How Cap Tables Help Founders Drive Business Growth?

Seasoned investors are aware of the importance of the dilution-related insights gained through cap table solutions. However, the benefits of such software to a startup founder are arguably much more significant. Not only does this software enable real-time ownership tracking, but it also simplifies stock option management and tax compliance. It can also catalyze the process of building consensus in funding and exit scenarios.

In this article, we will explore such key benefits of cap tables and how they can ultimately drive business growth.

Why are cap tables more than just equity trackers?

Cap table software is already deeply integrated in the venture capital ecosystem, with its market expected to grow steadily at a CAGR of 12.5% until 2033.

Here’s how founders can leverage this to drive business growth with clarity and confidence:

Faster access to capital

Since 46% of VC funds go to follow-on investment rounds, you have a fair chance of raising additional capital from your existing investors. However, relying too heavily on them risks shifting control. To balance both existing and new backers, you must set a valuation that’s attractive to both.

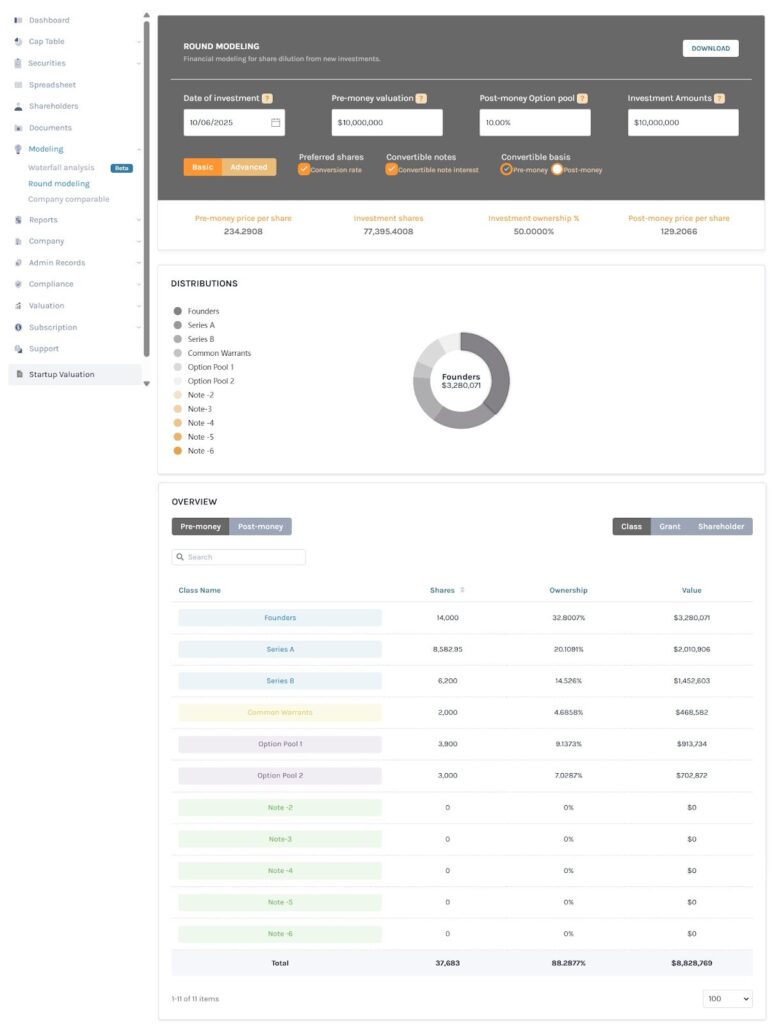

Ideally, you should start by deliberating valuation ranges with existing investors. This not only helps them reassess their return expectations and dilution tolerance but also sets clear guardrails for negotiations with new investors. These conversations are far more efficient when supported by a cap table software’s round modeling tools, which make the dilution impact immediately visible.

By establishing an agreed valuation range upfront, you achieve two key advantages. Firstly, existing investors are more likely to re-invest to offset dilution. Secondly, you can negotiate with external investors confidently without needing repeated approvals for every counteroffer.

Enables regular infusion of talent

In Silicon Valley, a startup employee may receive about 14% of their income through stock-based compensation. Eventually, when the startup succeeds, stock options can account for 86% of the net worth of such employees.

Stock-based compensation allows employees to participate in their company’s growth while their employer gets to conserve cash reserves.

Cap tables are crucial for effectively leveraging stock-based compensation plans.

They can help you project the expected dilution from such compensation plans, which can play a crucial role in securing board approval. Another benefit is that they help you identify when your option pools are insufficient in comparison to your hiring needs.

Given how competitive the cap table management space has become, service providers have had to evolve beyond simply enabling tracking and monitoring of stock-based compensation plans. Cap table software, such as Eqvista, provides key compliance services such as 409A valuations and ASC 718-compliant stock option expensing.

Effortless stakeholder communication

Suppose you raised funds from investors with diverse needs by issuing Simple Agreements for Future Equity (SAFE) and warrants and by offering anti-dilution rights. Then, the other investor you onboard would want cap table access because of the complex dilution implications.

If you maintain your cap table at a central database, your stakeholders will be assured of transparency.

But if you share access to the entire cap table, you risk breaching the privacy of stakeholders who do not wish to publicize their position. This brings you back to maintaining separate cap tables for each stakeholder.

This is why cap table software, such as Eqvista, has access levels ranging from limited viewing to full edit access. This ensures that all stakeholders have access to the necessary information without breaching the privacy of others.

Compliance support

The compliance features of cap tables are often underplayed. Firstly, most premium cap table packages will include 409A valuations, which establish your company’s fair market value (FMV). This forms the basis for calculating your employees’ taxable income from stock-based compensation. Any errors can result in non-compliance with Section 409A of the Internal Revenue Code (IRC), which carries adverse tax consequences such as a 20% tax penalty.

Secondly, some service providers offer stock option expensing compliant with ASC 718, which ensures accurate financial records and ultimately ensures tax compliance. You must note that following ASC 718 for stock option expensing is a cumbersome process that involves:

- Identifying stock options to be vested for each recipient in the tax period

- Determining the value of all such stock options, which also involves determining the value of your company

- Calculating the total expense to the company based on FMVs and exercise prices

- Making the appropriate journal entries and disclosures

By handling this process for you, cap table software can potentially save weeks for your finance team.

These compliance features also include filing services for Form 3921 and 83(b) elections, which can streamline the tax reporting experience for your employees.

Strategic decision-making

Cap table software plays a crucial role in making sense of the diverse ways in which startups can leverage equity for catalyzing growth.

At any given juncture, weighing all options requires advanced financial modelling, most of which is challenging without dedicated cap table software.

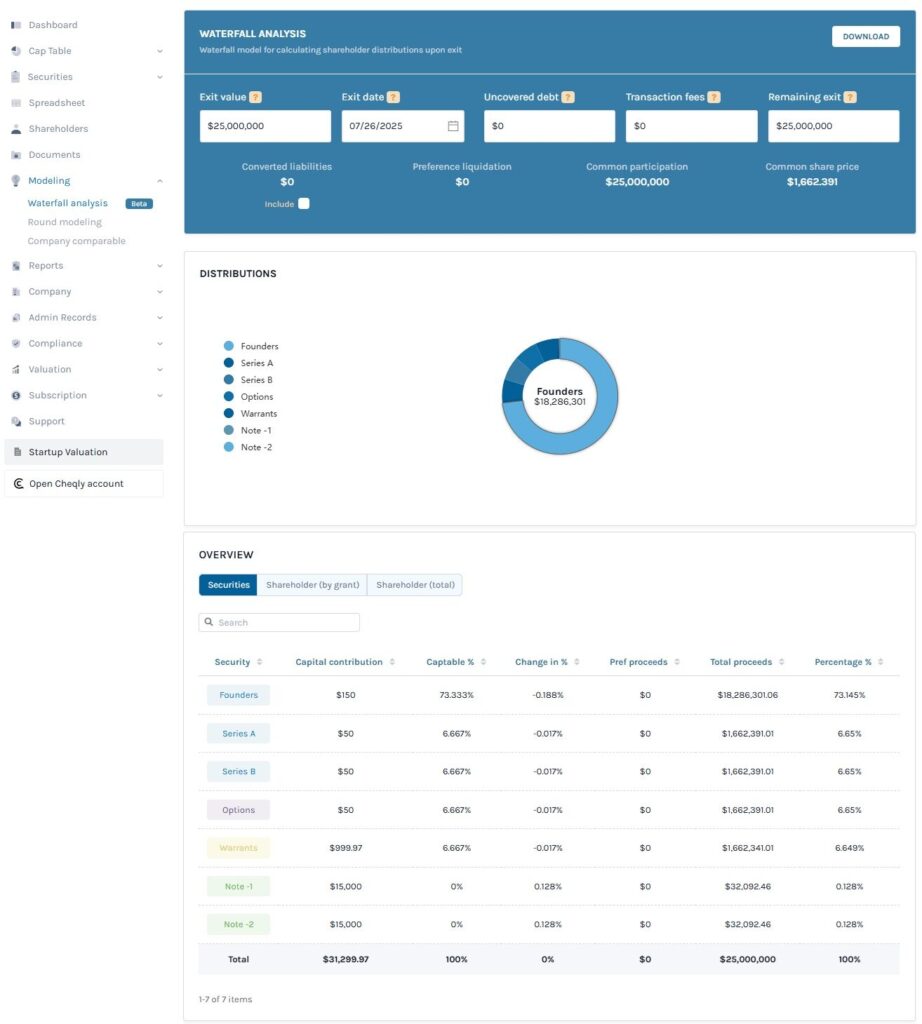

Beyond providing real-time visibility into ownership structures, these tools support round modeling, waterfall analysis, and even offer access to equity consulting services. This enables founders to make informed decisions with far less effort.

In fact, the utility of cap table software is not limited to just traditional equity planning. When you seek venture debt, founders can assess the long-term dilution impact of lender warrants using cap table software.

Founders also bear the responsibility of ensuring satisfactory exits. Cap tables such as Eqvista help founders model exit outcomes through waterfall analysis, making it easier to align stakeholders around the exit process.

Credible and scalable solution

Cap table software is arguably a much more scalable solution than spreadsheets. They provide better visibility into ownership structures while lightening the load of finance, compliance, and human resource teams. As the number of stakeholders grows over multiple funding rounds, the automated nature of cap tables will save weeks of effort for such teams. This allows them to focus on more mission-critical tasks.

As your startup expands to new regions and onboards employees and investors from different tax jurisdictions, the compliance support of cap tables will become invaluable.

Furthermore, as the number of stakeholders increases, governance features such as online board proposals and approvals will help preserve agility in decision-making, even at the highest levels.

Essentially, cap tables can be a great investment from a corporate governance perspective.

Eqvista- Turning complexity into clarity!

Cap table software can play an important supporting role in your scaling journey. If the benefits are measured in terms of time saved, you will notice that such software allows you to operate with leaner and cost-effective finance, compliance, and human resource teams. Not only that, it is invaluable for building consensus among stakeholders at critical junctures.

By choosing Eqvista, you can unlock these benefits for just $2 per month per shareholder. Contact us to know more!