Post- Money Valuation of Startup

After the first financing round from investors and venture capitalists, a startup company’s estimated market value is the post-money valuation.

When a startup decides to raise money through funding, the valuation of the company becomes an essential factor. This is so because the owners will use this as a negotiating factor for the amount of equity they will give to the investor in exchange for funds. A startup valuation is when you determine the value of the company.

Startup valuations are used by investors, venture capitalists, and owners. The main use of it is as a negotiating tool during the process of trading equity for funds. To derive the post-money value of a startup, there are different methods. You will have to choose the best one for your company. The reason for this circumstance is that there is no “right way” used across the market to calculate post-money valuation.

Post-Money Valuation

Startups are bound to face hurdles in their initial stages. The first five years are the most important and difficult for the business. There are many reasons the startup might require funds. A valuation can help you to make the startup successful, give you access to more investors, give you better knowledge about your company’s assets, and assist in an acquisition. The post-money valuation is essential here.

What is the post-money valuation of a startup?

After the first financing round from investors and venture capitalists, a startup company’s estimated market value is the post-money valuation. The valuation of the company before these funds are injected is called a pre-money valuation. By adding cash into a business’s balance sheet, it will increase the equity value, this makes the post-money valuation higher than the pre-money valuation of the business due to the additional cash. The post-money valuation is the pre-money valuation + new equity from external investors.

A majority of times investors will use the startup’s pre-money valuation to estimate how much equity they will have to get in exchange for the capital they invest. For example, ABC Inc has $200 million pre-money valuations. A VC invests $50 million into the company, and this results in the post-money valuation being $250 million ($50 million additional investment and $200 million pre-money valuation). Thus the investor would have got at least 20% equity in the company as $50 million represented a fifth of the startup value.

In the above example, we assume that the entrepreneur and the venture capitalist are in total agreement concerning the valuations. In the real world, this is not the case. There are harsh negotiations, especially if the startup has a low level of intellectual property and assets. Eventually, after the private companies grow and become more stable they gain the ability to dictate the terms and conditions for the financial valuation rounds. Only a certain number of businesses have been able to reach this stage.

Why is post-money valuation important for a startup?

Investors face the problem of dilution after several financing rounds in private companies. Even though the owners try to minimize the impact of funding on dilution through negotiations and certain terms, dilution still occurs. The investors and the founders set new terms on the new equity with a low but agreeable dilution rate. From preferred stock, the additional equity can consist of liquidation preferences. While calculating the shares’ dilution, you should consider all types of financing options like a stock option, convertible notes, and warrants.

Up-round, Down-round, & Flat round Financing Situation

It is called an up-round in a new equity funding round if the pre-money valuation is greater than the previous post-money valuation. In simple terms, if the pre-valuation of the company rises it is an up-round. Up-round is considered to be a positive indicator showing the growth in the company. This usually leads to an increase in the wealth of the investors.

A down round is an exact opposite; it is when pre-money is lower than the post-money valuation. Or, if the pre-money value falls it is a down round. Down-round financing can cause a drop in returns and it can also reduce the investors’ wealth by a significant margin. Existing investors and founders are tuned to the round scenarios. In real terms, this is so because a down round will lead to the dilution of existing shareholders. When a company is financing a down round, it is perceived as a desperate move to gather funds. In the case of an up round of financing, it is seen as a less hesitant move as the business is growing. They consider the company to be advancing towards a future valuation that will hold the public market when it goes public.

The third situation is the flat round, in this case, the pre-money valuation of this round and the post-money valuation of the last round are approximately equal. For example, if a company raises finance of $1 million at pre-value money of $3 million and is currently raising $4 million from another round, it is called flat round financing. This scenario is very unlikely to occur and is not common. Similar to the down round, investors and venture capitalists generally want to see signs of a rising valuation before investing.

Example of a Post-Money Valuation

Here are some examples of post-money valuation:

Example 1

GH Ltd is worth $500 million. An investor decides to invest $100 million in the startup in exchange for equity. The post-money valuation is now $600 million. The investor owns 16.667% equity in the company. This example shows the general concept of post-money valuation. But this is not the same case in real-life scenarios. Calculating a company’s post-money valuation can be a complex process as they might have a capital structure consisting of incentives for the employees such as warrants, convertible loans, option-based management schemes, and restricted shares.

It is the price paid per share by the number of shares that exists after the investment. In other words, it considers all the shares that arise from any in-the-money option, warrants, and conversions of loans. So it is essential that the company’s post-money valuation is fully diluted and converted. This means that the number of shares available to trade on should be totaled after the conversion of all the convertible shares, employee stock options, and convertible stock bonds are exercised. After all this is done and the dilution process is completed, the total number of shares will represent the equity.

In this case, the pre-money valuation = post-money valuation – total money coming into the business. The total amount of money coming into the business consists of the money paid to exercise in-the-money warrants and options, purchase of shares, nominal interest, and the conversion of loans.

Example 2

A company Space Inc has 2 million shares.

It also has convertible loans of $2 million at 75% of the next round price. Warrants for 400,000 shares at $100 per share. A granted employee stock ownership plan of 400,000 shares at $8 per share. An offer to invest is received for $16 million at $16 per share.

| Convertible Loans | $2 million | @75% |

| Warrants | 400,000 shares | $100/sh |

| Employee stock option | 400,000 | $8/sh |

| Offer to invest | $16 million | $16/sh |

First, we will calculate the post-money valuation = $16 x 4,733,334 (number of shares after transaction).

The next step is to add all the diluted shares. The number of shares includes the 2 million initial shares + the 2 million new invested shares + 333,334 shares of the loan conversion + 400,000 shares of the in-the-money options.

Then when fully diluted and fully converted, the post-money valuation is $37,866,672.

$37,866,672 - $16,000,000 - $2,000,000 - $1,600,000 = $18,266,672

Keep in mind that the warrants are not exercised as they are not in-the-money. This is so as the price of $20 per share is higher than the new price of $16.

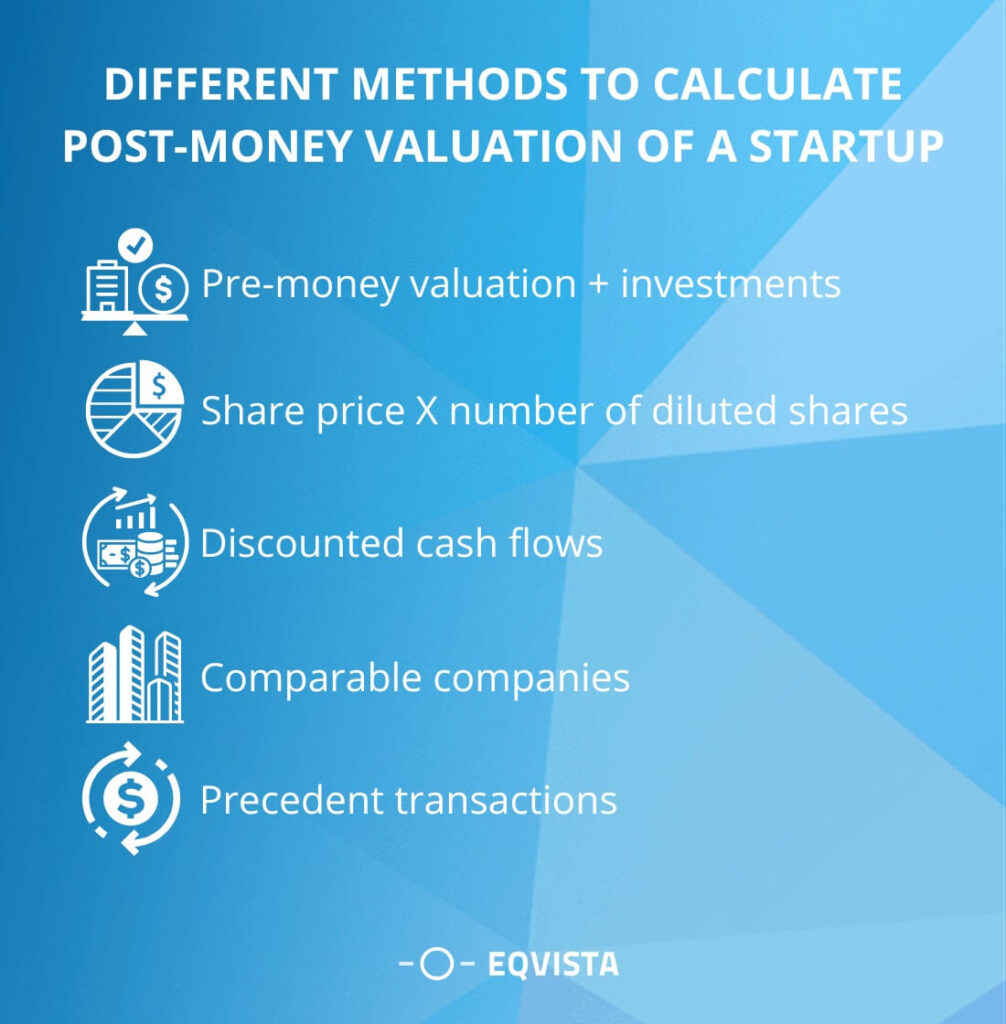

Different Methods to Calculate Post-Money Valuation of a Startup

Companies that need funds and are opting for financing rounds will need to negotiate the company’s worth with its potential investors. To do so, they need to calculate the post-money valuation of the startup. Here are the most commonly used methods by investors and founders to determine the value of a startup.

Pre Money Valuation + Investments

The most common way to value a startup is to add the value of the investment to the startup’s pre-money valuation. The post-money valuation formula = pre-money valuation + investments. It might be a bit confusing to account for the pool shares when valuing the startup using this method. If the funds existed before the investor came in, then the pre-money valuation consists of it. The other way to include the pool in the valuation is by multiplying the pool shares by the sale price and then adding it to the sum. The valuation can be drastically affected by the strike price. It might look like inflation in the valuation of the company if the strike price is high.

The other way to include the pool in the valuation is by multiplying the pool shares by the sale price and then adding it to the sum. The valuation can be drastically affected by the strike price. It might look like inflation in the valuation of the company if the strike price is high.

The fastest way you can determine the post-money valuation is by taking the amount invested and dividing it by the expected ownership percentage that you would get. For example, Google will like to invest $6 million for 60% ownership of your startup. The post-money valuation is $30 million ($6 million divided by 60%)

Share Price X Number of Diluted Shares

The second method takes into account the share price and the fully diluted number of shares. In this method, you can calculate the post-money valuation by simply multiplying the number of diluted shares with the share price( price per share in the last funding round).

For example, a shareholder expects that if he owns a certain % of the fully diluted shares then it should correspond to the % of post-money valuation. The Ledgy way removes the issue of the money valuation falling lower than the actual value when new shares are purchased at a discounted price. This is so because according to this method Post Money = pre-money + investment.

Discounted Cash Flows

Another way investors choose to evaluate the startup is through discounted cash flows. It is commonly used to determine the money an investor will get from an investment after adjusting the time value of money. The Time value method is based on the assumption that the value of a dollar at present is higher than the value of a dollar tomorrow. The reason behind this is because you can invest the dollar now. The Discounted cash flow method is for investors looking to invest in a startup with an expectation of gaining high returns in the possible future.

For example, assuming a 10% interest rate, if you have $2 in a savings account in a year, it’s worth will be $2.10. Similarly, if you delay payment of $2 this year, the present value of it becomes $1.9. It is not in your savings account, so there will not be any interest gained.

Comparable Companies

Also known as trading multiples or public companies, a comparable company is a method that is used to evaluate your startup by utilizing the metrics of other similar businesses in the same industry and region. This method is operated under the assumption that the businesses similar to your own have relatively same multiples. Multiples are the metrics of businesses such as the EBITDA. The analyst will compile a list of all the available data about similar companies in the same industry and region. They further review them to determine the valuation multiples so that they can compare them to your company.

Companies can likewise be based on transaction multiples. Transaction multiples are the data of the current acquisitions in the same market. The analyst will often compare the multiple by basing them on the acquisition price instead of the stock. Based on all the averages and benchmarks the analyst derived, he uses it to value the company.

Precedent Transactions

It is a method where the indicator and main data used is the price paid for a similar startup in the same market. The past prices are used to create and estimate what the stock price would look like if the company is acquired. Then the analyst uses this data to value the startup.

Which method is the Industry Standard?

There are many ways that you can use to determine the post-money valuation of a startup. But there is no official industry standard for calculating it. The main thing that matters is how it is calculated, understood, and acknowledged by the owners and the investors. This is so because they are the ones that will come to a deal in order to raise funds.

Interested in the post money valuation of your Startup?

To calculate the post-money valuation of a startup might sound easy, but if you are not well-versed with all the information, it could be a disaster. The best way to go around this is by hiring a professional. He will ensure that the valuation is done effectively and the amount is as close to accurate as possible. If not, then there is the possibility of you either overvaluing or under-valuing the startup, which could lead to huge losses.

When evaluating the company, the analyst often uses tools such as Eqvista not to make omissions or mistakes. Eqvista tools also provide you with a summary of all the data, allowing you to see all essential information and to make decisions quickly. Learn more about our professional 409a valuation services today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!