Top 100 CPA Firms for Startups in US

The Million-Dollar Question Every Founder Faces: Should you spend an extra $800 monthly on a specialized CPA when cash is tight and runway is everything?

When we asked founders across industries—from bootstrapped solopreneurs to venture-backed unicorns—about their biggest financial mistake, the answer wasn’t overspending on marketing or hiring too fast. It was picking the wrong accountant.

The numbers are staggering: 87% of successful founders said choosing a CPA based on price rather than expertise cost them thousands in missed deductions, compliance penalties, and strategic missteps. Meanwhile, those who invested in specialized CPAs—despite paying $500-1,000 more monthly—saved an average of $12,000 annually through tax optimization alone. This study reveals the exact frameworks successful founders use to identify CPAs who become strategic partners rather than just compliance checkboxes.

The secret of startup success isn’t your pitch deck or product-market fit—it’s your books!

What CPAs Really Tell Startup Founders?

Our survey with CPA reveals that startup founders most frequently ask about fundraising and cap structure (28%), followed closely by bookkeeping and financial systems (26%), valuation questions (22%), payroll and HR compliance (16%), and regulatory requirements (8%).

While fundraising questions peak during pre-funding periods (40%+), bookkeeping remains consistently high as the “quiet hero” of startup scaling. From cap table chaos that scares away Series A investors to six-figure tax penalties that could have been avoided with early planning, these financial professionals reveal that the startups winning the funding race aren’t the ones with the flashiest projections—they’re the ones with their financial house in order.

The message is crystal clear: build your foundation first, because investors do not just fund dreams—they fund businesses that know their numbers inside and out.

Why Does Your Startup Need a Specialized CPA Firm?

Based on our survey 78% of successful founders emphasized choosing a CPA who can grow with the business:

- Early stage: Basic compliance and tax optimization

- Growth stage: Financial reporting, investor relations

- Scale stage: CFO services, acquisition preparation

The founder responses reveal that CPA selection is not merely a compliance decision but a strategic partnership that can significantly impact startup success. The investment in specialized expertise pays immediate dividends through tax optimization, regulatory compliance, and strategic financial guidance.

While specialized CPAs cost $500-1,000 more monthly, founders reported average annual savings of $8,000-15,000 through tax optimization, avoiding penalties, and strategic guidance. The evidence suggests that founders should budget 15-20% more for specialized CPA services initially, as this investment typically returns 3-5x value through tax savings, avoiding penalties, and strategic guidance that accelerates growth trajectories.

Top 100 CPA Firms for Startups

We have compiled a comprehensive database of the US-based top 100 CPA firms, specializing in startup and emerging company accounting. Each of these CPA firms has been screened for:

- Deep industry expertise over firm reputation

- Proactive strategic thinking over reactive compliance

- Modern technology integration over traditional methods

- Responsive communication over hierarchical structures

- Growth-oriented mindset over cost minimization

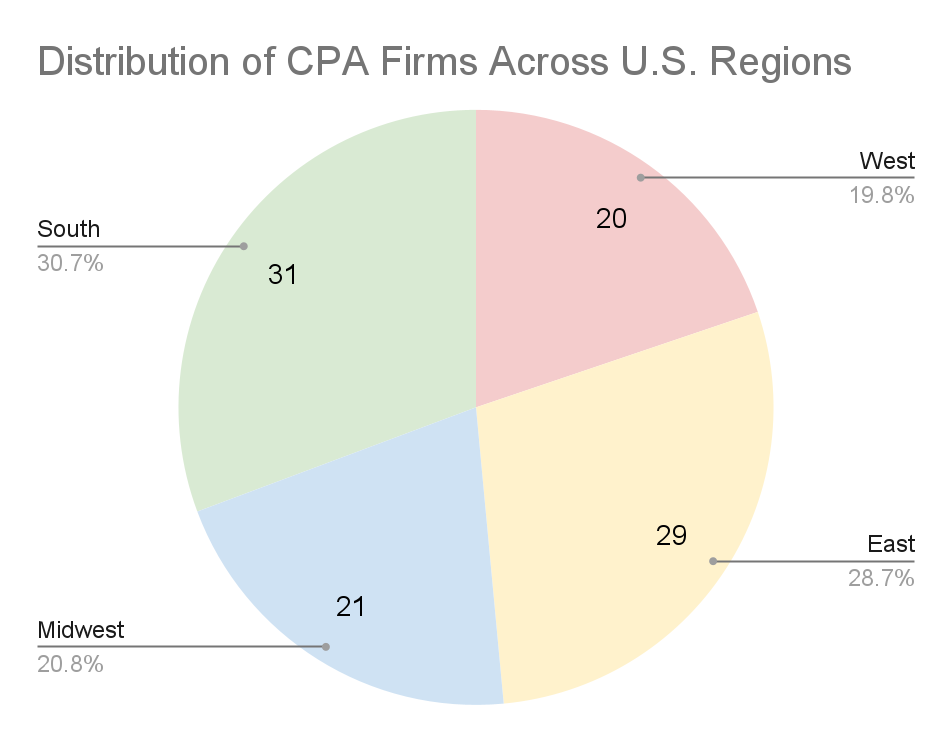

According to Eqvista’s research, CPA firms’ locations are indeed spread throughout the key US business sources, with the largest presence in New York, Ohio, and California. These states are also the biggest economies and major financial ecosystems, so they are a natural breeding ground for accounting and advisory services.

The CPA firm distribution across the regions in the U.S. indicates that the South, followed by the East, are the top performers, with both registering the majority of firms in the country. The Midwest is an important share too, and the West, though slightly lower in the numbers, still applies significantly to the overall picture. This dispersion shows that although there is reasonably good distribution of opportunities in CPA services, there is more concentration in the South and East (59.4%) than there is in the Midwest and West (40.6%).

| Firm | State |

|---|---|

| LBMC PC | Tennessee, United States |

| Anchin Block & Anchin LLP | New York, United States |

| Schneider Downs & Co. Inc. | Pennsylvania, United States |

| Berkowitz Pollack Brant | Florida, United States |

| Bennett Thrasher LLP | Georgia, United States |

| BeachFleischman PLLC | Arizona, United States |

| Abdo LLP | Minnesota, United States |

| AdamsBrown LLC | Kansas, United States |

| BMSS LLC | Alabama, United States |

| Bober Markey Fedorovich & Company | Ohio, United States |

| Brady Martz & Associates PC | North Dakota, United States |

| Brady Ware & Company | Ohio, United States |

| Calvetti Ferguson | Texas, United States |

| Centri Business Consulting | Pennsylvania, United States |

| Clark Nuber PS | Washington, United States |

| Dean Dorton Allen Ford PLLC | Kentucky, United States |

| EEPB | Texas, United States |

| Freed Maxick CPAs PC | New York, United States |

| Frost PLLC | Arkansas, United States |

| GBQ Partners LLC | Ohio, United States |

| Geffen Mesher | Oregon, United States |

| Gray Gray & Gray LLP | Massachusetts, United States |

| H&CO LLP | Florida, United States |

| Hannis T. Bourgeois LLP | Louisiana, United States |

| Hawkins Ash CPAs LLP | Wisconsin, United States |

| Haynie & Company | Utah, United States |

| James Moore & Co. PL | Florida, United States |

| KraftCPAs | Tennessee, United States |

| KRD Ltd. | Illinois, United States |

| Kreischer Miller | Pennsylvania, United States |

| KSDT CPA | Florida, United States |

| LGA LLP | Massachusetts, United States |

| MaloneBailey LLP | Texas, United States |

| Maxwell Locke & Ritter LLP | Texas, United States |

| Meaden & Moore LLP | Ohio, United States |

| MMB+CO | New York, United States |

| Moore Colson CPAs and Advisors | Georgia, United States |

| Nichols Cauley | Georgia, United States |

| Pease Bell CPAs LLC | Ohio, United States |

| Perelson Weiner LLP | New York, United States |

| Perkins & Co. | Oregon, United States |

| Porte Brown LLC | Illinois, United States |

| RBT CPAs LLP | New York, United States |

| Richey May & Co | Colorado, United States |

| Sax LLP | New Jersey, United States |

| Sensiba LLP | California, United States |

| SingerLewak LLP | California, United States |

| Smith Schafer | Minnesota, United States |

| Smolin Lupin & Co. LLC | New Jersey, United States |

| Squire & Co. PC | Utah, United States |

| Stambaugh Ness | Pennsylvania, United States |

| SVA Certified Public Accountants SC | Wisconsin, United States |

| Tanner LLC | Utah, United States |

| Topel Forman LLC | Illinois, United States |

| Walter Shuffain | Massachusetts, United States |

| WilkinGuttenplan | New Jersey, United States |

| Windham Brannon LLC | Georgia, United States |

| Wiss & Company LLP | New Jersey, United States |

| 415 Group Inc | Ohio, United States |

| Axley & Rode LLP | Texas, United States |

| Baldwin CPAs | Kentucky, United States |

| Bartlett Pringle & Wolf LLP | California, United States |

| Bauknight Pietras & Stormer PA | South Carolina, United States |

| Beaird Harris PLLC | Texas, United States |

| Berman Hopkins | Florida, United States |

| BFBA LLP | California, United States |

| Bowers & Company CPAs PLLC | New York, United States |

| Bregante + Company LLP | California, United States |

| Brock and Company CPAs PC | Colorado, United States |

| Cerini & Associates LLP | New York, United States |

| CG Tax Audit & Advisory | New Jersey, United States |

| Chortek LLP | Wisconsin, United States |

| Cooper Norman PLLC | Idaho, United States |

| Corrigan Krause | Ohio, United States |

| Coulter & Justus PC | Tennessee, United States |

| Crosslin PLLC | Tennessee, United States |

| CST Group CPAs PC | Virginia, United States |

| Dennis Gartland & Niergarth | Michigan, United States |

| Dent Moses LLP | Alabama, United States |

| Draffin & Tucker LLP | Georgia, United States |

| Fiondella Milone & LaSaracina LLP | Connecticut, United States |

| Firley Moran Freer & Eassa CPA PC | New York, United States |

| Frazer LLP | California, United States |

| Gallagher Flynn & Company LLP | Vermont, United States |

| Gorfine Schiller & Gardyn | Maryland, United States |

| Haefele Flanagan | New Jersey, United States |

| Hantzmon Wiebel LLP | Virginia, United States |

| Harris & Co. LLC | Idaho, United States |

| HLB Gross Collins PC | Georgia, United States |

| Hoffman Stewart & Schmidt PC | Oregon, United States |

| HW&Co. | Ohio, United States |

| Insero & Co. CPAs LLP | New York, United States |

| JamisonMoneyFarmer PC | Alabama, United States |

| JLK Rosenberger | California, United States |

| Johnson O’Connor Feron & Carucci LLP | Massachusetts, United States |

| KDP Certified Public Accountants | Oregon, United States |

| Ketel Thorstenson LLP | South Dakota, United States |

| KNAV Advisory Inc. | Georgia, United States |

| KPM CPAs & Advisors | Missouri, United States |

| Barton CPA | Texas, United States |

| Inkle | Delaware, United States |

Spotlight Top 15 CPA Firms for Startups

We have shortlisted a range of 15 top-tier CPA firms across the U.S. that have crafted dedicated teams serving startup founders.

1. SingerLewak LLP – Los Angeles, CA

SingerLewak LLP, based in Los Angeles, CA, serves venture-backed companies across growth stages, offering auditing, compliance, and complex transaction advisory. The firm uses advanced audit technology and tailored financial reporting tools to streamline processes. It supports fundraising with VC due diligence, financial modeling, and SEC filings. Strategic advisory includes fractional CFO and operational consulting, with flexible engagement models. SingerLewak also excels in entertainment finance, leveraging expertise in the LA market.

2. Sensiba LLP – Pleasanton, CA

Sensiba LLP, based in Pleasanton, CA, supports early- to mid-stage tech startups with scalable growth and exit preparation. As a Certified B Corp, the firm uses tech-driven accounting and cloud platforms for real-time insights. It offers fundraising support, including investor reporting and cap table management. Managing Partner John Sensiba leads exclusive C-level networking and mentorship. Transparent pricing scales with client needs, while emphasizing sustainability and community engagement.

3. Clark Nuber PS – Bellevue, WA

Clark Nuber PS in Bellevue, WA supports Pacific Northwest tech startups from seed to high growth stages. It offers cloud-based accounting, real-time financial dashboards, audit, and VC due diligence support. The firm’s outsourced CFO services provide strategic financial leadership without full-time costs. With strengths in SaaS, manufacturing, and biotech, Clark Nuber is recognized for client service excellence and innovation within the Seattle tech ecosystem.

4. Anchin Block & Anchin LLP – New York, NY

Anchin Block & Anchin LLP in New York specializes in later-stage, rapidly scaling fintech, media, and healthcare IT startups. The firm uses AI tools and proprietary risk platforms to enhance compliance efficiency. Services include SEC filings, audit readiness, and capital markets advisory for VC-backed companies. Their strategic advisory focuses on exit planning, M&A, and IPO readiness, with deep expertise navigating New York’s complex financial and regulatory environment.

5. Schneider Downs & Co. Inc. – Pittsburgh, PA

Schneider Downs & Co. Inc., based in Pittsburgh, PA, supports startups from formation to scaling in regional and national emerging tech markets. The firm offers technology-driven solutions like automated bookkeeping and financial modeling, optimizing R&D tax credits and investor-ready reporting. Services include fractional CFO and interim controller roles, blending the resources of a top 60 national firm with personalized boutique attention for startups.

6. LBMC PC – Brentwood, TN

LBMC PC, based in Brentwood, TN, is Tennessee’s largest professional services firm, evolving from traditional accounting since 1984 into a multidisciplinary provider for startups in healthcare tech, manufacturing, and SaaS. It integrates automation, cloud accounting, and data analytics to deliver strategic financial planning, operational optimization, and fundraising readiness. Offering fractional CFO and outsourced back-office services, LBMC caters to early-stage founders with flexible models and extends reach into broader Southeastern markets.

7. Bennett Thrasher LLP – Atlanta, GA

Bennett Thrasher LLP, headquartered in Atlanta, GA, supports emerging companies with tax, audit, and advisory services. With expanding Florida operations, the firm serves early- to growth-stage startups in technology, professional services, and consumer products. Utilizing cloud accounting and data analytics, they provide real-time financial insights. Services include fractional CFO support, investor-ready financials for capital raises, and multi-state compliance, enabling founders to enter new markets while managing operational costs efficiently.

8. Gray Gray & Gray LLP – Canton, MA

Gray, Gray & Gray LLP in Canton, MA, combines 80+ years of accounting expertise with a focus on tech startups and emerging companies in New England. The firm offers cloud-enabled accounting, advanced tax planning, and outsourced CFO services. It supports growth through fundraising preparation, R&D credit maximization, and strategic scaling advice. Gray, Gray & Gray integrates traditional accounting discipline with innovation, leveraging strong ties to Boston’s entrepreneurial and research communities.

9. Berkowitz Pollack Brant – Miami, FL

Berkowitz Pollack Brant, based in Miami, FL, is a leading Southeastern U.S. accounting firm serving entrepreneurs, executives, and high-growth startups domestically and internationally. Leveraging Miami’s strategic position, the firm excels in cross-border tax structuring, international compliance, and expansion strategies. Services include cloud and forensic accounting, transaction advisory, fractional CFO, and investor reporting tools. They support VC- and PE-backed companies through scaling and exit processes with strong expertise and personalized solutions.

10. Sax LLP – Parsippany, NJ

Sax LLP, with offices in Parsippany, Ewing, NJ, and NYC, serves privately held companies, focusing on tech startups in Greater NYC. The firm’s entrepreneurial advisors deliver growth-driven accounting, audit, tax, and strategic services, including stock compensation, equity planning, valuation, and M&A advisory. Sax leverages accounting automation and offers fractional CFO services to support fundraising and scaling. Its multidisciplinary expertise spans cybersecurity consulting to wealth management, addressing business and personal financial goals.

11. Windham Brannon LLC – Atlanta, GA

Windham Brannon LLC in Atlanta, GA excels in advisory, assurance, and tax services for tech startups, including fintech. The firm offers technology-driven accounting and strategic CFO advisory to help startups efficiently scale. Utilizing cloud platforms, it provides real-time financial insights focused on operational optimization and compliance. With tailored pricing and deep expertise in Southeast tech startups, Windham Brannon is a trusted partner for startups aiming for growth and regulatory adherence.

12. Wiss & Company LLP – Florham Park, NJ

Wiss & Company LLP, headquartered in Florham Park, NJ, offers over 50 years of experience with a strong focus on tech startups. The firm provides strategic advisory, tax planning, and business consulting alongside advanced automation and fractional CFO services. Known for optimizing R&D tax credits and handling revenue recognition challenges, Wiss supports startups through flexible engagement models, helping them navigate complex regulations while fostering long-term growth and scalability.

13. GBQ Partners LLC – Columbus, OH

GBQ Partners LLC, based in Columbus, OH, is a leading regional CPA and consulting firm serving Midwest startups, especially in technology sectors like SaaS, healthcare tech, and manufacturing. The firm offers cloud-based financial platforms and fractional CFO services, supporting startups from formation to expansion. Known for its hands-on approach to fundraising readiness, financial modeling, and audit preparation, GBQ is a trusted partner for scaling startups in the Midwest.

14. LGA LLP – Woburn, MA

LGA LLP, based in Woburn, MA, serves Boston’s startup ecosystem, focusing on biotech, fintech, and enterprise software. With decades of experience, LGA offers tailored accounting, tax, and advisory services using modern cloud technology. The firm provides strategic CFO advisory, supporting compliance, risk management, and fundraising. Known for sector expertise and strong ties to Boston’s innovation hubs, LGA guides startups in sustainable scaling and exit preparation.

15. Tanner LLC – Salt Lake City, UT

Tanner LLC, based in Salt Lake City, UT, is a premier independent CPA firm serving the Silicon Slopes tech corridor and Mountain West startups. The firm offers tailored accounting, tax, and advisory services with cloud-based tools and automation. Tanner provides fractional CFO services and personalized guidance, helping startups navigate fundraising, compliance, and operational scaling with a collaborative partnership approach focused on long-term growth.

How to Find Right CPA Firms for your startup?

CPA selection should be treated as a strategic partnership decision rather than a cost-minimization exercise. The founders who invested in specialized expertise early reported significantly better financial outcomes and fewer compliance issues as they scaled.

Analyzing responses from founders across diverse industries, several critical patterns emerge regarding CPA selection for startups. The overwhelming consensus is that industry-specific expertise trumps general accounting knowledge and that business model understanding is more valuable than firm prestige.

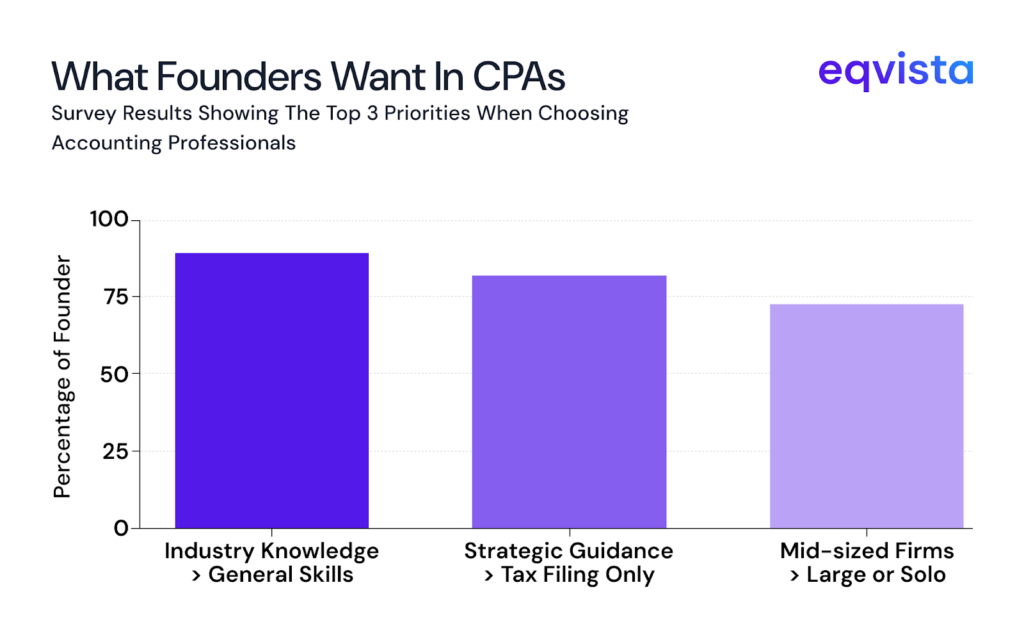

Based on our recent survey, the data shows that:

- 87% of founders emphasized that industry-specific knowledge trumps general accounting skills. SaaS/tech companies (31% of responses) particularly need CPAs who understand revenue recognition, R&D credits, and equity compensation.

- 73% of founders advised against both large firms (too bureaucratic) and solo practitioners (limited expertise), instead recommending mid-sized firms that combine expertise with personal attention.

- 82% warned against CPAs who only handle tax filing rather than providing strategic guidance. The most successful founders found CPAs who act as financial advisors, not just compliance processors.

Key Questions to Ask:

Based on their experiences with CPAs, these founders recommend asking the following questions:

- “How many businesses like ours have you worked with?”

- “What industry-specific deductions should we be claiming?”

- “How do you handle our revenue model for tax purposes?”

- “What’s your process for quarterly tax planning?”

- “Can you integrate with our existing software stack?”

Most Critical CPA Capabilities

The analysis reveals five essential capabilities,

- Cash Flow Management (89% of responses): Understanding irregular revenue patterns, seasonal fluctuations

- Revenue Recognition (67% for SaaS/recurring revenue models): Proper handling of subscriptions, deferred revenue

- Tax Strategy & Credits (78% of responses): R&D credits, Section 179 deductions, strategic planning

- Equity & Fundraising Support (45% of tech startups): Cap table management, investor reporting

- Multi-State Compliance (34% of responses): Sales tax, nexus rules, licensing requirements

Red Flags To avoid when selecting CPAs

Founders consistently warned against CPAs who:

- Focus only on tax compliance rather than strategic planning (mentioned by 82% of founders)

- Lack responsiveness – taking more than 24-48 hours for urgent matters (78% of responses)

- Use outdated technology – inability to integrate with modern accounting software (56% of responses)

- Treat all businesses identically – cookie-cutter approaches (91% of responses)

- Cannot explain complex concepts simply – poor communication skills (67% of responses)

The Bottom Line

Professional accounting isn’t an expense; it’s an infrastructure. Just as you wouldn’t build your product on unreliable servers, you shouldn’t build your business on unreliable financial data.

The right CPA firm becomes your financial co-pilot, helping you navigate growth challenges, optimize for key metrics, and position your startup for successful funding rounds and eventual exit.

Next Steps:

- Calculate your current monthly time investment in financial tasks

- Schedule consultations with the top 3-5 firms that match your industry and stage

- Ask for references from portfolio companies at similar stages

Don’t let accounting be the bottleneck that limits your growth

Stop wasting time vetting firms that don’t understand startups. At Eqvista, we’ve done the heavy lifting for you. Our team has personally evaluated and curated a database of the Top 100 CPA firms in the USA that exclusively focus on accounting for startups and emerging companies.

Ready to make the right choice? Contact us