How to Determine Stock Prices for Private Companies?

A stock price represents their overall financial health.

Methods for valuing private enterprises could include ratios, DCF analysis, or internal rate of return (IRR). For private companies, the most frequent valuation approach is the comparison of valuation ratios between the private firm and a publicly traded counterpart. In addition, private firms’ market capitalization and market bets significantly influence their stock price. Take a look at how the evaluation system unfolds.

Stock Prices in Private Companies

If a private company sells the stock, the stock market cannot decide the price. You’ll need a private company valuation formula to determine the value of shares, i.e., 5% or 10% of your business. Unlike public corporations, where the price per share is publicly available, private companies must be valued using specific methodologies.

Overview of Private Companies and Equity

Private equity is a non-listed investment class. Private equity is made up of funds and investors who invest directly in private enterprises or buy out public corporations, delisting public equity. Private equity is funded by institutional and individual investors and can be used to support innovative technology, acquisitions, working capital, and balance sheets. Private equity investments typically demand long holding periods to ensure a turnaround for failing companies or facilitate liquidity events such as an IPO or sale to a public corporation.

How does private company analysis work?

Due to the lack of a public market for private firm shares, it is difficult to calculate the valuation of a company. Unlike public firms, where the price per share is readily known, private company shareholders must use a variety of methods to estimate their share worth.

Comparative analysis

This is the most popular and quickest way, and it compares the private company to a comparable public company in terms of valuation ratios. You can use multiples like the price-to-earnings (P/E) ratio to value the private company with a similar size and business model. For instance, suppose your private company manufactures widgets, and a public company of comparable size manufactures widgets as well. As a public corporation, you have access to that company’s financial statements and valuation ratios.

If a public company’s P/E ratio is 15, this indicates that investors are willing to pay $15 for each dollar of earnings per share (EPS). You may find it sensible to apply this basic example to your own business. If your company earned $2 per share in earnings, you would multiply that figure by 15 to arrive at a share price of $30 per share. If you possess 10,000 shares, the value of your stock interest is around $300,000.

Discounted cash flow

DCF analysis is also a common technique for valuing stocks. This method makes use of the time value of money’s financial features by projecting future free cash flows (FCF) and discounting each cash flow by a specified discount rate to get its present value.

This is more complicated than comparative analysis, and its execution needs numerous additional assumptions and “informed guesses”. You must anticipate future operating cash flows, capital expenditures (CapEx), growth rates, and an appropriate discount rate, among other things.

Private share valuations are frequently performed to resolve shareholder disputes when shareholders desire to exit the business, for inheritance purposes, and for various other reasons. Numerous firms specialize in private business equity valuations and are commonly consulted for a professional opinion on the equity value in order to handle the concerns stated.

Importance of Determining Stock Price

A stock price represents their overall financial health. The greater a stock price, the better a company’s prospects. Hence it’s essential to determine the stock price. Some of the key importance of determining the stock price are listed below.

- Company’s Financial Health – Analysts look at stock price trends to assess a company’s health. They also use earnings history and price-to-earnings (P/E) ratios to determine whether a stock’s price accurately reflects its earnings. This data helps analysts and investors assess a firm’s long-term viability.

- Fundraising – Most companies receive funding throughout their IPO phases. However, a company may need additional financing to grow operations, buy other companies, or pay off debt. This can be done using equity financing, which is the sale of new shares. Creditors also prefer companies with higher-priced shares, which usually correlate with earnings. Companies with strong balance sheets can better pay off long-term debt, attracting lower-interest loans.

- A Growth and Performance Indicator – Investment analysts often follow a company’s stock price to assess its financial health, market performance, and overall viability. A rising share price indicates that a company’s management is focusing on profitability. Furthermore, if shareholders are delighted and the firm is on the rise, C-level executives are more inclined to stay on. Senior executives may also receive annual raises and bonuses. In contrast, a company’s board may opt to fire its senior executives if its stock price is falling. Simply put, decreasing stock prices are bad news for CEOs.

- Compensation – Compensation also drives decision-makers to do everything in their power to ensure a company’s share price flourishes. But the underlying stock price must rise for the option to be valuable. So stock options are critical to a company’s health. Alternatively, executives benefit when they make strategic decisions that boost a company’s bottom line, ultimately helping investors build their portfolios.

- Risk Takeover – A company’s stock price may also be affected by preventing a takeover. A takeover is more likely when a company’s stock price drops, partly because the company’s market worth is lower. Typically, large groups of people own stock in publicly traded corporations. Bidders who want to take over a company by acquiring a majority of shares can afford to do so while the stock is cheaper. As a result, management tries to keep the share price high to discourage this. A corporation with high share prices is better positioned to acquire a competitor.

- Positive attention – Media and analysts tend to favor companies with high share prices. The coverage of a corporation increases with its market capitalization. This attracts more investors to the company, allowing it to grow over time.

How are Stock Prices Estimated for Private Companies?

Understanding the market cap and market bets plays an important role in estimating a stock price for private companies. Let’s see how to check share value for the company:

Understand Market Cap

Analysts frequently use net worth and market cap to evaluate publicly traded organizations. The market cap of a publicly traded corporation can be determined by multiplying its stock price per share by the number of shares outstanding.

In other words, stockholders believe that a company’s net worth equals its market cap, which means that the company’s assets are only worth what they cost on the balance sheet. A company’s net worth is more than its book value, which means that investors feel that the company’s assets have an earning power that is bigger than the book value. This means that the market does not believe a company is worth even the book value of its assets if its market cap is less than its book value.

Betas and Their Importance in Estimating Stock Price

Beta is a metric that measures a stock’s projected movement relative to the market. If a stock’s beta exceeds 1.0, it’s more volatile than the market as a whole. So, it’s an essential factor when it comes to estimating the stock price. Determining the betas can be tricky as it involves a lot of considerations into account. Yet, by using the below-stated methods, betas can be determined.

Accounting Betas

While private enterprises do not have access to price information, they do have access to accounting earnings data. To estimate an accounting beta, we could regress changes in a private firm’s accounting earnings against changes in the earnings of an equity index (such as the S&P 500).

The regression’s slope (b) is the firm’s accounting beta. By contrast, utilizing net income yields a leveraged or equity beta.

This strategy has two major limitations; as such, regressions with few observations and low statistical power. These are common in private enterprises. As a result of this, accounting betas are frequently mismeasured.

Fundamental Betas

Researchers have tried to link publicly listed firm betas to observable characteristics like profits growth, debt ratios, and earnings variance and studied the accounting beta’s relationship with dividend payout, asset growth, leverage, liquidity, asset size, and earnings variability. The following regression relates the 1996 betas of NYSE and AMEX companies to four variables: CVOI, D/E, historical growth in earnings (g), and the book value of total assets (TA).

where:

CVOI = Coefficient of Variation in Operating Income

= Standard Deviation in Operating Income/ Average Operating Income

We could assess each of these variables and use them to estimate the firm’s beta. This method is straightforward but only as good as the regression. The poor R2 implies substantial standard errors for the beta estimates.

Bottom-up Betas

In valuing publicly traded companies in the example, unlevered betas of the businesses they operated in to estimate bottom-up betas were used. So the projections had low standard errors (due to averaging across many firms) and were forward-looking (because the business mix used to weight betas can be changed). Bottom-up betas for private enterprises offer the same advantages as for public firms. A private steel company’s beta can be determined using the average betas of publicly-traded steel businesses. The final estimate can account for changes in financial or operating leverage.

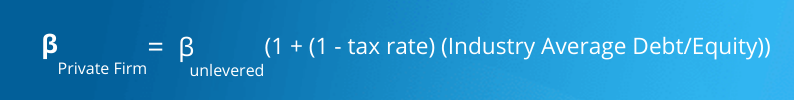

There is a difficulty with private enterprises when adjusting unlevered betas for financial leverage because the appropriate debt to equity ratio is a market value ratio. While many analysts utilize the book value debt to equity ratio to replace the market ratio for private companies, the following is recommended:

Assume the private firm’s market leverage is similar to the industry average. In this scenario, the private firm’s levered beta is:

If management is prepared to specify a goal debt to equity ratio, use that or an estimated ideal debt ratio to estimate the beta.

The adjustment for operating leverage is based on the fixed costs of the private enterprise. If this proportion is larger than usual for the industry, the private firm’s beta should also be higher.

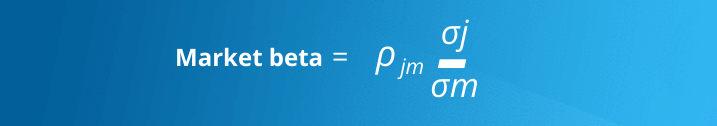

Adjustment for Non-diversifications

Assuming the owner has invested all of his or her wealth in the firm, the owner is exposed to all risks, not just market risk (which is what the beta measures). This non-diversifiable risk can be included in the beta computation with a simple adjustment. Assume the standard deviation of the private firm equity value (which gauges overall risk) is σj, and the market index standard deviation is σm If the stock and index correlation is pjm, the market beta is represented as:

If you don’t have market prices, you can’t calculate a market beta or a correlation coefficient. Notably, we estimated the sector’s market beta by looking at publicly traded companies. We may estimate a private firm’s overall beta using the same sample.

The whole beta adjustment question cannot be solved without first considering why the private enterprise is being valued. The market beta should be changed if the private firm is being appraised for sale. Since the potential buyers are stock market investors, there should be no adjustment for non-diversification. The level of the adjustment depends on the buyer’s portfolio diversification; the more diversified the buyer, the stronger the market correlation and the lower the total beta adjustment.

Role of 409a valuation and estimation of stock price

A 409A valuation assesses the stock’s fair market value. Any publicly-traded company’s stock price can be checked at any time. However, a privately held company requires an independent appraisal to determine its value.

The American Jobs Creation Act of 2004 added IRS Section 409A, which states: “Section 409A pertains to remuneration earned in one year but paid in another. Non-qualified deferred compensation. This is distinct from elective deferrals to qualifying plans (such as 401(k) plans) or 403(b) or 457(b) plans.”

Stock options are non-qualified deferred compensation that allows employees to buy common shares of your company at a fixed price (the strike price). It determines an “exercise price or strike price” that must be above fair market value.

Why choose Eqvista for 409A valuation and managing stock?

A good valuation firm will utilize the correct 409A valuation procedure to deliver the appropriate results. Since our inception, Eqvista has provided private company valuation services. Our clients can simply manage company valuation and equity from seed to IPO stage in a single scalable solution. Our platform includes all the tools you need to keep track of your shares. Check out the app or contact us for help. We’d be glad to help!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!