

- Exit Multiple Method

- WACC – The weighted average cost of capital (WACC) is a method of calculating a company’s cost of capital in which each capital type is weighted proportionately. A WACC computation considers all sources of capital, including common stock, preferred stock, bonds, and any other long-term debt. Because an increase in WACC signifies a fall in value and an increase in risk, it rises as the beta and rate of return on equity rise.

DCF calculation example

The DCF is calculated in three steps:

- First, forecast the expected cash flows from the investment

- Next, you choose a discount rate, which is usually determined by the cost of funding the investment or the opportunity cost of other investments.

- Finally, using a financial calculator, a spreadsheet, or a manual computation, discount the predicted cash flows back to the present day.

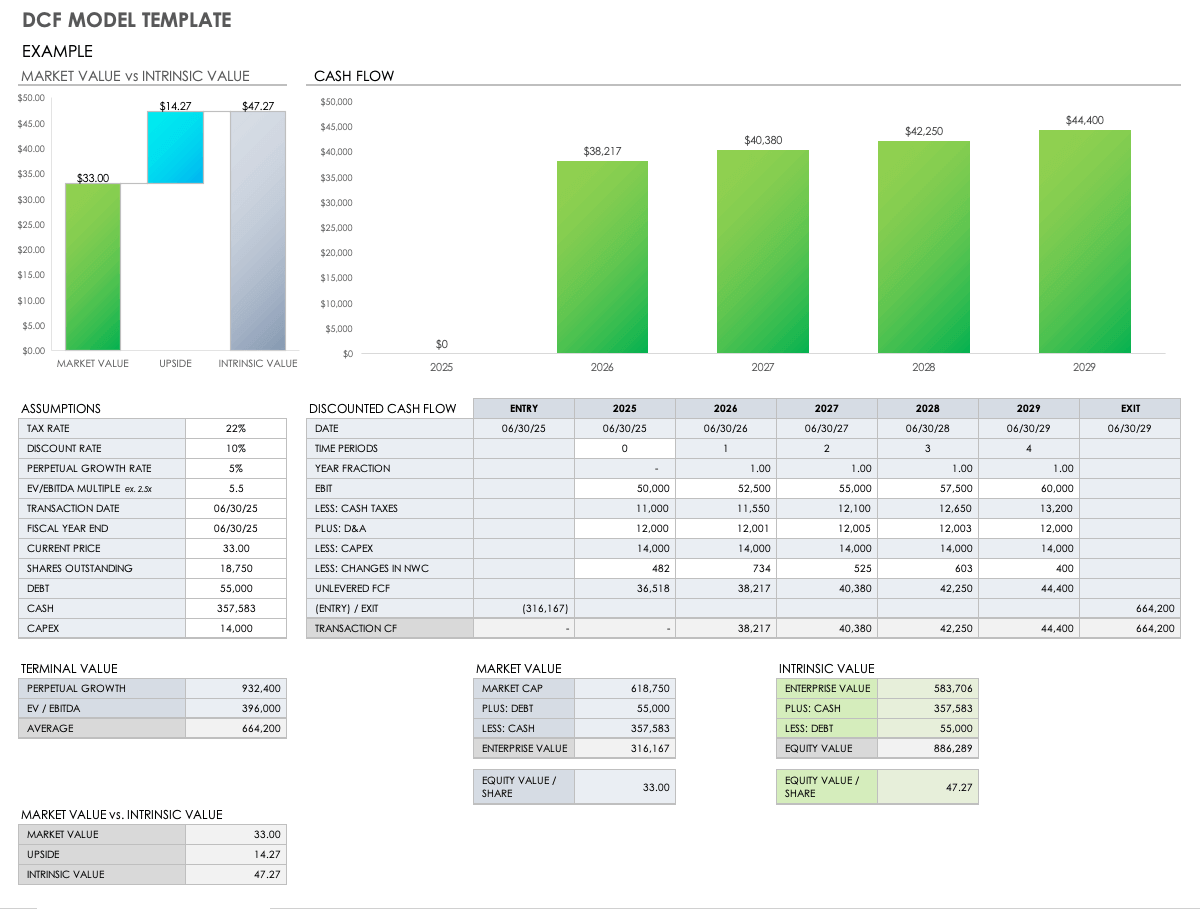

Discount cash flow template

This cash flow template showcases the market value, intrinsic value, discounted cash flow, and terminated value.

Important Forecasting Components of Discount Cash Flow

DCF is a way of calculating the current value of an asset using expected cash flows. It tells you how much money you can put into an investment right now to receive the desired return later on. If you want to determine whether an investment is beneficial, you can do a discounted cash flow analysis.

- Forecasting Revenue – A revenue forecast is a projection of your revenue over a specific time period. This period can be any length of time; however, it is commonly confined to a quarter or a year. A revenue prediction is dependent on several factors. Investors can then use these forecasts to determine whether or not the stock is worth purchasing.

- Forecasting Expenses – An expenses forecast is a projection of your ongoing operating costs over time. Rent, insurance, automobiles, advertising, staff compensation, and accounting and legal fees are just a few examples of business expenses. Use information from prior years to help you if you already have a business.

- Forecasting Capital Assets and Changes in Working Capital – In a first-principles approach to forecasting working capital, individual current assets and current liabilities are forecasted using several working capital ratios, such as receivable days, inventory days, and payable days.

- Forecasting Capital Structure – The exact mix of debt and equity used to finance a company’s assets and activities is referred to as capital structure. From a business standpoint, equity is a more expensive, long-term source of capital with more financial flexibility.

- Terminal Value – The value of an asset, business, or project beyond the predicted period when future cash flows can be estimated is the terminal value (TV). The term “terminal value” refers to the assumption that a company will continue to expand at a constant rate after the forecast period has ended. The terminal value often accounts for a significant portion of the entire assessed value.

- Timing of Cash Flow – The period in which the cash flow intake is being calculated. It usually happens within a period of 12 months. It’s important to understand the cash flow and the time period. Every report is updated every three months.

- DCF Enterprise Value – The enterprise value (also known as firm value or asset value) is the total value of a company’s assets (excluding cash). When utilizing a DCF model to value a business using unlevered free cash flow. The whole value of a firm is measured by enterprise value, which reveals how much it would cost to buy the complete company, including its debt. Add market capitalization, preferred stock, and debt together, then remove cash and cash equivalents to arrive at this figure.

- Equity Value – The worth of the company’s shares and loans that the shareholders made accessible to the business is equity value. The enterprise value of redundant assets is added to the calculation for equity value (non-operating assets). The debt is then subtracted from the cash available. We can eventually divide the overall equity value into the importance of shareholders’ loans and outstanding (both standard and preferential) shares.

Get your business valuation done with Eqvista!

The process of determining the economic value of a whole firm or company unit might be complicated. For various purposes, including sale value, establishing partner ownership, taxation, and even divorce proceedings, company valuation can be used to evaluate the fair value of a business. If you are finding it difficult to get your business valuation, don’t worry. Our expert team is here to help you. Just contact us and get a free consultation.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!