Backsolve Valuation Method

This method is recognized professionally as one of the most useful for the valuation of equity compensation in a privately held business and is highly recommended according to the latest AICPA guidelines.

For valuing the equity compensation in a privately owned company, with many different classes of equity and a complicated capital structure, the OPM Backsolve method is the best and most accurate. Often in portfolio companies with venture capital funds and private equity, employees are given equity-based compensation. The change in equity value is directly related to its profits, interests, equity compensation, and appreciation rights. The Backsolve method is also known as the 409A valuation. This method can be confusing if not understood properly. The backsolve method relies on the option pricing method to determine a value for the shares based on the most recent financial round by investors.

In order to adhere to the financial reporting, tax, and transaction requirements, Option Based Methods are used to value the equity. It does so by modeling the company’s share classes on the overall equity value as a chain of call options. This is further broken down into breakpoints, the point where it is profitable to the investor to convert their securities into common shares. This breakpoint will be used as a strike or exercise price for the share. In this article, there is a summary of the OPM Backsolve method. The Option Pricing method is based on the company’s most current transaction price.

Backsolve Valuation Method

The Backsolve Valuation Method is usually preferred if a company has complex capital structure consisting of multiple equity classes like convertibles, warrants, options, profits or interests, common or preferred. This method is recognized professionally as one of the most useful for the valuation of equity compensation in a privately held business and is highly recommended according to the latest AICPA guidelines. To comply with the financial reporting for ASC 718 and tax requirements of the IRC 409A while calculating the equity valuation in private equity, venture capital, and other privately held companies, this method is frequently used.

What is an option-based valuation method (OPM)?

In a situation where equity compensation has a conditional economic feature, such as constraints that need to be reached before an employee shares the value of equity, the option-based valuation method is used. The OPM backsolve method is a type of special application for the option-based method for valuation. This method is based on the idea that there is an economic relationship between the different classes of securities in a company that has a complex capital structure. The most common example of this is a stock option, where an employee can buy a stock for a specific price and redeem the share when the price is higher for a profit. Some other types of equity compensation that have conditional economic traits are restricted shares, stock appreciation rights, and profit interests.

OPM Backsolve valuation method

A special application of the option-based valuation method is the OPM backsolve valuation method, also known as the Backsolve option pricing model. The principle that the OPM backsolve method is based on is that an economic relationship exists between the various classes of securities. In a business with a complex capital structure, the relationship between the various classes of securities is the total equity value of the business. Even though each type of equity is connected through this factor, they can also have different characteristics. Some of the differences that they might have include exercise prices, required returns, conversion options, liquidation preferences, and other items.

These rights will determine the amount, values, and order of each class. This allocation of the values and amount is referred to as a waterfall. The difference in each level and participation will result in different values for each class of security in the various stages of the waterfall analysis. This can also be the case when equity-related securities are converted to common shares. In other words, the value of the securities can change when converted. When all the equity-related securities are converted into common shares, the result might be the same.

To create an option-based equation for the equity capital structure of the business, the relationships, economic rights, and participation levels in the waterfall are exercised with Black Scholes. When the value of a single class of equity is known, this method will provide the capability to determine the value for all other equity-related securities. This includes equity compensation also. In the most current transaction data, the values will act as a benchmark to assist in calculating the value.

Advantages of Backsolve Valuation Method

- This method helps establish a value for equity compensation based on the latest round of financing or transaction support. The main advantage of using this method is to derive the value of an entity that is based on the previous transaction or financing round and it helps ascertain a value for the equity compensation. Other methods might not be as effective as this is the main factor that differentiates this method from others.

- It is an extremely useful tool to value equity compensation in portfolio companies of venture capital and private equity funds. Many venture capital companies and private companies raise funds through financing rounds. This data can be used as the main factor to help derive the value of the entire entity.

- This method is particularly well suited to companies with multiple classes of equity ownership. Companies with multiple equity classes tend to have a complex capital structure. This method takes this aspect under consideration while calculating the total equity. And this allows the value to be as accurate as possible. The option-based equation was created for the OPM backsolve method. This equation can also be used to determine the value of equity compensation while using other methods to determine the total equity value.

How does the Backsolve Valuation Method Works?

The first thing to do while using the OPM Backsolve method is to estimate the value of the company to determine the threshold values in the waterfall of the business. This can be procured from the rights of different equity-related securities, the cap table, or corporate agreements. In the waterfall analysis, the corresponding participation amount and the equity interests which would share in value for every threshold are identified.

In the next step, you will use the Black Scholes to construct an option-based valuation equation for the capital of the business. This equation should consider the relationship between the rights, waterfall thresholds, participation levels, and the total value of equity. Estimates are formed with regards to the expected volatility of the equity (risk) in the company and the potential time period to an exit or liquidity situation. The equation derived will help determine the value correlated with attaining every threshold and the value expected to be allocated to all the equity classes during the waterfall stages. The equation also includes the probability that the value thresholds might not be accomplished during the potential exit.

Then using the latest transaction, the pricing data is assembled. Often, venture capital will involve an investment in preferred shares, but it can also involve equity security from the capital structure. This data should be adequate, latest, and should not be older than one year. Additionally, there should be no changes in the company that could have affected the value of the company since the last transaction. In specific cases, you can consider an alternative basis of this component or an adjustment in the most current transactions’ pricing.

The final step includes using the backsolve technique to estimate the common relationship that connects all the distinct securities. In this case, it is the total equity value. A backsolve valuation method is an easy way to distinguish an input that is required in an equation or reverse engineering to produce a specific result. In this valuation method, until the result is a value from the selected security and is equal to the price of the most current transaction, the Black Scholes-based equation for the company’s capital structure should be adjusted. When it matches the price of the transaction, the equation is solved. It now provides the value of all the equity securities in the company, and this will also include the equity compensation units.

To account for any premiums or discounts that are related to the control and marketability of the equity, adjustments can be made accordingly. In private companies, most of the equity compensations are non-marketable. In the latest transaction of the private equity and venture capital funds company’s portfolio, any premium or discount will reflect the nature of the equity security and an expectation of a liquidity event. At the end of all the calculations, you will end up with a business valuation that accurately values your company.

Backsolve Method in Action

Let us use an example of the backsolve valuation method to understand this better. Just to rephrase, the backsolve method should be used for companies with a complex capital structure. If the company has only common stock, for example, then the simple equation would be:

In the case of our example, if the recent funding round of common shares was priced at $0.20, and there were 15 million shares outstanding, then the total value would be $3,000,000 ($0.20 * 15,000,000 shares). But what if the company has preferred stock, stock options, warrants, and convertible notes? In this case we cannot do a simple multiplication of total shares, and must use the Backsolve method to help us calculate the company value.

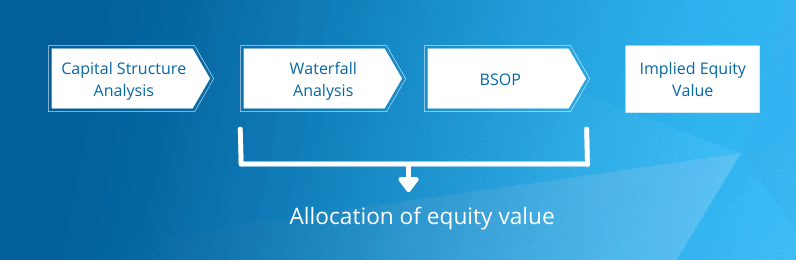

So according to the diagram above, the steps to calculate the company’s value using the Backsolve method are:

- Capital Structure Analysis

- Waterfall Analysis

- Black Scholes Option Pricing (BSOP) Model

- Implied Equity Value

We will explain each step and how to find the value using a simple company structure.

Capital Structure Analysis

For this case, we will take a company with a simple capital structure of common shares and a stock option pool that the founders set up for the company’s current and future employees.

| Share Class | Share Class Share Outstanding | Share Price/Strike Price | Share Price/Strike Price Ownership |

|---|---|---|---|

| Common | 12,000,000 | Issued to founders | 80.00% |

| ESOP 1 | 1,000,000 | $0.10 | 6.66% |

| ESOP 2 | 2,000,000 | $0.15 | 13.33% |

| Total Shares | 14,500,000 | 100% |

As you can see here, the initial 12,000,000 common shares were issued to the company’s founders at no buy in price, and total around 80% of the company’s total shares. The founder then set up and issued the first set of 1,000,000 options, ESOP 1, at a strike price of $0.10, which makes up around 6.66% of the company, as well as 2,000,000 options, ESOP 2, at a strike price of $0.15, or around 13.33% of the company’s total pool. Therefore the total employee stock options represent around 20% ownership in the company.

Once we have a good idea of the company’s capital structure, we can move onto the next step for the waterfall breakdown of the company.

Waterfall Analysis

The next step involves a waterfall analysis, ie. a breakdown of the levels of payouts in case it is acquired or liquidated. Basically who gets what value in case the company is sold. The waterfall analysis is a useful tool in financial modeling as it breaks down the amount each shareholder would get in case of a sale/exit, or with the backsolve method, the ultimate value of the company when you have the paid price per share.

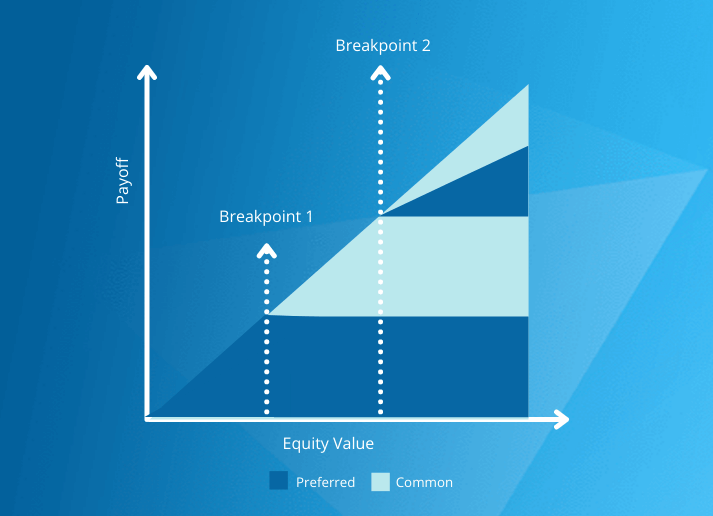

Breakpoints

In this case we need to find out the exact value of each breakpoint.

First let’s define the breakpoints:

- Breakpoint 1 – Common Shareholder receive value (before option holder’s decide to exercise)

- Breakpoint 2 – Common shareholders receive value with ESOP 1 holders (after exercising)

- Breakpoint 3 – Common shareholders receive value with ESOP 1 & 2 holders (after exercising)

So the question is, when do the ESOP 1 holders exercise their options? Well the question is obviously at a total price per share above $0.10. So in this case we would need to do the calculations to find out at what point each breakpoint occurs. The calculations would be as:

Breakpoint 1 – Common Shareholder receive value

Breakpoint 2 – In this case we take the common shares (12,000,000) + ESOP 1 (1,000,000) = 13,000,000 total shares. Then we take this times the strike price at $0.10, which equals $1,300,000. Be sure to add back the price the options holders are paying to the company, ie. 1,000,000 * $0.10 or $100,000.

We therefore get the first breakpoint at $1,200,000 ($1,300,000 – $100,000)

Breakpoint 3 – In this case we take the common shares (12,000,000) + ESOP 1 (1,000,000) + ESOP 2 (2,000,000) = 15,000,000. Then we take this times the strike price at $0.15, which equals $2,250,000. Be sure to add back the price the options holders are paying to the company, ie. 2,000,000 * $0.15 or $300,000.

We therefore get the first breakpoint at $1,950,000 ($2,250,000 – $300,000)

Once we have the breakpoints established, we can define the tranches of the company the the range in which each gets their value, as:

| Tranche | Total Value | Equity Holders |

|---|---|---|

| 1 | $0-$1,200,000 | Common |

| 2 | $1,200,000 - $1,950,000 | Common, ESOP 1 |

| 3 | $1,950,001 and upwards | Common, ESOP 1 & 2 |

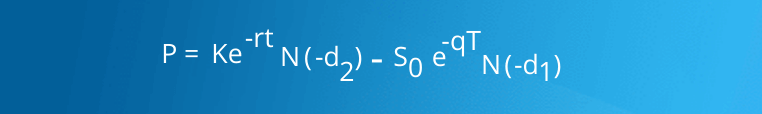

Black Scholes Option Pricing (BSOP) Model

Once we define each Tranche, we then use the Black Scholes Option Pricing (BSOP) Model, and treat each type of equity class as a stock option in order to determine the value. The equation for the model is as:

According to the BSOP model, we would need to define a few variables as:

- Stock value – Looking to define through Back Solve Method

- Exercise Price – Amount of Tranche Value, being $0.01, $1,200,000 & $1,950,000

- Time to Maturity – Time to maturity (exit) of company, in this case we assume 3 years

- Risk Free Rate – Risk free rate, assume to be 2%

- Volatility – Volatility of similar public companies, in this case assume to be 45%

From here we can set up the equations using 3 different BSOP models, and crunch the numbers to get a stock price of $0.20 for the recent round of funding of common stock. But first we need to define how much each security holder will get from the payouts of each round:

| Tranches | Common Stock | ESOP 1 | ESOP 2 |

|---|---|---|---|

| 1 | 100.00% | 0.00% | 0.00% |

| 2 | 92.31% | 7.69% | 0.00% |

| 3 | 80.00% | 6.67% | 13.33% |

These percentages of payouts are according to the number of shares each security holds relative to the number of securities under consideration.

Implied Equity Value

After crunching the numbers, we find the value of the company to be $2,600,000. Thus the value per each tranche according to the BSOP and the total value in real terms from the $2,600,000 would be:

| Tranche | Value per option | Tranche Value | Common | ESOP 1 | ESOP 2 |

|---|---|---|---|---|---|

| 1 | 2,600,000 | $1,051,413 | 100.00% | 0.00% | 0.00% |

| 2 | 1,548,587 | $448,171 | 92.31% | 7.69% | 0.00% |

| 3 | 1,100,416 | $1,100,416 | 80.00% | 6.67% | 13.33% |

| Total Value | $2,345,442 | $107,836 | $146,772 | ||

| Total Shares | 12,000,000 | 1,000,000 | 2,000,000 | ||

| Price Per Share | $0.20 | $0.11 | $0.07 |

From this table we can see through the backsolve valuation method that the total value of the company at $2,600,000, after finding through both the waterfall analysis calculations for the percentages for each security and the Option pricing model for the value of each tranche to calculate the price for the $0.20 price per share for the common stock.

This final price of $2,600,000, being $400,000 below the initial $3,000,000 price for 15 million shares, is because the stock options of the company, along with other factors in the OPM model, calculate the value of the company slightly less than at $2.6 million. This Backsolve valuation method gets more complicated with more complex cap tables, like those with preferred stock with liquidation rights, company debt, warrants, convertible notes, and others. That’s why it’s better to seek advice from a professional for using this method.

Get Your Company Valuation from Eqvista

The OPM backsolve method is the best way to calculate the value of a company with a complex capital structure and has several classes of equity ownership. It’s used to establish a value from the previous transaction or the latest funding round. Many investors and owners try to evaluate the company themselves. This might be a more cost-effective way, but it can result in huge losses as the chances of deriving a wrong value is high. Business valuation is an important aspect and should not be taken lightly. This is why you must hire a professional.

At Eqvista, we provide you with a platform that can assist you in valuing your company. We have an expert team that will help you with the valuation of your company through the appropriate method depending on the type of company you have. If your company has a complex structure, and recent funding, then the OPM backsolve method is best. We offer 409a valuations using the backsolve method. We will help you determine a close to an accurate value for your company regardless of the type and industry it is in.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!