Introduction to employee compensation

Employee compensation is when an employer can offer benefits or sufficient monetary value to the employees in return for their services to the company.

With the business world expanding, so are the number of employees and their employee compensation options. Employee compensation is when an employer can offer benefits or sufficient monetary value to the employees in return for their services to the company.

The overall idea of compensating employees goes far beyond wages. It includes forms of insurance, employee discounts or even paying for their vacation. The number of ways in which an employee can be compensated is growing and today, there are a million ways in which these are used by companies in the business world.

Employee compensation and startups

Even though employee compensation is something that many companies offer to their workers, startups may rely massively on it, especially on equity compensation. This is due to two main reasons:

- they are not cash-rich

- incentive alignment – the equity compensation links the fortunes of the employee to the company’s future

This article would explain all about employee compensation. Continue reading to understand more.

What is employee compensation?

To put it simply, compensation means the cash rewards that are given to the employees in return for the services that they provide to the company. Now, these rewards can be anything ranging from commission, incentives, wages and/or salary. For an employee to enjoy the complete package of employee compensation, the person would get both cash rewards along with other company benefits that the company offers.

How does compensation strategy work

Establishing a compensation strategy for a company is crucial for every business, especially for startups. An employee compensation strategy is a method by which a company decides how and what they wish to offer an employee in exchange for obtaining professional and productive services. The strategy that the company plans needs to be reasonably competitive, structured, and affordable.

If your company is a startup or a small enterprise, you may not be able to offer a high salary to your employees like other large companies. Hence, it is essential to gather various options and choose the best ones to compensate your staff. This should be the ones that would both attract and retain the best employees that you need in your business.

Don’t depreciate the number and the value of the benefits that your business can offer to employees. These also might be the things that are not available in the large companies. Your company can have the benefits like a flexible environment, lack of hierarchy, opportunities for interesting work and so on.

Many people are driven by the passion for being on the cusp of technological or scientific advances, or being part of a team in a fast growing company. This means that these kinds of people can agree to work at a low salary for a startup if they enjoy the work and future potential of the company.

Salary and wages as employee compensation

A salary, being a fixed amount given to a worker in a company, may not provide the right motivation to employees to work hard for the success of the company. Their desire of a higher salary may not be directly linked to the success, and ultimately profitability of the company.

Due to this, employees may leave after some time to move to another company with more lucrative compensation packages. Moreover, some employees feel that it is not fair to get a fixed salary when some days they work more with no extra benefits.

Commission as employee compensation

Commissions are also one form of employee compensation where an employee is rewarded for selling a product or service to clients. The idea behind this is to create a strong incentive to give the staff who put in the time and effort for the best and get results. Commissions are normally a percentage of the cost of the service or the product.

For instance, let us say that a salesman has to sell a computer for some amount. If he is successful in selling two or three of the computers, he would get about 5% of the sale price from each piece as a commission. The payment given to these might either be a straight commission without any salary, or it could be with a base salary and commission.

Basically, the structure of this employee compensation includes reaching specific quotas which are normally agreed upon beforehand by the employee and the management. These targets are usually connected to the sales revenue, unit sales or any other volume-based plan.

how does employee compensation help attract the best employees?

Employee compensation can come in the form of benefits, incentives, and salary. Even though benefits and salary is always competitive, better incentives that come along is always likely to attract the best employees. As we talk about incentives, three types that come up are bonuses, profit sharing, and stock options.

#1 Bonuses

A bonus is given to an employee as a reward to achieve the goal or exceed the target before the deadline. These goals that are attained by an individual, company and/or team are normally performance-based, realistic and the ones that closely match the people involved and the business.

The payout as a bonus should be large enough to be worth it for the person earning it. A company can easily offer bonuses to their employees as a form of compensation. This would create a drive among the employees and they would begin to support the needs of the business such as significant project milestones, successful completion of projects, profitability, and annual results.

#2 Profit sharing

This kind of employee compensation is a payment that is linked to the profits of the company. Under this, the company offers their employees with a predetermined percentage of the profits that are earned by the company. The profit-sharing bonus is usually given out during the end of the year on a deferred basis or in the form of cash.

#3 Stock options

Under this option, an individual gets the choice to purchase the shares of a business at specific price over a certain period of time. Moreover, the option can be used by the person any time they want within the specified period as agreed upon, subject to any vesting schedule.

This type of employee compensation is normally for management, but some companies can also offer it to other primary employees instead of a higher salary, mostly when the business does not have a high cash flow or is not yet profitable. At the end of the day, when the business grows, the stock of the company would rise in value as well. When this happens, the holders of the options will share the financial benefits too.

What is equity compensation?

Most often, the best tool for a company’s employee compensation for staff is equity compensation, rather than using a straight salary. Even though a few companies might have used it for giving an upfront payment to their employees, it is very rare to find cases where it is provided as a complete replacement rather than getting a standard compensation package.

Moving ahead, employees that choose to get equity compensation from their owners may be able to select from common stock, preferred stock, or stock options. The difference would be briefly explained below.

Types of equity compensation

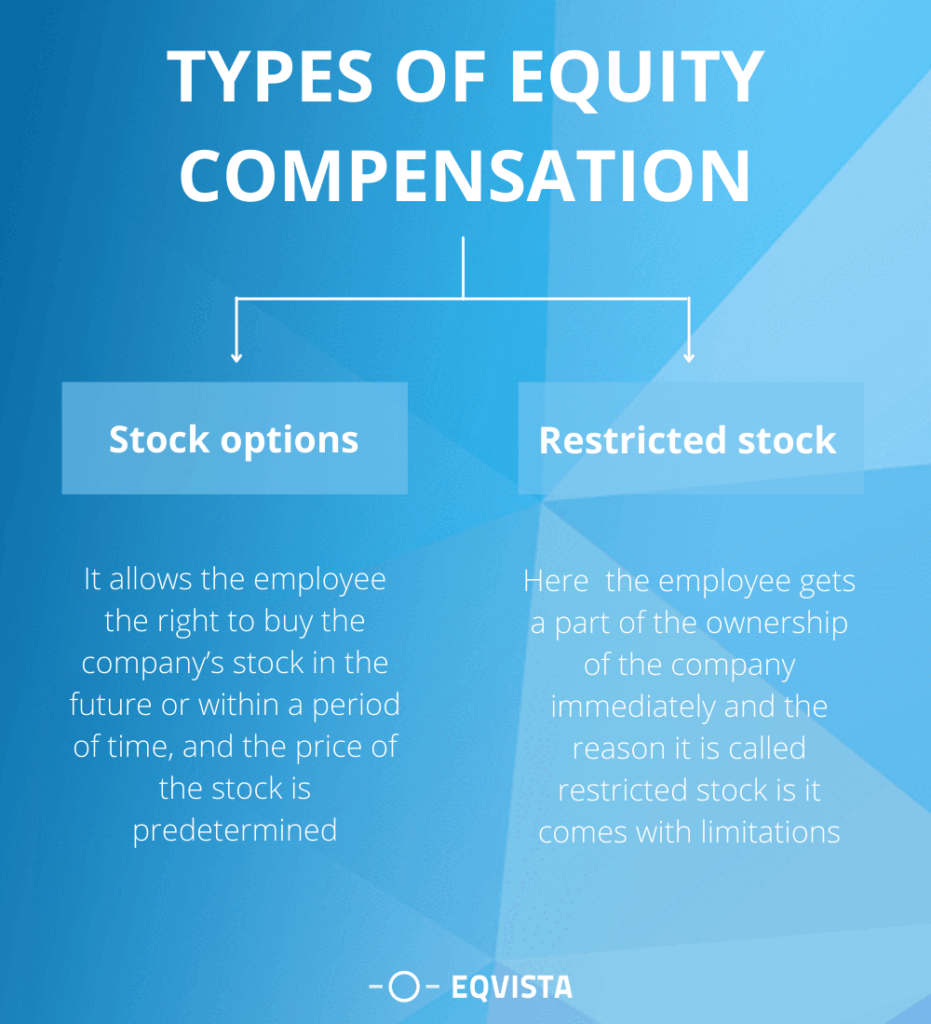

When the owners of a business decide to provide employee compensation with stocks, there are two main options that they can decide from to use. These include:

Stock options

Regarding equity compensation, it is one of the most common types of employee compensation. Stock options allow the employee the rights to buy the company’s stock in the future or within a period of time. The price of the stock options is always predetermined when the options are given.

The reason why employees take this is that the shares of the stock may turn out to be higher in the future, which would be highly beneficial to the staff. This also means that they get to buy a higher rate stock at a much lower price. If the stock’s price reduces in the future, they wouldn’t need to purchase it at all.

Through an ESOP, also called the Employee Stock Option Plan, the stock options are provided to the employees. This also includes the vesting period, which is normally for up to three or four years and frees up a percentage of the stock options so that the employee has a chance to buy it as long as they stay in the organization.

Nonetheless, in case the employee leaves their job in the organization before the vesting period is over, the employee would have to give up any stock that has been vested (but not purchased, or exercised) and any stock that are already fully vested.

Stock options are usually issued for rewarding employees that stay for a long time with the company and for encouraging loyalty in the company. In short, the longer an employee remains in the company, the more their stock options vest.

Restricted stock

Under this kind of stock option as employee compensation, the employee gets a part of the ownership of the company immediately. Unlike stock options, where the employee has the choice to buy the stock or not, restricted stock is normally granted to the employee.

The reason it is called restricted stock is it comes with limitations, such as the employee cannot vest the stocks. These kinds of stocks are normally provided to the early employees where the stock values are zero or near zero, and they are also provided to the founders.

Why offer equity as employee compensation?

Usually equity is offered as an employee compensation when the company is in the startup stage, and there isn’t much cash to pay salaries to these employees. This is also when the company is looking to retain high-quality staff.

Here are some reasons why you should offer equity as the employee compensation explained in details:

When it’s the “norm” for your industry

Yes, that’s right. If you were in Silicon Valley and you were building or had any tech company there, it is usually considered a norm to provide equity as a part of a employee compensation package.

But why is it the norm for most of the technology companies? Well, there are a few reasons to this:

At first, the businesses that offer the equity package as employee compensation know that it is the only way they can keep their offer different from the other companies. This is for making the candidates stay in the company, who can use their skills and get the same or a higher salary elsewhere.

Moreover, with the number of tech companies starting up, it is not a surprise to find them offering equity as a form of employee compensation to attract the best talent into their company. As a matter of fact, the startups in Silicon Valley are normally high-growth businesses that have an exit plan, which means that they would either be acquired or they would go public.

Working for a tech startup that has high growth needs an immense amount of dedication and work. By offering the employees with ownership of the company, it helps to balance the enormous efforts needed. Moreover, if the company does not exit, everyone would be rewarded for the hard work they put in.

When cash flow is very poor in the company.

In the case of low cash flow creating a problem for a startup, offering employees with equity as employee compensation might be a great method to circumnavigate the problem where you need to pay a high salary every month.

In case you feel that an employee has the potential to influence the best result that would lead towards the success of the company.

Equity is used as a form of employee compensation for the senior positions in a business, mostly when the person has the potential to help the company grow fast and reach success. Moreover, the senior positions are the ones that have a lot of responsibility towards the business to help the company grow and become successful.

On the other hand, the lower staff normally do not have much influence over the company. Hence, they may not have any equity grants as employee compensation, or it would be minimal in the company.

When an employee has showed excellent skills over a long time.

The best time for extending the equity grants as employee compensation is at times when a person has shown excellent skills for a long time in the company. It is normally given as an opportunity and reward for the person to excel much higher.

In case you have great plans for your startup.

In case you want your business to grow faster, or if you are looking for investment from angel investors or VCs, it is a good idea to provide equity. It is normal for the angel investors and VCs to check if you have offered key employees with equity as employee compensation to incentivize them and have them build a strong team that would help the company grow.

With all this said, there is one thing that you should keep in mind. It is to not provide equity as employee compensation to the employee that are not good for the company. Hence, do not rush into initially providing equity option as soon as you hire an employee. Give it some time so you have the chance to see the suitability of the employee in their role and responsibilities. By offering it too soon, you can end up learning that the employee is not the right fit, and it would be a huge loss for you and your company.

Pros and cons of employee options

Now that we have understood the basics of employee compensation, let us talk about the pros and cons of each.

Advantages of providing equity programs to Employees

At first, let us talk about the advantages of offering equity programs. Offering the employees a part of the company has many main advantages as:

- By offering equity to your employees, consultants, and advisors as employee compensation instead of cash, you can save money for other vital expenses for the business. For those startups that are cash-strapped, equity-based financing might be the only way in which they can get the right talent in the company.

- By granting equity as employee compensation, it helps in getting the financial interests of the employee aligned with that of the company. This would make them invest more in the future of the business. The idea behind this is that the value of the stock and the company would increase with the dedication and hard work of the employee. And this would help them earn from the equity they have. Also, those employees that hold stock options or stock of the company take themselves as owners and work much better as compared to a regular employee.

- Employee turnover can be minimized with the correct type of vesting schedule. The normal vesting schedules are usually for a 4-year period with a 1-year cliff. The cliff here means that in case the employee leaves before a year, they get nothing. Hence, it is good for employees to be offered with employee compensation for sticking with one business for a long time.

- This might be one of the most critical points; most employees that get into tech companies expect to get some form of an equity-based package as a part of their complete employee compensation package. And this is mostly for the high-level or senior hires. In case you fail to offer such a package, you may not be able to hire top talent for your company. Hence, it is usually a norm now to offer equity to the employees.

Disadvantages of providing equity programs to Employees

Moving towards the disadvantages of offering equity as the employee compensation, one main problem is that you would have to give up the ownership of your business. This may make things complicated as compared to a traditional cash-based salary system. But that is not all, there are other disadvantages as well, and they are:

It doesn’t matter how structured your programs are and how well you keep the cap table, equity-based compensation may become complicated. You may need to hire a professional tax attorney to make sure that you do not have to register your equity compensation plan with the state/federal securities law. Also, you would need them to help you meet any regulations. The structure and timing of this would have many tax implications for the business.

If you are a business owner or professional, you can start creating your cap table and manage it online. Try out our Eqvista App, it is free!

Other than the structuring, the founders need to be ready for any ongoing alterations, where things typically get messy. Founders tend to forget to update the cap table when they grant an employee a longer period for exercising their option or when they change up the performance-based metrics. At times, the company also forgets to update the accounting when an employee leaves. In short, changes happen and it is normal for things to become messy.

The tax issues get complicated when you offer equity as employee compensation, though it entirely depends on how the equity programs are structured. Additionally, different business structures have different rules concerning stock options, and it is recommended to take the advice of a professional attorney before making a decision.

As you offer equity to the employees as employee compensation, it is essential that the employees know all about the finances of the startup which might make the founders uncomfortable. So, it is vital to choose the right employee who receives the equity grant or if you want to give out equity compensation at all.

Manage your company’s Equity and shares with Eqvista!

By providing equity-based plans to your staff as employee compensation, every startup can quickly get the best talent in the industry and grow faster. Nonetheless, the founder of the startup has to comprehend the complete scope of providing these programs and their added tax and legal complexities.

And for this, you need to understand in detail, the various types of employee compensation programs and how they can work for you. The next article gives you the details regarding it. Check it out!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!