409a Valuation – The Complete Guide for Your Business

It is important to get a founder-friendly and proper 409A valuation, which is a problem many business owners face.

Have you had your business valuation done or are you somewhere in between just finding out that you need to do it and what does a 409A valuation have to do with you?

It is important to get a founder-friendly and proper 409A valuation, which is a problem many business owners face. But what does the 409A evaluation have to do with all this? Continue reading to know more about the 409A valuation and the steps to get one done.

What is a 409A valuation?

The very first thing that you need to understand is that the 409A regulation and valuations are two different things. To understand this, it is important to comprehend the difference between 409A and the business valuation as seen by investors during funding period.

Before we can talk about the 409A valuation, let us understand what a business valuation is. Business valuation is the process where a set of methods are used to get the value of the interest of the owner in their business. This process can be performed by the owner themselves or someone from inside the company like the accountant or financier.

On the other hand, the 409A evaluation is utilized to find the fair market value (FMV) of the business. This value is usually set by a third party valuation service and not by the owner nor the company. Regulated by the IRS, 409A sets the strike price for the common shares that are usually awarded to the advisors, employees, and others, and makes sure that these options represent the actual value of the company.

And the main reasons for this is that the investors usually receive the preferred stock of the business. The preferred stock is normally valued at a much higher price as compared to the common stock due to the much better liquidation preferences.

In addition to this, third-party independent valuation providers help the company to establish the safe harbor status. This in turn, prevents the onerous IRS penalties that can be placed on the shareholders of the company in case the FMV of the company was not determined appropriately.

Let us understand 409A more

The 409A valuation is required by section 409A valuation of the U.S Internal Revenue Code, which was enacted in 2004 as part of the American Jobs Creation Act. This crucial process helps to protect companies and employees by establishing the Fair Market Value (FMV) of the common stock for the purpose of equity compensation.

To establish the FMV and comply with section 409A, private companies should obtain an independent 409A valuation from a professional appraiser that provides a safe harbor for the company against potential IRS challenges.

409A valuation is a critical legal requirement under U.S tax law to ensure private companies properly price employees stock options and avoid adverse tax consequences. Failure to obtain proper 409A valuation, or setting the option price below the FMV, can lead to significant tax penalties and liabilities for both company and its employees.

For Instance, APNE Inc., a private manufacturing company, wants to grant stock options to its employees. In order to ensure compliance with IRS regulations under section 409A, APNE hires a professional valuation company to conduct 409A valuation of the company’s common stock. The valuation professionals analyze APNE’s financial statements, Market comparables and other factors that are relevant to determine the FMV of Common stock, and set it at $1.60 per share.

APNE documents the valuator’s methodology and conclusions in a detailed report, also the company then consistently used the $1.60 per share FMV as the exercise price for all stock options granted to employees.

An example of this, together with past 409a valuation strike prices, would look like:

| Full Name | Grant Date | Options Granted | Strike Price | Source |

|---|---|---|---|---|

| John Smith | April 15, 2023 | 50,000 | $0.75 | Set by 409a |

| Jane Doe | May 10, 2023 | 50,000 | $0.75 | Set by 409a |

| Michael Lee | August 1, 2023 | 50,000 | $0.75 | Set by 409a |

| Amanda Lopez | September 5, 2023 | 50,000 | $0.75 | Set by 409a |

| David Patel | October 14, 2023 | 50,000 | $0.75 | Set by 409a |

| Sarah Garcia | November 20, 2023 | 50,000 | $1.60 | Set by 409a |

| William Chen | December 7, 2023 | 50,000 | $1.60 | Set by 409a |

| Emily Jones | January 12, 2024 | 50,000 | $1.60 | Set by 409a |

| Daniel Kim | February 24, 2024 | 50,000 | $1.60 | Set by 409a |

| Olivia Brown | March 10, 2024 | 50,000 | $1.60 | Set by 409a |

By following this process, APNE has established a 409A safe harbor. Key Results:

- This safe harbor protects APNE and employees from potential tax penalties and liabilities.

- Allows APNE to confidently use equity compensation to attract and retain top talent in the company.

What is the purpose of a 409a valuation, and why is it important?

Getting a 409A valuation allows your business to follow all the tax laws and avoid any of the IRS audit sessions that can cause legal troubles, tax issues and even interfere in the company’s functions if problems arise. Moreover, the need to hire consultants or lawyers for defending your company while the case drags would cost you a lot more.

More importantly in these situations, the employees in your company would suffer the most due to the immediate tax issues for them, which is not good for a company putting their employees at risk. It is important to remember that you gave the stock options to your employees to reward them, and not to leave them with a huge penalty with the IRS.

Why Is a 409A Valuation Important?

A lot of founders ask us what a 409a valuation is about and why it’s important. Of course the main purpose of a 409a evaluation is for compliance reasons, ie. to protect your strike price or FMV in case of any audit by the IRS for underpriced options. However, another major reason for understanding the importance of a 409a valuation is how the FMV affects your taxes.

This particular example was inspired by a real life shareholder a few years back. In this case, a shareholder was issued 50,000 stock options with a strike price of $0.75, and another at a 33% lower price of $0.50. Here are the differences stack up against each other:

| Scenario 1 | Scenario 2 | ||

|---|---|---|---|

| Options Granted | 50,000 | Options Granted | 50,000 |

| Strike Price (409A Valuation Price 33% lower) |

$0.50 | Strike Price (Original 409A Valuation Price) |

$0.75 |

| Sale Price | $4 | Sale Price | $4 |

| Taxable Income per Share (Sales Price – Strike Price) |

$3.50 | Taxable Income per Share (Sales Price – Strike Price) |

$3.25 |

| Total Taxable Income | $175,000 | Total Taxable Income | $162,500 |

| Tax due (20%) | $35,000 | Tax due (35%) | $56,875 |

You can see that in both scenarios, the options were liquidated at $4.00 a few years later, with their taxable gain per share, total gains, and taxes due.

SCENARIO – 1

After 3 years, the ISO options vested. The employee exercised their options at the strike price of $0.50 and acquired the shares. Then, they sold the shares at $4 per share, so:

$4 – $0.50 = $3.50

$3.50 x 50,00 = $175,000

With a lower strike price at $0.50, the shareholder was able to exercise their options and hold onto their stock for over a year, allowing their ISOs to be taxed as a *qualifying disposition. So the taxes were:

$175,000 x 20% = $35,000

*Qualifying Disposition:

- Options held for at least two years from the grant date and one year from the exercise date. Under this, profits are taxed at the long-term capital gains rate.

- In this case, the gains were taxed at the long-term capital gains rate i.e .20% (as per US long-term capital gains rate).

SCENARIO – 2

Under the second scenario, the shareholder had a strike price of $0.75, and didn’t have enough funds to cover the exercise to shares and hold them for over a year, eventually selling these back to the Company in the same year. With this, this sale did not count as a qualifying disposition, and was taxed at Income Tax Rates, as:

$4 – $0.75 = $3.25

$3.25 x 50,000 = $162,500

With the gains taxed under ordinary income tax i.e. 35% (federal (22%) + state(13%)), the total taxes due were:

$162,500 x 35% = $56,875

TAX SAVINGS

Comparing the two scenarios and stock option pricing, the total tax difference was:

Difference = $35,000 – $56,875 = $21,875

Thus going back to the beginning of the example, with the drop in the 409a valuation price of from $0.75 to $0.50, the option holders had a tax difference of over $20,000 on their tax returns

This example shows why having a good understanding of the 409a valuation process and end results has on your taxes.

What factors influence your 409A valuation?

While you are having the 409A valuation done, you also have to keep in mind the various factors that would influence the valuations. Here are some questions that you would need to ask yourself and be prepared to answer:

- What method for valuation should you use? This is obviously the most important question and the very first questions that you would have to ask, keeping the industry that your company is a part of, the services it offers, the tangible and intangible assets, the profit that the company makes, etc., in mind. The valuator would be able to explain this better to you as per your situation and company type. You might need to use more than one method for getting the value.

- How would you support your concluded marketability discount? The IRS would look at the evidence of the considered factors that the appraiser used, and that are specific for your company. They would also need the data that was used like the restricted stock studies, and not just the quantitative models. Hence, you would need to save all these things when having the 409A valuation done.

- Can the valuation be utilized for both the financial reporting and tax purposes? You do not have two different values of a business and you need to make sure that the 409A valuation done is right, so that you can use it for any area in which the value is needed.

When to get a 409A valuation?

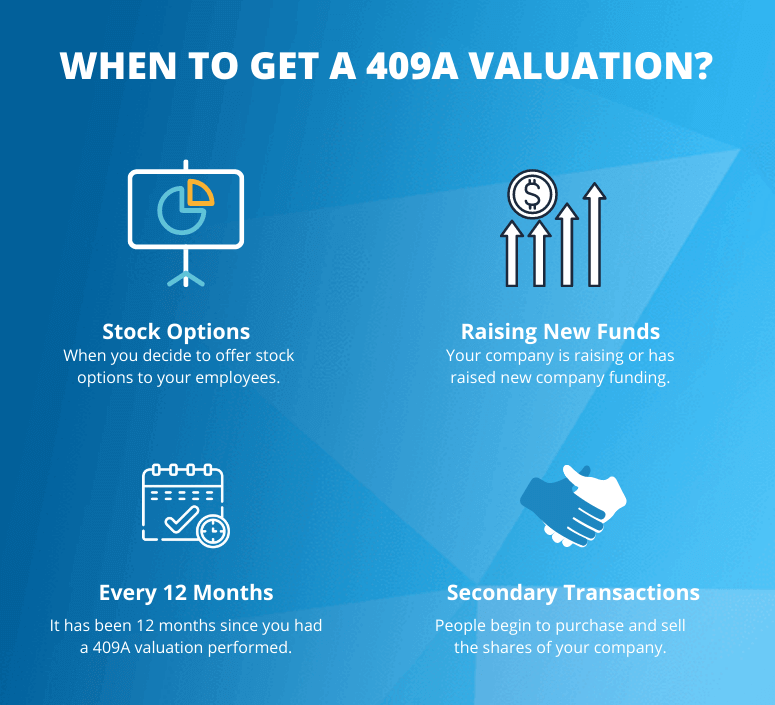

There isn’t a single specific time when you might need to get the 409A valuation done, but there are a few triggers that would help you understand when it is needed urgently. They are when:

- You decide to offer stock options to your employees.

- It has been a year since you had a 409A valuation done.

- Your company is raising or has raised new funding.

- People begin to purchase and sell the shares of your company, which does not include the shares that you had issued originally from the corporation.

In any of the cases, you know that you need a 409A valuation done so that you can easily bypass any possible penalties for valuation by the IRS.

Understanding 409a Refresh

After getting your first 409A valuation done, do you know whether or not you should get another one? Getting a 409A valuation is not a one-off deal; in fact, it’s important to have a 409A valuation done at least once a year. This is what we call a ‘409A Refresh’, which is an updated 409A valuation. This is done in order to maintain your company’s safe harbor status.

What is a 409a refresh?

A 409A Refresh is basically an updated valuation that’s done in several circumstances. According to IRC Section 409A, a 409A valuation provides a 12-month period of safe harbor, during which you issue option grants at the designated strike price. After the 12-month period, you will need to update your 409A valuation in order to “restart” the period of safe harbor for another 12 months. Using an independent third party to establish the FMV of a company’s common stock every 12 months is one technique to ensure that the stock’s value is assumed to be “reasonable” by the IRS. The IRS refers to a reasonable valuation technique as a “safe harbor”.

When do companies require a 409a Refresh?

There are several situations when a 409A Refresh is needed. Usually, companies should get a 409A Refresh after 12 months in order to maintain safe harbor for issuing option grants at the strike price. However, there are times when a 409A refresh is required before the end of the 12-month period. Some scenarios are: a new qualifying round of stock or debt financing, or a major event that could impact the company’s valuation.

What is a safe harbor for your company?

The meaning of safe harbor for your company means that you have had the 409A valuation completed in the last 12 months for your company at an acceptable price, which is protected from proving that the FMV is accurate to the IRS. This means that any burden of proof for your valuation would be on the IRS if they choose to audit your company. This is important as it means they would essentially have to disprove your valuation with facts, figures and documents.

If you are do not have the safe harbor, and the IRS comes to audit you to find out that you have issued options improperly at an incorrect price, your employees would be taxed immediately on this and have to foot an extra 20% fine on the difference in value plus any additional penalties.

In short, this is a significant financial burden to your employees, who should be protected by a more responsible and knowledgeable company founder. In order to avoid these problems, most companies choose to play safe, and appoint a third party valuer to conduct their 409A Valuation.

How to get a 409a valuation?

Now that you are aware of when and why to get the 409A valuation, let us understand how to get it done. There are three ways for how you can get a 409A valuation, and they are:

- Do it yourself.

- Use software.

- Hire a valuation expert

Options to Get 409A Valuation

| Options | Advantages | Disadvantages |

|---|---|---|

| Do it yourself |

|

|

| Use software |

|

|

| Hire valuation expert |

|

|

Option 1: Do the 409A valuation yourself

If you have the valuation knowledge, experience, and skills needed, and if you meet the IRS requirements, then you have the option to do a 409A valuation yourself. On the other hand, doing it yourself would not give you the entitlement to the safe harbor protection. And in case your company is audited, the burden of proof would be entirely on you.

One of Eqvista’s valuation experts commented, “I would only recommend doing the 409A Valuation yourself if you’re a professional appraiser with the necessary expertise and experience. If the IRS deems the valuation inaccurate, your employees could face immediate taxation on their stock options and a 20% penalty tax and interest.”

Option 2: Use External Software

In order to get 409A valuation, software tools are designed to streamline and automate parts of the 409A valuation process. These valuation softwares helps to ensure the 409A valuation is updated annually and can withstand IRS scrutiny, with review by experienced valuation professionals. Also valuation software safeguards against overvaluation and has the ability to explore a range of defensible valuation outcomes .

While selecting the valuation software for your company, Eqvista’s expert suggests to make sure the softwares have these key features:

- Reputation and track record

- Integration with cap table management

- Live support

- Secure data storage and transmission

- Audit ready reporting

Option 3: Hire a firm

Hiring a reputable valuation firm is one of the best practices to get a 409A valuation. Hiring a qualified valuation firm is important for companies to comply with regulations and avoid penalities and properly structure equity compensation and demonstrate sound financial practices to investors.

To get a 409A valuation conducted by an experienced firm with expertise will provide a well supported defensible valuation that can withstand IRS scrutiny. The IRS and SEC can challenge a valuation that is not conducted by a qualified appraiser, thereby increasing the risk of a costly and time consuming audit.

Maintaining an accurate and up-to-date 409A valuation sends a positive signal to investors about the company’s financial discipline and management.” says one of Eqvista’s senior valuation experts.

Guidelines for 409a valuation

With all the ideas clear about the 409A valuation, here are some guidelines to keep in mind:

- Have a valuation done before you issue the first common stock options

- Get a new 409A valuation done when you have raised a round of funding

- A 409A valuation refresh is needed every 12 months to maintain a safe harbor status

Other than these points, below are some extras to know about and keep in mind.

409A Valuation Process

The time frame for the entire process goes like this:

- Prepare and hand over your data to the valuer. The data and documents that most of the 409A valuation firms need are:

- Your up to date Cap Table

- Past 409A reports, if any.

- Full set of financial statements.

- Article of Incorporation

- Copies of rev share agreements, partnering agreements, joint ventures, etc.

- Any liabilities or assets that are not noted on the balance sheet like product warranties, compliance requirements, pending lawsuits, etc.

- Copies of agreements or documents dealing with shareholder rights.

- Term sheets

- Convertible note or term debt agreements

- Preferred stock purchase agreements

- Any history of secondary transactions

- Financial projections of at least 1 year, but it would be much better if it was for 5 years.

- The firm then runs the report, which normally takes less than 3 weeks.

- Once the first draft is prepared, you will be asked to review it and make any comments you may have.

- After receiving your comments, the revisions will be made by the firm. Usually, the revisions are for lowering the strike price, which is the price at which a stock option can be exercised.

- The final report will then be delivered. It can take anywhere between 1 to 10 days to complete the revisions.

Strategies for the valuation of your company

Now that you are clear about the 409A valuation, let us understand how the valuation is performed. Out of the many methods available, there are three main strategies that are used the most.

Each has been explained below:

- Market Approach (also called OPM Backsolve) – This method is used when the business has just raised equity funding. As the investors assumedly paid a FMV for the equity, this would be used to get an estimate of the common FMV for the company. The other market-based approaches utilize financial multiple information which includes revenue, net income, EBITDA, etc., from publicly traded companies that are from the same industry and situation. These are then used to compare with for estimating the company’s equity value.

- Income Approach – This is an approach that is very straightforward and it is used for the companies that have a positive cash flow and sufficient revenue.

- Asset Approach – This is the least common and supported 409A valuation approach, and is mostly for the very early stage businesses that have not raised any funding and do not have any revenue yet. Hence, this method is used to just calculate the net asset value to figure out the right value for the business.

Lowering the strike price

With all the explanation above, you might know now that you would need a low strike price for your 409A valuation. But why? Well, the lower your strike price is, the lower your employees can use to exercise the stock options. Moreover, this also means that the company gets higher realization of value when it becomes successful. Other than this, if the strike price is high, the option holder would get more when they sell the underlying stock.

Nonetheless, there are founders who feel that a lower strike price would make their business look bad for the investors, which is not always the case. Investors are aware that the 409A valuations are used to set the common stock prices, which is why they usually do not use the 409A to evaluate your company before they agree to fund it.

Risk Factors

Now that you have an idea that a low strike price has a huge impact on the 409A valuation, let us understand the risks better. Well, the actual risks are mentioned below:

To have a lower strike price risk and can put you in risk with the IRS. Here are the factors that you would have to deal with if you have the valuation done by yourself or someone you know from the company due to which the strike price is set as a low as possible:

- No safe harbor protection and you would have to show proof to the IRS during the audit to prove the strike price decided by you. Hence, you would not be able to answer any audit questions to prove that the value you have set is right.

- In case the actual strike price turns out to be higher than what you had set, you as well as your employees who exercised their stock options would be penalized.

- The valuator does not have proper credentials and experience to evaluate the company, which is why the strike price is low.

- You may be blacklisted by the audit firms and this news would spread to other firms in the area.

- Due to the low valuation, you would be challenged about the past valuations even if a certified valuator had performed it.

- Investors might not hear your plea for raising any funds for the business.

- You might also lose your credibility as a brand and new talents would not come into your company, if the word goes out.

Hence, it is better to settle for a higher strike price when you are in doubt about something, especially if you are doing the 409A valuation yourself (though you should have a professional valuator do it).

Possible Penalties for valuation Non-compliance

While nonqualified deferred compensation plans are an excellent way to attract and retain employees, they are certain things you need to know about the Internal Revenue Code Section 409A. In today’s competitive environment, a nonqualified deferred compensation plan might help you attract and keep critical employees. Compliance with IRC Section 409A, on the other hand, can be difficult, the penalties can be severe, and the IRS has no policy of negotiating settlements. When it comes to Section 409A compliance, businesses frequently make the following mistakes:

- Plan deferrals and dividends were calculated incorrectly

- Inability to make timely deferral or distribution decisions

- Failure to follow the definitions in Section 409A for certain terms

- An amount due in a subsequent year is paid in advance

- Payment of an amount due in a previous year is late

What are the 409a penalties?

Employers will be subject to withholding taxes on the vested deferred compensation portion of employees’ earnings if your 409A valuation is found to be non-compliant with the Internal Revenue Code. If employees do not receive their deferred compensation, the IRS will consider it to be included in your taxable year of failure on December 31.

The 20% penalty and premium interest tax, fortunately, are not subject to withholding taxes. If your NQDC arrangements are subject to 409A requirements and you have an operational failure, the IRS can tax and penalize all of your NQDC arrangements. Supplemental executive retirement plans (SERPs), pay deferral plans, severance agreements, executive employment agreements, and unwritten bonus programs all fall within this category. However, if you have multiple sets of NQDC stock options or SARs, the failure of one set does not automatically result in the failure of all of your other NQDC stock options or SARs.

When a stock option is not properly valued or does not meet safe harbour standards, executives, employees, contractors, and other businesses are penalized. The following are examples of penalties:

- Deferred pay for the current year and earlier years is included in gross revenue for the current year.

- On the taxable amount, accrued interest is assessed.

- There is a federal penalty of 20% of the deferred compensation that must be included in gross income.

- Furthermore, a 409A violation may result in state-level penalties, including additional taxes and a 20% penalty.

How much can you save if you do 409a correctly?

Different valuation firms offer different pricings for 409A valuations. It’s important to look into what methods the valuation firm uses before you have them conduct it. While you should definitely work with your 409A provider to optimize the value, don’t use dubious valuation methods and/or assumptions – as we’ve already shown, this can have major, unintended implications. Anyone can quickly determine whether this is true by looking at your company’s KPIs and financial performance. With Eqvista, you are guaranteed expert help from our NACVA certified valuation analysts, giving you one of the best services out there.

What certification do you need to perform the 409a Valuation?

The team at Eqvista has the certifications and knowledge to help you with your business valuation. To help you understand better, here is a list of certificates needed to be a certified valuation provider:

- ASA & IBA – It is vital for a valuator professional to receive accreditation from the American Society of Appraisers, such as the Accredited Senior Appraiser (“ASA”). This proves that the person has achieved the highest level of education, training, and report writing for business valuations. Another such certification is the IBA certification, which is from the Institute of Business Appraisers (IBA).

- AICPA & NACVA – AICPA, the American Institute of Certified Public Accountants, is a professional organization of Certified Public Accountants in the US. The valuation professionals that have this certification make them well-versed and experienced in preparing the most accurate valuation reports. Another important certification that the professional can have is the NACVA certificate. Eqvista has accreditation from NACVA, the National Association of Certified Valuators and Analysts.

- iBBA – The iBBA certification identifies an experienced and dedicated business broker. This certification is given to those who have proven professional excellence with verified education along with an exemplary commitment to the industry.

These are just some of the main certifications, but there are others that show a business analyst is certified to get the business valuation done properly.

FAQs

A 409a valuation might seem to be tricky but once you understand the concepts, you will be able to figure out how the businesses work and how they will affect the fair market value and the stocks given to the employees. To guarantee that your organization is in compliance, you’ll need a 409A valuation. Non-compliance can lead to disastrous results. Stock option undervaluation can result in significant IRS penalties and missed compensation.

Who needs 409a Valuation?

Private companies that plan to issue stock options, shares or other equity incentives to employees are required to have a 409A valuation.

Why do businesses need a 409a valuation?

The IRS regulation IRC 409A states that stock options cannot be issued for less than their fair market value (FMV). Furthermore, the FMV should ideally be evaluated by a third party who is not affiliated with the company.

Does a simple agreement for future equity (safe) trigger a 409a valuation?

Yes , issuing a SAFE can trigger the need for a 409A valuation, as it may affect the fair market value of the company’s stock, especially if the valuation cap is material or the funds will drive significant business growth.

Is section 409a income taxable?

Only income tax is covered by section 409A. Deferrals will be added to most plans after FICA is removed. Deferred compensation under a non-compliant plan or arrangement is liable to standard federal income tax, a 20% excise tax, and a penalty.

How often should a 409a valuation be updated?

Generally 409A valuations are performed annually, which expire after one year. But it may be required after significant events like funding rounds or mergers and acquisitions.

Can I do a 409A myself?

It is better to have a 409A valuation done by professionals. While financial specialists (e.g., M&A experts, equities research analysts, and venture capital firms) can determine business value in a variety of methods, in order for The Company’s FMV to have safe harbor (audit protection) it is required to be done by an independent third party.

Can a 409a valuation be done in-house?

For companies less than 10 years old, there is a safe harbor that allows them to determine the FMV internally, but most companies prefer to use an independent third -party valuation firm.

What are the best practices companies can ensure their 409A valuations?

Regular updates, independent valuation, awareness of material events and future implications, and choice of appropriate valuation methods.

What information is needed for a 409a valuation?

Key information include: Company financials, Cap table, Industry details, Fundraising history, Desired valuation date and Other relevant information. Our valuation experts can provide detailed information on the requirements to proceed with the valuation, Contact Us to know more.

Do all private companies require a 409a valuation?

A 409A valuation is required for private corporations to grant ownership to employees (often a key recruiting tool). Since the value of a private company’s common stock isn’t readily available as it isn’t listed on a public stock exchange, a 409A valuation is required.

How long is the FMV from a 409A valuation good for?

Valuations under IRC 409A are valid for a maximum of 12 months after the effective date, or until a “material event” occurs. A material event is something that potentially has an impact on the stock price of a corporation. Qualifying funding is the most typical significant event for the majority of early-stage firms.

How much does a 409a valuation cost?

409A appraisals are required by the IRS and can cost anywhere from $2,000 to $5,000+ depending on the intricacy of the exercise and the valuation provider. Eqvista provides affordable startup valuations from $990, $1,290 for Seed Stage, $1,990 for Series A.

Get Audit-ready 409a Valuation With Eqvista!

409A valuation is a complex but essential process for private companies offering equity compensation to attract and retain talent.The key purpose of 409A valuation is to legally and accurately determine the FMV of a private company’s common stock for the purposes of issuing stock options to employees.

Eqvita is a leading provider of 409A valuations for startups and private companies with in-house of 15 valuators in the team and $1B monthly client asset valuation. Eqvista’s 409A valuations are designed to provide companies with an accurate, audit ready valuation that protects them from IRS penalities. Our team of NACVA certified valuation analysts have experience working with companies across various sectors.

Eqvista’s 409A valuation services are priced affordably, starting at $990. Book your appointment today to know more about Eqvista’s valuation.

Updated on: July 23, 2024

NEED A 409A VALUATION FOR YOUR COMPANY?

Eqvista has got you covered for your 409A valuation needs. Contact us to discuss your case today!