SaaS Valuations: Valuing a Software Company

SaaS is short for Software as a Service. It is a unique and growing industry and is also one that needs a lot of special considerations when it comes to selling such a company. The reason for this is simple, SaaS companies offer services such as applications and so on. Each company has its own specific kind of service product, for instance, WhatsApp might have some related applications that offer the same things but WhatsApp is one of a kind. In fact, every service is usually one of a kind, which makes it all the harder to value.

Keep reading to understand everything about the valuation of IT companies better.

SaaS Valuation or Business Valuation for Software Companies

Before we can talk about the Saas valuation, let us talk about the Saas industry. We are in 2021, and this industry is growing exponentially. And even after COVID-19, the economy has been showing some signs of stability in this sector. But with this last year, we have learned that digital operations are more important than ever. A lot of things have accelerated in this industry. The influence of technology has been massive over the last few years, and it has made way for many new software companies to come into the picture.

Software industry overview

The US has some of the most advanced software and IT companies in the world, making it one of the largest hubs for SaaS companies. In fact, more than 40% of the $5 trillion global IT companies are in the US. The US software industry itself accounts for $1.8 trillion of the US value-added GDP and 11.8 million jobs. There are more than 500,000 software and IT service companies in the US with about 40,000 tech startups that were established in 2018 itself.

There are some sub sectors under this sector as well, like:

- Cloud Computing Services: The worldwide public cloud service market is reaching to become a trillion-dollar industry. And the US is the market leader in this as it has some of the largest companies in the sector. Platform-as-a-service (PaaS) and infrastructure-as-a-service (IaaS) are expected to be the fastest-growing segments of the cloud service market.

- E-commerce: In 2022, retail e-commerce sales were estimated to exceed 5.7 trillion U.S. dollars worldwide, and this is expected to reach new figures in the coming years. This is bound to grow with everyone’s lifestyle having changed with COVID. People now prefer to purchase almost everything online.

- Entertainment software: In 2014, the combined revenues in video games and computer software were about $15.4 billion. And now, it has reached a trillion and is growing rapidly.

Why is a valuation important for software companies?

Valuation for SaaS companies is just as important as the valuation for any other company. If someone wants to purchase a company, how will they know what the worth of the company is without a valuation? As a matter of fact, getting a software company valuation is not that easy. It involves a lot of technical work. For us to get the value of a company right, an extensive-financial knowledge is needed.

The person who would be appraising the company would also have to study the company’s business model in depth. They would also have to look into other things like the market of the company and the corporate strategy, along with all the factors that create value for the company. And looking beyond the traditional numerical due diligence parameters is what allows valuators to get the actual value of the company. This is the value that would help the seller negotiate a good amount from the buyer. Obtaining the value of the company also helps in obtaining funding from investors and is an important aspect when giving out options to employees.

Important SaaS valuation parameters & metrics used in software company valuation

Before the appraiser begins the work to get the valuation of the IT company, the business valuation professional would first consider some parameters and metrics of the company. These are important since they help in preparing the final value of the company. They include:

- The purpose of the valuation

- The objective of the valuation

- The background of the business

- The nature of the business

- The business’ services

- The industry cycle

- The political and economic environment

- Liabilities of the company

- Assets of the company

- Company’s working capital

- Executive compensation of the company

- Customer relationships in the company

Considerations that can have a huge influence on the value of the company such as goodwill and other intangible assets are also considered. The competitive landscape of the industry, market position, diversity of the customer base, and the dependency on a key employee(s) or the owner are also considered.

Some of the other main things that are considered in the software company valuation include:

- Price to earnings ratio

- Price to book value

- Price to sales

- EV/Sales

- EV/EBITDA

Valuing a Software Company – Case Study

Let’s take an example of a case study of a software company. This will provide a practical example of how an actual software company valuation is conducted and what valuation analysts would consider.

Company Background

Let’s take a look at a company, Secure Storage, which deals in data storage and other cloud services. The company started in 2019, and spent its time developing a cloud storage solution for companies. The company was created by three founders, Andy Stone, Simon Davis and Kate Jones. It launched its MVP in March 2019. Reception was quite slow at first, but grew slowly month by month, as over the last 2 years, the company has amassed around 250,000 users up until June 2021.

Here is their growth month to month over that time from 2019 to 2021.

| Month-Year | Active Users | Added Users |

|---|---|---|

| Feb-19 | 5 | 5 |

| Mar-19 | 10 | 5 |

| Apr-19 | 30 | 20 |

| May-19 | 80 | 50 |

| Jun-19 | 120 | 40 |

| Jul-19 | 250 | 130 |

| Aug-19 | 500 | 250 |

| Sep-19 | 1000 | 500 |

| Oct-19 | 1300 | 300 |

| Nov-19 | 1560 | 260 |

| Dec-19 | 1950 | 390 |

| Jan-20 | 2535 | 585 |

| Feb-20 | 3346 | 811 |

| Mar-20 | 4685 | 1338 |

| Apr-20 | 6559 | 1874 |

| May-20 | 8526 | 1968 |

| Jun-20 | 11937 | 3410 |

| Jul-20 | 17905 | 5968 |

| Aug-20 | 25067 | 7162 |

| Sep-20 | 33840 | 8773 |

| Oct-20 | 47376 | 13536 |

| Nov-20 | 59220 | 11844 |

| Dec-20 | 68103 | 8883 |

| Jan-21 | 88534 | 20431 |

| Feb-21 | 110668 | 22134 |

| Mar-21 | 143868 | 33200 |

| Apr-21 | 179835 | 35967 |

| May-21 | 215802 | 35967 |

| Jun-21 | 250331 | 34,528 |

From the table you can see that during the first 6 months, the number of monthly sign ups was less than 100. But afterwards this began to increase and hit over 1,000 sign ups per month in March 2020, a year after launch. By June 2021, they had around 250k users on their platform, with adding around 35k new users every month.

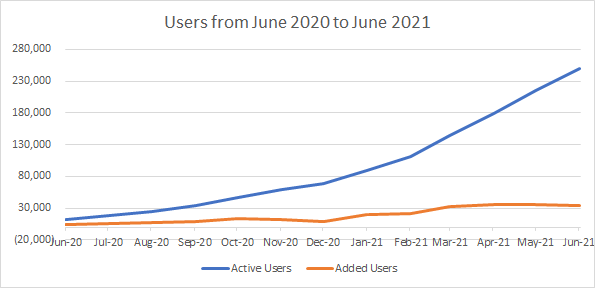

Here is how their growth in users looks from June 2020 to June 2021.

After adding thousands of users every month and testing different strategies for their software solution, they set on a pricing policy that was accepted by their clients and fit within the market. Their pricing policy for their Basic Plan was for $5/month, Standard Plan for $10/month and Premium Plan for $15/month. This pricing policy made sense for the features provided for their cloud solution, and the split among their clients was around 65%, 25% and 10% for their user base respectively.

Now with this total number of users at 250,000, pricing policy of $5, $10 and $15, and split of clients, we can get a snapshot of how the total sales of the company looks like at the current level.

| Pricing Policy | User/Mo | By user | Sales/ Year |

|---|---|---|---|

| Basic | $5 | 65% | 812,500 |

| Standard | $10 | 25% | 625,000 |

| Premium | $15 | 10% | 375,000 |

| Total | $1,812,500 |

Their hard work was paying off, and they had started to make a great product that fit in the market. However they anticipated the need for more staff to help with the growth of the company, and decided to start hiring and set aside an employee stock option plan (ESOP) to attract and award their employees. They set aside around 15% of their total shares for this.

After setting up their ESOP, their cap table looked like:

| Cap Table | Common | % Ownership |

|---|---|---|

| Andy Stone | 1,000,000 | 28.57% |

| Simon Davis | 1,000,000 | 28.57% |

| Kate Jones | 1,000,000 | 28.57% |

| Employee Stock Option Pool | 500,000 | 14.29% |

| Total | 3,500,000 | 100.00% |

Now with everything in place for new hires, they also decided to forecast what their future years would look like at such a growth in users and how much sales they could generate over the next 5 years. This would help them with the development of the software, hiring plans for different positions, and number of hires to get to scale correctly. Thus they came together and created a basic sales forecast for the next 5 years.

| 2021 | 2021-2022 | 2022-2023 | 2023-2024 | 2024-2025 | 2025-2026 | |

|---|---|---|---|---|---|---|

| Users | 250,000 | 500,000 | 900,000 | 1,530,000 | 2,448,000 | 3,794,400 |

| Growth | - | 100% | 80% | 70% | 60% | 55% |

| Sales per package | ||||||

| Basic | - | $1,625,000 | $2,925,000 | $4,972,500 | $7,956,000 | $12,331,800 |

| Standard | - | $1,250,000 | $1,250,000 | $1,250,000 | $1,250,000 | $1,250,000 |

| Premium | - | $750,000 | $750,000 | $750,000 | $750,000 | $750,000 |

| Total Revenue | - | $3,625,000 | $4,925,000 | $6,972,500 | $9,956,000 | $14,331,800 |

Their sales forecast starts with 100% growth in 2021 to 2022, then slowly decreases as the company grows year to year, as its difficult to keep up a 100% Year to Year growth after a certain point. However the total dollar value increased by $1.3 million from 2022 to 2023, $2.05 million from 2023 to 2024, $2.98 million from 2024 to 2025 and $4.38 million from 2025 to 2026.

With this forecast in place and financial figures, the company decided to get a valuation done to see how to set the strike price for their new 50,000 stock options they plan to give their employees.

How to Value a Software Company?

There are three widely accepted methods to value a company namely, income, market, and the asset approach. By using any one of these methods or a combination of these methods can help you in getting the final value of the company. For conducting this saas valuation, we would need to conduct 5 steps, as in:

- Step 1: Conduct valuation methods

- Step 2: Reconcile the valuation methods

- Step 3: Find the price per share

- Step 4: Apply a DLOM (Discount for Lack of Marketability)

- Step 5: Calculate the final value

Each of these methods has been explained below in details:

Step 1: Conduct three valuation methods

Income Approach

The income-based approach is used to value the software companies that are a going concern. It is also used to get the value of the companies that have predictable earnings and cash flow, where they can at least be forecasted. Usually, the income-based approach includes three methods including:

- Discounted cash flow method (DCF method)

- Capitalized cash flow method

- Capitalized earnings method

In the end, the value that is obtained from these three methods depends on the earnings (cash flow) of the company. In this case we will consider the Discounted cash flow method as the company has a forecast in place. The theory of the DCF method is that the company’s current value is equal to the future cash flow of the company, discounted to today’s present value. The Discount Rate can be thought of as the risk an investor would be willing to incur each year, ie. the return they expect to receive each year for investing in such a company.

As the DCF is based off of the future cash flow, which normally is equal to net income (for simplicity sake we will disclude any depreciation, amortization, capital expenditures or other major cash based transactions), the company’s expenses need to also be forecasted as well.

After reviewing their past expense history, the company came up with an estimate for their expense and full Income Sheet forecast for the next 5 years.

| 2021 | 2021-2022 | 2022-2023 | 2023-2024 | 2024-2025 | 2025-2026 | |

|---|---|---|---|---|---|---|

| Users | 250,000 | 500,000 | 900,000 | 1,530,000 | 2,448,000 | 3,794,400 |

| Growth | - | 100% | 80% | 70% | 60% | 55% |

| Sales per package | ||||||

| Basic | - | $1,625,000 | $2,925,000 | $4,972,500 | $7,956,000 | $12,331,800 |

| Standard | - | $1,250,000 | $1,250,000 | $1,250,000 | $1,250,000 | $1,250,000 |

| Premium | - | $750,000 | $750,000 | $750,000 | $750,000 | $750,000 |

| Total Revenue | - | $3,625,000 | $4,925,000 | $6,972,500 | $9,956,000 | $14,331,800 |

| Expenses | ||||||

| Bank fees | - | $90,625 | $123,125 | $174,313 | $248,900 | $358,295 |

| General and Administrative | - | $725,000 | $985,000 | $1,394,500 | $1,991,200 | $2,866,360 |

| Rent | - | $50,000 | $50,000 | $80,000 | $80,000 | $100,000 |

| Software Development | - | $290,000 | $394,000 | $557,800 | $796,480 | $1,146,544 |

| Salary | - | $1,450,000 | $1,970,000 | $2,789,000 | $3,982,400 | $5,732,720 |

| Sales & Marketing | - | $181,250 | $246,250 | $348,625 | $497,800 | $716,590 |

| Total Expenses | - | $2,786,875 | $3,768,375 | $5,344,238 | $7,596,780 | $10,920,509 |

| Income | - | $838,125 | $1,156,625 | $1,628,263 | $2,359,220 | $3,411,291 |

For their expenses, the company forecasted around 2.5% of total sales in bank fees, around 20% of sales in general and administrative expenses, rent to increase from $50k to $80k and $100k in 2025/2016, software development at 8% of sales, salary at 40% and sales and marketing at 5%. This leaves the company with net income (excluding tax) each year to be used in the DCF method.

Once we have the net income, or cash flow in this case, the next step is to find the discount rate. For this example, we will just use the fixed discount of 20%. Once we have the discount rate (r), we need to use this to find the present value of the future cash flows. The formula for the present value is:

n is equal to the future year, so 2021-2022 would be n=1, 2022-2023 n=2, and so on. With this formula we can calculate the total present value factor for each year, with the terminal years being the same as year 5, as below:

| 2021-2022 | 2022-2023 | 2023-2024 | 2024-2025 | 2025-2026 | Terminal Years | |

|---|---|---|---|---|---|---|

| Net Cash Flow | 838,125 | 1,156,625 | 1,628,263 | 2,359,220 | 3,411,291 | 37,524,201 |

| Present Factor | 0.8333 | 0.6944 | 0.5787 | 0.4823 | 0.4019 | 0.4019 |

| Today's value | 698,438 | 803,212 | 942,282 | 1,137,741 | 1,370,921 | 15,080,135 |

With these in place, we can find the present value of these cash flows. Do this by taking the net cash flow each year, in this same the same as net profit, and multiply it by the present factor to arrive at the value of the cash flow in today’s value. Adding these all up, we find the total value of the company to be $20,032,728 using the Income Approach.

Market Approach

The market-based approach is the method that uses the actions of the actual market participants to get the value of the software company. Nevertheless, it is usually hard to find a proper comparable company. This is mainly because every company has its own unique software type. And when the companies are private, it adds to the difficulty since the private companies do not disclose a lot of information to the public, like the terms of transactions and financial data, which is what is needed to compare and value the software company.

Even though there are a lot of challenges, the market-based approach is still considered if even one comparable company is found. And then, this method is used to review the market valuation multiples involved in the particular transaction, such as the EV/Revenue or EV/EBITDA.

There are normally two types of market approach, guideline public company approach and the transaction approach. For this case, we will use the guideline public company approach as its easier to understand. For the numbers, we used fake companies to explain this method in detail.

Let’s say that for Secure Storage, there are 6 comparable public companies traded in the market, with all having enough revenue and cash flow (EBITDA in this case) to compare with. These comparable software companies were also selected based on similar business operations in the market. The details of these companies being:

| Company Name | Rev | EBITDA | EV | EV/Rev | EV/EBITDA |

|---|---|---|---|---|---|

| Company A | $20,000,000 | $5,000,000 | 160,000,000 | 8 | 32 |

| Company B | $50,000,000 | $12,500,000 | 300,000,000 | 6 | 24 |

| Company C | $100,000,000 | $25,000,000 | 500,000,000 | 5 | 20 |

| Company D | $250,000,000 | $62,500,000 | 1,000,000,000 | 4 | 16 |

| Company E | $500,000,000 | $125,000,000 | 1,500,000,000 | 3 | 12 |

| Company F | $800,000,000 | $200,000,000 | 1,600,000,000 | 2 | 8 |

These companies are arranged by revenue size, with the smaller companies having higher EV/REV and EV/EBITDA multiples as they are experiencing higher growth and have not yet hit a mature business cycle yet. The EV/REV multiple for Company A is 8, in comparison to Company D at 4 and Company F at 2. Likewise Company A’s EV/EBITDA multiple is 32 compared with 16 for Company D and 8 for Company F.

A closer look at these multiples reveals:

| EV/Rev | EV/Rev | |

|---|---|---|

| Count | 6.00 | 6.00 |

| Average | 4.67 | 18.67 |

| 10th Percentile | 2.50 | 10.00 |

| 25th Percentile | 3.25 | 13.00 |

| Median | 4.50 | 18.00 |

| 75th Percentile | 5.75 | 23.00 |

| 90th Percentile | 7.00 | 28.00 |

When taking the different figures for multiples, its important to do an in depth analysis of the company compared with the public companies. Both in terms of size, revenue growth trends, income growth trends, and financial ratio analysis as well. After an in depth analysis of Secure Storage with the public companies, it was found that many of the figures matched several companies in the field, thus a median value was taken.

Each software company valuation has numerous factors to consider before choosing a specific valuation multiple, depending on the size, growth and comparability to other companies. Your valuation analyst would be able to help you in choosing the appropriate multiple for your company valuation.

In this case, we take the median value for both multiples yields, and find:

| Secure Storage's Revenue | 3,625,000 |

| Median Revenue Multiple | 5 |

| Total value | $16,312,500 |

| Secure Storage's EBITDA | 838,125 |

| Median EBITDA Multiple | 18 |

| Total value | $15,086,250 |

| Average | $15,699,375 |

As can be seen the EV/Rev multiple calculated the company’s total value at $16,312,500 and the EV/EBITDA multiple calculated it at $15,086,250. Taking the average of these yields the company’s value under the market approach to be $15,699,375.

Asset-Based Approach

This method is considered to be the easiest business valuation method since it gets the total value of the assets in the company. The assets can be both intangible and tangible. Although the market value can be determined for the tangible assets, it is not easy to get the value of the intangible assets, which is usually the software in a software company. That is why there are two sub-approaches under this method:

- Going Concern: In this, the business lists out the net balance of its assets, and the liabilities are then subtracted from it. This method is not great for those companies who want to be sold or acquired.

- Liquidation Value: Just as the name says, it is a method used mostly when a company is about to be liquidated. It is done much faster than the going concern method. In this method, the net amount is calculated, the assets are sold, and all the liabilities are paid from the amount obtained. The amount obtained is usually lesser than the market value since it is obtained in an “urgency” circumstance.

For the asset based approach, the most common method is to use the company’s balance sheet (in the case of a net book value), and make any possible adjustments needed to show a more accurate value of the company’s asset and liabilities. This may include adjusting some fixed assets or intangible assets to fair market value, capitalization of expenses in case they should be classified as assets for the company, or adjusting for related party balances/transactions.

Step 2: Reconciliation of Valuation Approach

Now that we have the value of both the Income Approach and Market Approach, we need to reconcile these values to make a single value for the company. Multiple factors can go into choosing how to weigh the different approaches, for example how much the company expects to achieve their forecast, how accurate is their forecast, how closely comparable are the public companies, etc.

For this example, we will weigh both approaches equally at 50:50, as there is ample evidence for both the income approach and market approach to show an accurate view of the valuation, which can be seen as:

| Value | Weight | Weighted Value | |

|---|---|---|---|

| Income Approach | $20,032,72 | 50.00% | $10,016,364 |

| Market Approach | $15,699,375 | 50.00% | $7,849,688 |

| Total Value | - | - | $17,866,052 |

Thus with equal weight for each approach, the total value of the company would be $17,866,052.

Step 3: Finding the Price per share

Now that we have the total value of the company defined at $17.87 million, we can take the company’s capital structure and derive the price per share.

If you remember from earlier, the company’s cap table looks like:

| Cap Table | Common | % Ownership |

|---|---|---|

| Andy Stone | 1,000,000 | 28.57% |

| Simon Davis | 1,000,000 | 28.57% |

| Kate Jones | 1,000,000 | 28.57% |

| Employee Stock Option Pool | 500,000 | 14.29% |

| Total | 3,500,000 | 100.00% |

According to the company share structure, 3,000,000 shares are owned by the founders and 500,000 stock options to be issued to new employees. As the company has both common stock and stock options, its best to use a waterfall method to calculate the share value of each class, which is also used when conducting the backsolve method for recently funded companies. However to keep this example simple, we will merely take the total amount of 500,000 common shares and options by the total value of $17,866,052.

This results in a price per share of $5.10, before applying the DLOM.

Step 4: Applying a DLOM for the SaaS Valuation

Now that we know the value and price per share of the company, as the company is privately owned, a DLOM (Discount for lack of marketability) would need to be applied. This DLOM basically is the discount that applies for illiquid companies, ie. those which are not public and cannot be traded on an public exchange, like Amazon or Facebook. This would signify what a willing buyer would pay for a private company with a discount for having to find a market (another buyer) would purchase the shares at.

One such common way to calculate a DLOM is by using the volatility of the similar stocks of the company, defining a liquidity event, and putting the equation into the Block Scholes Model.

Based on our similar public companies, we can find the following volatility over the past year:

| Volatility | |

|---|---|

| Company A | 42.00% |

| Company B | 54.00% |

| Company C | 55.00% |

| Company D | 38.00% |

| Company E | 32.00% |

| Company F | 60.00% |

| Average | 46.83% |

Taking average volatility of 46.83% for the group of companies, and plugging this into the model used for DLOM, we get a final result of 35%.

Step 5: Calculate final valuation of software company

With the reconciled valuation of Secure Storage, together with the share price and DLOM of 35%, we can use these three inputs to calculate the final valuation. Applying these together yields the following:

| Total Value of Company | $17,866,052 |

|---|---|

| DLOM (35%) | 35% |

| Final Value | $11,612,933 |

| Price Per Share | $5.10 |

| DLOM (35%) | 35% |

| Final Price Per Share | $3.32 |

After all of the calculations above, we find the final value of the company to be $11,612,933 and the price per share of $3.32.

When considering getting a valuation for your Saas company, considering the following for helping increase your company value:

- Documentation: It is important to have detailed financials for the company that will help you easily prepare for the sale. To do this, use accounting applications like QuickBooks and so on. Make sure all the details are there and are organized well as buyers want to see everything before they invest in the business.

- Operating Procedures: No business operates on its own. And buyers always want to know what responsibilities are there on a daily basis. So, document everything that happens in all procedures. In fact, buyers are more inclined to pay a lot more for well-documented operations. You can use applications for writing standard operating procedures (SOPs) quickly like SweetProcess and so on.

- Customer Metrics: For SaaS companies, metrics are vital for convincing buyers about the strength of the company. They would want to review the CAC, LTV, churn, MRR, retention, and your cash burn rate closely. These can be monitored by SaaS analytics applications including ChartMogul.

- Outsourcing: If you are able to outsource tasks to others, do it as the online business has the tendency to be sold at a higher price when all has been sorted out already. The buyer does not want to do all the work to run the company, remember that. Get a virtual assistant as well to take care of and manage the business.

- Powder in the Keg: If you have a new strategy in place, then do not implement it right before the sale as it would take about 6 months to set in. Instead, use it as leverage to get a higher price.

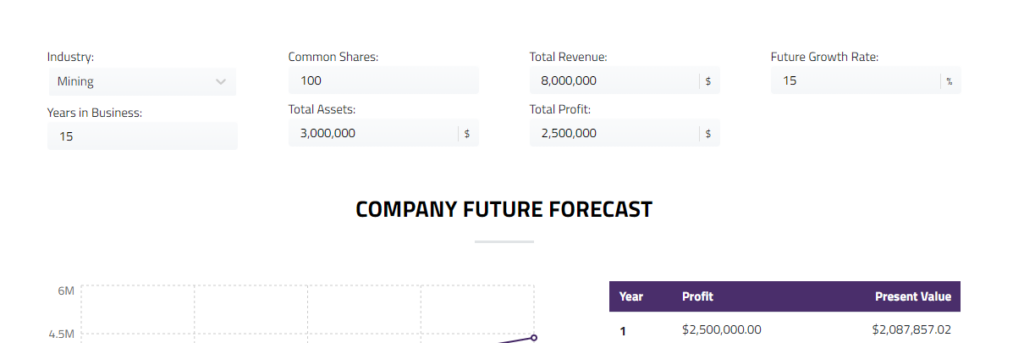

Free Software Company Valuation Calculator

Getting your company’s value has been made easier with Eqvista. We have a dedicated software company valuation calculator that would help you get the final value of your software business or company. And the best part about this is that the calculator is free to use. You just need to add in the details in the fields available and you will get the final value.

Interested to find the Value of your Software Company?

Do you own a software company and are looking for the SaaS valuation of your business? Eqvista can help you with it. We have a team of certified and expert professionals with years of experience in valuing software companies. Opt for our 409a valuation services for a full valuation of your company, be it for investors or bringing on new employees.