Different type of investors

The information shared here would give you all the details and information about the different types of investors.

Obtaining startup funding for your company is not an easy task, but it’s not impossible to secure funding for your company’s growth. There are constant announcements and daily hype surrounding startups getting funding. And with all the news about the rise in the types of investors, there are many new ways for companies to find funding.

For many entrepreneurs who are entering into the business for the first time, expect to spend about 4 to 6 months to raise the necessary startup funds. The main reason behind this is that not everyone knows everything about funding off the bat, and the different types of investors and startup funding.

Types of investors for companies

Most startup owners depend on investors for funding in their new business. It doesn’t matter if the company is introducing a new product, conducting an upgrade on equipment, or expanding operations, the investor’s capital can offer tremendous support for the company.

This may even end up coming from you, injecting funds into your own business as an investor.

Even though there are many stories about people who fund their own startups by utilizing bootstrapping and putting all their earnings and wealth into a business, this approach is many-a-times too difficult and unrealistic for many starting off. It is normal for budding startups to seek the help of investors that would help them give a proper base to their project and plan.

There are four main kinds of investors for startups which include:

- Personal Investors

- Angel Investors

- Venture Capitalist

- Others (Peer-to-Peer lending)

Generally, the capital from these types of investors is utilized by the company to upgrade supplies and equipment, expand operations, or introduce a new product. Nevertheless, every situation is different, which is why companies should always take precautions before contacting an investor.

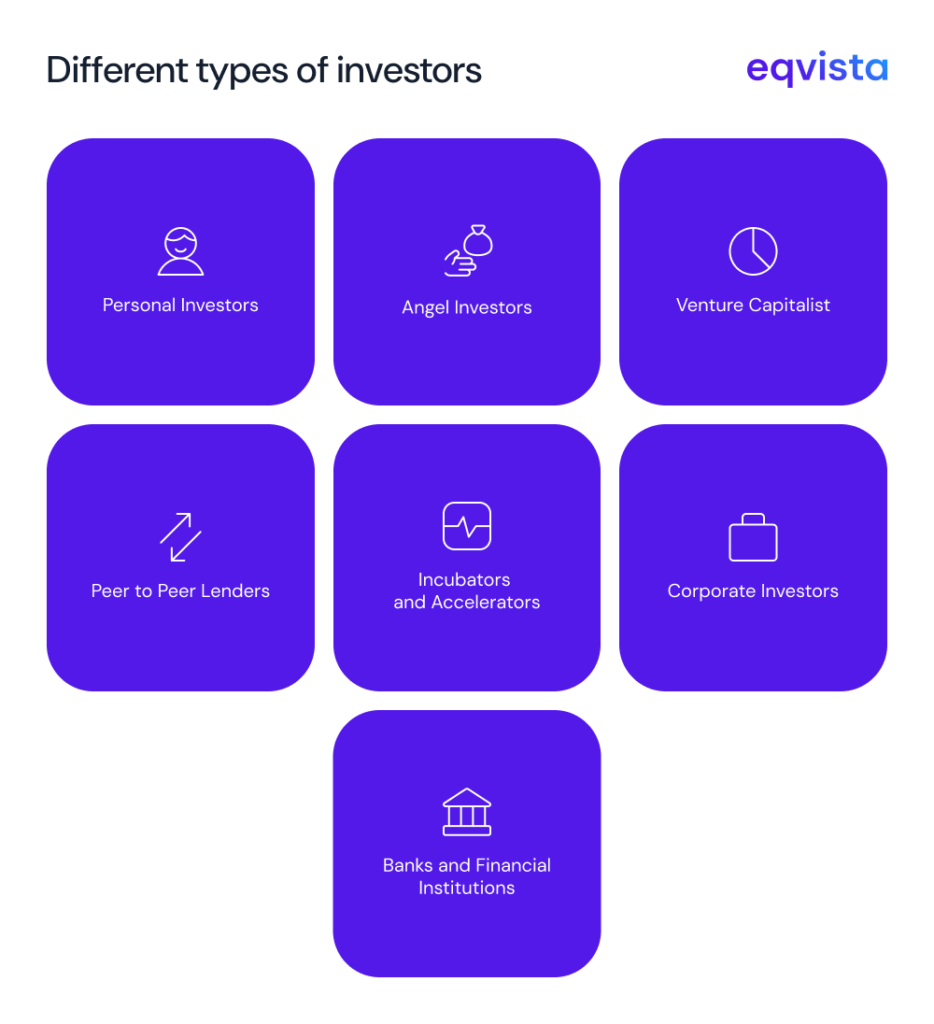

Different types of investors

As mentioned above, there are many types of investors who have their own resources, capabilities, and motivations. And you might prefer one type of investor over another depending on the strategy, capital needs and the company’s size. In addition to this, the company preferences would change over time, and the progress of the company would change as well.

In fact, investors are one of the main players in the process of the company, where their level and quality of involvement would determine the success or failure of the company. This is why it is essential to know everything about the various types of investors so that you can understand which to choose and how to approach the right one.

Types of Investors

| Personal Investors | Family members, friends, or close acquaintances who provide smaller amounts of capital in the early stages of a business. |

| Angel Investors | Individuals with high net worth not only invest their personal funds in early-stage startups in exchange for equity, but they also bring invaluable mentorship and connections to the table, enhancing the potential for growth and learning in these startups. |

| Venture Capitalist | High-net-worth individuals invest their personal funds in early-stage startups in exchange for equity. |

| Peer to Peer Lenders | Online platforms that connect businesses with individual or group lenders willing to provide funding, offering an alternative to traditional bank loans |

| Incubators and Accelerators | Incubators help develop ideas into businesses, while accelerators speed up the growth of early-stage startups. |

| Banks and Financial Institutions | Traditional lenders that offer business loans typically require a solid revenue stream, collateral, and a strong business plan. It is more suitable for established businesses. |

| Corporate Investors | Firms that acquire a controlling stake in more mature companies to improve operations and profitability and eventually exit the investment at a higher valuation. |

Personal Investors

Most business owners usually depend on their close acquaintances, friends or family to help them by investing in their business, normally during the initial stages. These types of investors are called personal investors, and even though they can assist with funding, there is a limit to how much they can invest in your company.

It is often easier to convince a loved one to help you out, but there is heavy documentation that is required for which they can be taxed for helping as well. So, if you are going to take a personal investor’s help, ensure that you consult a lawyer to help you avoid any complications.

Angel investors

Angel investors are those who put their money in small startups or new entrepreneurs. This is the most famous type of investors that most people may have heard about before. An angel investor might even be close to the startup owner, like friends or family.

Angel investment is normally either a one-time off funding for the business to propel, or an on-going investment to support and take the company ahead in the initial stages. Angel investors usually offer much more favorable terms as compared to the other type of investors. The reason is that angel investors invest in the entrepreneur opening a business, and not the viability of the company.

In short, angel investors are always focused on helping the startups to grow in the initial stages instead of obtaining a profit from it. As a matter of fact, angel investors are also referred to as business angels, seed investors, private investors, angel funders, or information investors.

Venture Capitalist

A venture capitalist (VC) is an investor who offers capital to the startups that are believed to have long-term growth potential. Venture capitalists are normally investment banks, well-off investors, and any other financial institutions. Even though this is a risky way for investors to put in their funds, a successful payoff is worth it.

A VC would put their resources into a company that they feel has the possibility to grow, and in return, they would demand equity in the company and get an overall say in the company’s decisions. Since entrepreneurs get both open funding as well as the advice of an experienced and knowledgeable person, many tend to choose these types of investors.

In a VC deal, large chunks of the ownership of the business are produced and sold to some investors via independent limited partnerships which have been built by venture capital firms. At times, these partnerships are made up of a pool of various similar enterprises.

An essential difference between the other equity deals and the venture capital deals is that VC deals normally focus more on growing companies that are looking for an abundance of funds for the first time. So, if you want a lot of money for your startup, along with some long term experience and knowledge, this option is a good one.

Others (Peer-to-Peer Lenders)

Peer-to-peer lenders are groups or individuals who provide capital to small business owners. But to obtain this capital from these types of investors, the owners would need to apply with companies that are experts in peer-to-peer lending, like the Lending Club or Prosper. As soon as the owner’s application gets approved by the company, the lenders would then determine if the company is right for their investment or not.

Incubators and accelerators

Incubators and accelerators are a gateway to various investors. If you get accepted into any incubator and accelerator programs, you might get somewhere in the range of $10,000 to $120,000 in seed money to develop your thought and gain traction while profiting from extra information and assets. Assuming everything is working out in a good way, you will pitch to more prominent investors and will be instructed with subsidizing sources during their demo days that can assist with taking you to a higher level. Be prepared to hustle; these programs need you to grow rapidly heading to the next stage.

Banks and Financial Institutes

These aren’t accurate investors like the others on this list; however, they can be a source of capital. Conventional banks are not sources of capital for new companies and independent ventures. In any case, as you gain a foothold, they might offer business credit cards and advance loans.

There are government programs that provide grants to a particular kind of project. That doesn’t imply that acquiring this sort of capital will be any more straightforward, and loans require repayment regularly when you genuinely need liquidity and slack as possible. They will not need to surrender value to your organization. Yet, they can affect your productivity, which might show up when you attempt to fund-raise from different investors in the future.

One thing to note about government programs is that they accompany specific limitations and restrictions that might be difficult for new businesses on many occasions. Considering this, founders should survey cautiously about what those expectations are.

Corporate investors

When big corporations put their resources into a budding business, they have various benefits. This consists of supporting their development number, diversifying their assets, and distinguishing between talent and innovation, which can assist them with battling off industry changes and fuel significant profits. Some corporate investors have assets to put resources into outside new companies. Many of these investors are launching their accelerators and incubator programs and building environments for developing these opportunities.

These investors can be great partners in taking your business to a higher level. However, they can be unique to work with. Any integration or collaboration on sales channels, systems, and customer bases should be drawn nearer cautiously and with a ton of tolerance.

Establishing business people and corporate investors have completely different perspectives and styles. It will be crucial to figure out how to see one another and have a few limits set up while going in, in case this will be a casual relationship.

Why would any investor invest in your startup/business?

Investors are different from lenders, and as a business person, you will need to consider that when you decide what kind of funding you want. An investor can be a reliable source for business advice and may have a strong business network that you can draw on. However, remember that your investors will have specific reasons why they would invest in your startup.

Investors are here to see a return on their investment. The main motive behind putting money into the business is growing business to make their own money. In case you can show that your business plan or idea will make money, the investor will be interested in your business for sure. Given below are a few reasons that investors look into your business:

Hard data: Crunch the numbers

The first thing that an investor will look for is the data. As we just mentioned, investors want to make money. It is your job to demonstrate to them that your organization will make that goal happen for them. In case your organization has been up and running for a while, you must show that you have had excellent financial performance till now.

Solid business plan

A solid business plan demonstrates to investors that you are serious about your business and have given thought to your plans to make money. No investor will put money in without one. Therefore, ensure that your business plan alone is sufficient to convince investors to back you.

What you need, where it will go and when they will get it back?

Your investors aren’t simply going to give you the money you need and leave. Once more, they’re in this for the return. So they will need to know precisely why you want the money and exactly how you intend to manage it. Likewise, they will need to know when they can anticipate a return – that should be a piece of your marketable business strategy.

A Clear Investment Structure

Purchasing ownership in an organization has lawful implications and investors will need to realize that you’ve effectively viewed those issues. You will have to have a business structure in place that takes into consideration different parties to purchase in. Likewise, you’ll have to have a reasonable arrangement for how the venture will function. In the event that the investors are partners or shareholders, will they reserve the privilege to decide on business choices?

A part of this includes having a reasonable valuation for your business. This is a method for sponsoring up your solicitation for a specific measure of cash in return for a particular measure of proprietorship. It also consists of assembling a stockholder’s arrangement (and perhaps adding a corporate constitution) that sets out the rights of all owners.

How to choose the right investor?

Now that you know a bit about the type of investors that you might encounter, it is vital to choose correctly, so that both parties do not reach a disagreement or have any issues later on. You wouldn’t want to connect with a person who ends up being wrong for your business, as well as your life. To be on the safe side, here are some things that you should keep in mind:

Understand the various funding choices

Selecting the right investor is a lot more difficult than just trying to obtain the capital you need for your business. This also requires a certain level of commitment from your side. You would need to make a list of what your expectations are before you can approach any particular type of investors you feel is right to fund your business.

Most importantly, you need to understand what they expect and how involved these type of investors would want to be in the company operations. Are you ready to meet their expectations? Ensure that you keep options open for you and find all the details before you make a deal with the wrong person.

Know where to look

Even though finding the right type of investors can be daunting, all you need to do is search for them in the right place. You can search online and take advantage of many investor databases like the Angel Capital Association, AngelList, or the Angels Den in the beginning.

Another thing that works wonderfully these days is self-promotion. You can participate in community business activities, network, and even write blog posts about yourself and the company. These things can help you have potential investors come to you instead of you going to them.

Make an investor’s shortlist

For enhancing your chances of obtaining funds, it is good to narrow down your list of potential investors to the ones that you feel are more appropriate for you. You can keep the criteria for the list of things like the investor’s reputation, previous partnerships, and mutual connections.

Ensure that you have a list of about 30 to 50 investors that you can put on the spreadsheet along with any other vital and relevant information for easy reference.

Look at your networks

It doesn’t matter which type of investors you choose, each one of them are looking for ways to reduce their risks while lending cash to startups. And this means that they would have more interest in you if they know you or if you have been highly recommended.

Hence, it is better to use your networks to gather all the potential connections with the investors available, and then you can consider the right investor for you and your company. When you have decided this, you can ask the person who knows the both of you to make an introduction.

Perfect your pitch

As soon as you have the attention of an investor, the next thing you need to do is have a perfect pitch to interest them into approving your proposal. If you spend your time and knowledge to prepare, it pays off. Add all the points that would give a proper idea and assurity of how the audience would be approached, and how the sales would increase.

Another thing that you need to focus on is to make sure that the starting of the pitch should be so interesting that the entire discussion has the investor’s attention. Also, the business plan has to be clear and outline the investor’s profit in the plan.

Ultimately those who take their time to find the right type of investors for their business, who are both tailored to their particular operational and financial needs, would be able to build the right support required for a long and successful partnership.

Look for investors’ industry expertise

It is essential that you know the industry your investment partner comes from. It’s really smart to observe venture accomplices who comprehend the intricate details of your industry, preferably through involved insight. These financial investors ought to have profound information on how the business has changed over the long run, the market factors that are influencing it now, and where it’s going in the future. When your investors know about your industry, they can give understanding and useful advice to address the market and stay away from pitfalls.

Look for investor’s functional expertise

Investors with financial expertise have authority in some or all of the fundamental abilities related to business and fundraising. Fundamentally, you need your investor to know about what they are doing. So that they can assist with taking your business to a higher level.

In case they are angel investors, check if they have built or sold an organization. Have they previously worked as consultants to new companies or been in the same shoes of being a founder? Assuming that they are firms, do they spend significant time in money or industry-specific analytics? Do they typically assist new businesses with their operational difficulties? Get some information about the investors you are talking with, and dive into their experiences to uncover the worth they can offer you beyond just money.

Track investor’s history/record

An investor with abundant resources might appear extraordinary; however, assuming they lack experience with new businesses like yours, you might be in an ideal situation without their cash. It can be useful to do some examination into their investing history. Have they worked with organizations that resemble yours?

Preferably, you will search for capital firms with a background marked by effective ventures and exits. One method for assessing an association’s history is its gross internal revenue (IRR). Firms with a higher IRR throughout a more extended portfolio are hypothetically more prepared and more qualified to assist you with developing your business. Various firms regularly put forth unique IRR objectives for their portfolios, depending upon the phase of organizations they periodically put resources into. Early phase investors typically focus on a 30% net IRR north of eight years, while some late-stage investors set an objective net IRR of around 20% over a similar period.

Large numbers of successful investors are previous business people who constructed profitable new companies of their own. You can likewise search out references from individuals who’ve recently worked with a specific firm to find out about how they respond when their ventures start to go south.

Investor’s financial records

In the event that you are raising your series A, don’t get self-satisfied. You should as of now be pondering raising your B and C rounds, as well. Who invests in your current round will convey messages to other future investors. What’s more critically, your present investor will likewise be vital for assisting you with tracking down future financing through their organization and shall have enough funds to invest in your finances for the future. There are a huge number of individual investors around the world, make sure that you consider their financial records before starting to work with them.

Ultimately those who take their time to find the right type of investors for their business, who are both tailored to their particular operational and financial needs, would be able to build the right support required for a long and successful partnership.

Which types of Investors to avoid?

Not all the investors are the same. Hence, it is crucial to examine potential investors with the same due diligence that the investors take in considering the startup options that they would like to fund.

Types of Investors to Avoid

| Predatory Investors | investors may attempt to exploit inexperienced entrepreneurs by offering unfair terms or trying to take control of strategic decisions. |

| Litigious Investors | Investors who are prone to litigation or legal disputes can be problematic for a business. Such investors may create unnecessary conflicts and divert resources away from growing the company. |

| Investors without Sufficient Capital | . Working with investors who lack the funds they promise can lead to funding shortfalls and jeopardize the business. |

| Investors with Misaligned Goals | Misaligned goals can cause conflicts and impede the growth and success of a business. |

How do I get introduced to investors and where to look?

People often say it’s not what you know, but who you know, and the same is true for obtaining the right type of investors. As a matter of fact, many investors do not just listen to new entrepreneurs entering the market and approve the deal. These investors tend to listen to other investors or the news about a new product that might get high market value.

To explain this better, here are some steps that would help you obtain investors to come and knock at your door:

Begin to look within your own network and figure out who you know and if that person knows someone, so you can look for more within their network. You would be able to find connections on LinkedIn online and the other social networking sites. This would help you get more types of investors and get introduced to them as well.

You can study their body language, the way of talking and how they interact with other like minded entrepreneurs.

In the end, you might not find the right VC for you, as some may not attend meetings for these new types of investments. However, an introduction by another investor would help you build connections and your network.

Request a colleague or friend to have you introduced to some specific type of investors that you have had an eye on for some time and researched about. You can also ask for their email address and send them a concise email with all the details.

And since your friend might have already sold the idea of funding your startup, you need to explain mostly about the marketing part and the investor’s profit. Also, do not ask your friend to introduce you to a long list of people. Instead choose two or three right ones to get introduced to.

Request for connections or introductions from a fellow entrepreneur. If you are not considered as an entrepreneur at the moment in the circle, make friends and ask them to help you connect with the right type of investors.

Ensure that they are entrepreneurs who have been in the industry for some time. Since they started with the same spirit, they would be able to give you some good contacts. Just make sure the entrepreneur is inline with your business objectives and goals.

Request early investors to introduce you to the other type of investors if you have already got the initial funding. And since an investor often listens to another investor, you can get more potential investors in your list. Another thing is that since the first investor already has an idea about what your company is about, his experience would be able to convince the next investor.

Make a database of the type of investors that you would want to be introduced to, along with those who can introduce you to them. As soon as you begin to learn more about them and also are introduced, you can add specific details here and there so that you do not get confused on who to choose.

Tell the person who introduced you to an investor about how it went, since they would want to know if their reference paid off or not. This would help you build long term relationships with these people and both can help each other later from the trust that you build.

With this list of things to look for with investors, remember not to ask other people to identify the right type of investors and do all the work for you. You need to do your own research, and take help of getting connections and being introduced by others. This is one of the biggest steps in the funding industry and can help you for a long-term.

Get business valuation to find the right investors for your company with Eqvista!

Now that you are aware of all the types of investors that you can get and how to find them for your startup, it is now important to learn about the types of funding and how to prepare yourself for each step. The next article would help you understand the types of funding options that you have and which ones that would be right for your company and at which stage.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!