Cap table management:101 Guide for Startups

A cap table is a defining document for founders, investors, and employees. It’s the most important point of reference for understanding how ownership in your company gets divided. Who owns what percentage of the company, funding rounds, vesting schedules, and liquidation preferences are all captured clearly in the cap table. The cap table comes into play at every stage of your company’s life; however, for early-stage startups, the cap table is the most important of all documents. This article covers everything a founder needs to know about cap tables, how to manage a cap table, how to issue shares through a cap table, and how cap table management software can help you do all this.

Cap table management for business and startups

The cap table is the foundation of your company; it’s the document that states how ownership in your company is divided among founders, investors, and employees. It’s important to have a good understanding of how cap tables work as well as a way to manage them. Usually, the cap table should be updated after every financial event such as funding rounds, granting stock-based compensation, acquisitions, and share issuances. As a result, the cap table should be monitored and updated on a regular basis.

What is a capitalization table?

A cap table, also known as the capitalization table, is a spreadsheet that identifies who owns what percentage of a company. A capitalization table captures in one place all the information investors, employees, founders and people with a vested interest in the company want to know about ownership. In addition to this, potential investors and lenders will want to see the capitalization table before they agree to lend money or provide funding. The objective of this document is to clearly define ownership of the company and make it more transparent to everyone involved.

How does a cap table work, and what information does it track?

The cap table document tracks the ownership of each stockholder in a company. By tracking the total ownership of each stockholder, the cap table is able to give you precise information on how your company is being financed, who owns what share in the company, how all stockholder shares are allocated, how new shares are issued, what is the effect of dilution, etc.

Cap tables come in different formats, but they all have the same basic building blocks. Thus, depending on your company’s share structure, in a cap table, everything from the number of shares you have issued to their outstanding shares to the vesting schedule and any stock options granted or exercised will be captured.

What does a cap table include?

The cap table tracks every aspect of the company’s equity. As a matter of fact, the information in a cap table will vary depending on the complexity of the company’s equity structure and the number of rounds, shares issued, and dilutions that have already taken place. However, regardless of your company’s structure, the following are a few basic pieces of information that should be included in your cap table:

- Authorized shares

- Outstanding shares

- Unissued shares

- Shares reserved for stock options (option pool)

- Valuation details (total valuation, pre and post-valuation)

- List of shareholders (name, type of shares they own, total number of shares, and percentage ownership stake)

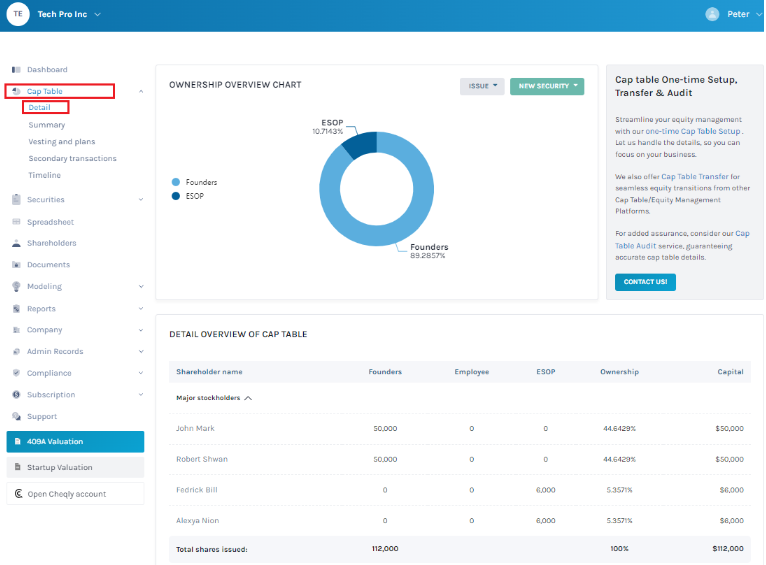

Understand cap table better with example

The image below is a cap table example in Eqvista’s cap table management software. The table is set up to track the ownership of shares that have been issued in the company. Each column contains information such as the shareholder’s name, the number of shares they have, the ownership percentage and the amount of capital invested. While the major shareholders are listed at the top of the table, followed by the option pool and so on. Further, the total number of shares issued or outstanding is listed at the bottom of the table. Therefore, this is how a cap table will look in Eqvista’s cap table management software.

Why do startups and business need cap table management?

Now that you know why you need a cap table and what it includes. But why is it necessary to manage the cap table? Well, the following are some of the reasons startups and businesses need to manage their cap tables:

- Generally, startups come across a number of financial events in their short and eventful life cycle. In order to understand the effect of these events in a clear and transparent way, it’s important to have a good grasp on cap table management. Regularly reviewing your cap table is the best way to recognize the effect of each financial event as well as track any gains or losses/dilutions in percentage ownership of a company.

- Understanding and managing a cap table will give you the ability to make informed decisions about your company’s future. Whether it is granting equity compensation to employees, raising more capital, or issuing new shares, the information gathered from the cap table will only be useful if the cap table you are relying upon is well-managed, up-to-date, and accurate.

- As a part of the pitch deck, you will need to share a cap table with any potential investor. This is a typical part of the process and will give potential investors a clear overview of who is involved and what they own. Why would an investor invest if they don’t have all the information they need? Regularly updating and managing the cap table will ensure that you are giving credible and accurate information to potential investors.

Is the cap table subjected to confidential or public information?

Well, private companies are not legally required to disclose the cap table. It is the company’s discretion to decide whether to keep the cap table confidential or not. Even so, it has been noticed that many companies choose to keep their cap table private. This is because the cap table gives important information about the company’s ownership and equity structure. Usually, startups limit access to their cap table to a very few limited people within the organization and keep it confidential. However, potential investors, attorneys, and auditors will look at the cap table before they agree to provide funding or advisory services.

Manage your cap table

The task of managing the cap table varies based on the type of company and the stage of development at which it is operating. The level of sophistication you need to put into managing the cap table is going to increase as your startup evolves. Regardless of your company’s stage, you should always keep your cap table up-to-date.

Generally, after each financial event, you need to update your cap table by adding new investors, issuing shares, and changing the ownership stake of each stockholder. Hence, it is recommended that you put in place a cap table management software like Eqvista early on to ensure that your cap table is managed in a streamlined manner.

When should you start managing your cap table?

There are certain events or milestones in your company’s life which will trigger the need to manage your cap table. Here are some of the events that typically get you started with managing your cap table:

You should start managing your cap table as early as possible in your company’s lifecycle, ideally from the beginning. Here’s why:

- Early Establishment – The best time to set up a cap table is before a company starts raising money. This ensures you have an accurate record of ownership from the outset.

- Investor Attraction – A well-organized cap table is crucial for attracting investment. Industry experts emphasize that startups aiming to attract investment must prioritize maintaining a clean cap table.

- Transparency and Trust – A properly managed cap table provides investors with a transparent view of the ownership structure, cultivating trust and aiding in informed decision-making.

- Due Diligence – Investors scrutinize the cap table during due diligence to evaluate not just ownership details but also the founders’ ability to manage this critical aspect effectively.

- Avoiding Complications – Starting early helps avoid errors or disorder in the cap table, which can result in legal complications, hinder fundraising efforts, and lead to substantial legal expenses.

- Scalability – Start using cap table software early in your company’s growth to save time and money as your business scales, instead of relying on spreadsheets, which may be sufficient only in the earliest stages.

- Compliance – A well-managed cap table helps you stay compliant with regulations like Internal Revenue Code Section 409A, Rule 701, Rule 144, and the $100K ISO limit as your company grows.

- Employee Equity Management – Early cap table management allows for better planning and tracking of employee equity plans (ESOP).

- Valuation Tracking – Keeping your startup’s valuation up to date is an important aspect of cap table management.

- Dilution Awareness – Early and consistent cap table management helps you track and understand startup dilution, which is crucial for long-term planning.

Important factors you should consider while managing cap table

As you begin managing your cap table, there are some important factors that you should consider. Following are some of the essential factors that will help you to manage your cap table easily and efficiently:

- Cap table factors and format – When you are managing your cap table, you will come across different terms, structures, and formats which will require you to make several adjustments. Having in-depth knowledge of all these elements and their proper use will help you in keeping your cap table up to date. More than simply a financial document, the cap table needs to be your company’s primary means of communicating important information, including common stock, preferred stock, stock options, transfers, exercises of options, and so on.

- Executive alignment – The cap table needs to be correctly aligned with your company’s departments in order to ensure that the cap table acts as a value driver. Whether it is the HR department or the legal department, the cap table needs to be used as the central source of information for all the departments in terms of ownership and corresponding valuations. This will ensure that the correct information is passed around to the right people at all times. Hence, it is important that you get the executive alignment right so that it works to your advantage.

- Financial statement – A cap table is similar to a financial statement in the sense that as the company grows, the diversity and complexity of the document will increase. For early-stage startups, the cap table may have only a few columns and rows. However, the cap table will take on a more complex structure as the startups grow and develop. You may use Eqvista’s cap table management software from the initial days of founding your company as a way to manage your cap table in the long term proactively.

- Stakeholder’s ownership – The cap table is an important document for anyone who owns stock in the company. It is an important tool used by all stockholders to track their respective ownership, understand their holdings’ total value and determine their ownership dilution. Essentially, creating and maintaining an accurate cap table is a basic requirement for any business owner.

- Necessary information for investors – Investors rely heavily on the cap table to know the ownership structure of the company and their respective stake in the company. As such, companies should decide on how much disclosure should be provided to investors. Companies usually provide the summary points of their cap table, which include enough information for investors to know their equity ownership and even for auditing purposes.

- Necessary information for employees – When it comes to employees, they are usually interested in the cap table because of the possible stake or vested interest they may have in the company. While it is important to balance the shareholder’s privacy concerns and employees’ need for information. Founders should decide on the type of information they are willing to share with their employees, including a summary of the cap table or a complete cap table with detailed information.

Tips to manage your cap table efficiently and effectively

While managing your cap table, it is important to keep a few things in mind. Following are some of the key tips that will help you to manage your cap table effectively and efficiently:

- Put equity compensation early in the cap table – The trend of equity compensation has become pretty common in today’s corporate world. Companies are eager to attract talent and are offering more perks to newly hired employees. As such, equity compensation should be given more prominence in the cap table and added in the first few months of incorporation. The information on this will make it easier to track, monitor, and manage equity compensation.

- Monitor your sizing option pool – The option pool is an integral part of your cap table. It indicates the number of shares that have been reserved to give to employees. As a result, you should monitor your option pool regularly and make adjustments as per the changes in your employee compensation. Thus, you should make adjustments promptly to keep the option pool in sync with the new grants.

- Add series A, B, or C to the cap table – In order to expand and diversify their operations, startups generally raise seed funding, including series A, B, or C. These cash infusions help the company to ramp up its operations and expand its market; however certain percentage of equity is also taken in return. The cap table should be used to track and record these rounds of funding as well in order to track the details of these investments accurately.

- Consider all the necessary compliances – While you are managing your cap table, it is important that you keep in mind that there are certain laws and regulations that govern your company’s cap table. These regulations include the ISO 100k limits, IRC 409A, ASC 718, Rule 701, and 83(b) election, to name a few. All of these regulations have specific rules that need to be adhered to and need to be documented properly in the cap table.

- Centralized the data – Well, all the legal documents, set of bylaws, and other such documents should be centralized in one place. In order to create and manage the cap table, these documents need to be centralized and accessed easily. This would ensure that you are on par with all the necessary legal and regulatory rules and regulations. Hence, it helps to avoid potential legal disputes.

- Share information in the company – Essentially, founders should analyze and further decide how much information they want to make available to the employee and to investors. They can opt for either a summary cap table with basic information or the complete cap table with additional details. However, it is important that all of them are aware of their stakes and on the same page regarding this information.

- Reverie your cap table consistently – You should ensure that you are reviewing your cap table on a regular basis in order to ensure its accuracy and authenticity. This would help to avoid any mistakes or clerical errors that may lead to unnecessary complications. Therefore, you may use Eqvista’s cap table management tool to create and manage your cap table.

- Reconcile your cap table – Finally, companies must reconcile and verify their cap table consistently in order to ensure that all the information is accurate and up-to-date. This is a process of verification in which all the data on the cap table can be compared to related documents and sources. Thus, by constantly reconciling the cap table, you can be sure that it is accurate.

Future-Proofing Cap Table Management

As ownership structures become more complex, leveraging technology to maintain a clear and up-to-date picture of equity ownership is becoming essential for success in fundraising and overall business management. These trends reflect the importance of efficient and accurate cap table management for startups and emerging growth companies.

Blockchain technology exploration

While not mainstream, some companies are exploring blockchain technology for cap table management. Blockchain technology is being integrated into cap table management in several innovative ways, like:

- Immutable record-keeping

- Enhanced security

- Automated updates

- Improved transparency

- Tokenization of equity

- Regulatory compliance

- Efficient share distribution

- Integrated investor management

AI and machine learning integration

Integrating AI and machine learning into cap table management aims to improve efficiency and accuracy and provide more insightful data for decision-making.

These technologies are helping to automate routine tasks, reduce errors, and offer predictive capabilities that can assist founders and investors in making more informed choices about equity management and company growth.

How is Eqvista exploring blockchain integration and AI-powered valuation tools?

Eqvista is actively exploring blockchain integration and AI-powered valuation tools to enhance its services and provide more accurate and efficient valuations for companies, particularly in the rapidly evolving AI and blockchain sectors.

For blockchain integration, Eqvista recognizes the potential of tokenized equity, which uses blockchain technology to create digital tokens representing ownership in a company. This approach offers several benefits:

- Easier capital raising process for companies

- Increased flexibility in terms of rules and regulations.

- Enhanced security through cryptography

- Improved transparency with transactions recorded on an immutable public ledger

Regarding AI-powered valuation tools, Eqvista is leveraging artificial intelligence to improve its valuation processes and methodologies. Some key aspects of Eqvista’s AI integration include:

- Holistic approach – The valuation process considers multiple factors, including algorithms, intellectual property, user adoption, revenue streams, and scaling potential.

- Advanced algorithms – Eqvista uses state-of-the-art algorithms and industry expertise to provide comprehensive valuations for AI companies.

- Market trend analysis – AI-driven tools help analyze market data, economic trends, and company performance to predict stock movements better and improve valuation accuracy.

- Scenario analysis – Eqvista employs AI to enhance scenario analysis capabilities, allowing for more accurate predictions of potential risks and opportunities in various future scenarios.

Integration of real-time valuation

Real-time valuations are becoming increasingly important in modern cap table management solutions. By providing real-time valuations, cap table management solutions are helping companies make more informed decisions, improve transparency with stakeholders, and streamline equity management and fundraising processes.

Cap table management software

With the increasing demand for cap table management software in the market, many such companies have emerged today and are offering a wide range of solutions to track your cap table. Some of these solutions offer services that include automatic data entry, analytics to report on key performance indicators, and even charting, among others. Applications like Eqvista’s cap table management tools have powerful software that gives you access to all the required features for managing your cap table.

What is cap table management software?

Cap table management software is software that is specifically designed to help you create, update and maintain your cap table. It comes in handy as it allows you to enter, track, analyze and manage all the details in an automated manner. The ease of use of cap table management software makes it flexible and gives you easy access to all the information on your cap table. Thus, the softwares is available in different forms and with different interfaces; however, they all help you manage your cap table.

How does cap table management software help maintain the cap table?

As the company grows, the number of transactions and the structure of equity change. The cap table management software helps you to track such changes in a smooth manner by allowing you to update your cap table quickly and efficiently. As these software are linked to cloud-based solutions, there is no need for any installation or maintenance, which makes it suitable and convenient for all kinds of companies.

Why is it important to have cap table management software?

Manually managing the cap table can be difficult with multiple shareholders, various funding rounds, and diversification of equity. However, with cap table management software, you can just enter the data that is needed and then let the system do the rest of the work. It will automatically track information using a number of techniques and algorithms and then store them in the database. Cap table management software will also help you maintain your cap table with greater accuracy and authenticity by eliminating or minimizing the manual errors that are generally quite common in a manual process.

Why choose Eqvista’s cap table management software?

Are you confused about which cap table management software to go for? Do you need a solution that is easy to use and offers all the required features to manage your cap table? Then, you are at the right place. Eqvista’s cap table management software is one of the most efficient and quick applications for managing your cap table. It allows you to create and manage your cap table through a user-friendly interface. The software offers cloud-based solutions, personalized services, and analytics to provide detailed reports and help you navigate your cap table.

How to manage your cap table using Eqvista?

Eqvista’s cap table management software offers a comprehensive solution for managing your cap table. Sign up for free with Eqvista, add the relevant and required information to the software, and you are ready to go. A cap table will be created, and then view all the details on the online dashboard. You can search for specific details, filter them based on your preferences, add new records or update existing ones.

Manage your cap table with Eqvista!

Instead of spending hours every day manually managing your cap table, why not let the software do the work for you by allowing them to manage and maintain it completely automatically? It’s time to take advantage of the efficient, quick, and easy-to-use Eqvista’s cap table management software to manage your cap table. Our team of certified experts and professionals has the right skills and knowledge to make sure you get the best solution for managing your cap table. Experience the difference today with Eqvista!