Start-up employee equity pool or Option pool

Equity for employees is offered in the form of stock options and restricted stock.

One of the best recruitment strategies in the startup world today is to offer equity compensation. Early-stage cash-strapped startups treat equity as a currency and use it to complement cash compensation packages. Equity is a great way to attract investors as well. Entrepreneurs set aside a portion of the company equity solely for this purpose. This section of equity ear-marked for recruitment and fundraising is known as the startup equity pool or the option pool.

But how to decide who deserves the larger pie? Let’s find out.

Employee Equity Pool or Option Pool

Once a startup is incorporated, founders own 100% shares. There on, with every new recruitment or funding round that demands equity distribution, founder shares are diluted. Let’s imagine a startup has three founders. It may be complicated to decide which founder shares and how much of it can be traded at every opportunity of dilution. This is why a startup equity pool must be created right at the start of company operations.

What is an employee equity pool in a startup?

The chunk of company equity that founders set aside for distribution is known as the option pool. Continuing with our model situation, let’s say the three founders decided to split 75% company equity equally among themselves (25% each). This allows the remaining 25% company equity to be free for recruitment or investment purposes. The availability of an option pool gives startups the much needed competitive advantage in funding rounds.

Equity for employees is offered in the form of stock options and restricted stock. This is sometimes collectively referred to as the Employee Stock Option Pool (ESOP). With stock options, employees are granted the right to purchase shares at a set price on the day of the grant, also known as the strike price. As the company grows and the share value increases, employees buy these shares at the strike price at a later stage when the market value of the shares have skyrocketed. On exercising their options, employees gain from the difference. Meanwhile, with restricted stock, employees are granted stock ownership all at once but based on restriction of either time, performance, or incentive benchmarks. In this case, employees need not invest in ‘buying’ shares.

Employees joining early (top professionals, experienced key players) are prone to high risk considering the company has just begun operations and its future is yet to be determined. This is why they are granted a higher percentage from the option pool as compared to employees joining a couple of years later, when the business has become reliable and started generating profit.

While from an investor’s perspective, right from the seed stage, funds are granted in exchange for a percentage from the startup equity pool. This is quite a tricky affair as investors are always careful not to dilute their shares under any circumstances. We discuss this aspect in detail in the following sections. However, despite the risks involved, there is no denying the fact that startups simply should not proceed without figuring out their option pool. Here is why.

Why is the option pool important for a startup?

Recruitment is a given. It is a well-known fact that employees holding equity in the startup are better motivated and committed to the business in comparison to their exclusively cash-salaried counterparts. Apart from this, here are the three other important aspects that establish the need for a startup equity pool:

- Equity compensation aligns the employee’s financial interests with that of the business. As the business grows into a profitable prospect, so does the employee value of equity. In the long run, employees immensely profit by exercising their options.

- If a startup plans to be acquired or go public in a few years, building an option pool must be a strategic move. A lucrative option pool helps build value and credibility for a startup. Having a clear vision about equity distribution is a sign of skilled management.

- Angels and Venture capitalists agree to work with startups only when they have a startup equity pool. These investors fund for a short time and expect quick profits that completely rely on the startup multiplying its share value. None of this funding machinery can be approached without a plan to offer company equity.

As important as the option pool is, how should a startup go about it? What could be a decent size of option pool? This decision is fundamental in a startup operation. Designing a startup equity pool is almost an art. It should neither be too burdening on the founders or too little to put off investors. Also, creating an option pool is only the beginning. Managing it sustainably throughout the business life cycle is what differentiates a successful startup from a struggling one.

How big should an option pool be?

A simplified approach to the startup equity pool may lead us to believe that maybe, the more the better. The greater the option pool, the higher the chances of recruiting the best minds in the industry. But on the flip side, the bigger the option pool, the higher the dilution effect on founder shares. It is counterproductive if founders end up running their business for peanuts.

Hence the best way to approach this is by predicting recruitment needs for at least the first 12 months of operations from the time a startup decides to issue employee equity. The startup must account for staggering employee equity plans based on the employee’s position in the business. A C-level executive would demand a higher percentage as compared to a junior executive. It is safe to budget for 6 – 8% just for this category of employees.

This line of thought provides a fair idea about how much equity must be set aside for the option pool before the next funding round. It is good to be economical at the start. The size of the equity pool can always be increased in the later stages. Here is an approximate idea about the size of the option pool based on company valuation:

| COMPANY FINANCING VALUE | OPTION POOL SIZE |

|---|---|

| Under $5 million | 9 – 22% |

| $5 million - $14 million | 10 – 15% |

| $15 million - $49 million | 11 – 17% |

| $50 million - $89 million | 10 – 15% |

| $90 million and more… | 14 – 18% |

Option Pools across Europe vs. US

The US and Europe markets function differently in the case of the startup equity pool. There is intense competition in the US markets and startups have to offer attractive equity packages to hire the best talent in the industry. It is almost a norm even for a startup with about a hundred employees to hire using equity. There are set benchmarks for stock options for all stages in the company. US startups also display high rates of profitable exits and employees find this truly profitable. After a successful exit, many employees even choose to become entrepreneurs and angel investors. Such is the drive of innovation and creativity in the US startup market. With startup accelerators such as 500 Startups and Y-combinator, the US is a thriving scene for startups.

Meanwhile, Europe displays a different trend. With a cluster of 30 countries, equity ownership laws and tax regulations vary across the region. Estonia happens to be the most favorable and UK’s EMI and the French BSPCE fare better than the US. However, unlike the US, in Europe 2/3rd of a company’s stock options are reserved for the top executives while only 1/3rd is allotted for other employees. Overall in terms of profitable exits, Europe still lags in comparison to the US. The startup industry is not as exciting as the US markets. But this trend seems to be changing. European startups are gradually beginning to see the benefits of equity compensation for employees and the benefits of an option pool.

How does Equity Pool Works?

From a company perspective, we know that founders must set aside at least 10 – 20% of total shares for the startup equity pool. This must be done before the startup begins issuing shares. Likewise, an investor also insists to complete option pool calculations based on the pre-money valuation, that is before they come on board with new funds. No investor will agree to dilute their options once on board. With a pre-money valuation, investors can immediately gauge their post-money option pool.

The way to approach this is to consider that all options have been issued at pre-money. Once the investor decides to grant funds in exchange for equity, the question is merely how much of the option pool they are willing to pay for. A startup must ensure they have a sizable option pool as investors will push them to expand if it is too little. But if it is too large, in the next funding round when dilution is required, investors will push founders to part with their percentage of shares without compromising their own.

Here is a simple example of how this works. Let’s assume Company ABC has a pre-money valuation of $2.833 million and before inviting any external investors has issued 5,000,000 shares to its founders. This implies 100% founder ownership at this stage. Now the startup enters a seed funding round where an investor grants $500,000 at a 15% stake. Additionally the investor insists on an option pool of 10%, but all of this on the post-money valuation. This means that the startup must create an option pool before receiving the funds, diluting founder shares in a way that after the funds are granted, the investor gets his share of 15% without having to contribute anything to the new 10% option pool. This table is a snapshot of how the equity situation will look pre-money and post-money.

| ORIGINAL OWNERSHIP | ||

|---|---|---|

| Stakeholders | Shares | Ownership % |

| Founder shares | 5,000,000 | 100% |

| Option pool | - | - |

| Investor shares | - | - |

| Total | 5,000,000 | 100% |

| PRE-MONEY OWNERSHIP | ||

|---|---|---|

| Stakeholders | Shares | Ownership % |

| Founder shares | 5,000,000 | 88.24% |

| Option pool | 666,680 | 11.76% |

| Investor shares | - | - |

| Total | 5,666,680 | 100% |

| POST-MONEY OWNERSHIP | ||

|---|---|---|

| Stakeholders | Shares | Ownership % |

| Founder shares | 5,000,000 | 75% |

| Option pool | 666,680 | 10% |

| Investor shares | 1,000,120 | 15% |

| Total | 6,666,800 | 100% |

Finding your Equity Pool on Eqvista

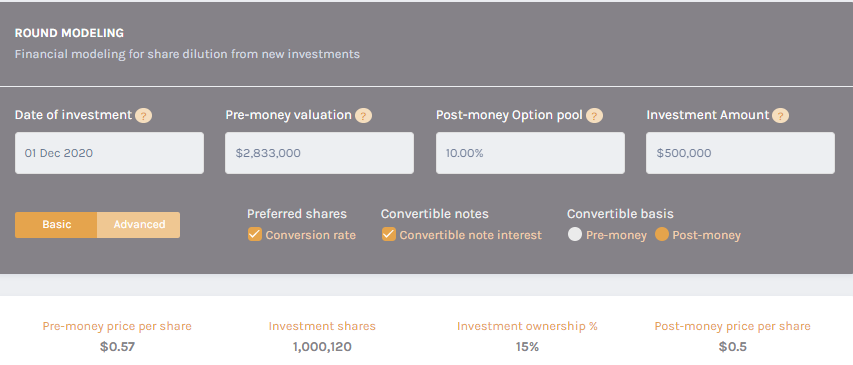

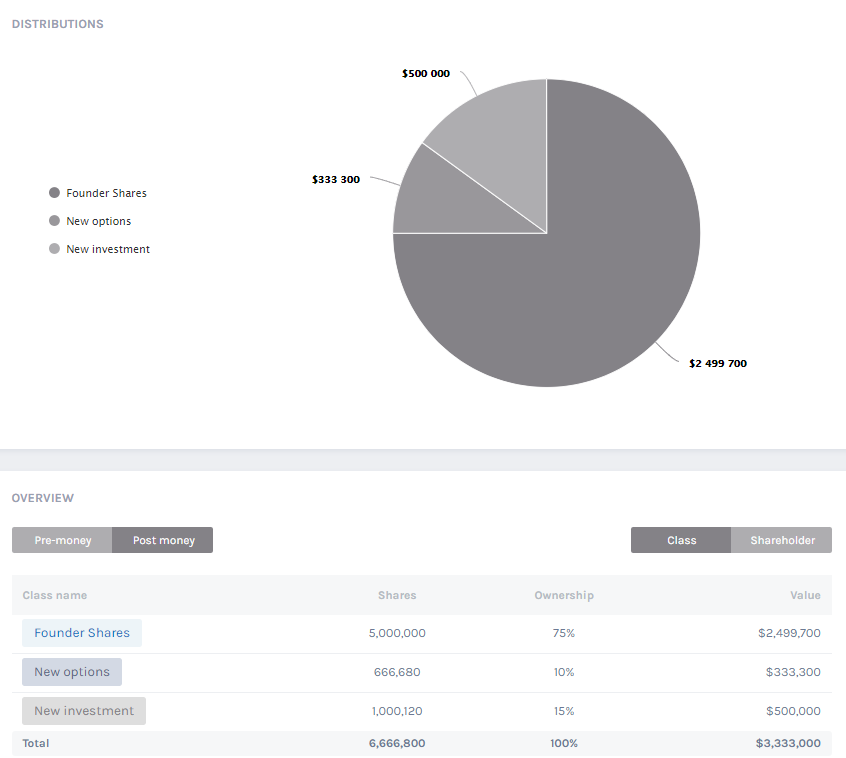

On the Eqvista app, you can use the Round Modeling feature to find out how the numbers would break down when setting up your option pool and shares for the new round of funding.

Let’s take the same example of a new company with 5,000,000 founder shares, and put in a pre-money valuation of $2.833 million with a 10% post money option pool, and a new investment round of $500,000. Here is how the inputs would look on the app.

After putting in the variables into the round modeling, it will generate the breakdown of the new total shares for the founders, option pool and new investor.

In less than a minute you can use the Eqvista Round Modeling to calculate the breakdown of your new option pool. In case you have multiple new investors or differences in their investment rights and conversion rates, you can include that too in the model.

Option Pool Shuffle

Fundraising inevitably has a dilution effect on the equity pool. With every round, a new injection of funds comes at the cost of giving away a considerable percentage of business ownership. It is safe to assume that investors will always find ways to stretch their profit options and this happens at the cost of the company shares. One such situation is the option pool shuffle.

What is an option pool shuffle?

Many times, investors demand to increase the size of the startup equity pool. This needs to be done at the pre-money stage which means that the company has to figure out how to shave off shares from their existing stakeholders and increase the option pool. Most often in a startup scenario, founders hold the majority shares. Thus any dilution happens from their holdings. The investor has nothing to lose in this case, but the startup is dealt with a heavy hand. Here is how it works:

For example, let’s say the startup’s pre-money valuation is $10 million. Their option pool is 10%. Thus the value of their option pool is $1 million. Now if the investor demands to expand the equity pool to 20%, the value of the new option pool becomes $2 million at pre-money. This way the investors have a wider range to play with. But the founders and top executives have to pay for this additional $1 million in the expanded option pool.

Create a Stock Option Plan on Eqvista

If you have decided on your startup equity pool, the next thing in line is the cap table. Figuring out how much equity to give away is only the first part of the plan. It has to be followed through with a meticulous process of issuing, tracking, and managing shares. A capitalization table is used for this. As the company grows and interacts with varied stakeholders (investors and employees alike), minimizing manual handling of the cap table is advised.

Eqvista’s sophisticated software is designed for your needs. With this easy to use platform, companies can easily create stock option plans for startup employees and automate cap table management. Even board resolutions can be handled online including the necessary approval process. Read about our entire list of support articles here.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!