Share Dilution: Complete Guide

This guide will help you understand all you need to know about share dilution, how to calculate share dilution, and everything in between.

Share dilution otherways called Equity Dilution, is one of the most important topics for any startup entrepreneur. It is one of those subjects that always has people looking for a secret cheat sheet, and many founders end up finding themselves asking the question, “How can I prevent share dilution?” Before you go out looking for the answer, you need to know that there is no specific way out. All you can do is be smart enough with every company decision that you make or else it may cost you a lot of ownership of your company.

What is Share Dilution or Stock Dilution?

Share dilution, also known as stock dilution or equity dilution, takes place when a company issues new stock which results in a decrease of an existing shareholder’s ownership percentage of that company. Stock dilution can occur when the holders of stock options, such as employees, exercise their options or when noteholders convert their convertible notes. Basically, when the number of outstanding shares increases, each existing shareholder owns a smaller or diluted percentage of the company, making each share less valuable.

Understanding share dilution

Equity dilution is vital for all businesses. To put in simple words, dilution is simply the case of cutting a cake into more pieces. The number of pieces would be more but the portion of each piece would be smaller. This means that you will still get your piece of cake, just that it would be much smaller than you had been expecting, which is usually not a desired outcome.

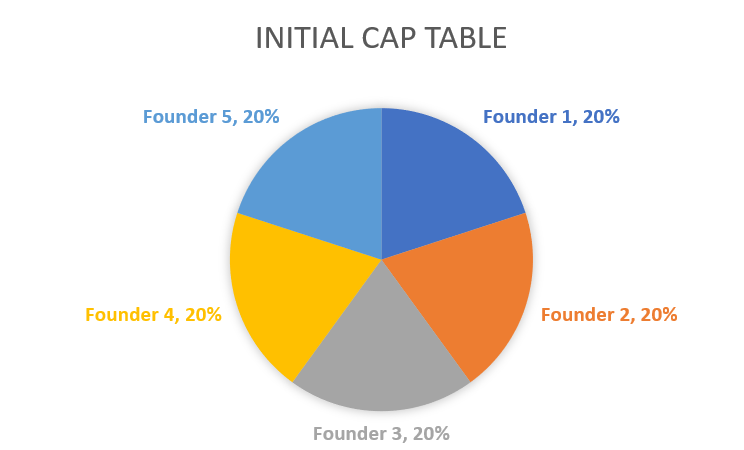

Equity dilution can occur when a company issues additional shares to raise capital, finance acquisitions, or retain key employees. Here is a look at an initial cap table with five founders:

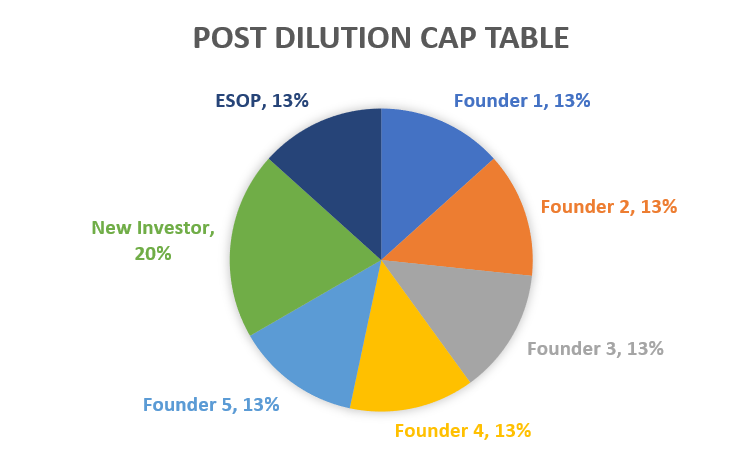

And here is the post dilution cap table after introducing a new investor and stock options.

In this example the original five founders each had 20% ownership of the company, but with the introduction of a new investor and Employee Stock Options Plan (ESOP), the founders shares were diluted to 13% each.

A share of stock represents the ownership in a company. When the board of directors make the decision to take their company public, mostly through an initial public offering (IPO), they sanction the number of shares that will be initially offered. This number of outstanding stock is commonly referred to as the “float”. If that company issues additional stock, they have officially diluted their Equity stock. The shareholders who bought the IPO now have a smaller ownership stake in the company.

And even though it primarily affects the company ownership, equity dilution also reduces the EPS of the stock, which is the net income divided by the “float” and often depresses stock prices. Because of this, a lot of public companies calculate both the diluted EPS and EPS, which is actually a “what-if-scenario”. The diluted EPS assumes that potentially dilutive securities have already been converted to outstanding shares thereby increasing the denominator, which is the “float”.

Simple Example of Equity Dilution- How it works

Let us take a simple example first to explain share dilution calculation. Let us say that a company has issued 100 shares to 100 shareholders. This means that each shareholder owns 1% of the company. Now, if the company has a secondary offering and issues 100 new shares to 100 more shareholders, each shareholder would now own just 0.5% of the company. The reduction in the ownership percentage also reduces the investor’s voting power.

Common Reasons for Equity Dilution

A lot of startups think that dilution occurs when they only issue new equity to investors, but that is just the tip of the iceberg. Share dilution comes for many different sources including:

- Issuing new preferred stock, typically to raise money

- Issuing new common stock, typically to co-founders and others

- Issuing new stock options, typically to new hires

- Issuing new warrants, typically to lenders

- Increases in the conversion rate of preferred to common shares, this normally happens in recapitalization situations

- Issuing convertible debt, it is a type of loan when issued, but dilutes the shares when it converts at some point in the future.

There are bigger areas that also causes share dilution which include:

- Liquidation preferences

- Participation rights

- Cumulative dividends

- And many more

Equity dilution can indicate the financial well-being of a company. A company usually sells its shares to raise capital for many reasons. A clear understanding of equity dilution can help companies negotiate better terms with investors, such as higher valuation and lower dilution. If it is having trouble servicing current liabilities, it may sell shares to help cover expenses, particularly if covenants prohibit it from issuing new debt. Or, it may sell shares to fund acquisitions, expansion projects, or other growth strategies. Whatever the reason is, companies usually let board members and the people involved study it before taking action.

How do you calculate share dilution?

It is important that you think about dilution in terms of a simple equation:

Where N = the amount of ownership you are giving up as a percentage.

The main idea of this equation is that you want to maximize the value of your ownership stake. So, if you dilute your ownership stake by N, then your company’s value would have to increase by 1/ (1-N) to make your equity worth the same as it was before you diluted your stake. It is actually very simple math.

For instance, if you owned 50% of a company that is valued at $2M, your stake would be worth $1M. Now, if your ownership gets diluted by 20% due to the issuance of new shares and the value of your company stays the same, your shares would be worth $800k. So, this means that your stake worth has reduced by $200k, which is 20% less than what it was.

Now, to keep your value the same, you will need your new ownership, which is 40%, times the company’s value (C) to equal $1M. By solving using simple algebra, we get the value of C at $2.5M. $2.5M is basically 1.25 times the original company’s value, which was $2M. So, if the math is right, 1 / (1-N) should be 1.25, which is the multiple factor of the company’s value in order for you to maintain the value of $1M.

Is Stock Dilution Good or Bad?

Equity dilution occurs when a company issues additional shares, which can reduce the value of existing shares. A lot of people assume that the issuance of more shares is not good as it causes share dilution. But in reality, it is not that bad, if the funds raised by selling new shares are spent in a very productive way. For instance, if the money raised is used to purchase a company that would boost the earnings and revenue, the stock-issuing company can end up coming out ahead. On the other hand, if the new shares do not boost the value of the company, that is when the share dilution takes place.

To overcome this, some companies work on repurchasing some of the shares back, retiring them and thereby reducing the share count. This is good for shareholders usually as it boosts the proportional claim of remaining shares. But if the shares are overvalued when they are bought back, the company is actually destroying some value since the money could have been used somewhere else.

This is why it is important to keep an eye on the company’s shares count. Rapidly rising share counts would make it hard for earning per share to grow along with the new income as the earning will be spread over more shares. And shrinking share counts, while often a good thing, can be a result of buying back overvalued stock or can mask slow growth if they’re boosting EPS without investors’ noticing. Selling assets or issuing bonds is a confident way for a company to raise capital without diluting equity. In short, share counts matter when you want to worry about the share dilution.

What are the effects of equity dilution?

Equity dilution holds crucial significance for both startups and established companies. Even though there is a positive side to issuing new shares, many shareholders do not view share dilution to be good. After all, by adding more shareholders into the pool, their ownership of the company is being cut down. That may lead shareholders to believe their value in the company is decreasing. In some cases, investors that have a large chunk of stock can normally take advantage of shareholders that own a smaller portion of the company.

Equity dilution can decrease a company’s valuation when additional shares are issued, as investors may be unwilling to pay high prices due to dilution.

Diluted Earning’s Per Share

Basic EPS does not include the effect of dilutive securities. It simply measures the total earnings during a period divided by the weighted average shares outstanding in the same period. If a company did not have any potentially dilutive securities, then its basic EPS would be the same as its dilutive EPS.

However, investors usually want to know what the value of their shares would be if all the convertible securities are executed. This is because, by doing that, it reduces the earning power of every share. The value of earnings per share if all convertible securities were actually converted to common shares is called diluted earnings per share, in short, EPS. It is calculated and reported in company financial statements.

The simplified formula for calculating diluted earnings per share is:

Diluted EPS = Net Income − Preferred Dividends / WA + DS

Where:

- WA = Weighted average shares outstanding

- DS = Conversion of dilutive securities

If-Converted Method Diluted EPS

The if-converted method is used to calculate diluted EPS if a company has potentially dilutive preferred stock. With this, you will have to subtract the preferred dividend payments from the total income in the numerator and add the number of the new common shares that would be issued if converted to the weighted average number of shares outstanding in the denominator.

For instance, let us say that the net income is $20B and there are 1,000,000 weighted average common shares, then the basic EPS is $20 per share through the calculation $20,000,000 / 1,000,000. If the company issued 20,000 convertible preferred shares that pay a $10 dividend, then each preferred share was convertible into ten common shares, diluted EPS would equal 16.83 ([$20,000,000 + $200,000] / [1,000,000 + $200,000]). The $200,000 is added to net income assuming that the conversion will occur at the beginning of the period, which also means that it would not pay out dividends.

And like this, the diluted EPS is calculated for share dilution.

Anti Dilution Protection

Anti dilution provisions are clauses that are built into some options and convertible preferred stocks to assist in shielding investors from their investment potentially losing value. When new issues of a stock hit the market at a cheaper price than that paid by earlier investors, then equity dilution can occur. Anti-dilution provisions are also referred to as anti-dilution clauses, preemptive rights, subscription privileges, or subscription rights.

To explain better, share dilution takes place when the percentage of an owner’s stake in the company decreases since there is an increase in the total number of outstanding shares. The total outstanding shares may increase due to new share issuances for an equity financing round. Share dilution can also take place when the option holders such as the employees and the optionable security holders exercise their options.

How does anti dilution work?

Share dilution can be very annoying to preferred shareholders of VC deals whose stock ownership can get diluted when later issues of the same stock hit the market at a cheaper price. Anti dilution provisions can discourage this from happening by tweaking the conversion price between convertible securities, such as corporate bonds or preferred shares and common stocks. In this way, anti-dilution clauses can keep an investor’s original ownership percentage intact.

Free Stock Dilution Calculator

With all this clear, you may need the help of a share dilution calculation. In theory, it is quite easy to get the share dilution value from a new equity issuance. But in real life, a CFO would need to do a lot of math to get the value. This is even more true if you want to understand how all the share dilution types are affected from a new round.

The CFO often needs to take into account:

- The waterfall impacts of new round

- Repurchase of stock as part of the new round

- Issuance of new options before and/or after the round

- New shares from equity investment

- Conversion of convertible notes with warrants, valuation caps and discounts

Round Modeling on Eqvista

As mentioned above, Eqvista offers a tool that can help you with the share dilution calculation, our round modeling tool. Round modeling is a financial tool that assists the management and investors in a company to view the dilution of the company’s cap table with the introduction of new investment rounds.

The results from this financial analysis can help the company make critical decisions on the timing and amount of the new investment into the company from outside investors. It is the main key for any startup that wants to grow their company.

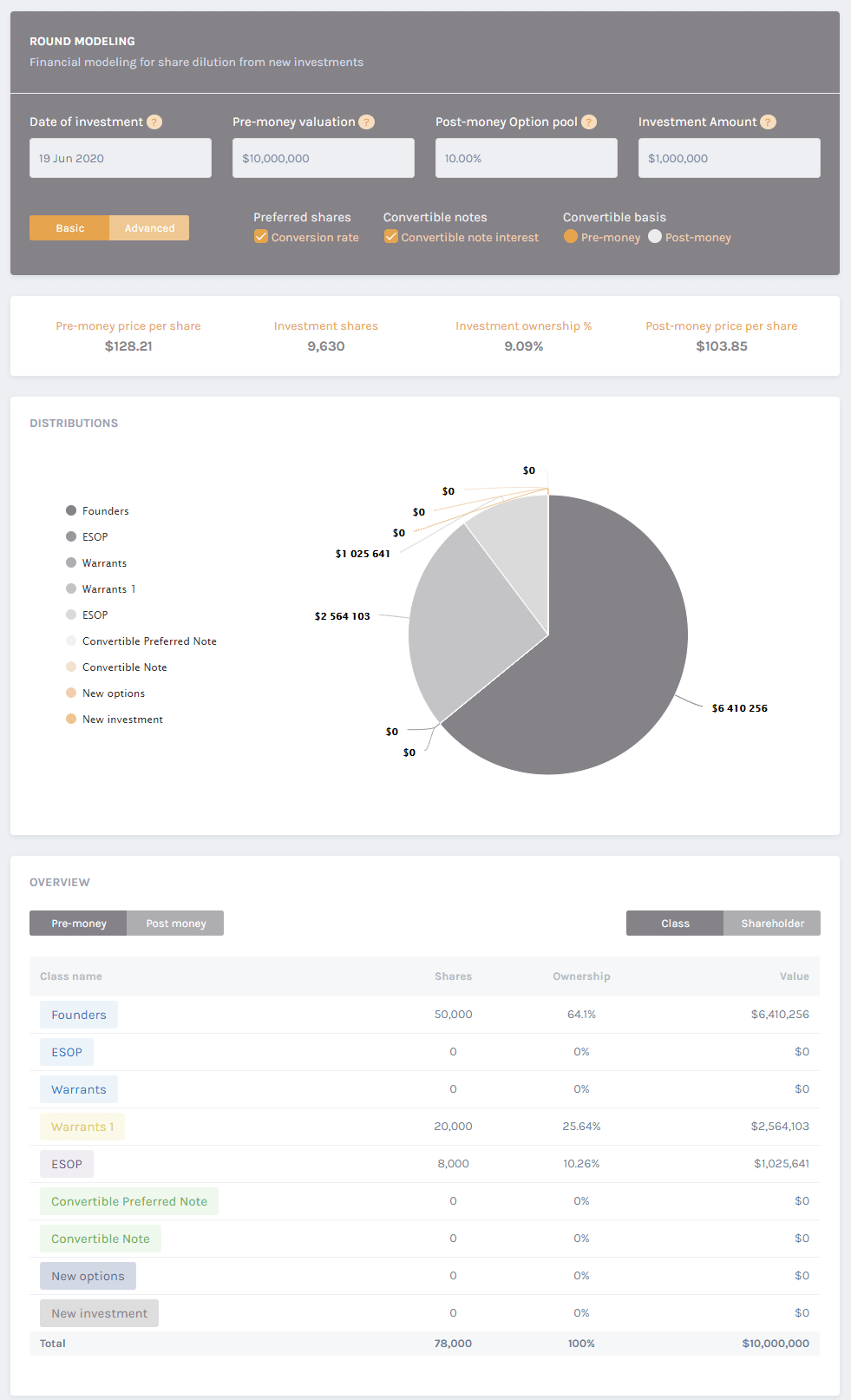

Here is how the round modeling looks like on Eqvista for a company:

This is the pre-money valuation results of the round modeling. Here, you can see how the ownership has been divided according to the cap table. Also, it should be noted that the convertible notes, the options and all have not been exercised and converted yet. This would happen when the next valuation takes place, which would be the post-money valuation.

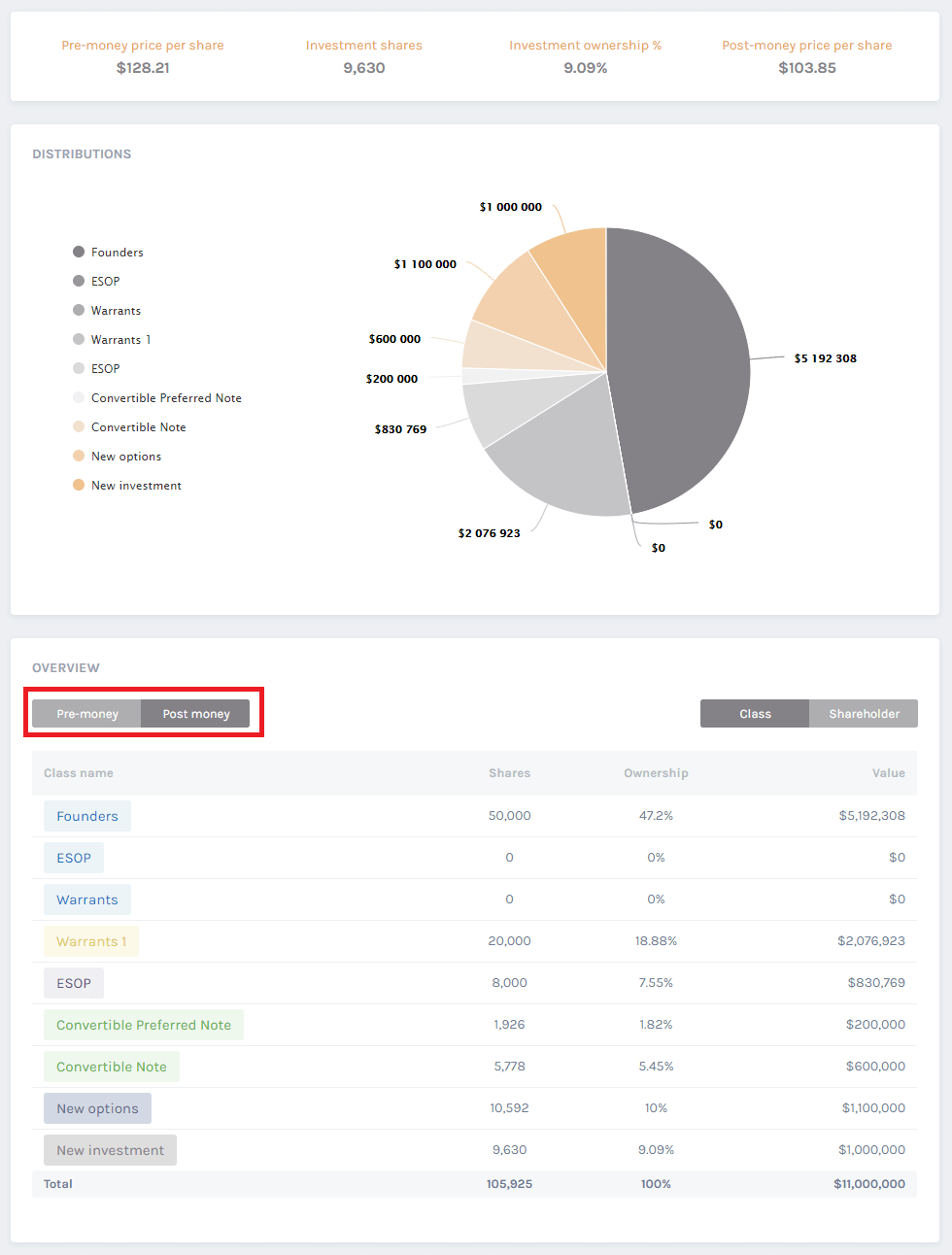

Here is how the post-money valuation report would look like. All you need to do for this is click on the “post-money” option as shown below and the report appears along with the round modeling chart.

You can see that the round modeling has done the work of assuming that the convertible notes have been converted, and the ESOPs have been exercised. In that case, the ownership of the founders is diluted. In short, the round modeling chart on Eqvista would help you see how much share dilution would be there in the future.

Additionally, here are some of the key features of Eqvista’s round modelling:

- Instantly reactivity of input data

- Basic and advanced version of new investment

- Pre-money & post-money convertible basis

- Convertible note interest options for convertible notes

- Convertible rate options for preferred shares

- Pie chart & key figures of new investment

- Multiple inputs for date of investment, pre-money & post-money valuation, and investment amounts

Easy Financial Modeling Tools on Eqvista

Eqvista also has other financial modeling tools like our waterfall analysis. All you need to do is sign up for our application for FREE and begin using it as your cap table application today. It would help you make the right decisions for your company and you can easily calculate your share dilution using the round modeling and company exits with the waterfall analysis tools. Try it out here today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!