Portfolio Valuation – ASC 820

With Eqvista’s portfolio valuation services, you understand your portfolio’s current value and future potential.

Valuing portfolios, especially with private investments and limited data, is challenging. Eqvista’s Portfolio Valuation Services specializes in this complexity, offering regular updates for accurate financial reporting despite data limitations.

But What is Portfolio Valuation?

Portfolio valuation determines the total value of a portfolio’s financial assets, including bonds, stocks, commodities, and cash reserves and it is essential to make informed decisions about asset allocation and portfolio management strategies.

Clients we target for portfolio valuation services

We target a diverse range of clients for our portfolio valuation services, including Private Equity Firms, Family Offices, Venture Capital Firms & Micro Venture Capital Firms.

We target all types of industries serving: Finance, SaaS, Real Estate Investment Trusts (REITs), Technology, Energy and Utilities, Manufacturing, Retail and Consumer Goods, Media and Entertainment, Biotechnology and Pharmaceuticals, and many others

We have worked on portfolio valuations for funds from $5 million to $100 million, with portfolios of up to 60 portfolio companies.

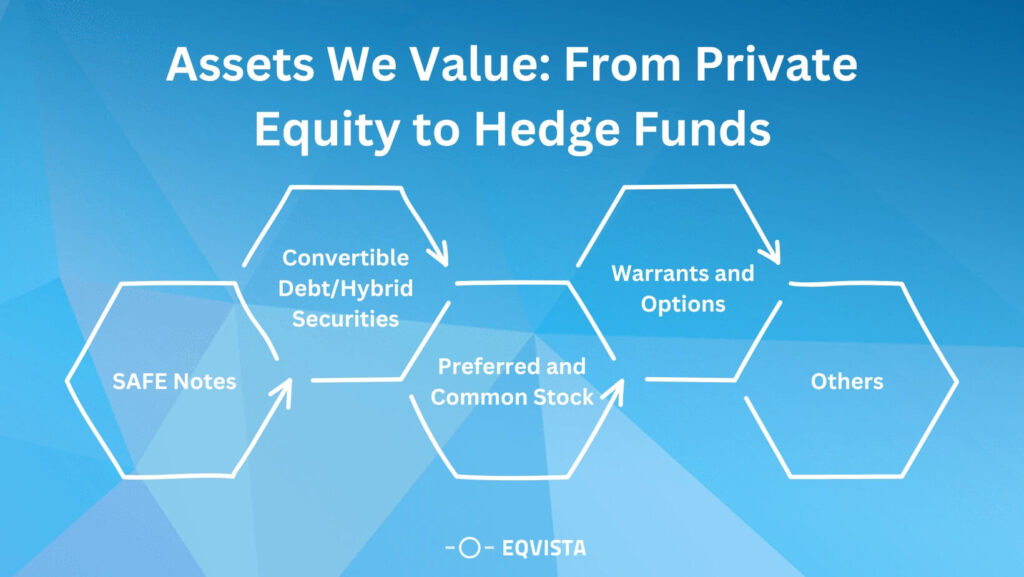

Assets We Value: From Private Equity to Hedge Funds

Our portfolio valuation services cover a wide range of asset types, Level 1 assets include listed stocks, EFTs, and government bonds, while Level 2 assets include corporate bonds, derivatives, and real estate. Level 3 assets include private equity investments, complex structured products, and illiquid assets. The wider focus of assets are:

- SAFE Notes – Simple Agreement for Future Equity (SAFE), a type of convertible instrument used in early-stage financing rounds.

- Convertible Debt/Hybrid Securities – Debt securities converted into equity shares at a predetermined conversion rate and other hybrid securities

- Preferred and Common Stock – Equity shares representing ownership in a company, both preferred stock (investors) and common stock (founders/employees).

- Warrants and Options – Derivative securities that give the holder the right to buy or sell an underlying asset at a specified price within a specified time frame.

- Others – Our clients hold other financial instruments and securities, including complex derivatives and structured products.

Portfolio Valuation Methodologies We Employ

We utilize a range of valuation methodologies tailored to the specific characteristics of each investment to determine the fair value. These methodologies include

- Market-based – We estimate the fair value based on the prevailing market conditions by analyzing recent market prices or comparable transactions of similar assets.

- Income-based – We evaluate the present value of anticipated future cash flows generated by the asset, considering factors such as expected growth rates, discount rates, and risk assessments.

- Cost-based – This method involves determining the fair value by considering the cost incurred to acquire or produce the asset, adjusted for depreciation or obsolescence.

- Backsolve – Utilizing observed market prices or transaction data, we reverse-engineer valuation models to derive implied inputs, such as discount rates or growth assumptions, consistent with observed market prices.

- OPM/Binomial – We employ Option Pricing Models or the Binomial model to value options and derivatives, considering factors such as underlying asset value, volatility, time to expiration, and risk-free rates to estimate fair value.

Reporting Formats and Frequency

We offer portfolio valuation reports on a frequency tailored to our client’s needs, including:

- Annual valuations – Comprehensive reports provided once per year.

- Quarterly/Monthly valuations – More frequent updates for active portfolio management and reporting.

Compliance with Relevant Standards and Regulations

Our valuation practices adhere to relevant accounting standards and regulations, including ASC 820 (formerly known as FASB Accounting Standards Codification Topic 820, or “Fair Value Measurement”). Compliance with ASC 820 ensures that our valuation processes meet fair value measurement and disclosure standards.

We work with both Big 4 firms and Tier 2 accounting firms to ensure our valuations are accurate and meet all standards for audit purposes.

What Our Client’s Say

“Fast, Professional, Competitively Priced. Turnaround was within 2 weeks. They were organized and professional, and proactively reminded me to provide information. Price was very competitive. And they were willing to listen to feedback on how the qualitative state of our business might impact the valuation.” by Chris L.

“Their streamlined process. They were very clear what they needed from me and what documentation they needed.” by Ty. H.

“Overall great experience. Great team to work with. Went through the process step by step and revealed their logic at each phase in determining the value of the software.” by Darin R.

How to Get Started?

With Eqvista, initiating the valuation process is simple:

- Contact Eqvista via phone, email, or our website.

- Our experienced professionals will reach out to understand your specific needs.

- Consult with our valuation team to discuss objectives, timelines, and details.

- Provide necessary data and documents related to your assets and financials.

- Our team conducts thorough analysis and research to accurately assess your investments’ value.

- Upon completion, receive a comprehensive report outlining findings, methodologies, assumptions, and conclusions.

Pricing

Eqvista’s investment valuation services start at $4,000. Our pricing is transparent and competitive, reflecting the value and quality of our services. For a personalized quote tailored to your specific valuation needs, please contact our valuation team for more information.

Ready to Get Your Portfolio Valuation?

Portfolio valuation is complex and requires a deep understanding of markets, specific assets, companies, and financial data. With growing scrutiny from regulators, auditors, and investors, there’s a need for transparent and well-documented valuations.

Eqvista’s team of valuation specialists is here to help when it comes to valuing diverse or complex portfolios. Start now to ensure your investments are valued and managed effectively.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!