Startup Valuation Multiples

A startup valuation multiple is a financial tool for measuring financial metrics.

If you ever ask a professional whether all the valuation methods are the same, they will tell you that they are not. There are various types of valuation methods that rely on different factors and assumptions. An analysis of a company is only accurate when the forecasts are accurate. The valuation multiples technique is a type of analysis that depends on the forecasts.

Startup Valuation Multiples

A startup valuation multiple is a financial tool for measuring financial metrics. To value a startup company you need to understand the topic further. Let us look at this in detail.

What are valuation multiples?

A valuation multiple is a tool that evaluates one financial metric as a ratio of another. This makes businesses more comparable to each other. Multiples are a portion of one metric to another. For example, share price to earnings per share. The process of comparing a company’s value with other similar companies is made easier by valuation multiples. The approach assumes that a ratio is applied to the business.

This ratio is applied to companies in the same business industry. Simply put, investors use this method to compare their target company to other businesses in the same industry to estimate its value. This method puts a company’s financial and operating characteristics in a single number. This number then further can be multiplied by a financial metric to determine the value. In the valuation multiple formula, the denominator is the metric you are focusing on for the current analysis, in the P/E ratio you are focusing on earnings. The PE ratio can be transformed into a multiple which you can further use in the valuation analysis. This is done by multiplying both sides of the equation by the metric to get a new equation:

Let us take an example to understand the formula better. On September 30, 2019, AXL’s shares closed at $67.12 and the EPS was $4.76. Using this we get the PE ratio of 14.10, if these numbers are arranged in the order of the above equation it will be:

- $67.12 = $4.76 x 14.10

AXL had 2.58 million shares outstanding in December 2019, bringing the total valuation (market capitalization) to $67.12 x 2.58 million = $173.1 million

By design, the ratios are commonly expressed in the form of a multiple instead of a percentage. This is the case in every sector excluding the real estate sector. The value is analyzed with a value driver in order to determine the valuation multiple. For example, When the enterprise value of AA Ltd, 1,000 is divided by the earnings before interest and tax (EBIT) of 100 we get a multiple of 10x. If a buyer, with the expectation of an earning stream, pays 1,000 at 100 per year, they have then paid 10x earnings before interest and tax.

Why are valuation multiples important and how are they used?

Valuation multiples are essential to estimate the value of the company. This is because they can provide the analyst with a sense of how similar the companies compare in their values. Additionally, they can assist you in understanding various other factors such as:

- Business Value

- The Fair value of another company

- Adjustments that you can make to increase the company value

- The relation between current valuation and historical periods

The multiples are important as choosing the right ones will help you get a good valuation estimate. This will ensure that the benchmark valuations that you use to compare your company to others is close enough.

There are some things that you should keep in mind in order to use the valuation multiples:

- It is essential that you ensure that the multiple calculated is the same across all businesses. For example: If company A is using historical data and company B is using forward projections, it will not be possible to draw reasonable data from the information given. You need to understand how they are used. The data needs to be of the same type or else it will not be useful. If one company example is using EBITDA, you need to ensure that the others are also using the same for earnings.

- Use a good variety of multiples to evaluate a business when possible. There are different common formulas that drive different principles of the business. In the case when the businesses are similar and data is comparable, using various multiples will help you to get a more accurate value.

Pros and Cons of Valuation Multiples

Using startup valuation multiples can assist you in determining a good estimate of the value of the company. This is best seen when all the multiples are used correctly as they give important data about the business’s financial status. Additionally, multiples provide an advantage to you as it is relevant, easy to use, and is based on actual transactions that took place in similar companies under similar circumstances. This is because the investment decisions include key statistics from multiples.

Principles of valuation multiples

Valuation multiples are governed by principles. Valuation multiples are based on the theory that similar assets sell at similar prices. There are also other principles of this method:

#1 Valuation is the current or the projected value of the company

A valuation is the price of the company. The owner has a product that they want to sell i.e. their company. This product is wanted by investors as they are willing to buy. A valuation is a price at which the investor agrees to buy a part of the ownership from an owner of the business. There is a chance that the investor pays a higher price than the current value of the business, but this will depend on the preferences and alternatives available to the investor.

#2 Valuation of a mature company is the goal

There are various standard techniques to evaluate mature businesses. Such companies have been in operations with stable cash flows. There are techniques that take advantage of this factor, like:

- P/E ratio

- Previous transactions

- Discounted Cash Flow

- Comparable Analysis

Valuation Multiple Types

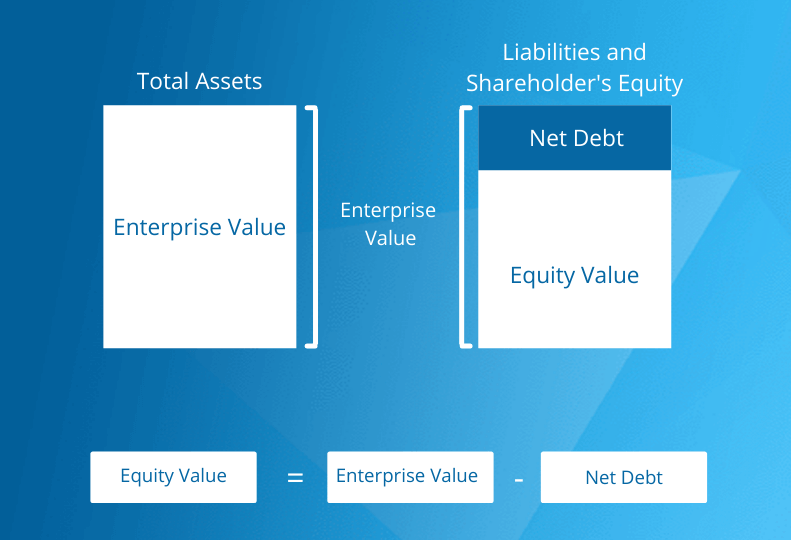

There are different types of valuation multiples and are used in different industries, they are further divided into two parts: equity value and enterprise value. Equity value expresses the value of the shareholder’s equity and the cash flow of the company. Enterprise value is the cost of buying the right to the entire company including its cash flow.

Generally, the equity value reflects all the residual earnings after the payment is made to the minority shareholders, creditors, and other claims. On the other hand, enterprise value reflects the entire capital from debt, equity to minority interest. They both have multiples that help to derive the value, the multiples are:

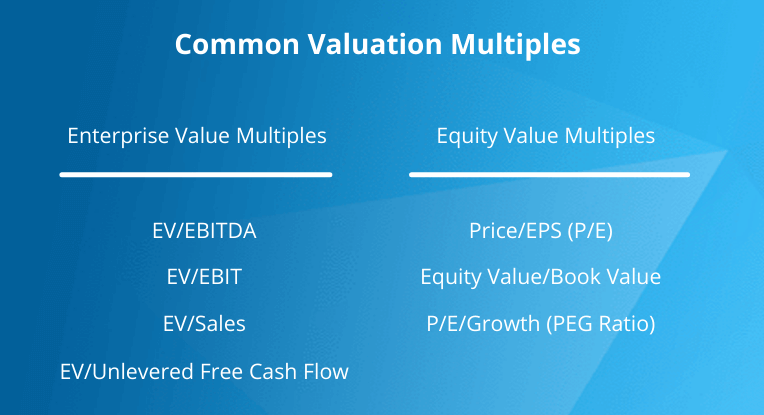

Some of the multiples to know are:

- Enterprise value multiples – Enterprise value multiples are needed in an acquisition or a merger. The most appropriate multiples to use to evaluate the acquisition or merger while eliminating the effect of the debt financing is enterprise value multiple.

- EV/EBITDA – Most commonly used, the EV/EBITDA is a valuation metric that is used as a proxy for cash flow available to the company. Usually, it is in the range of 6x to 18x.

- EV/EBIT – EBIT recognizes the amortization and depreciation in cases where non-cash charges reflect the expenses related to the use of assets that ultimately will be needed to replace. Generally, it stays between 10x and 25x.

- EV/Revenue – EV/Revenue is affected by the differences in accounting. It is computed as a part of the sales to revenue or enterprise value.

- EV/EBITDAR – This is the most used technique in the transport and hotel industries. This is a part of the EV/EBITDA and rental costs. It is equal to the proportion of Enterprise Value to Earnings before deductions. Deductions are Interest, Tax, Depreciation & Amortization, and Rental Costs.

- EV/-Invested Capital – This metric is helpful in cases where capital assets are the main drivers of earnings. This is why the multiple is commonly used in capital-intensive industries. It is the Enterprise Value to Invested Capital. It measures the dollar value in EV of each dollar of invested capital.

- Equity multiples – This is used to examine the investment decisions, especially when the investor is looking to attain a small part in a company.

- P/E Ratio – P/E ratio is the Price-Earnings ratio is a multiple that is used to determine the earnings per share. This is one of the most commonly used metrics. Keep in mind that the P/E ratio is equal to EV/Net income which further is divided by the total diluted shares. They are usually in the range of 15x to 30x.

- Price/Book Ratio – This ratio is used when the earnings are primarily driven by the assets,

- Price/Sales – In cases when companies make losses, this metric can be used to derive quick estimates.

Here is how how the multiple can be using startup valuation methods:

| Company | EV/Rev (2020) |

|---|---|

| AVID TECHNOLOGY, INC. | 2.33 |

| CORELOGIC,INC. | 4.83 |

| INTERNATIONAL BUSINESS MACHINES CORP | 2.18 |

| Average | 3.11 |

| Median | 2.33 |

| 25th Percentile | 2.26 |

| 75th Percentile | 3.58 |

| Target Company's Revenue | $3,000,000 |

| Multiple | 2.33 |

| Company Value | $6,991,074 |

Different methods of Valuation multiples

For performing the startup valuation multiple analysis there are two methods you can follow:

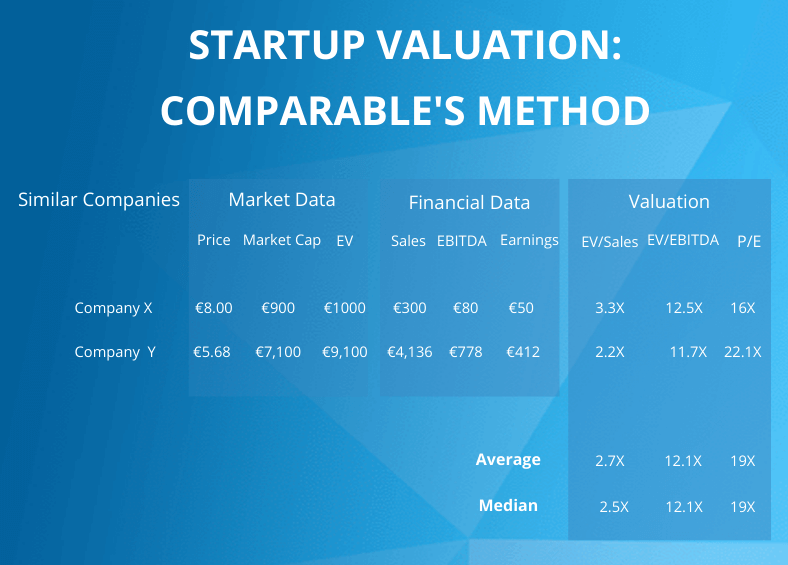

- Comparable Company Analysis – In the comparable company analysis method, the companies that are similar to the target company are found. The analyst will then gather all the relevant data on similar companies such as the EBITDA, earnings, share price, capital structure, market capitalization, and revenue.

- Precedent M&A transactions – In the Precedent M&A transactions method, the analyst will analyze any similar past acquisitions and mergers and use this data as a reference for the target valued business.

How to conduct a multiples analysis

In order to conduct a multiple analysis, you need to follow the given steps:

- Identify comparable or similar companies and derive all the values of them

- Convert the values into standardized values. This is only relative to the key statistic and is not possible to compare it to the absolute value.

- Apply this method to the company’s key metrics. This will control the difference between comparable and valued assets.

Startup Valuation Multiples Template

Startup Valuation Multiple

#1 Fintech startups

Since high-growth startups often raise venture capital in their late stages, it is easy to predict the value of the startup before funding. You can track the multiples through every funding round. For example, if a company sells a part of it, you will have a new value of the company depending on the funds raised.

Let’s say the company sold 10% to an investor for $40 million. This means that the company is valued at $800 million. $40 mil / 0.05 = $800 million.

This data can be used by investors to project valuations for other similar companies. A popular example is Fintech startups, they regularly update the capital index in order to look at the multiple for the revenue run rate. The recent update shows that the valuation is equal to the medial multiple of 14.8 x run-rate revenue. This multiple has evolved over time. In the first quarter, a 28% discount was proposed for valuing private businesses.

#2 Tech Startups

In tech startups, the value of the company is what another investor paid to acquire a similar company. The company data allows the board to estimate the value of the business if it were to be sold. But while doing so there are two things to keep in mind:

- Not all buyers are going to value the company as you do. Investors usually seek an investment where they will pay a lower amount than the acquirers who want to buy the company for a strategic purpose.

- Oftentimes there are other considerations beyond the metrics that can affect the valuation of an acquisition of a tech startup. If you choose the wrong metric and focus on it, you will significantly misvalue the company.

Looking to Value your Startup Business?

The fastest way that you can get an estimate on your startup’s value is through startup valuation multiples. Often times investors will expect a discount while investing in a business since they are taking risks. This is because they want to make a good return in the future. This multiple valuation method will help you determine the value of the startup as close to accurate as possible. But doing this on your own can cause you to miss out on important multiples or over/undervalue the company. This is why you should get a professional to do this.

Eqvista is backed by valuation analysts that will help you value your company accurately. The platform also provides you with other assistance such as 409a valuations and cap table management. You can easily get your company valued by professionals and use other helpful tools along the way.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!