Difference between Series A, B, C – Fundraising Guide

Series A, B, and C funding is reserved for small businesses with outstanding growth potential or snowballing businesses and are ready to continue expanding.

Starting up a business without finance is next to impossible. A founding team must arrange and manage the startup funding. A startup cannot achieve the targeted objectives no matter how great or viable the idea is. Even building a minimum viable product (MVP) in startups needs seed capital, which can be arranged from family, friends, incubators, accelerators, and business angles.

Series A, B, C Funding

Startups require funding at different stages of their growth and life cycle. At an embryonic stage, a startup requires Series A funding; once the startup decides to launch its products and services, it requires another level of funding which is essentially Series B.

The types of funding differ and depend upon multiple factors like sector, the industry they function, growth stage, the overall macroeconomic scenario of the incorporated region.

Understanding Series Funding

Startup pitches their idea in various venture capital fund houses in several rounds. Investors assess their idea in many stages. For every phase, they have a different evaluative basis.

The amount is raised in multiple rounds of investments, and the company’s valuation is done. The company seems to have increased chances of accomplishment, evidence of notion and customer base surge will get the final approval to get investment.

Types of Series Funding

There are mainly three rounds of investments in which a company can get funds which are: Series A, Series B and Series C. The difference between the three are explained below:

- Series A Funding – A company may consider series A funding once it has achieved some level of operational stability (a stable user base, consistent revenue statistics, or another KPI) in order to enhance its user base and product offerings.

In this stage of Series A funding, developing a long-term business model is essential. Investors are looking for start-ups with innovative concepts and a clear plan for turning such concepts into profitable enterprises. - Series B Funding – This round of funding is all about taking businesses to the next level, past the development phase. Investors help startups get thereby expanding market reach. Series B funding helps grow the company to meet the large-scale demand levels. Building a mature product and growing a team requires quality talent acquisition. Bulking up on sales, advertising, tech, support, and employees costs a firm a few pennies.

- Series C Funding – Companies acquiring funds in this series of funding are established quite well. The companies are looking for additional funding to help them develop new products, expand into new markets, or acquire other companies. In Series C funding, investors involved are- Hedge Funds, Investment Banks, Private Equity Firms, and large secondary markets.

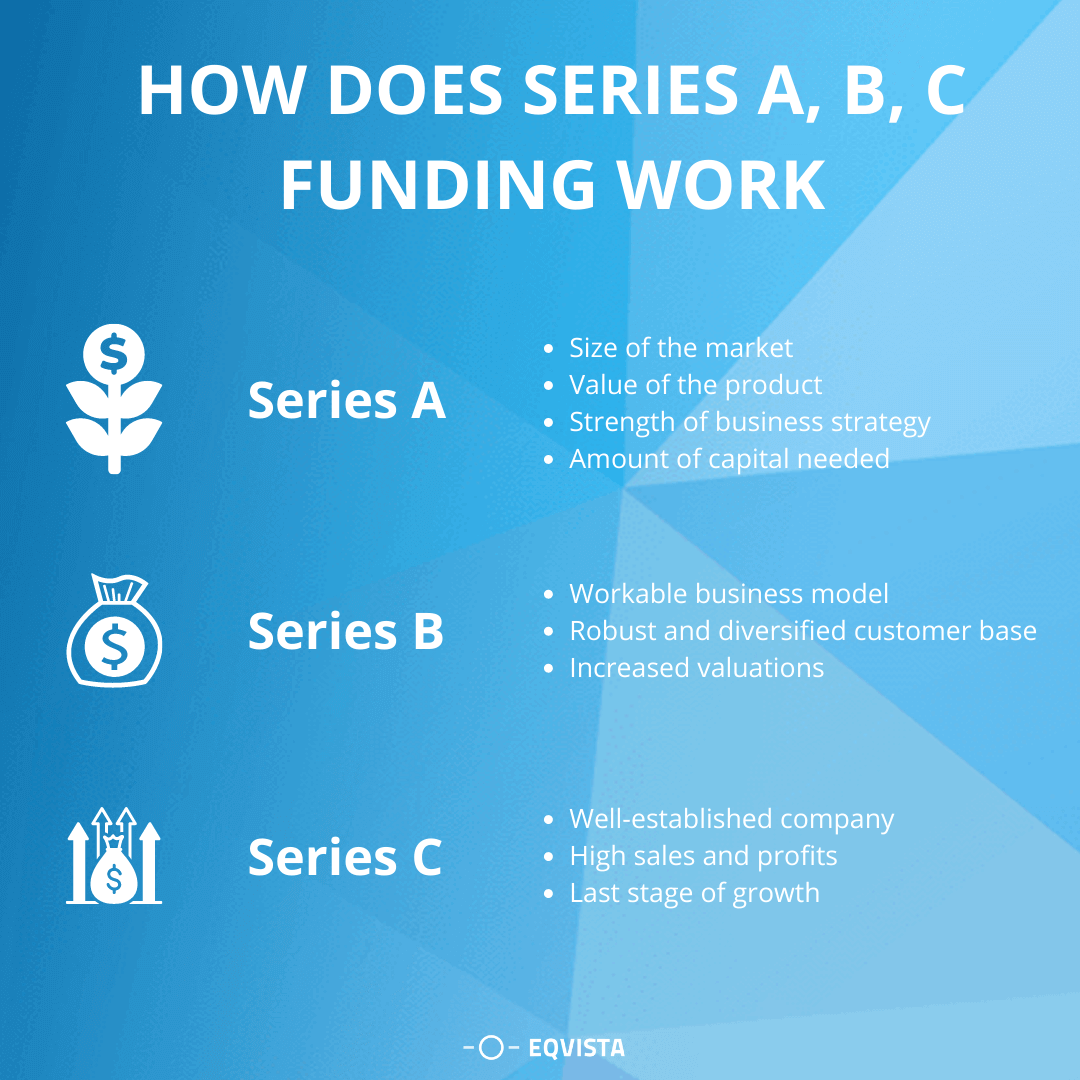

How does series A, B, C Funding work?

Before understanding how this series funding works, let us know about the participants a pitching ground has. Along with that, one needs to understand their mindsets.

In the first place, there is the investment seeker, or it could be said that startup companies are hoping to gain funding for their company. As the business matures, it tends to grow through a series of funding rounds. It’s common for a company to start with seed capital and continue with Series A, B, and C funding rounds.

On the other hand, some investors wish for businesses to grow and profit because they support entrepreneurship and believe in the objectives and growth charts of the companies. They also hope to gain back from their investment.

Now let us understand how exactly these rounds of series funding works?

- Series A – There are a number of important requirements that must be met in order to secure Series A funding. These factors include the size of the market, the value of the product, the strength of the business strategy, and the amount of capital needed. Even if the company has a proven product or business model, it may not have enough revenue to expand. The company will then seek additional funding from venture capitalists or individual investors.

- Series B – Series B funding comes down to scaling business operations. It would be best to have more than a workable business model to reach this stage. Once a startup has a robust and diversified customer base, the founder can opt for the series B funding stage. The Series B fundraising round has allowed companies to enhance their business, which has resulted in increased valuations. Past investors typically pay a lower price for their shares when participating in a Series B company.

- Series C – When a startup’s business model works and helps gain market share, it becomes a sign of maturity. Companies that plan to achieve Series C funds are no longer startups. They are in the category of well-established companies and successfully at the last stage of their growth, with high sales and profits. Many people rely on their products or services, which has a big impact on the market.

Importance of series A, B, C funding

As a startup, individuals usually do not have enough funds to expand their business and reach more customers. Series funding helps entrepreneurs analyze their growth potential and strengthen them with an opportunity to grow their company.

In exchange for a share of the company’s profits, investors provide capital. It basically implies that if the company is generating money, they get a cut of it, but if the business is losing money, investors will face its brunt with the startup. You’re not the only one who has to deal with it.

The team always needs to have technical and managerial support. Once the startup gets the funds, the team can support investors already invested in the business. For now, they are more interested in business; they will give the most helpful advice, and they have got to find the team’s back.

How to raise funds for series A, B, C?

The only way of getting series funding is the valuation of the company. The company needs to have a compellable valuation for every fund stage that attracts investors. It must not be too good to be true, and it must be reliable and trustworthy to get funds. At every step, founders have to value their company at different criteria. Let us discuss how-

How to get Series A funding?

Companies must have a clear and rigorous valuation to get funding from this stage. There are many kinds of company valuation; some of them are look for book value, the cost value of assets, resale price of assets or a combination of several features of startup.

Choosing the right method that shows a startup in the best light is essential. The team must ensure that business operations support the startup’s valuation; if potential investors question it, one can answer it. It helps to reduce some risks relating to liabilities affordability and accusations of deliberate fraud.

How to get Series B funding?

At this funding stage, the business would have grown and staked its claim to attract more market share, and investors might want to look again at how a startup is valued. When startups’ continued growth in business is combined with new development, the valuation could be much higher and more appealing to investors of Series B fund providers.

How to get Series C funding?

The sum of money involved in this funding stage is substantial, meaning that the offer will more likely only appeal to significant financial institutions, like investment banks, private equity firms, and hedge funds.

The company valuation must be precise and reliable. That means founders must have a compelling offer to show investors and remove some of their risk and doubt.

Funding amounts in Series A, B, C

Once startup businesses complete the initial seed stage, it becomes vital to scale up the operations. A startup cannot increase or maintain optimal business growth without consistent funding. This section discusses the funding amount each Series pertains to.

- Series A Funding – Startups typically raise between $2 million to $15 million, but this figure has risen due to technology-based industry valuations or unicorns. As of 2020, the average amount of capital for a Series A round will be $15.6 million.

- Series B Funding – Companies that have been around for a while are eligible for investments of between $15 and $25 million in this round of funding. However, this quantity has risen as well. A Series B round typically raises $33 million in total.

- Series C Funding – Companies planning to get funding in the C series round are not in the startup category, and they are pretty well successful. They can take funding approx $50 to $80 Million.

Which industry/company receives series A, B, C

Typically Startups across every industry can avail series A, B, C. Investors lend suitable capital in exchange for an equity stake in the startup business. Startup funding is needed to manage working capital needs, launch a new product or service, launch a marketing and advertising campaign. These funds are required irrespective of the industry or sector they cater to. Many Venture Capital firms fund e-commerce, healthcare, logistics, and all sectors.

Example of series A, B, C funding

The following are some examples of companies that received series A, B, C funding:

- Series A Funding – Coinbase used the $5M they raised in their Series A round to focus on their business objective. Their objective was to make Bitcoin more comfortable to trade.

- Series B Funding – Stripe who now boasts a $35 B valuation, went through Series B funding in 2012. It was required to scale up the organization. According to TechCrunch, the co-founder Patrick Collison has planned to use these funds for hiring talented employees.

- Series C Funding – A new fintech company Revolut raised an attractive $250M in its Series C funding. The company also increased its workforce from 350 to 800 highly skilled employees.

Key differences between series A, B, C Funding

It is important to understand the distinction and differences between each series of funding from the perspective of legal compliance.

| Basis | Series A | Series B | Series C |

|---|---|---|---|

| Amount of Funds | $2-$15 million | $15-$25 million | $50-$80 million |

| Company valuation | $50-$80 million | $40 million | $68 million |

| Best For | Going-to-market and stabilizing | Scaling products and delivery channels | Scaling reach and operations |

| Stage of business | Introduction | Growth | Maturity |

How to find investors for each stage of series funding?

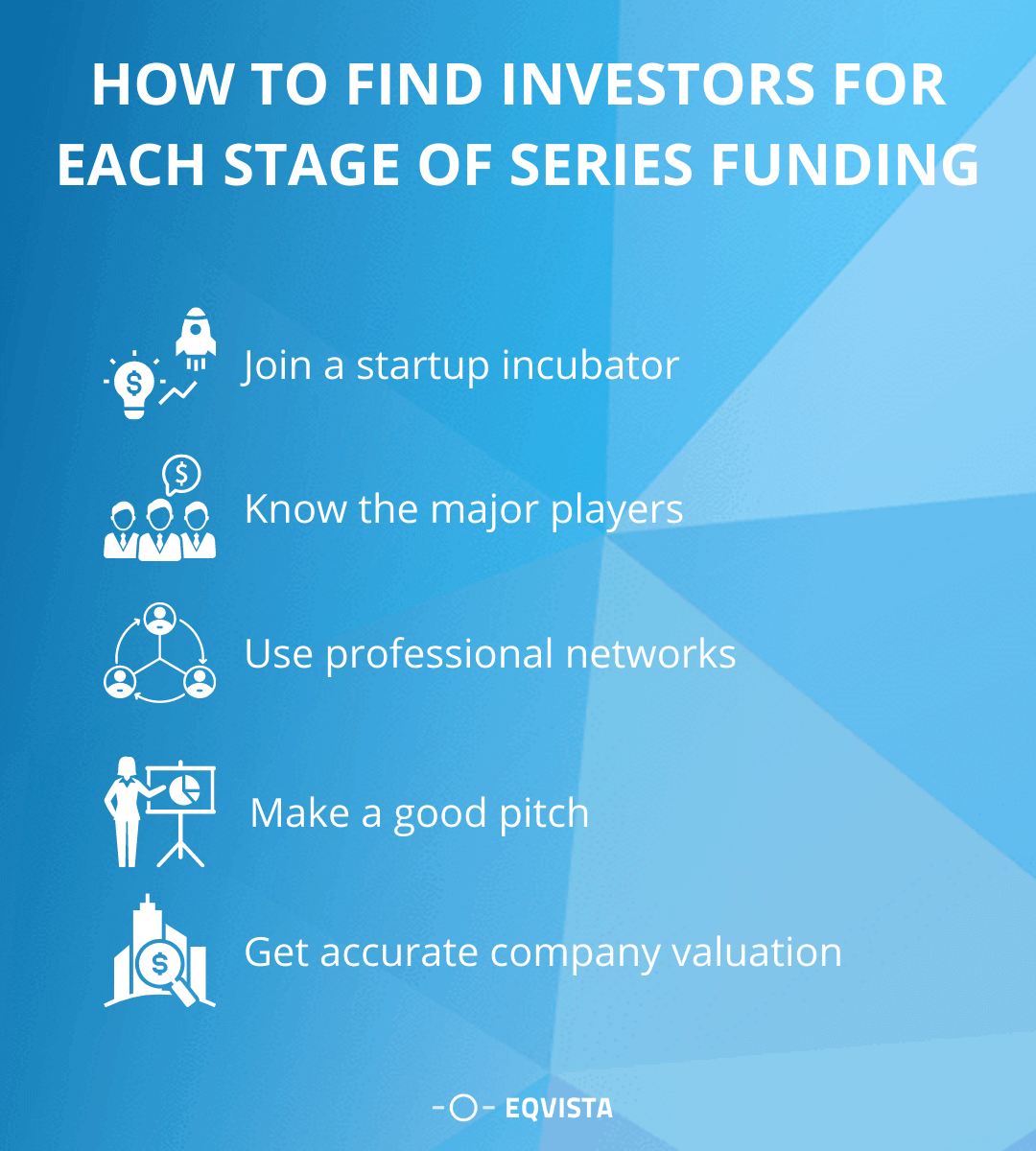

At an initial stage or at an embryonic stage, friends and family pump in money into the new business or the startup venture. This resembles seed funding. As the startup grows to a scalable level, the founding team approaches a Venture Capital firm to fund the startup and thus accelerate its growth engine. An experienced small business owner may not know where to begin when it comes to growing into new markets or securing capital for expansion. These are the actions you should take to identify investors that can help you grow your business: When the startup venture decides to go public, it approaches an investment bank to work on its Initial Public Offering (IPO) deal.

- Join a startup incubator – They are also known as a startup accelerator, which can contact investors interested in investing in new businesses. These programs mentor companies during their beginning stages, offering training and valuable mentorship for promising startups.

- Know the major players – Research the most active startup investors and analyze what kinds of businesses they invest in.

- Use professional networks – Startups’ professional networks know the business better in the context of business intentions. If these networks are proven to be helpful, a startup will get better financial and managerial support.

- Make a good pitch – The pitching skill will help the team exclusively get funds. If founding members are capable enough to deliver intentions and objectives correctly, there are many more chances of getting funds.

- Get accurate company valuation – As discussed earlier, a precise and reliable company valuation is necessary to make investors trust the company’s growth potential.

Get a business valuation from Eqvista!

Tracking cash inflows and outflows would help founders plan to fundraise. The significant difference between each series is the valuation of the startup. Establishing reliability among investors might help startups to reduce milestones to get funds. The stronger the valuation and the more real customer traction and hike in revenue, the more chances the startup will land substantial funding. Get an effective business valuation to raise series A, B, C, funding with Eqvista! Contact us now for more information.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!