409A Valuation for Pre-IPO Companies

The article will cover the importance of a 409A valuation for pre-IPO companies and the steps involved.

Pre-IPO companies, those privately owned businesses gearing up for an initial public offering (IPO), must adhere to financial reporting and tax regulations. To determine the equitable market value of their common stock, these companies require a 409A valuation. However, assessing the fair market value of such firms’ stock options can prove daunting. Therefore, obtaining a 409A valuation is critical in establishing the fair market value of a private company’s common stock.

Pre-IPO Companies and 409A Valuation

Private businesses preparing for an IPO but yet to be listed on a public stock exchange are known as pre-IPO companies. These organizations need a 409A valuation for tax compliance, financial reporting, and fair employee compensation. Any pre-IPO company navigating the complex world of startup funding needs a 409A valuation.

The effect of market and industry changes on the fair market value of a company’s common stock is a crucial factor to consider in a 409A valuation for pre-IPO companies. For their stock options to remain reasonably priced, businesses should select a reliable valuation firm and do regular valuations. Finally, pre-IPO companies should know the potential penalties and legal repercussions for erroneous valuations.

What are Pre-IPO Companies?

Pre-IPO companies are businesses still in the early stages of growth and have not yet been listed on any public stock exchange. These businesses frequently have high growth potential and may have obtained money through private investment rounds from VCs, angel investors, or other private investors. Pre-IPO companies are often in a rapid growth phase and may seek extra capital through an IPO to support further development.

Example For Pre IPO Companies

- Airbnb – Before its IPO in December 2020, Airbnb was a pre-IPO company. It engaged in private fundraising rounds and strategic planning to prepare for its public debut.

- Stripe – Stripe, a fintech company, was considered a pre-IPO company before its anticipated IPO in the future. It raised significant private funding while keeping its shares non-public.

Pre-IPO Market Emergence

The pre-IPO market has experienced significant growth, fueled by increased investor interest in high-growth private companies, longer timeframes for companies to go public, and the ability for companies to raise substantial funds through private investment rounds.

Accredited investors now have the opportunity to invest in potential firms before they go public, potentially benefiting from the company’s growth and taking part in its future IPO.

Pros and Cons of Pre-IPO Companies

The demand for pre-IPO investments has resulted in the emergence of more platforms and services to connect investors with pre-IPO opportunities.

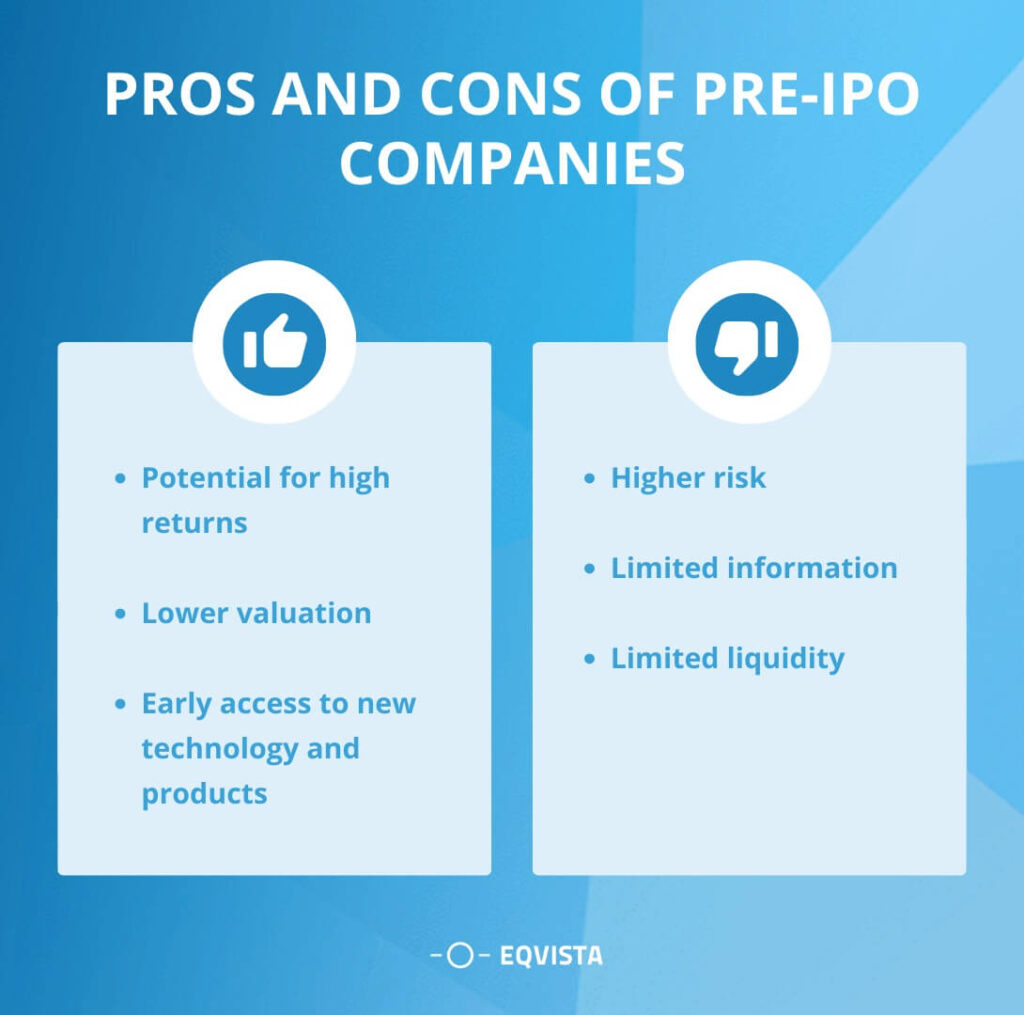

Here are some of the pros and cons of pre-IPO companies:

Pros

- Potential for high returns – Pre-IPO businesses frequently have strong growth potential and can provide early investors with substantial returns.

- Lower valuation – Pre-IPO companies frequently have lower valuations than their public equivalents, allowing investors to participate at a lesser cost and make substantial profits when the company goes public.

- Early access to new technology and products – An industry-disrupting new technology, product, or service can be early access for investors who invest in a pre-IPO business.

Cons

- Higher risk – Compared to investing in a publicly traded firm, a pre-IPO company is considered riskier. Companies in the pre-IPO stage may have unproven business concepts, unproven goods, or an unproven history of success.

- Limited information – It may be more difficult for investors to make wise investment decisions when pre-IPO companies are not compelled to disclose as much information as publicly traded corporations.

- Limited liquidity – Since pre-IPO shares are frequently volatile, it may be challenging to sell them before the firm is public or bought.

Understand 409a Valuation

The IRS requires a specific kind of assessment known as a 409A valuation for privately owned businesses to ascertain the fair market value of their common stock. It is important for companies that provide stock options or other forms of equity compensation to their employees or vendors.

A 409A valuation is required for businesses to confirm that the fair market value of their stock options or other forms of equity compensation is accurately priced, reflecting the amount a buyer would offer a seller. The IRS mandates that an independent third-party valuation company carry out this appraisal to ensure objectivity and impartiality.

The company’s financial performance, market conditions, and the worth of comparable businesses in the same industry are only a few factors to consider in the valuation. When the company’s financial performance or market circumstances significantly change, the valuation report must be updated at least once a year.

FAQ Of 409a Valuation for Pre-IPO Companies

For the purpose of granting equities, Pre-IPO businesses must get a 409A valuation to verify the fair market value of their common shares. The IRS requires this assessment in order to ensure compliance and avoid tax fines.

How does a 409a Valuation Protect Pre-IPO Companies?

Pre-IPO corporations can benefit from the protection offered by a 409A valuation, as it is used to determine the fair market value of their common stock for equity compensation purposes. The corporation can lower the risk of tax fines and ensure compliance with IRS rules by getting a 409A valuation to make sure the equity compensation it offers is valued at fair market value.

How much should be the 409A valuation for a pre-IPO company?

A pre-IPO company’s 409A valuation is dependent on a number of characteristics that are specific to the business and its sector. Therefore, there is no set target or benchmark . An independent third-party valuation company that has worked with pre-IPO businesses and is familiar with the specific variables that affect valuation should conduct the valuation.

When should a pre-IPO company require a 409A valuation?

A 409A valuation is required to determine the fair market value of a private company’s common stock for the purposes of issuing stock options. The IRS requires tax regulations to be followed. Before giving your first common stock options, after raising a round of venture capital, once every 12 months, and/or following a significant event that could impact the company’s value, you should obtain a 409A valuation.

What information is needed for pre-IPO company valuation?

Depending on the chosen valuation methodology and the firm’s unique characteristics, several pieces of information are required for a pre-IPO company valuation. The company’s financial statements and cash flow statements, as well as projections of future financial performance, industry, and market data, details on comparable businesses, the business plan and strategy of the company, and any pertinent legal or regulatory information, may nevertheless be required.

Tax penalties for not having 409a valuation for Pre IPO company

Failure to obtain a 409A valuation as required by the Internal Revenue Code could result in a 20% penalty on the employees, company, executives, or board of directors members. It could also lead to retroactive taxation of stock options, lower acquisition offers, and other negative financial and legal consequences.

How often Pre-IPO companies do 409a valuation refresh?

Pre-IPO companies normally update their 409A valuations at least once a year or more frequently if material modifications to the business’s financial performance or market environment could affect the common stock’s fair market value. A new round of financing, changes to the market or the level of competition, a significant shift in the company’s business plan, or the introduction of new goods or services are all examples of material changes. It’s important to update the valuation regularly to follow IRS rules and make sure equity pay is given at the right market value.

Why should you Hire Experts for your pre-IPO company 409A valuation?

Hiring experts for your Pre-IPO company’s 409A valuation is important for several reasons, as experts bring objectivity to the process, ensuring compliance with tax regulations and establishing credibility with investors, potential acquirers, and regulators.

A comprehensive 409A valuation can also help you make strategic decisions about fundraising, mergers and acquisitions, and other key business initiatives. With everything in the picture, overall, hiring experts is essential for mitigating risk, ensuring compliance, and making informed strategic decisions.

How can Eqvista help?

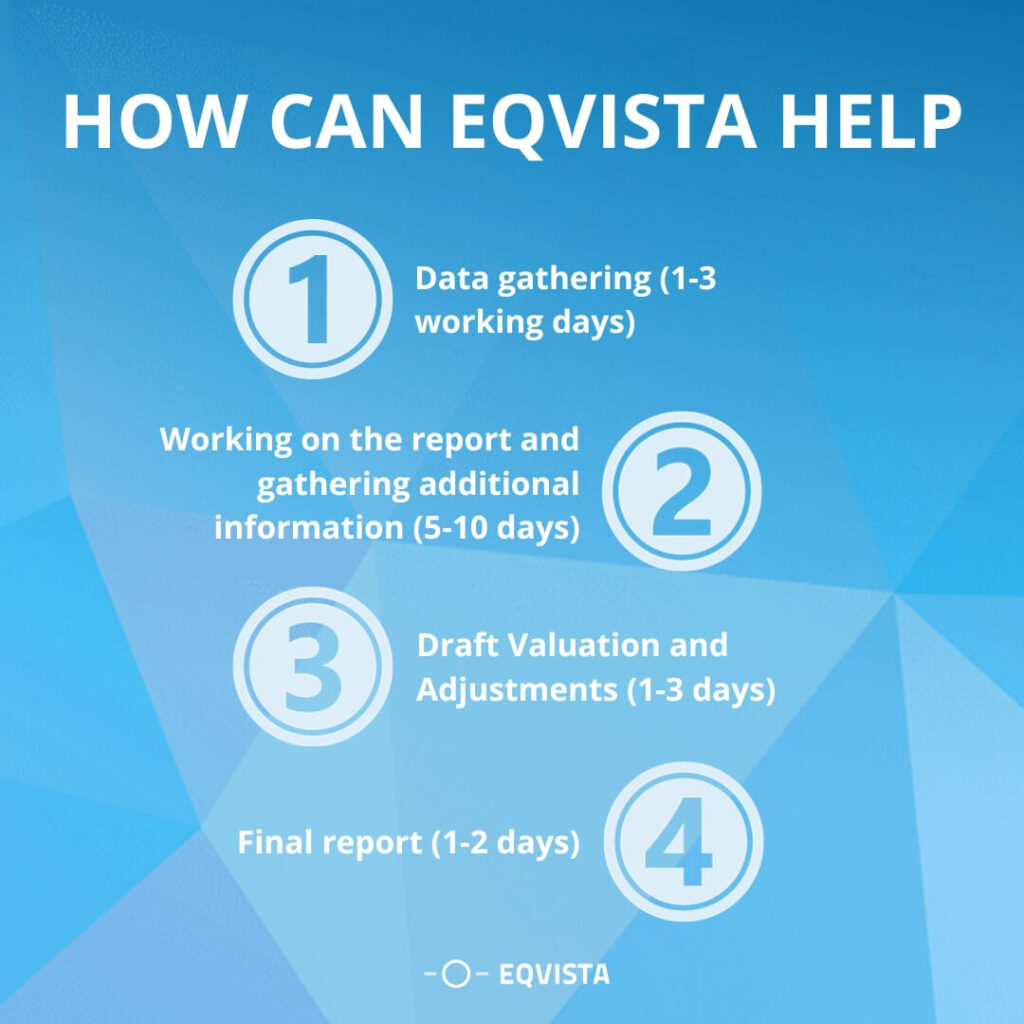

A Precise expert analysis can help you avoid tax penalties and legal liabilities while providing valuable insights into your company’s financial health and market position. Eqvista adheres to a fairly simple 409A valuation process.

- Data gathering (1-3 working days) – Our team will compile all the necessary information about your business based on a checklist to ensure a comprehensive valuation.

- Working on the report and gathering additional information (5-10 days) – Before we can proceed with creating the report, the engagement agreement must be signed. Once that’s done, we will continue working on the report and will reach out to you if we require any additional information to ensure accuracy.

- Draft Valuation and Adjustments (1-3 days) – We will share the draft report with you for review and work with the board of directors to incorporate any requested amendments or approvals.

- Final report (1-2 days) – Once all adjustments have been made and the board has accepted the report, we will conclude the valuation process and send you the final 409A valuation report.

Get 409A valuation for your Pre pre-IPO company with Eqvista!

Use a 409A valuation service to lower your risk exposure by valuing your business! One of the top companies offering 409A valuation services is Eqvista, and we would be delighted to help you and your business. Our team is made up of seasoned valuation experts who have completed assessments for businesses of various sizes and stages.

A dedicated internal analyst is assigned to each valuation and is responsible for gathering information, communicating updates, and responding to questions as they arise. We provide 409A valuation services that are affordable, accurate, audit-ready, and finished quickly. A committed team member would remain with you. So, Choose Eqvista and we are to help!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!