File Form 3921

Want to file Form 3921 for ISO exercise? Eqvista is here to help you!

ISO is a stock option given to employees. Form 3921 is used to report an ISO exercise to the IRS. Eqvista’s platform lets you easily generate all your 3921 forms within minutes. This feature is available to all Premium accounts, so don’t hesitate to start enjoying the benefits of being one of our Premium subscribers.

Form 3921

In brief, form 3921 is a form to be completed if an employee has exercised an ISO. It needs to be filed to let the IRS know that the exercise has taken place. It is a formal declaration by the employee on the exercise of an ISO and has to be filed with the Internal Revenue Service (IRS). In the case of failing to file form 3921 in the time and manner as per the IRS rules, penalties may apply. Therefore, it is important to know all the details about form 3921.

When do you need to file Form 3921?

In order to avoid any complications, the form must be filed before January 31 for the previous calendar year. For better understanding, consider a scenario where an employee exercises their ISO in August 2020; you must provide the employee with a 2020 Form 3921 no later than January 31, 2021. It’s good practice to make these forms available to employee’s right after the end of the year, which means early January, rather than waiting until January 31st.

Filing Form 3921

By following the Form 3921 instructions, it would be comparatively easy and straightforward. However, it is advisable to have an experienced specialist like Eqvista to help you with the proper filling of the form. Want to know how to file Form 3921 online? Given below is the information you need to provide in order to fully file form 3921.

What information is needed to file Form 3921 electronically?

You can submit eFile form 3921; here are a few things to get started:

- A list consisting of which employees exercised ISOs in the last year.

- Employees’ tax ID numbers who exercised ISOs.

- The company’s transmitter control code (TCC)

- You need to create an account on the IRS’s official website (form 3921 software).

Deadlines/important dates to file Form 3921

As you know, form 3921 has to be submitted to the IRS by January 31. However, there are certain other dates that you should keep in mind.

- January 31 – Form 3921 deadline for filing copy B to all employees who performed ISO in the last year

- February 28 – Deadline for filing copy A with the IRS on paper

- March 31 – Deadline for filing copy electronically with the IRS

Let us look at the three copies in order to understand the filing process in detail.

- File copy A with the IRS, electronically or by mail

- Give copy B to the employee who exercised ISO

- Keep copy C for your company’s record

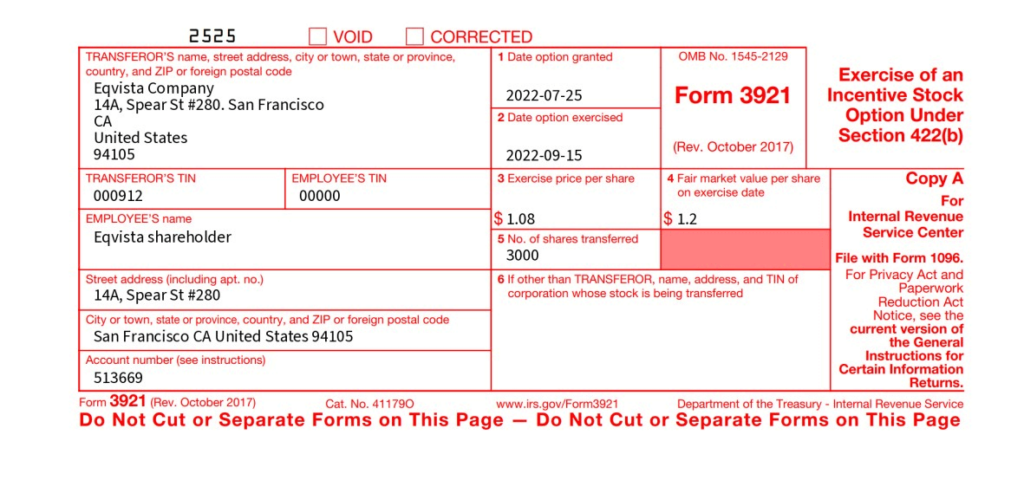

Sample of Form 3921

By logging in to the Eqvista app, you can create form 3921 from the compliance tab in the dashboard. You will receive a copy of the file. Our app helps the Company create and download completed form 3921 reports in minutes. This includes free and unlimited technical support for all premium subscribers.

Note: Information is for presentation purposes only.

Consequences if Form 3921 is not filed correctly

There are a few penalties that can be levied if you do not file your forms correctly. Following are the penalties that you need to be aware of:

- Within 30 days after the due date – A charge of $50 per form is imposed in the event of a late filing. The penalty is capped up to $547,000 per year or $191,000 for small businesses.

- More than 30 days after the due date, but by August 1 – A charge of $100 per form is imposed in the case of a late filing. The penalty is capped up to $1,641,000 per year or $547,000 for small businesses.

- After August 1, or if you never file correctly – a penalty of $270 per form is imposed. The maximum penalty is capped up to $3,282,500 per year or $1,094,000 for small businesses.

Easily File Your Form 3921 With Eqvista!

Eqvista’s app will help you generate your Form 3921 correctly by simply logging in to our app, which not only keeps you compliant, but saves you time and ensures that the Form 3921 is completed accurately.

We developed this feature exclusively for our Premium subscribers by knowing the ins and outs of ISO, fair market reporting, and the various rules regarding filing form 3921. You can count on our expertise to help you file form 3921 correctly and minimize your burden.

Maximizing your Experience with Premium subscription

Our Premium plan subscribers are offered the convenience and assurance of creating form 3921 and having it ready to file to the IRS. This eliminates the need to enter data manually, reduces the risk of errors, and saves time. Additionally, subscribers have access to our customer support team, who can provide further guidance on navigating the system.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!