Tokenized Equity – Everything you need to know

The purpose of this article is to provide a basic understanding of what tokenized stock is, and the benefits of tokenized private equity.

Blockchain is an emerging technology that is disrupting the financial industry and is quickly proving to have the potential to change the way we invest. With its decentralized, immutable ledger, Blockchain can provide a secure, trustless platform for peer-to-peer transactions. In this regard, tokenized equity refers to creating and issuing crypto coins or digital tokens that are represented as equity shares in a company. Similar to traditional stocks or shares, except that the fact that tokenized equity is in the form of coins or tokens. The purpose of this article is to provide a basic understanding of what tokenized stock is, why tokenized equity is, the benefits of tokenized private equity, and the working process of tokenized equity.

Tokenized equity

Basically, tokenized equity is a form of security; however, it is different from traditional securities as it is a digital token programmable and secured by cryptography. The issuance of tokenized stock is designed to mimic the process of IPO and capital raising in traditional finance while utilizing the power of blockchain technology and digital tokens to increase flexibility in terms of rules and regulations.

The crypto space is unregulated, providing a more easy solution for companies to raise capital by issuing their own tokenized equity. In addition to this, blockchain technology is gaining wide acceptance in the financial sphere and is significantly promoting the development of tokenized stock.

Understanding token and equity in a business

To better understand tokenized equity, it is essential to have a solid understanding of tokens and equities in business. Tokens are virtual currencies that are created using algorithms and mathematical problems; typically, the process is known as mining. Bitcoin, for example, is the most famous token in the crypto industry, and since its creation in 2009, it has grown in popularity and value. Basically, tokens are designed to represent a specific asset or utility that is being purchased.

While equity, on the other hand, is a form of ownership in a company that entitles the owner to participate in the monetary gains of the company and its activities. In other words, it is the amount of equity or ownership a shareholder or stakeholder in a company has.

How do tokens work in a business?

When a company issues its own token, it uses smart contracts as a way to transfer virtual tokens and issue them to investors. Smart contracts are sophisticated algorithms that help track the flow of money and assets in a decentralized system. As a result of this, all transactions are recorded on an immutable public ledger and verified by every node in a distributed network, eliminating the need for trusted third-party verification.

Types of Tokens

Businesses can utilize different types of tokens:

- Utility tokens – These provide access to specific services or products within the ecosystem.

- Governance tokens – This allows holders to participate in decision-making processes.

- Security tokens – Represent ownership or investment in real-world assets or projects.

- Payment tokens – Function as a medium of exchange within the platform.

This makes it possible for users to easily verify each transaction and make sure that everything is running smoothly. However, the crypto market is unregulated, and therefore cryptocurrency exchanges of virtual tokens are generally not subject to government oversight or financial regulation.

Advantages of Token Integration

Integrating tokens can provide several advantages for your business:

- Enhanced user engagement and loyalty

- Rapid funding options through token sales

- Increased transparency and security of transactions

- Improved liquidity for traditionally illiquid assets.

- Creation of network effects and ecosystem growth

How does equity work in a business?

Equity is the ownership of a company and is represented in the form of shares. The ownership of the company is split between shareholders. Each shareholder holds a certain number of shares representing their company ownership. In most cases, equity is granted in exchange for financial capital.

Investors provide funds or other resources that allow the company to expand and grow, and in return, the investor receives a certain amount of equity. Not only does the company issue and distribute shares to investors, stock-based compensation, for example, is a way of distributing shares among employees. As a result, there are various ways in which equity can be distributed.

What is tokenized equity?

Now that we understand the basics of equity and tokens, it is time to explore the concept of tokenized equity. Essentially, the name indicates that the equity is tokenized and represented in the form of coins or tokens. Tokenized equity allows users to purchase the “equity” of a company through the issuance of digital tokens. This allows the company to raise capital for growth and expansion by releasing its own tokenized stock.

However, unlike traditional equity, tokens do not represent ownership rights in the company; instead, they represent value or some form of utility. The concept of tokenized equity is developed as a way to bring the benefits of ICOs to the traditional financial markets by offering a more flexible approach for companies to raise capital.

How does tokenized equity work?

Tokenized equity functions similarly to an initial public offering (IPO) and the basics of creating stock tokens are as follows:

- Frame a base plan – The first step involves framing a base plan for the issuance of tokens. Selecting the appropriate jurisdictions in order to issue and distribute equity tokens is important, along with structuring the financial instruments.

- Onboard approved investors – You are required to onboard the approved investors through a fair and transparent process. This means allocating the tokenized equity to the investors and securing their approval.

- Manage operations – The last step involves managing the operations of the tokenized stock. It includes monitoring, servicing, taking proper corporate actions, and making sure that the shareholders are duly consulted on all matters.

Why do companies tokenize their equity?

By tokenizing their equity, companies can leverage these advantages to create more efficient, accessible, and flexible capital structures while potentially expanding their investor base and improving overall market dynamics.

Companies tokenize their equity for several compelling reasons:

- Capital Raising – Tokenization allows companies to raise capital more efficiently and flexibly compared to traditional methods. It enables them to bypass certain restrictions and regulations associated with public offerings, making the fundraising process more streamlined.

- Global Investment Attraction – Tokenized equity provides companies with a unique opportunity to attract investments from a global pool of investors, expanding their potential funding sources.

- Increased Liquidity – Transaction costs of tokenization can be reduced by eliminating intermediaries and streamlining processes. Smart contracts automate many administrative tasks, further reducing fees and expenses.

- Flexibility – Companies can issue tokens with a more customizable approach, allowing them to structure their equity offerings in ways that best suit their needs and those of their investors.

- Fractional Ownership – Tokenization enables fractional ownership of assets, making it possible for investors to participate in the company’s equity. This democratization of investment opportunities can attract smaller investors who might not have been able to invest in traditional equity offerings.

- Transparency and Security – Blockchain technology ensures a high level of transparency in transactions, with every transaction recorded on a distributed ledger. This provides clear audit trails and enhanced security protocols, increasing investor confidence.

- Automated Compliance – Companies can automate compliance obligations through smart contracts, simplifying the management of regulatory requirements.

- Broader Investor Base – Tokenized equity allows companies to reach a new breed of investors, particularly those interested in digital assets and blockchain technology.

- Efficient Management – Companies can manage their investors and responsibilities from a digital interface, streamlining operations and reducing the administrative burden associated with traditional equity management.

Benefits of tokenizing equity

The benefits of tokenizing stock are more than just about accessing capital. It also offers a wide range of other advantages. Here are the top 4 benefits of tokenized equity:

- Automation – One major advantage of tokenized equities is that it allows organizations to raise funds without the cumbersome and time-consuming process of issuing conventional securities. It provides a streamlined and automated method of obtaining cash, cutting down on both time and effort spent.

- Global reach – Another benefit of tokenized equity is that it offers the potential for companies to raise funds from anywhere around the world. As such, the geographical barriers that are involved in traditional equity systems are no longer an issue.

- Transferability – The time between the trading and settlement of traditional securities can be up to several days, causing companies to lack efficiency. However, in the case of tokenized equity, the trades are settled immediately, giving the investors quick access to their funds.

- Legal compliances – Tokenized equity is all about offering a more flexible way to raise capital and increasing the efficiency of the process of raising capital. Legal obligations can be programmed into the tokenized stock in order to ensure that all eligible investors participate.

An important consideration for tokenizing equity

While tokenized equity is set to provide more flexibility and efficiency in terms of raising capital, it is important to consider certain things before issuing the tokenizing stock. ICOs and cryptocurrencies are still in the early stages of development, and it is, therefore, important to make sure that you go through all the due diligence. The lack of clarity in regulations and government supervision leaves room for fraud. Overall, the risk involved in tokenizing equity is huge, and therefore, it is better to be cautious when looking for tokenized stock.

Example of tokenized equity

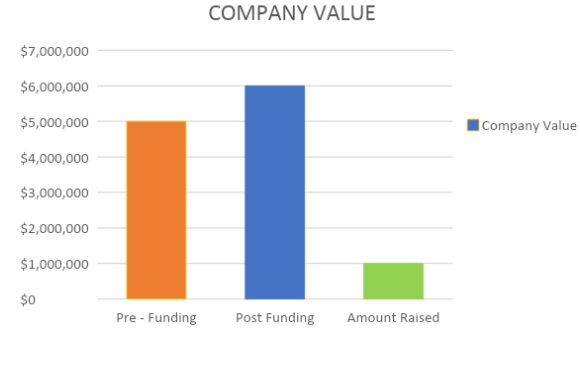

Tech Innovators Inc. is a fast-rising startup specializing in cutting-edge AI technologies. After developing their products, the company is looking to raise capital to fund its next growth phase.

| Pre-Funding | Post-Funding | ||

|---|---|---|---|

| Company Value | $5,000,000 | Company Value | $6,000,000 |

- The board of Tech Innovators Inc. decides to tokenize 20% of the company’s equity to attract a broader range of investors and streamline the fundraising process. Each token equates to a specific fractional ownership in the company.

- The company partners with a blockchain-based tokenization platform to create and manage security tokens with relevant regulations.

- Smart contracts are developed to govern the issuance, ownership, and transfer of tokens. These contracts automatically enforce investor eligibility, voting rights, and dividend distribution.

- The company then decided to launch a fundraising campaign and raised $1 million by selling 1,000,000 tokens at $1. The company uses the capital to expand operations, develop new products, and grow its market presence.

| Amount Raised | $1,000,000 |

| Price Per Token | $1.00 |

| Number of Tokens (Owned by Investors) | 1,000,000 |

- Investors hold their tokens in digital wallets and can trade them on approved secondary markets.

- The company’s value increases to $6 million after receiving funding by selling tokenized equity.

By leveraging tokenized equity, companies can efficiently raise capital, streamline equity management, and provide enhanced liquidity and security to their investors. This approach demonstrates the potential of blockchain technology to revolutionize traditional equity markets.

Other types of assets that can be tokenized

The concept of tokenizing can be extended to other forms of assets as well. Any kind of asset that is tradable can be tokenized; the following are a few examples.

- Fine art and collectibles – These physical assets are often characterized by their scarcity, high price, and long-term value. Typically, it can be a visual art object, an antique, vintage, or other highly valuable assets.

- Gold and silver – These are still considered the highest forms of investment and have long-lasting value. The value of gold and silver has been on the rise ever since the 1950s, even despite economic crises and depressions. This is because people still consider them as a safe investment and a hedge against inflation.

- Real assets – Property, land, and other real assets can be tokenized. The tokenization of real assets essentially involves the collection of data and information on these assets, which can be sold and traded as tokens.

- Intellectual property – Patents, copyrights, and trademarks are all forms of intangible assets and can be tokenized. The tokenization of intellectual assets is deemed the most difficult form of tokenization since it is not possible to find a physical embodiment of intellectual assets that can be sold and traded.

- Unlisted physical securities – Other forms of security that are not currently tradable on exchange platforms can be tokenized. These securities are often traded in over-the-counter (OTC) markets.

Manage your equity with Eqvista!

Are you looking forward to tokenizing the equity in your company? Well, in this case, you need to get your tokens valued. Nobody wants to end up offering tokens at a price that is not fair for investors. At Eqvista, with a team of expert advisors and analysts, be assured of getting accurate and complete valuation reports. Our valuation process is based on software that is powered by established principles and standardized methodologies. Get in touch with us!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!