Startup Valuation Software

Get your startup valuation in minutes from Eqvista, one of the leading and advanced business valuation software in the industry.

Knowing the worth and value of your company is important in the business world, especially if you are a startup. Getting a startup valuation reveals your company’s ability to employ new cash to expand, exceed consumer and investor expectations, and achieve your other goal.

There are many valuation methods available to determine your company’s value, but at Eqvista we have developed a special software that will help determine your company’s valuation in just a short period of time.

What Is Eqvista’s Startup Valuation Software?

Eqvista’s startup valuation is a built-in software in our platform where we offer startup valuations in minutes:

- It’s a quick and easy solution for startups looking for valuations in a short amount of time and at a cheaper price.

- Easily download your startup valuation report in PDF format.

How does the software work?

Compared to a regular valuation which takes days to complete by a professional valuation analyst, the startup valuation software requires you to answer a series of questions about your business. The process is simple and straightforward:

- There is no need to prepare any documents beforehand – We will not ask you to upload or send any documents for the valuation.

- Answer a set of questions – The valuation will include 32 multiple-choice questions that cover 5 areas:

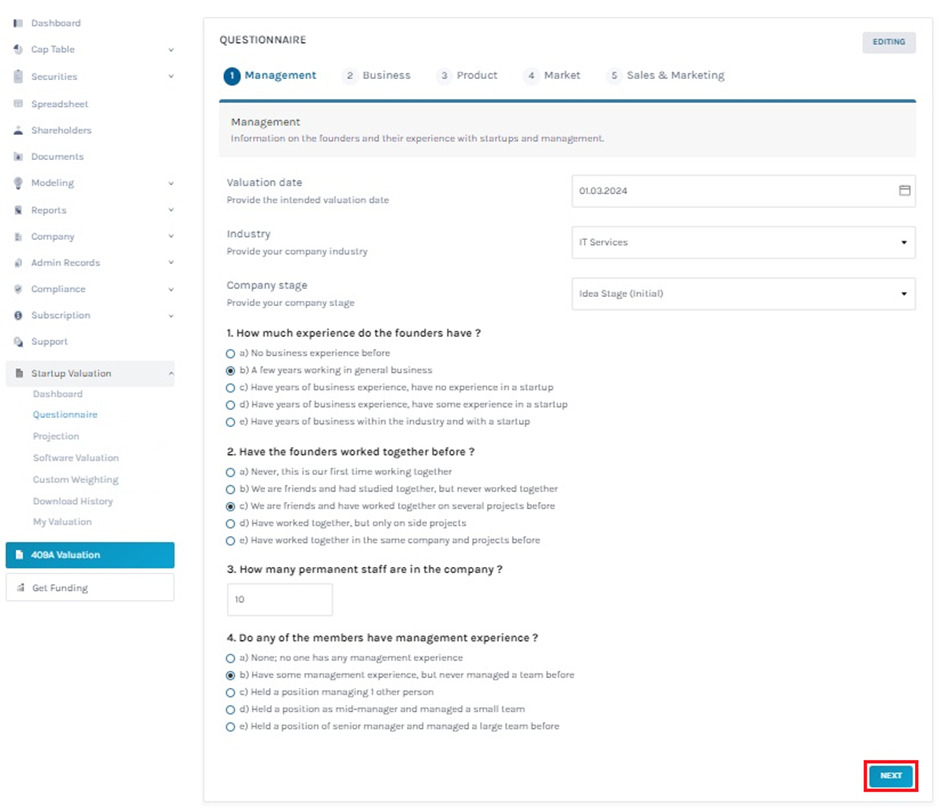

- Management – This section starts with Fill out the questionnaire with details such as the valuation date, business nature, and company stage. The page collects information on founders’ experience with startups and management.

- Business – These questionnaires contain a set of 9 questions that provide information about how your business can grow, its development stage, and how it’s being funded.

- Product – This is a series of five inquiries that will provide information regarding your company’s position in the market, its distinctiveness, and its susceptibility to replication.

- Market – This section contains eight questions regarding market competitiveness, anticipated market share, and plans for global expansion.

- Sales and Marketing – This section of the survey consists of six questions that gather information regarding the strength of the company’s brand, its relationships with partners, vendors, suppliers, and resources for marketing.

Here is an example of the “Management” section of the questionnaire:

After answering the questions (which will take around 20 minutes), a summarized valuation report will be prepared and made available for you.

Note: Select the best answer most suitable for your company for a more accurate valuation. To know how to fill out the startup valuation questionnaire, check out the support article here!

Valuation Methodologies

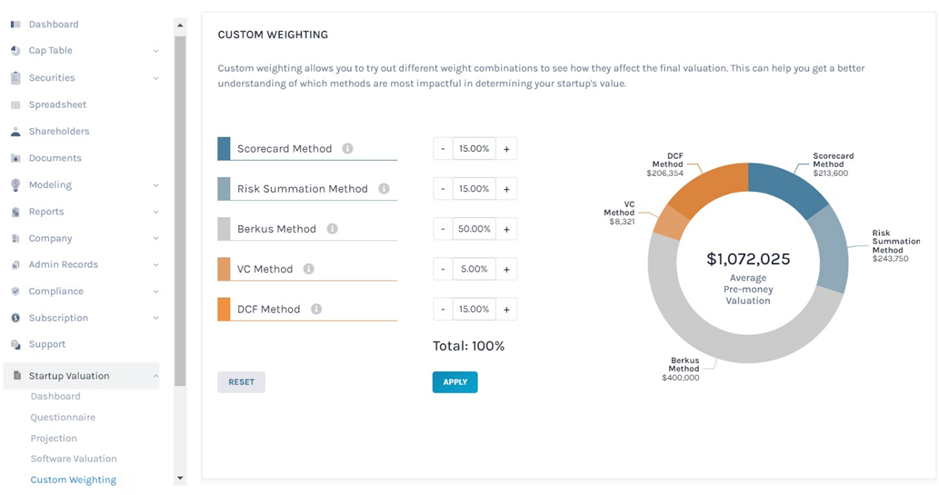

Most startups are new business enterprises focusing on creating new ideas or technology and offering them to the market as a new product or service. When conducting a valuation, financial analysts use a variety of valuation methods to determine the value of a business. In our startup valuation software, we make use of 5 valuation methods:

- Berkus Method – The Berkus Approach focuses on evaluating a startup based on a thorough examination of five critical success factors: (1) Basic Value, (2) Technology, (3) Execution, (4) Strategic Relationships in its primary market, and (5) Production and Subsequent Sales. A thorough analysis is carried out to determine how much value the five main success criteria provide to the enterprise’s total worth in quantitative terms.

- Scorecard Method – The scorecard method assesses businesses based on several criteria, including stage, market, and area. These elements have a direct impact on the company’s value. This value allows angel investors to determine an average valuation for startups that have the potential to expand but have yet to generate revenue. The target startup seeking investment is compared to other similarly financed startups using this strategy. To calculate an appropriate average, this method employs weighted percentages and market data.

- Risk Factor Method – For new startups, the risk factor method is a rough pre-money valuation method. It bases the company’s valuation on a comparable startup’s base value, and this baseline value is then modified for a total of 12 risk variables. This means that your startup is being compared to other startups to determine whether you are at a higher or lower risk. How to analyze an early-stage startup, how the startup works, how to justify startup valuation for financing, and many more questions frequently come in a valuation. At the start of their fundraising journey, most founders are concerned about all of these issues.

- VC Method – The Venture Capital (VC) Method is the ideal solution for startups, especially if your startup does not have revenues yet. The VC method can be used to value early-stage, pre-revenue enterprises, which is why venture capitalists all over the world refer to it as a valuation strategy.

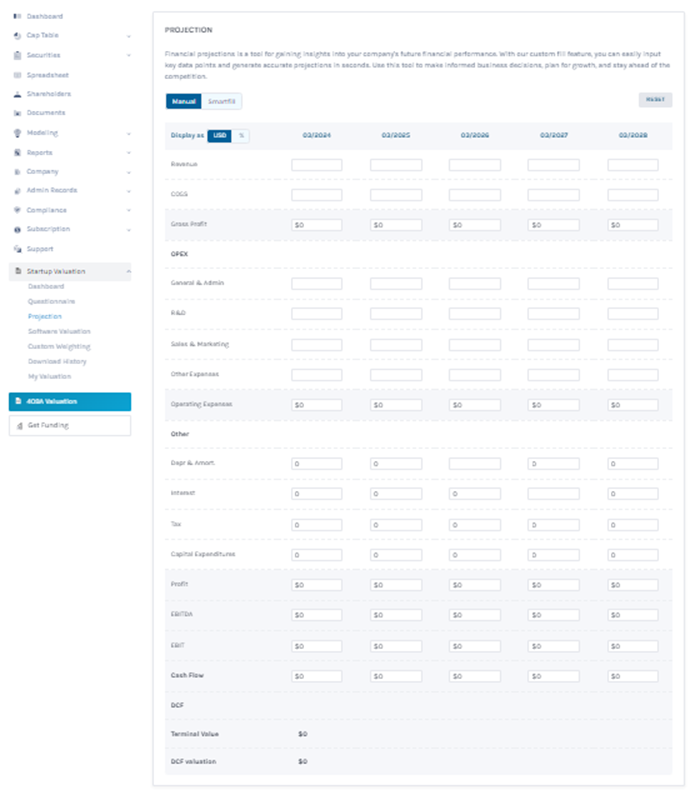

- DCF Method – Discounted Cash Flow (DCF) uses predicted future cash flows to determine the value. It determines the current value of an asset based on future forecasts of how much money it will generate. The method considers inflation when calculating the present value of the company.

To get more valuable insights and improve your company valuation, you can use:

- Projection – Projection is a tool for gaining insights into a company’s financial performance to make informed business decisions, plan for growth, and stay ahead of the competition.

- Custom Weighting – Custom Weighting allows you to try out different weight combinations to see the impact on the final valuation. It gives you a better understanding of which methods are most impactful in determining your startup’s value.

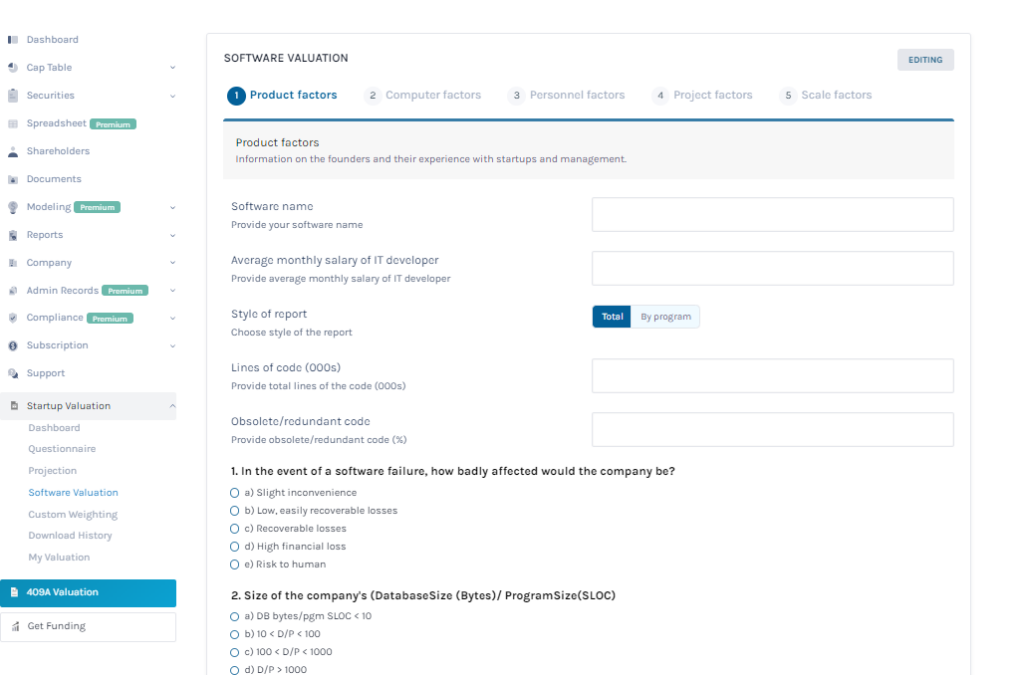

- Software Valuation – The Software Valuation will include 23 multiple-choice questions that cover 5 factors – Product, Computer, Personal, Project, and Scale. After answering the questions which will take approximately 20 minutes, a summarized software valuation report will be prepared and available for download.

Valuation Reports

Once you answer the questionnaire and provide the required information, a valuation report will be prepared. Take note that this is not a full valuation report, but only a quick summary that will be helpful for your startup.

- What does our valuation report include? – The valuation report includes the value of your startup and its utility in the market. It determines the value of a startup based on its condition and location.

- Where can you use your valuation report? – Upon receiving the valuation report, you can use this report to acquire funding for your company and get new projects. Having a valuation can attract a lot of venture capitalists and shareholders to your business.

- What does the valuation report look like? – To give you an idea of what your valuation report includes, we have a sample report of a startup valuation as a reference. The report will cover information from our online valuation questionnaire with customized graphs that explain the different methods used in the valuation.

Pricing

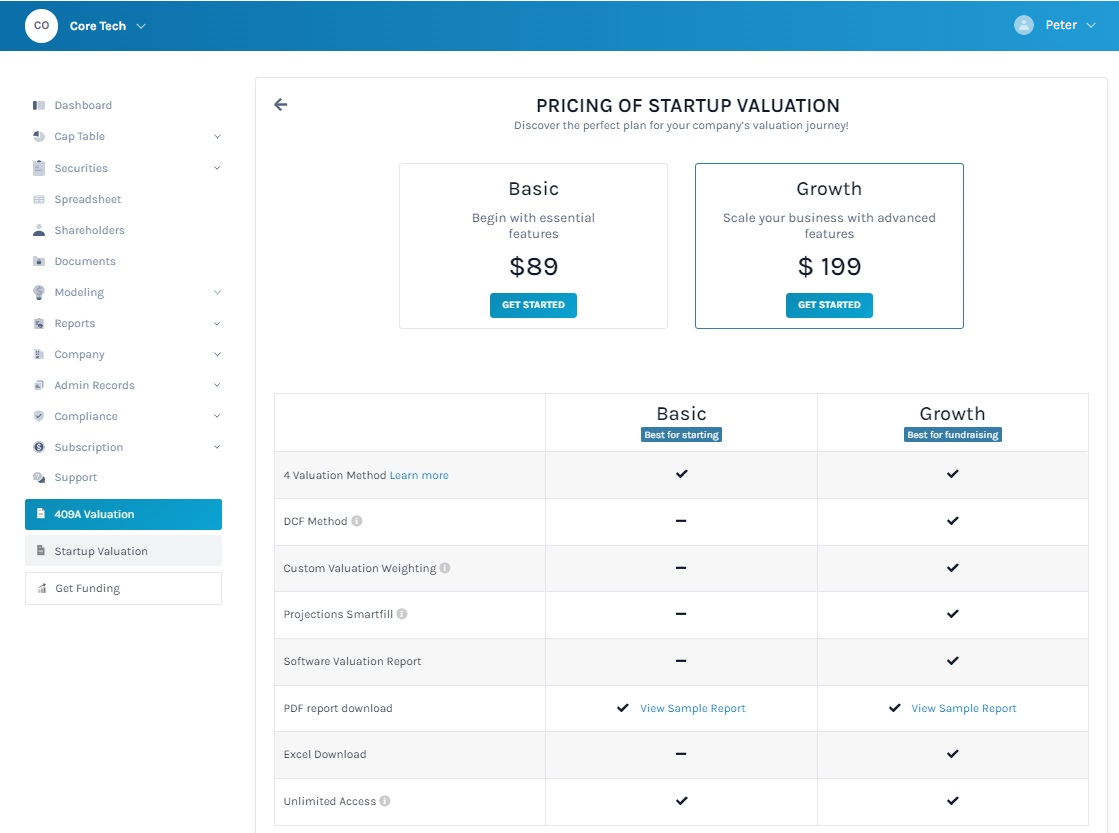

Getting a valuation can be costly, especially for new businesses. That’s why Eqvista has created an alternative for startups looking for a cheap and quick valuation. Our affordable pricing package offers:

- Basic Plan with essential features at $89

- Growth Plan to scale your businesses with advanced features at $199

Note: To further understand the difference between the two plans, check out the support article here!

The startup valuation is not the same as a full valuation report. If you are looking for a full valuation, please get in touch with us.

Need a startup valuation urgently?

Get a summarized valuation report in minutes with Eqvista’s startup valuation software.