How to Issue Shares in Private Limited Company?

Keep reading to know more about these shares and the procedure for how to issue shares in a private limited company.

A lot of startup businesses choose to run as a private limited company as it is the best form of business entity for most owners. It is normally better than having a sole proprietorship or a partnership as it offers limited liability protection. A private limited company is also a separate legal entity and has its own rights. It has a complex structure and you can easily issue shares in a limited company, which is not possible in a sole proprietorship or partnership.

Private Limited Company

Let us begin by talking about limited companies. Just to be clear, limited companies can be public or private. Both have limited liability protection but they are different. A public company has its shares traded in the stock exchange market, while on the other hand, a private limited company does not trade its shares publicly. And it also has a limit of a maximum of 50 shareholders.

What is a private limited company?

A private limited company is a type of business entity that can be set up and run by any entrepreneur. It is a separate legal entity with the shareholders being the company founders. The company ownership is split into shares that are owned by the shareholders of the company. In this company type, the company has to pay corporate tax on the profits, and the remaining profits are then distributed to the shareholders.

“Limited” here means that the financial responsibility of the company is limited to the value of company shares. This means that the owners of the company are not personally liable for any debt of the company. It makes them save as their personal assets would never be used to pay out the debt of the company.

One great example of a private limited company is a local retailer, such as a restaurant or a shop. An example of a public company is a large corporation such as a chain of restaurants or retailer shops. Public companies normally have their shares sold in the market, so if you are able to buy the shares of a limited company, it is a public limited company.

Who runs limited companies?

The people who operate a private limited company are known as directors or company officers and are responsible for managing the company. These people can be hired by the company shareholders or can be the shareholders themselves. A private limited company usually has at least one director and it is normal for the company owner to be the director of the company. So, this means that you can open the company and manage it as well, by yourself or with others.

Advantages of private limited companies

Before you move ahead and open a private limited company, it is important for you to understand the numerous advantages that come with it. These include:

- Professional Status: A private limited company offers a more professional status and is considered reliable as compared to a sole proprietorship. This is because it has a transparent nature. It means that the business accounts of the company, along with the details of the people in charge, and the directors of the company are more open.

- Doing business with other companies: To say this in simple terms, large companies are not comfortable to do business with unincorporated companies. With a private limited company, you can easily get more business contracts to work with larger companies allowing you to grow your company and profits as well.

- Protect your business name: When you incorporate your company, you are able to protect your business name. This means that no one can use your business name or any name that is similar to it. You can make a brand out of it without the fear of someone else stealing it.

- Tax-efficient income: A private limited company can be a tax-efficient way to pay yourself too. To put it simply, company owners and directors can pay themselves through a salary and also get paid the shareholder dividends after the corporate tax has been paid to the government.

- Limited Liability: As mentioned above, in a private limited company, the company owners are not liable to pay any outstanding company debt. This helps them keep their personal assets such as their home and savings safe. So, if the company is sued by someone and has to pay a hefty fee, the fee would be taken from the company’s assets and not from the owner’s personal assets.

- Raising capital: In a private limited company, you can easily raise capital by selling shares to help in growing your business. Basically, you can issue shares in a private limited company in exchange for funding to help grow the company. And the best part about this is that the investors are also protected in case the company fails or gets in trouble. This is also why many investors would rather invest in a private limited company rather than a sole proprietorship.

Issuing Shares in Private Limited Company

When a private limited company is set up, the first shareholder chooses how many shares a private company can issue. But as per the government, there is a minimum requirement, where the company has to issue at least one share in the company. There is no upper limit to the number of shares issued unless the shareholders choose to add restrictions while incorporating their company.

So when you register a new company, you can choose the number of shares you want. And this decision would obviously be based on the number of shareholders you want in your company. It would also be based on your plan in the future to raise funding from investors in exchange for company shares. Initially, if you are setting up the company on your own, you can just issue one share to yourself.

This one share would represent the whole company, making you the 100% owner of the company. On the other hand, you may want to issue more shares to yourself, or to other people if you are opening your business with more partners. Usually, even numbered shares are preferred, such as two, four, 20, 100, etc. It makes it easier to get the percentage of ownership of each shareholder then. This percentage then helps in understanding the amount of company profits each person receives.

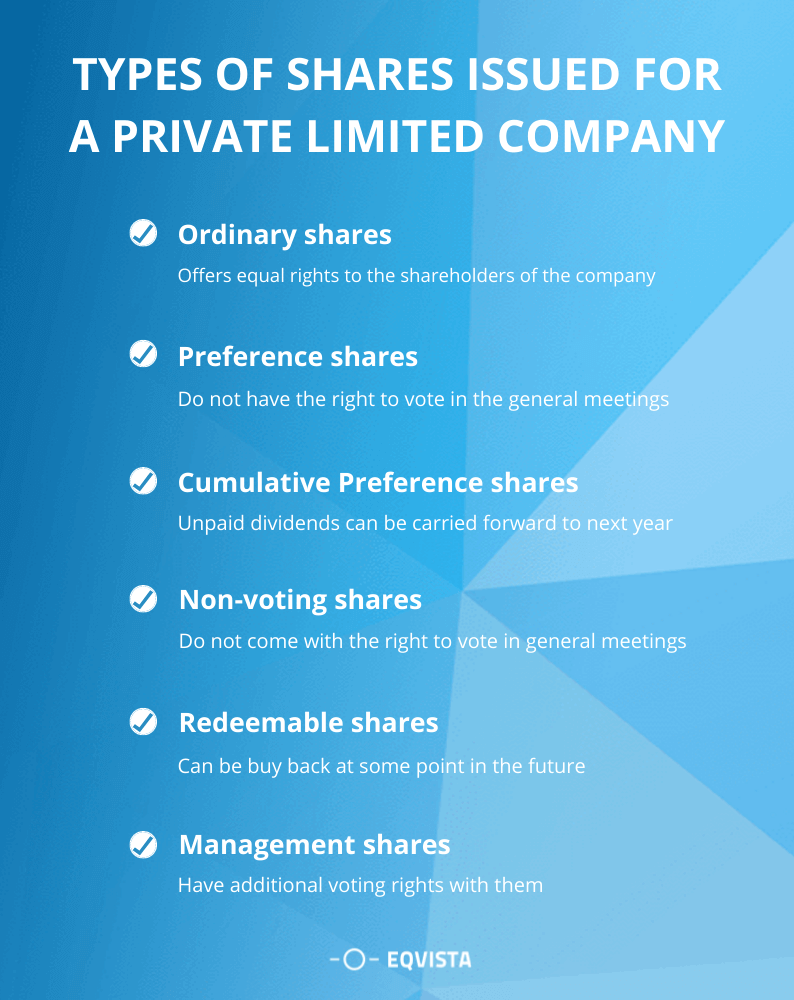

Types of shares issued for a private limited company

There are many different types of shares in a private limited company, also known as classes of shares, and come with different rights. These include:

- Ordinary shares: This is the standard kind of share that has no special restrictions or rights to it. Each share offers equal rights to the shareholders of the company. In short, with each share comes one vote that the shareholder can use on matters in the general meeting of the company. They also come with the right to receive dividends and the right to share in any remaining assets or capital when the company is being wound up.

- Preference shares: These shares do not have the right to vote in the general meetings. This class of shares has the right to preferential treatment when the dividends are paid out. In short, those who hold these shares would be paid before the ordinary shareholders are paid dividends from the company profits. But the preferred shareholders would get a fixed dividend sum. This is great for investors especially when the company is undergoing a lot of financial difficulties. Nonetheless, if the profits in the company increase, the shareholders would lose out on that.

- Cumulative Preference shares: This share has the right where the unpaid dividends of one year can be carried forward to the next year and so on. In short, if a shareholder misses a dividend in one year, they would get the missed amount along with the next year’s dividend. This means that the shareholder is guaranteed to get their profit entitlement at some point. Plus, just like preference shares, these shares do not have the right to vote in general meetings.

- Non-voting shares: As the name suggests, these shares do not come with the right to vote in general meetings. This share of a private limited company is normally given to family members or the employees in the company as compensation along with their earnings. It is a great way since companies do not want their employees to be able to vote on any important matters in the company.

- Redeemable shares: Redeemable shares are those shares that the company can buy back at some point in the future. The date on which they can be bought can be fixed earlier or can be in response to a specific event. This type of share is often issued to directors with the provision that they will be redeemed if and when the director leaves the company.

- Management shares: Management shares have additional voting rights with them. This includes having 5 votes per share or even 15 votes per share. This class of shares is usually given to the main shareholders of the company, allowing them to retain most of the control and power in the company.

What’s the process of issuing new shares in a private limited company?

If you are about to issue shares in a private limited company, you need to follow some rules.

Here we listed six steps several steps and legal requirement for issuing new shares in private company:

| Aspect | Description | Action |

|---|---|---|

| Board Resolution Approval | The directors must draft a resolution specifying the number of shares to be issued and the terms of the issuance. | This resolution must be approved by the board of directors |

| Shareholders' Resolution Approval | Shareholders must approve the issuance of new shares. This can be done through a general meeting or by obtaining written consent from all shareholders. | Ensure that the approval process complies with the Articles of Association and any existing shareholder agreements. |

| Compliance with Articles of Association | Review the company's Articles of Association to check for any specific conditions or restrictions related to issuing new shares. | Fulfill any conditions outlined in the Articles of Association before proceeding with the share issuance |

| Submission of Form NSC1 (Return of Allotment) | This form, available on the Companies It List, includes details such as the number of shares allotted, the amount paid or to be paid, the type of share, and shareholder information. | Submit Form NSC1 to the Companies Registry within two months of issuing the shares |

| Compliance with Legal and Financial Requirements | Ensure that the company is compliant with all legal and financial requirements, such as submitting annual returns and audited financial statements. | Address any outstanding compliance issues before issuing new shares |

| Issuing Share Certificates | Share certificates must be issued to the new shareholders, matching the information provided in Form NSC1. | Ensure that the new shareholders receive their share certificates within two months of the share issuance |

Rights attached to shares

As mentioned above, each share class has its own rights. To keep things simple, we will just talk about the rights that come with ordinary shares. The rights that come with ordinary shares in a private limited company are normally known as the ‘prescribed particulars’. These rights are mentioned in the company’s articles of association, and also in the private shareholders’ agreement at times.

For the ordinary shares in a private limited company, these are the rights that come with it include:

- Capital distribution rights: Each share has the right to get the distribution made from winding up the company. In short, the shareholder has the right to a share of all the assets and money based on their percentage of ownership when the company is being wound up.

- Dividend rights: Each share has the right to dividend payments or any other distribution in the company. This means that the shareholder has the basic rights to get a percentage of the company’s profits in relation to each of their shares.

- Voting rights: Each share has the right of one vote in any circumstance of the company. This means that the shareholder can cast one vote for each share they own on important matters in the general meetings.

FAQs

Here, you’ll find detailed answers to common questions about issuing shares:

What are the tax implications for companies issuing new shares?

The tax implications for companies issuing new shares can vary depending on the specific circumstances and jurisdictions involved. Income Tax Implications, Capital Gains Tax (CGT), Pre-emption Rights and Shareholder Approval, Documentation and Compliance, Specific Jurisdictional Considerations, Professional Advice

What documents are required to issue shares in a private company?

Documents required to issue shares in a private company are Share Allotment Forms, Share Certificates, Articles of Association, Additional Agreements or Contracts, Audited Financial Statements, Compliance with Regulatory Filings

What are the common reasons companies issue new shares?

Companies issue new shares for several common reasons, including Raising Capital, Attracting and Retaining Employees, Acquiring Other Companies, Increasing Liquidity, Maintaining Control, Diversifying Ownership, Gifting Shares, and Allowing Early Investors to Cash Out.

What happens if existing shareholders have preemptive rights when new shares are issued?

They are given the first opportunity to purchase these new shares before they are offered to outside investors. This process protects the shareholders’ ownership stakes, voting rights, and profit entitlements from being diluted.

Issue and Manage Your private Limited Company Shares on Eqvista

Have a private limited company set up and looking for a way to record and keep track of all the shares in your company? Well, Eqvista can help you here. Eqvista is an advanced platform that helps in keeping track of all the shares in a company. You can use the application to issue and manage shares in your private limited company.

There are a lot of extra features that complement the process of share issuance on Eqvista such as the creation of vesting schedules, issuing options, and so on. Try out the app today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!