Complete List of Unicorn Companies 2024

Last Updated: March 2024

Despite facing massive obstacles during the pandemic, private companies continue to grow. 2023 is turning out to be exciting for startups. More and more investors are funding small and medium startups that have potential in the innovative sector. Many industries have been on the rise, especially the tech industry. Recent data shows that this year the demand has been high for startups. This is not only proving to be an excellent opportunity for entrepreneurs but also for investors.

Unicorn Companies 2024

Startups or companies in industries like the tech sector often tend to cross thresholds such as the billion-dollar mark. When they do and are worth such amounts, they are given certain titles.

What does a unicorn company mean?

When a venture capital company’s net worth reaches the billion-dollar mark, they are called a “unicorn” company. Aileen Lee, the founder of CowboyVC, popularised calling privately held companies that achieved this threshold as a Unicorn company. Within the human resource sector, a recruitment marvel is also referred to as a unicorn. When hiring, HR managers have high expectations. They often tend to look for candidates with higher qualifications than what is required for the position. In other words, managers look for a Unicorn. This creates a gap between the expectation of the ideal candidate and the available candidates.

Features of A Unicorn Company

It is not easy for a company to achieve unicorn status, but some do. Each of these companies that achieve this status has things in common. Here are the features of a unicorn company.

- Private businesses: The main feature of a unicorn company is that the company is private.

- High-Tech: A recent research shows that a majority of the companies that have managed to achieve the unicorn status are software and the rest are either hardware or product & services companies.

- Innovators: It is commonly seen that companies that are the first to do something unique and different achieve unicorn status. They innovate and change the norms, creating a new necessity. Additionally, such companies regularly keep innovating over the lifetime of the company to stay ahead of their competitors.

- Consumer-focused companies: When looked at, around 62% of the unicorn companies are customer-focused. Their main aim is to make things easy and simple for the people, being a part of their daily lives. One example is Spotify, they made listening to music from every corner of the world easy.

- Disruptive innovation: One other thing that is common in these companies is that they have disrupted the industries that they are in like changing the norms and making things better. Some examples are Tesla, Airbnb, and Uber.

How many unicorn companies are there globally?

There are over 1400 unicorn companies globally today. With a failure rate of 70-80% of startups within the first five years of operations, achieving a billion-dollar net worth is not an easy task. However, some companies have managed to do so despite the hurdles. The world of venture capital is booming, leading to many startups and companies achieving this threshold.

Current unicorn companies’ trends

- Current unicorns raised over $800B in over 7,000 financing rounds from 8000 investors and have a cumulative valuation of $4.3T.

- FinTech, SaaS, E-commerce & AI are top unicorn industries.

- Software & IT are the top industries for unicorns (48%), followed by finance & IT.

- The US holds over half of the global unicorns, with a strong presence in enterprise tech & healthcare.

- The US leads in unicorns, followed by China, India, UK & Germany. (700+ US unicorns)

- The top five US unicorns by value are SpaceX ($125B), Stripe ($50B), Instacart ($39B), Databricks ($38B), and Juul ($38B).

- Top unicorn investors: Tiger Global, Accel, Andreessen Horowitz & Sequoia Capital. Their unicorn investments include Juul, Waymo, ByteDance, Databricks, and Square.

List of Unicorn Companies 2024

There are over 1517 unicorn companies globally today. Here is the list of the top 100 unicorn companies:

| S. No. | Company | Post Money Value | Total Equity Funding | Lead Investors Include | Country |

|---|---|---|---|---|---|

| 1 | ByteDance | $220B | $8B | Kohlberg Kravis Roberts Japan, Sequoia Capital | China |

| 2 | Ant Group | $150B | $19B | GIC, Temasek Holdings | China |

| 3 | SpaceX | $125B | $9B | Mirae Asset Venture Investment | United States |

| 4 | Reliance Retail | $100B | $8B | Abu Dhabi Investment Authority | India |

| 5 | Shein | $66B | $4B | General Atlantic, Mubadala | China |

| 6 | Reliance Jio | $58B | $20B | India | |

| 7 | Stripe | $50B | $9B | Andreessen Horowitz, Baillie Gifford | United States |

| 8 | Databricks | $43B | $4B | NVIDIA, T. Rowe Price | United States |

| 9 | Checkout.com | $40B | $2B | Tiger Global Management | United Kingdom |

| 10 | JUUL | $38B | $15B | Altria | United States |

| 11 | Revolut | $33B | $2B | Woodford Investment Management | United Kingdom |

| 12 | Fanatics | $31B | $5B | Clearlake Capital Group | United States |

| 13 | Cruise | $30B | $8B | General Motors | United States |

| 14 | Waymo | $30B | $6B | Fidelity, Perry Creek Capital | United States |

| 15 | Alibaba Bendi Shenghuo Fuwu Gongsi | $30B | $4B | Alibaba Group, SoftBank Vision Fund | China |

| 16 | OpenAI | $29B | $10B | Microsoft | United States |

| 17 | Canva | $25B | $572M | T. Rowe Price | Australia |

| 18 | Chime | $25B | $2B | Sequoia Capital Global Equities | United States |

| 19 | Epic Games | $23B | $8B | The Walt Disney Company | United States |

| 20 | BYJU'S | $22B | $5B | Qatar Investment Authority | India |

| 21 | Xiaohongshu | $20B | $918M | Temasek Holdings, Tencent | China |

| 22 | J&T Express | $20B | $5B | Boyu Capital, Hillhouse Investment | Indonesia |

| 23 | FNZ | $20B | $1B | CPP Investments, Motive Partners | United Kingdom |

| 24 | Lineage Logistics | $18B | $7B | D1 Capital Partners | United States |

| 25 | JD Digits | $18B | $5B | APOFCO, CICC | China |

| 26 | Miro | $18B | $476M | ICONIQ Growth | United States |

| 27 | Yuanfudao | $17B | $4B | YF Capital | China |

| 28 | Trendyol Group | $17B | $2B | General Atlantic, SoftBank Vision Fund | Turkey |

| 29 | Discord | $15B | $979M | Dragoneer Investment Group | United States |

| 30 | Gopuff | $15B | $3B | Robert Iger | United States |

| 31 | Rapyd | $15B | $770M | Tal Ventures, Target Global | United Kingdom |

| 32 | Genki Forest | $15B | $721M | Temasek Holdings | China |

| 33 | CloudKitchens | $15B | $1B | Saudi Arabia's Public Investment Fund | United States |

| 34 | Bitmain | $15B | $765M | Crimson Ventures | China |

| 35 | GAC Aion New Energy Automobile | $14B | $3B | - | China |

| 36 | Plaid | $13B | $734M | Altimeter Capital | United States |

| 37 | OpenSea | $13B | $427M | Coatue, Paradigm | United States |

| 38 | Grammarly | $13B | $400M | Baillie Gifford, BlackRock | United States |

| 39 | Celonis | $13B | $2B | Qatar Investment Authority | Germany |

| 40 | Zeekr | $13B | $2B | Geely, Geely Auto Group | China |

| 41 | Devoted Health | $13B | $2B | Fearless Ventures, GIC | United States |

| 42 | Faire | $13B | $2B | Shopify | United States |

| 43 | Brex | $12B | $1B | Greenoaks, TCV | - |

| 44 | PhonePe | $12B | $3B | General Atlantic | India |

| 45 | GoodLeap | $12B | $0 | - | United States |

| 46 | Biosplice Therapeutics | $12B | $778M | aMoon Fund, Eventide | United States |

| 47 | Xingsheng Youxuan | $12B | $5B | Ontario Teachers' Pension Plan | China |

| 48 | Deel | $12B | $679M | Coatue | United States |

| 49 | Getir | $12B | $2B | Mubadala, Tiger Global Management | Turkey |

| 50 | Northvolt | $12B | $4B | Caisse de Depot et Placement du Quebec | Sweden |

| 51 | Airtable | $12B | $1B | XN | United States |

| 52 | Dunamu | $12B | $741M | IMM Investment | South Korea |

| 53 | The Access Group | $12B | $1B | Hg, TA Associates | United Kingdom |

| 54 | Rippling | $11B | $1B | Greenoaks | United States |

| 55 | Swiggy | $11B | $4B | Invesco | India |

| 56 | Notion | $10B | $343M | Coatue, Sequoia Capital | United States |

| 57 | Alchemy | $10B | $564M | Lightspeed Venture Partners, Silver Lake | United States |

| 58 | KuCoin | $10B | $180M | Susquehanna International Group (SIG) | Seychelles |

| 59 | Digital Currency Group | $10B | $0 | OMERS Ventures | United States |

| 60 | Ripple | $10B | $294M | Tetragon Financial Group Limited | United States |

| 61 | $10B | $1B | Fidelity | United States | |

| 62 | Zuoyebang | $10B | $3B | FountainVest Partners, Tiger Global Management | China |

| 63 | Chehaoduo | $10B | $4B | H Capital Advance, Sequoia Capital China | China |

| 64 | Talkdesk | $10B | $497M | Viking Global Investors | United States |

| 65 | Thrasio | $10B | $2B | Advent International, Silver Lake | United States |

| 66 | Lalamove | $10B | $2B | Hillhouse Investment, Sequoia Capital China | Hong Kong |

| 67 | Wiz | $10B | $900M | Greenoaks, Index Ventures | Israel |

| 68 | Mahindra Electric Automobile | $10B | $388M | Temasek Holdings | India |

| 69 | OYO | $10B | $3B | Microsoft | India |

| 70 | Gusto | $10B | $746M | Friends & Family Capital | United States |

| 71 | ServiceTitan | $10B | $1B | Thoma Bravo | United States |

| 72 | Navan | $9B | $1B | Greenoaks | United States |

| 73 | Tata Passenger Electric Mobility | $9B | $988M | TPG Rise Climate Fund | India |

| 74 | N26 | $9B | $2B | Coatue, Third Point Ventures | Germany |

| 75 | Niantic | $9B | $770M | Coatue | United States |

| 76 | Tanium | $9B | $775M | Salesforce Ventures | United States |

| 77 | Yanolja | $9B | $2B | SoftBank Vision Fund | South Korea |

| 78 | VAST Data | $9B | $381M | Fidelity | United States |

| 79 | HeyTea | $9B | $594M | Coatue, Hillhouse Investment | China |

| 80 | EV Co | $9B | $486M | - | India |

| 81 | Ping An Healthcare Management | $9B | $1B | SBI Group, SoftBank Vision Fund | China |

| 82 | Kavak | $9B | $2B | General Catalyst | Mexico |

| 83 | Nuro | $9B | $2B | Tiger Global Management | United States |

| 84 | Chainalysis | $9B | $537M | GIC | United States |

| 85 | Pony.ai | $9B | $1B | NEOM Investment Fund | United States |

| 86 | Anduril Industries | $8B | $2B | Valor Equity Partners | United States |

| 87 | Personio | $8B | $724M | Greenoaks | Germany |

| 88 | Bolt | $8B | $2B | Fidelity, Sequoia Capital | Estonia |

| 89 | Tipalti | $8B | $549M | G Squared | United States |

| 90 | Lacework | $8B | $2B | Google Ventures | United States |

| 91 | The CrownX | $8B | $750M | Alibaba Group, BPEA EQT | Vietnam |

| 92 | Tempus | $8B | $920M | United States | |

| 93 | DJI | $8B | $105M | Accel | China |

| 94 | Flexport | $8B | $2B | Shopify | United States |

| 95 | Fireblocks | $8B | $1B | D1 Capital Partners, Spark Capital | United States |

| 96 | THG Ingenuity | $8B | $2B | SoftBank | United Kingdom |

| 97 | FalconX | $8B | $474M | B Capital, GIC | United States |

| 98 | StarkWare Industries | $8B | $261M | Alameda Research, Coatue | Israel |

| 99 | Dream11 | $8B | $1B | D1 Capital Partners, DST Global | India |

| 100 | Octopus Energy | $8B | $3B | Canada Pension Plan Investment Board | United Kingdom |

| 101 | Caris Life Sciences | $8B | $1B | Sixth Street | United States |

Source: Crunchbase.

Top 10 Companies’ Total Funding Amounts

Some of the most successful startups get funding from different sources. Funding can come from VCs, angel investors, and other investors looking to invest in promising projects. The following table shows the 10 highest total funding amounts that some companies have received:

| S. No. | Company | Post Money Value | Total Equity Funding | Lead Investors Include | Country |

|---|---|---|---|---|---|

| 1 | Reliance Jio | $58B | $20B | India | |

| 2 | Ant Group | $150B | $19B | GIC, Temasek Holdings | China |

| 3 | JUUL | $38B | $15B | Altria | United States |

| 4 | OpenAI | $29B | $10B | Microsoft | United States |

| 5 | SpaceX | $125B | $9B | Mirae Asset Venture Investment | United States |

| 6 | Stripe | $50B | $9B | Andreessen Horowitz, Baillie Gifford | United States |

| 7 | ByteDance | $220B | $8B | Kohlberg Kravis Roberts Japan, Sequoia Capital | China |

| 8 | Reliance Retail | $100B | $8B | Abu Dhabi Investment Authority | India |

| 9 | Cruise | $30B | $8B | General Motors | United States |

| 10 | Epic Games | $23B | $8B | The Walt Disney Company | United States |

| 14 | Waymo | $30B | $6B | Fidelity, Perry Creek Capital | United States |

Issue Company Shares on Eqvista

Raising funds is an essential part of any private business, let alone a unicorn company, and should be done professionally. One way to keep track without any mistakes is by issuing them through the use of the software. Eqvista is a tool through which you can issue shares to your shareholders accurately. Not only will you be able to see the summary of the shareholders through our dashboard feature, but you can also see and manage your cap table through the same tool.

Here is a step by step guide on how to issue shares on Eqvista:

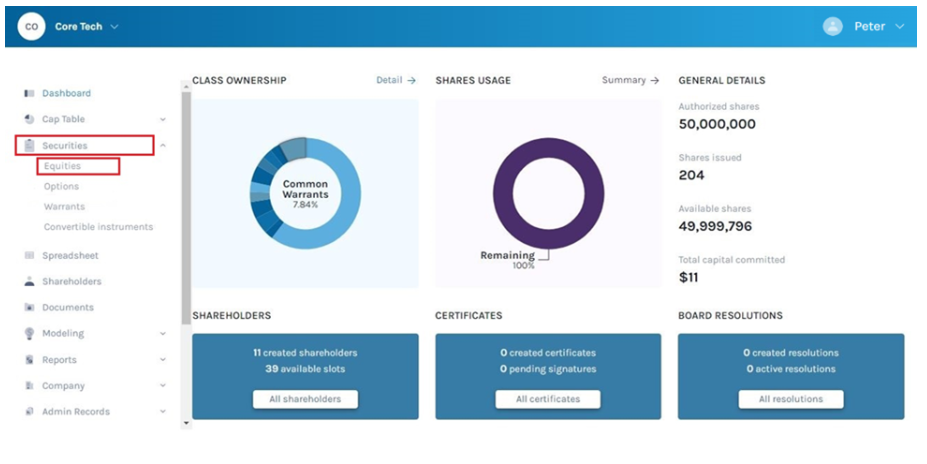

Step 1: Login into your Eqvista account and select the company in which you want to issue shares to investors. Once you have selected the company you will be directed to the dashboard.

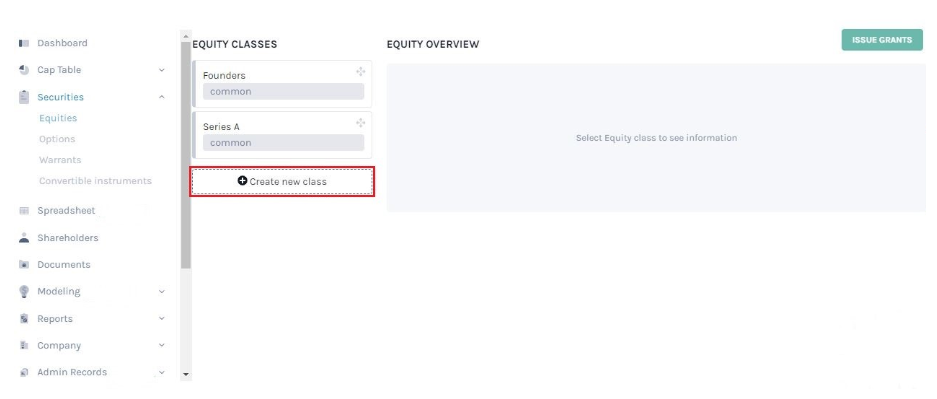

Step 2: Now you will have to select the securities option to the left of the screen, then choose equity.

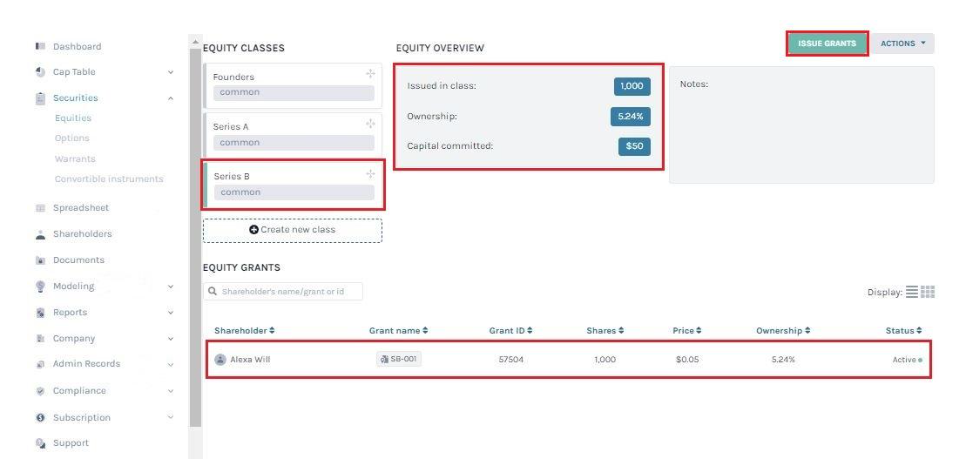

To issue the shares you will have to click on the option issue grants at the top right of the screen. Then on the next page, select the share class name in which you want to issue the shares to investors, and add new grants.

Step 3: Select the shareholder’s name. If in any case the shareholder name is not included in the list, you can choose the option to add a new shareholder.

Once you have completed filling the form, click on submit.

After this, you will be directed to this page showing the shares that you have issued. This page also gives you a small summary of the shares that you have issued to the shareholders in each class.

Interested to learn more about the top unicorn companies?

Companies raise funds to either expand or fund their daily operations; this allows them to grow and reach a wider range of customers and should be done professionally. Eqvista is a professional platform that not only allows you to issue company shares but also track them. You can also use other tools to have cap table management, 409a valuations, and manage your shares. Contact us today!