Get 409a Valuation for Your Startup

About to issue options to the employees in your company and need your 409A valuation for your startup? We can help you!

Getting Started with 409a Valuation

Valuation is a vast topic, and there are different kinds of valuations that every business goes through at different stages. But a 409A valuation for startups is becoming a popular choice for growing startups issuing shares in their company.

What is a 409a Valuation?

The IRC Section 409A is regulated by the IRS and states that 409A valuations for startups need to be done by a third-party professional. 409A is an independent valuation that is done to get the value of the common stock of a company. The valuation is performed at the Fair Market Value (FMV) of the company. It sets the strike price of the options issued to employees, advisors, contractors, and anyone else who receives stock in the company.

What do I need to do for a 409a Valuation and what will I get?

All you need to do is prepare your data and search for one of the best 409A valuation providers to offer you the service. You need to ensure that the company has the certificates and experience to give you the most accurate and IRS-defensible 409A valuation report. Once you have all the documents in place, you will need to give it two weeks to a month to get the final 409A valuation report.

Purpose of a 409a Valuation for Your Startup

The 409A valuation is proof that your company’s strike price is right as per the rules set by the IRS. It offers safe harbor status where the IRS accepts the report as it followed the regulations and the valuer used the correct startup valuation methods. But if you do not get it done properly, the company could incur a lot of penalties and extra taxes.

How long does a 409a Valuation take?

Normally it takes two weeks to one month to get the final 409A valuation report from startup 409a valuation providers. The time taken is for collecting data, 409a valuation calculations, and getting the board’s approval on the first draft valuation report.

When do you need Valuation?

If you are about to sell a car and you do not know what it’s worth, would you be able to sell it? Well, the same goes for the company shares. When you are about to give out common stock or stock options, that is when you need to start the 409A valuation process in your company.

- Angel round investment

- Ready to issue ESOP or equity grants

How much does a 409a cost?

The startup 409a valuation cost ranges from $1,200 to $5,000. Regardless of the price, you need to ensure that the firm helping you has the experience and knows what they are doing. Eqvista has a team of experts to help with your 409A valuation for your startup.

Type of companies need 409a valuation

Almost every company, regardless of the industry, might need 409A valuation providers to prepare their company’s valuation. Here is a list of industries (company types) that would need the 409A valuation:

- SaaS companies: These are the companies that usually offer software as their product for their customers. Some examples of these companies include BigCommerce, Google Apps, Salesforce, Dropbox, MailChimp, ZenDesk.

- Hardware: The hardware industry is also known as the computer hardware industry. These companies manufacture computer hardware like the mouse, monitors and so on. Examples of such companies include HP, Dell, Lenovo, Asus.

- Services: The service industry is filled with companies that do work for their customers. The services can be anything from healthcare services to law-based services. So, any company that offers services falls under this. Examples of companies in this industry include HomeX, Parting Stone, Lane Gate Advisors, Rocket Lawyer.

- E-commerce: The E-commerce industry includes companies that offer the option for customers to buy or sell products over the Internet. Some famous examples of companies that come under this are Amazon and Ebay.

- Cybersecurity: The cybersecurity industry is another one that offers security to companies and people for protecting their networks and computers from information disclosure. Examples of such companies include Viper Defense, Polaris Guard, Free Cyber.

- Fintech: The fintech industry includes companies that offer financial services and support to customers using technology. Examples of such companies include Personal Capital, Lending Club, Kabbage, PayPal, Wealthfront.

- Biotech: Biotechnology, also known as biotech companies, derive their products from the extraction or manipulation of living organisms. Examples of such companies include Novo Nordisk A/S (NVO), Regeneron Pharmaceuticals Inc. (REGN), Alexion Pharmaceuticals Inc. (ALXN), etc.

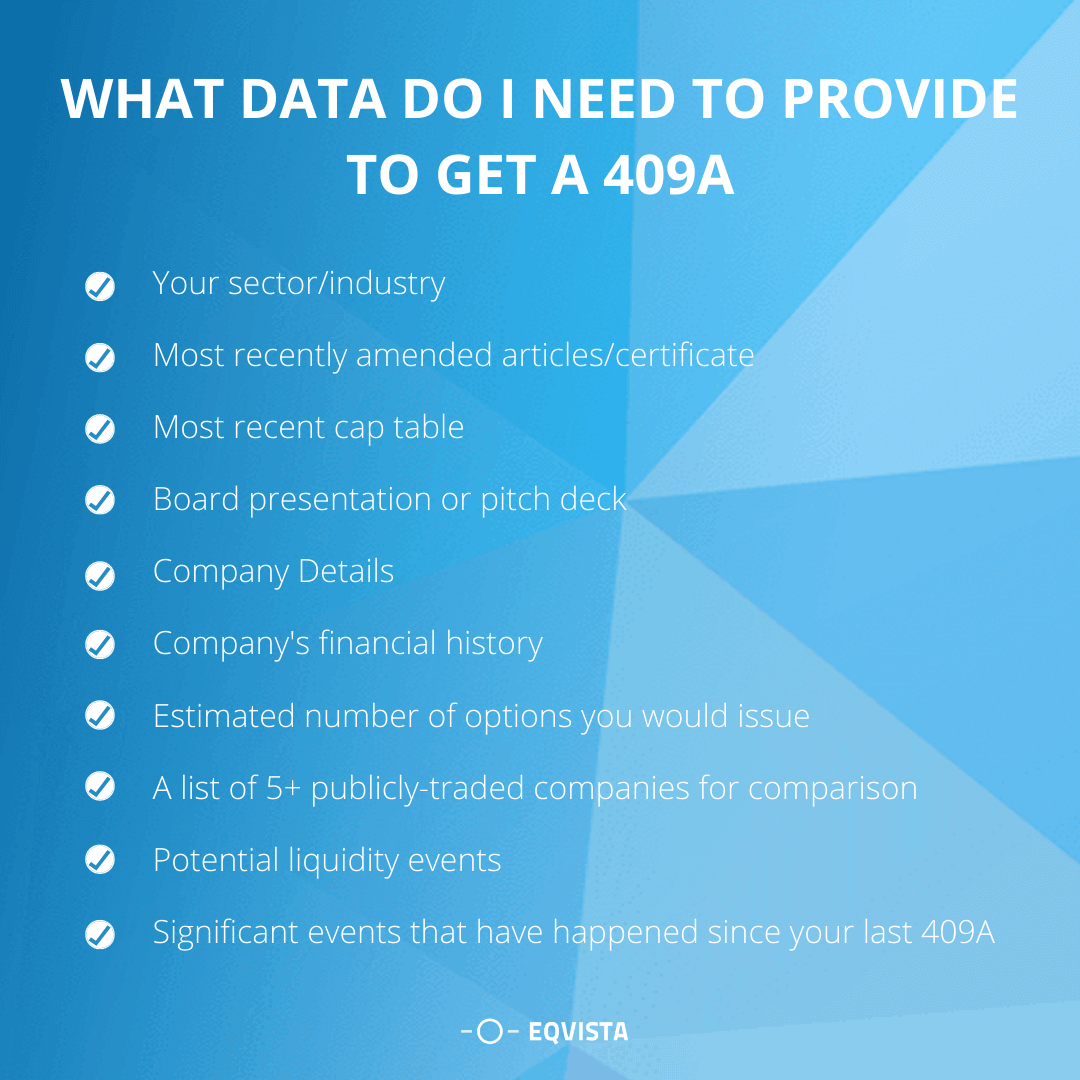

What data do I need to provide to get a 409a?

409A valuation providers would need data of your company and would spend time to understand the company to get the most accurate value of your company’s common stock. The data needed for obtaining the 409A valuation includes:

- Your sector / industry

- Most recently amended articles of incorporation/certificate of incorporation.

- Most recent cap table: If you are on Eqvista, you will have most of these details there. If not, you will need to get the one you have.

- Board presentation and any recent pitch deck you created

- Company Details including – Founders & Shareholders details

- Company historicals and 3-year profit and loss (P&L), cash balance, and debt projections. If you are just a startup, then the details for the last 12-months, if available.

- Estimate on the number of options you would issue over the next year. You need to share your hiring plan as well.

- A list of 5+ publicly-traded companies that can be compared to your company. The person in charge of the 409a valuation process can also help with this.

- Timing expectations around potential liquidity events, such as the acquisitions, M&A, and an IPO.

- Significant events that have happened since your last 409A

If you have all these items mentioned in the list, it would take about 2 weeks for the final draft to be prepared, since it is for a startup. The board would then have to approve it, after which the final report is prepared in the third week. Hence, it takes approximately 2-3 weeks to get the value of your business.

Calculations in a 409a Valuation

Although there are a lot of different ways to get the value of a company, there are three main methods that almost every analyst uses including the market, income and asset-based approaches. These startup valuation methods are normally used in combination with each other or with some other methods as well to get the most accurate 409A valuation results. A brief of each method is as:

- Market approach:In this, the value is based on the comparable valuations in the market. An analysis is done comparing the comparable private and public companies and transactions.

- Income approach: In this, the value is based on the future discounted cash flows in the company. The analyst uses the company’s free cash flows to determine projections for the next five years to get the value.

- Asset approach: In this, the value is based on the value of the underlying assets in the company. It is basically an analysis of a company’s tangible and intangible assets with those of public companies.

Eqvista 409a Valuation Process

Eqvista follows a very straightforward 409A valuation process.

- Data collection (1-3 days): Our team will gather all the data needed as per the checklist to understand more about the company.

- We work on the report & further details request (if anything needed from you) (5-10 days): The next step includes the signing of the engagement letter to begin the preparation of the report. The report is worked on and in case there are more details needed, our team would keep contacting you so that the report is as accurate as possible.

- Review your draft & revisions (1-3 days): These last few days including sharing the draft of the report with you. The company and its board would approve it or ask for any revisions, which our team works on accordingly.

- Final Report (1-2 days): Once all the revisions have been done and the board has approved the report, we then finalize it and submit the final 409A valuation report for you.

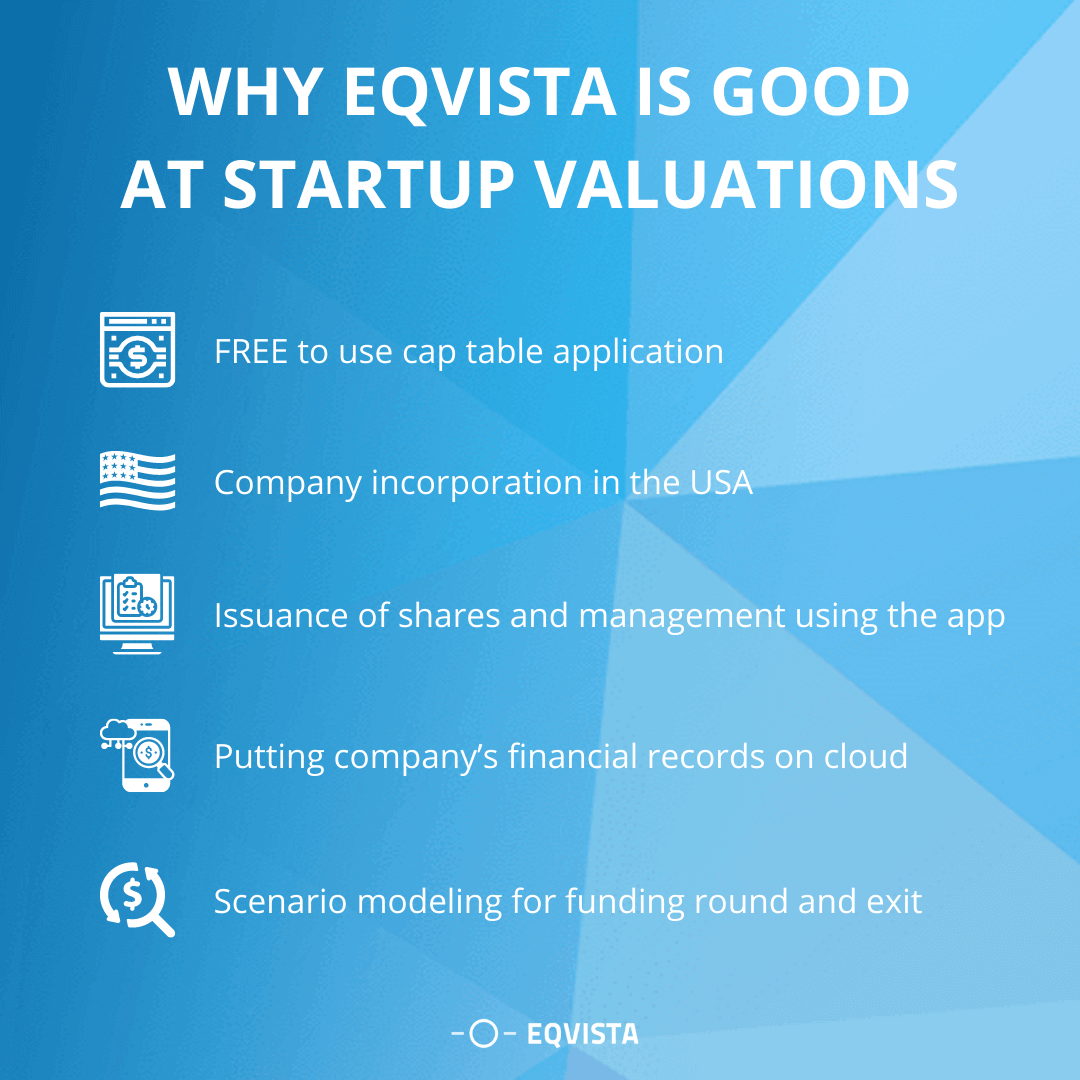

Why Eqvista is good at Startup Valuations

Eqvista is one of the best 409A valuation providers since we conduct business valuations for startups in different sectors. We use the best methods and a proven approach to prepare a 409A valuation for your startup. In addition to this, Eqvista also has many other services including:

- A FREE to use cap table application (you pay a subscription only after the number of shareholders go above 20).

- Company incorporation in the USA

- Share management and issuance of electronic stocks using the app

- Putting all your company’s financial documents and transactions on the cloud using Eqvista.

- Scenario modeling to make better decisions for new funding rounds and when you want to exit.

Get 409a Valuation Reports for your Startup

Are you planning to give out stock in your company or issue stock options to your employees? Then it is time for you to get your company’s 409A done. Eqvista has a professional team who will work on your case dedicated to giving you an accurate valuation report. The best part – the price for getting your 409A valuation is just $990.

Want to Get Your 409A Valuation Done Faster?

If you want to get your 409A valuation process completed in a hurry, Eqvista offers our Expedited Service. In this, your valuation report would be prepared in 3 to 5 working days. The processing time is dependent on client updates on information requests. This service comes with an additional fee of $390. So, you will be paying $990 + $390 = $1,380 for the Expedited Service. Contact us to know more and our professionals would connect with you to learn more about your case!

NEED A 409A VALUATION FOR YOUR COMPANY?

Eqvista has got you covered for your 409A valuation needs. Contact us to discuss your case today!