Cap Table Checklist – How to Manage your Cap Table

Essential part of business evolution is suitably managing and developing your company’s shares through a cap table.

With a unique idea, a founder starts a business in the market and through hard work and innovation, grows to achieve stable traction and maturity. For growth, future strategic decisions management techniques need to be developed and changed accordingly. And an essential part of business evolution is suitably managing and developing your company’s shares through a cap table (capitalization table).

Being new to the business world can be an overwhelming experience and makes it difficult to draw a cap table and make decisions related to it. With a cap table checklist, this useful information will help founders understand and manage their resources to grow their business.

Cap Table – Why is it important?

A cap table provides you with data laid out in a practical manner such as the debt and equity ownership in the company, liquidation rankings of all investors and the lenders who have invested in the business. As a majority of startups do not have traditional debt lenders, the list usually consists of data of the shareholders and the owned percentages. Although equity has various forms like common stock, preferred stock and convertible notes, all of these have an impact on the present and potential future investors.

As a company, a cap table is essential because you will eventually make decisions that will have an affect on your company’s capitalization. For example, while running activities of the business, this cap table will assist you in running through various possibilities such as available options and pre-money valuations faster.

Or if you are hiring a new COO, the candidate may ask for an option of getting a percentage ownership in the company. To swiftly check if the option is available or not, determine how much grant you will give, and calculate the percentage you are ready to give, you will need a cap table. This is why cap table management is important for modern companies.

How does it help your company/startup?

A well-organized cap table helps your startup attract investment and reduce the chances of diluting stakes. It can be a tedious task to maintain a cap table but it is essential to do so for a couple of reasons:

- Potential investors are able to determine the amount of leverage and control to be maintained in negotiations.

- Real time value can be seen by employees with equity stakes or options.

- It assists the current investors to forecast potential dilution in specific situations and also enables them to forecast future payouts.

- Your legal team will be able to present accurately the companies holdings and history with a well maintained and managed cap table during the audit.

- In exchange for the capital by a new investor, a shareholder can determine the percentage to give of the company.

- For raising new funds, insight to the history of the company can help in negotiations for valuation.

Company founders should strategically invest time into setting up a cap table with the intricacies included.

Cap tables in Excel vs. software-based cap tables

To new startups, it seems absurd that a capitalization table can be a massive hassle. In the early stages of a business the capitalization is an ordinary spreadsheet on Excel that consists of titles, names, number of shares and percentages. This may seem manageable at the beginning by the most basic users of Excel.

But as the business grows so does the intricacy of the cap table. When the company raises capital, it in turn increases the number of investors and the different classes of shares. This leads to the addition of more rows and columns. Recruiting more employees will lead to testing schedules and tracking the option grants. This creates the need for formulas and more sheets. Now if an employee chooses to resign it will result in their options returned to the company or being purchased. A precise alteration will require time as with a cap table, minor errors can result in loss and faulty decisions as all of the information on the sheet is sensitive data.

But this is not the case, as managing an Excel file for a cap table is less efficient and time consuming. If your company goes through a major strategic shift like a change in the corporate structure, acquisition, or even a merger, an Excel file will simply not cut it. Here are a few points on how it will affect your company:

1. Getting Acquired or Acquiring

Initial Public Offering (IPO) is the dream of almost every single entrepreneur. The second best thing to happen is being acquired. This is a very fragile process as more challenging issues come up during this process, and is led by a selected few while growing the business is the main objective of the remainder of the employees to be focused on.

While going through this process, you will be required to present your current cap table to the company that is taking charge. For the current investors and employees, you will also be required to develop deluge scenarios. This would take next to forever for those working with Excel to go through as it is heavily complicated, but with Eqvista’s Cap Table Management software, getting this information only needs a few clicks. Having a software allows the team to concentrate on other aspects and important things during the acquisition.

2. Company Mergers

If you decide to do a major merger, half of your company still stays on the sheets if you are using Excel. The cap table is complicated so deriving data such as hybrid requirements, grant types and vesting of schedules in specific ways will not be an easy copy and paste. Eqvista’s Cap table Management allows you to create rules and the formulas you need to derive these data as these formulas will pronounce the shares of classes that will be transformed into the new company shares. This software helps record deals, leaving you with only 10 to 15 calculations instead of 500, and narrows the room for mistakes to a re-traceable area.

3. Changing the corporate structure

When your company grows, it leads to many decisions, with a major one being structure change. This might be the right thing to do but the process is laborious with an Excel sheet. The process to convert option grants to profit interests and stocks to membership units needs a massive alteration in the cap table.

To go through this process you need to be sure that your cap table is accurate down to the point. In Excel this will result in a huge nightmare for the company, as a proper map needs to be drafted for the vesting cycle from the old organisational structure, each and every stakeholder will be required to sign off on the change to the new structure. Using software, the transfer agreement will all be tracked online, and the shares would automatically be converted. Software is key and the way to go.

Cap Table Management – Checklist

Entrepreneurs that have long term goals spend time with essential people who have a part in growing the company to be successful. They are realistic about their growth requirements, and their hiring needs are highly preferred by and also attract investors. Below are some essential tips for getting your cap table management done properly:

#1 Know the company equity details

It is important to know your founders, key employees, and advisors so that when you set a pool of the total equity between 10% and 20%, you can award these individuals. Derive the compensation to give these key players with a formula and the given pool. If you have plans for growing the employee base with future hiring, you should set aside a different pool as well as incentives for employees. In short, ensure that you have all the needed details of the shareholders in the company along with the amount and type of equity that they hold.

#2 Record basic share details

Next is to record all the details you have gathered in the most secure place that wouldn’t need your constant attention. The best way to do so is by using a cap table software like Eqvista. This will include the shareholders name, price of the share investment, price per share, and number of diluted shares. An Excel sheet can offer you the option to record the details, but as soon as more shareholders join the company, things become highly complicated and you will be spending time in editing the old records as well as adding new ones. But with cap table software, you will not need to spent time doing this.

#3 Centralize data and share it

Instead of creating many spreadsheets and struggling with managing the information, get it centralized on software and share it with those who need it. You can make sure your company data is accurate and consistent with cap table software. It is also essential that you track all the legal documents such as notices of option grants, the articles of incorporation, and stock purchase agreements as they legally represent the cap table.

You will know the true figures of the cap table if you keep track of the legal documents as this information assists the company to decide how proceeds can be dispensed and what amount to invest.

#4 Keep up on compliance

To make sure that you are in compliance with all rules and regulations, here are some key rules that you should know:

- 83(b) election pertains to the tax treatment of restricted stock awards. Should be filled within 30 days of the grant.

- ASC 718 (formerly FAS 123R) to measure and record the expense associated with issuing equity-based compensation requirements for accounting.

- ISO $100k limits stipulate how many options can best qualify for certain tax treatment in a given calendar year.

- Rule 701 is an exemption to issue equity compensation the company gains from being registered with the SEC.

- IRC 409A is a regulation that helps determine a share price by doing a formal valuation for the company’s equity.

Using a simple Excel sheet would be more difficult to ensure you follow these important rules for your company’s shares. This is the reason many companies are making the shift to cap table software. Eqvista’s cap table makes these processes easy by Keeping track of Company Equity and shareholder details, centralizing data for easy sharing, staying compliant with regulations, and maintaining up-to-date information. It also lets founders and shareholders understand changes in the cap table.

#5 Give everyone in the company up to date information

The company and those interested in the company need updated and accurate data as it affects key decisions about equity. If your investors are using one type of cap table and you are using a different version, it institutes conflict and jumbling of data. This is where you need centralized cap table software as it can be shared with investors in real time.

#6 Review it consistently

If any change is made such as receiving funding, hiring new employees, or other share transactions, you should review the equity plan and keep updating the cap table. The best way to do it is when you are linking up quarterly with your accountant and do it at the same time. As the owner of the business, it is essential for you to know and understand who invested in the company and how much they have put in. And keeping an updated cap table will help you stay ahead of this.

Example: Managing a Cap Table using Eqvista

With all this said, Eqvista is a cap table software that helps with your share management. Our platform helps with the cap table management process for creating various share classes, options, warrants and convertible notes all in one place.

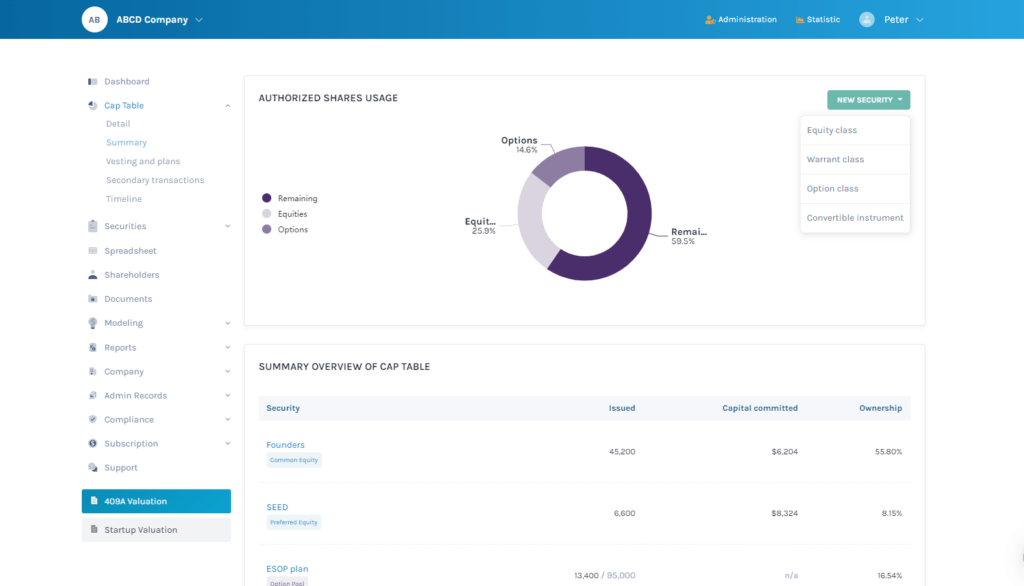

All you got to do is create an account on Eqvista and create your company profile. Next, you will need to create a share class and issue new shares. All this can be handled from the Cap Table – Summary. On the right hand side, you can create a new security type.

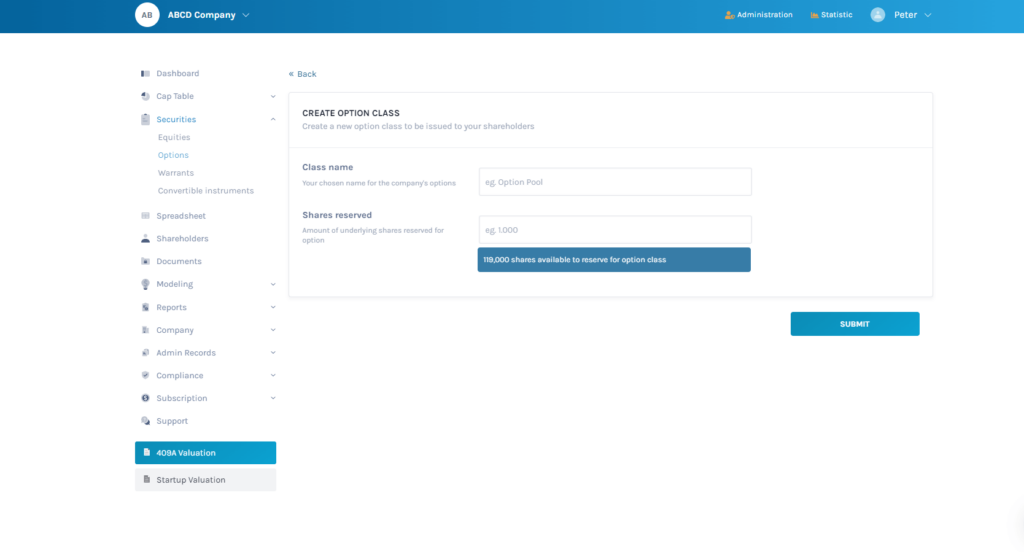

Let us say you choose to create a new option class in your company. The key details you will need to fill is the option class name and the amount of shares reserved for these options. All this would be added in the fields as shown in the image below.

When you are done creating the option class, you will be redirected to the page where you can see all the details of the class. On this page, you will see the option that says “Issue shares” on the equity class page.

By clicking on this, you will begin the process of issuing the options. The key details to fill for the issuance process include the underlying security (option class name), shareholder name, date of issuance, number of options issued, strike price, option grant name, and vesting schedule (if any).

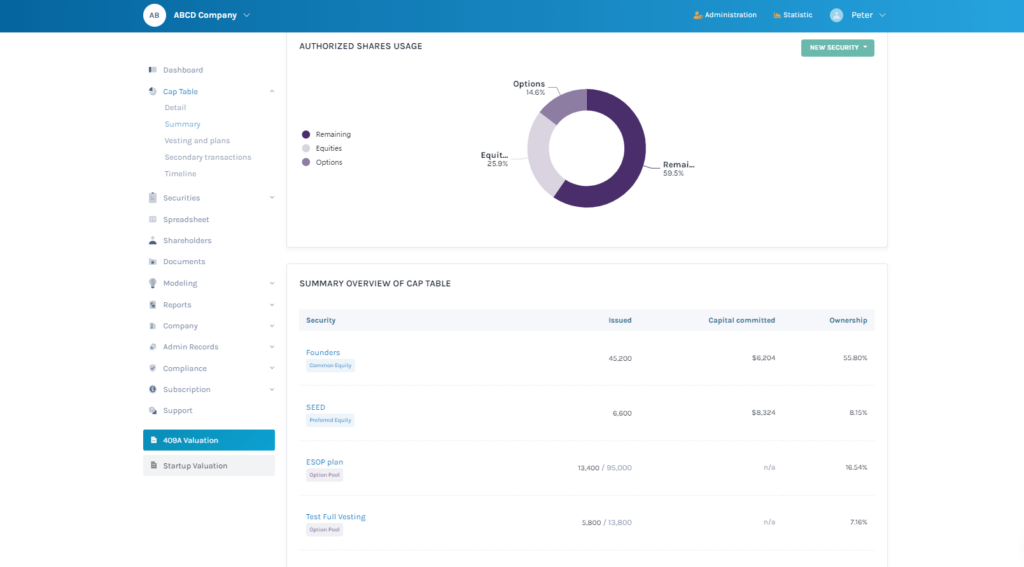

Once you have issued the options in your company, you can check out the cap table details by going to “cap table” and then “summary” on the sidebar. This is how the cap table will be shown.

In short, it is very easy to manage all the shares of your company through a cap table software like Eqvista. It will help you save time in managing your company’s equity and avoid common cap table mistakes.

Eqvista provides three different packages – Freemium, Premium, and Enterprise. If you are a beginner, we recommend our Freemium package, which is free of charge and allows you to have up to 20 shareholders. Our Premium and Enterprise packages offer additional features such as adding unlimited shareholders, managing unlimited complete companies under a single account, handling annual corporate filings, and more.

EQVISTA’S CAP TABLE -THE ULTIMATE CAP TABLE SOLUTION!

You now know the key things to pay attention to in your company’s cap table and why companies are making the switch from Excel to a cap table management software. Instead of using an Excel sheet, try out Eqvista today. It has the latest technology to help you track and manage all the shares in your company easily. You will also be able to stay connected with your shareholders. Try it out here!

You can easily manage your company’s cap table and valuations with Eqvista! Whether you’re a small startup or a large corporation, Eqvista provides tailor-made services and packages to fit your company’s needs, including cap table management and unlimited 409A valuations combined. Eqvista’s Cap Table not only Manages your company’s equity but also updates all company records and filings.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!