Discounts For Lack Of Marketability (DLOM)

The Discount for Lack of Marketability or DLOM is the amount that is subtracted from the ownership interest value.

A lot of the privately held companies treat their stocks like they treat public company stocks. But private company stocks are less liquid as compared to public company stocks. This lack of liquidity is usually what creates a lot of complexities when the shares are being valued in a company. The value of a privately held business usually seems simple at first glance. The value needs to be equal to the per-share value of the share that is multiplied by the number of shares.

Discounts For Lack Of Marketability (DLOM)

Usually, when a business is getting valued, the main point that is considered is the company’s ability to generate future cash flow. They use the present value alongside the future cash flow value to show the company’s worth to the investors. Nonetheless, in reality, this process does not give accurate business value to the investor. In short, there are some circumstantial and situational elements of the transactions that also need to be accounted for but are not. That is where the discount for lack of marketability comes into play.

What is Marketability?

Marketability, also called liquidity, is the ability to convert the property to cash at the lowest cost and fast, with a high degree of certainty of realizing the anticipated amount of proceeds. The two things that let you know about the levels of value in the transaction include the degree of control that the investors will have through the equity ownership and the marketability.

What is Discount For Lack Of Marketability (DLOM)?

The Discount for Lack of Marketability or DLOM is the amount that is subtracted from the ownership interest value. The final output then shows us the amount/percentage of the absence of marketability in the company. As mentioned above, marketability relates to the saleability of an asset; this does not necessarily mean liquidity. But there is also a transaction risk of anticipated proceeds that are being realized in this.

When looking into the theory of how to calculate the discount for lack of marketability, a lot of the valuers follow a set of instructions that is called the Mandelbaum Factors. These factors were created after a tax case that took place in 1995, where the judge shared multiple factors that have to be taken into consideration when we calculate the discount for lack of marketability, including:

- Costs associated with making a public offering

- Company redemption policy

- Holding period for stock

- Restrictions on transferability of shares

- Amount of control in transferred shares

- Company management

- Nature of the company, which includes things like its economic outlook, history, and position in the industry

- Company dividend policy

- Financial statement analysis

- Private vs. Public Sale of Shares

Although these tests were created for taxation purposes, they are now used as some of the main factors to calculate the discount for lack of marketability. In fact, some of the factors are considered to be standards around the world to get the DLOM figure.

Challenges in DLOM

Getting the value of private companies is tough for valuators since they do not have enough information on the assets, especially the price of the asset. In addition to this, there are also many tax-related issues that come up due to non-marketable and a non-controlling ownership interest in closely held companies. In short, it is highly time-consuming and costly to obtain the value of interest which the owner wants to sell in a private company. It also brings in a lot of uncertainty and variability during negotiations.

And, in case it is a closely held private company that has only a handful of shareholders, there are costs that are associated with losing control of the company. This introduces other discounts that overlap the discount for lack of marketability, including:

- Discount for Lack of Control (DLOC) – The discount of lack of control is the amount deducted from the subject pro-rata share value of 100% of an equity interest to compensate for the lack of any or all powers in a control position in the company. It has been explained a bit more in detail in the next sections.

- Discount for Lack of Liquidity (DLOL) – The discount of lack of liquidity is the amount that is deducted from the ownership interest to compensate for the lack of assets that can convert to cash without the significant loss of principal. It is somewhat similar to the DLOM but marketability usually doesn’t always mean liquidity, which is why we also have this value.

In short, when the prices for private and public companies are compared, the discounts have to be considered. And looking at different discounts makes it difficult to get the DLOM of a privately held company.

How do you calculate a discount for lack of marketability?

It is clear that private companies do not have a market to trade their shares. This just makes it very difficult for them to sell and buy shares. And the lack of marketability causes these shares to have a lower worth than otherwise. Plus, it is not very easy to get a discount as shared above due to the various challenges such as lack of information in a private company, mostly the pricing information. Due to this, selling an interest in a private company is a lot more time-consuming and costly. It also comes with a lot of uncertainty and variability that arises from the negotiations. That is why the following methods were created to make things easier.

Restricted stock method

Restricted stock is the unregistered shares of ownership in a public company. They are the shares that are not publicly traded and are normally held by insiders including the directors and executives of the company. These stocks are called restricted since they have restrictions on them where they cannot be sold or transferred, which is there to deter the early selling of shares.

The directors and executives are given these shares so that they have the same interest in the company as the shareholders. Moreover, the Securities Exchange Commission (SEC) enacted the restricted resolutions to reduce all the agency problems where the general shareholders and management have different interests. As compared to the other publicly traded common stock, restricted stock has much less worth.

Option pricing method

Options are given to people in the company. They are basically rights given out to the holders to purchase or sell some of the company stock at a defined rate, which is the strike price, and at a specific date in the future. The prices of these options (also called the market for the options) can help in getting the value of a stock. With the market of options being different from the market of stocks, the difference between the strike price and the price of the options can give the value of the DLOM.

IPO method

The last method to calculate the discount for lack of marketability is the IPO method. An initial public offering is when a private company offers its company shares to the public for the first time through a new stock issuance on a financial exchange. Through this, the private company can get a wider range of investors and also enhance its legitimacy. The IPO stock goes through a process of moving from a pre-IPO price to a post-IPO price. The post-IPO price is the one that is the value of the now-public company. In the IPO method, the discount for lack of marketability is calculated by taking the difference between the pre-IPO price and the post-IPO price.

Discount for Lack of Control (DLOC) vs Discount for Lack of Marketability (DLOM)

With this said, what is the difference between DLOM and DLOC? It is important to understand the difference between the two since both are not the same and have a huge role in the calculation of the discount rate. This then helps with obtaining the final valuation of the company. Hence, these terms are very important and cannot be interchanged as well.

So, let us understand this better by understanding DLOC first. DLOC is the discount for lack of control. Control is when the ownership interest in a closely held company has a huge influence over the actions in the company. This means – whether or not the person who has the controlling interest being valued has control over things like selecting the management, acquiring or liquidating assets, and having a say in many other things in the company.

So, the person who wants to purchase the controlling interest in a company would have to pay a lot as the controlling shareholders are the ones who control all the actions in the company. On the other hand, the non-controlling ownership interest is the one that lacks a few or all control over the company’s actions. Hence, it is usually worthless as compared to the controlling ownership interest, on a per-share basis. Hence, there is a premium price for control and a discount associated with the lack of control, which is called the discount for lack of control (DLOC).

Difference between DLOM and DLOC

It is very simple. When we talk about the discount for lack of marketability, we are talking about whether an asset, usually shares, can be converted to cash and how fast. When it can convert to cash fast, it means that it is marketable and when it cannot be done easily, it means it lacks marketability. On the other hand, lack of control is when the shares being valued or sold do not come with any control over the company. Both of these are two different things and are usually used together for the valuation analysis.

DLOM Example for calculating final value

In this example, we will take the second option of #2 Option pricing method to ascertain the discount for lack of marketability for a subject private company. We use this method as its normally the most often used method and can be justified with data relevant to the subject company.

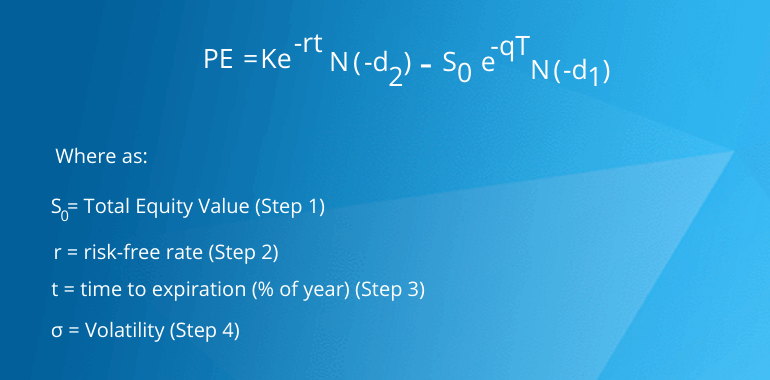

The equation for using this method is stated as:

As you can see, we will first need to find a few information before applying the DLOM. First we will need the total equity value (company valuation), time to expiration (length of holding period, or length until company expected exit), risk free rate, and the volatility.

Step 1

Let’s say we have a Saas company called Innovative Inc., and after conducting the company valuation using the income approach, market approach, and asset based approach, and reconciling the values, we conclude the value of the company to be $10,000,000.

Step 2

The risk free rate here we assume to be fixed at 2.0%, around the rate used for 30 year treasury bonds rate.We can find this from sources online, like this rate from CNBC.

Step 3

The next step is we need to define the time until a company exit or major liquidity event. After forecasting the company’s future operations, the company estimates that there will be a potential exit in 2 years.

Step 4

The last step here is to calculate the company volatility. Now as the firm is a private company, it does not have an inherent volatility of its company stock, unlike public companies where shares are traded in the market. Therefore in this case you would need to find similar publicly traded companies and calculate their stock volatility over a certain period of time, usually being 1 to 5 year periods.

Let’s say for Innovative Inc that the company’s comparable publicly traded companies are Adobe (Ticker ADBE), Avid Technology (AVID), Salesforce (CRM), IBM (IBM), and Microsoft (MSFT).In this case we can calculate the volatility of these companies, say over a 3 year period, from 1/1/2018 to 12/31/2020. After running the calculations, we find the volatility of these companies’ stocks to be:

| Company | Volatility |

|---|---|

| ADBE | 64.22% |

| AVID | 105.30% |

| CRM | 67.94% |

| IBM | 51.99% |

| MSFT | 55.78% |

| Median Volatility | 64.22% |

In this case we can see the highest volatility during the 3 year period was with AVID at 105.30% compared with the lowest volatility as IBM at 51.99%. For calculating the volatility of the 5 public companies, it’s common to use either the average or median values. As the spread seems to be focused in the 50-60% range, and AVID being more or less an outlier, we decided to use the median here.

After doing all the calculations, we find the summary of the values to be:

| Risk Free Rate | 2.00% |

| Time to Exit | 2 years |

| Volatility | 64.22% |

| Total DLOM | 32% |

Once you run these numbers in the formula, you will get the DLOM to be 32%.

With the total value of the company being $10 million, let’s say the company has a total of 1 million shares outstanding. That would be $10 per share, before applying the DLOM. So the total value and ending share price would look something like:

| Total Value | Share Price | |

|---|---|---|

| Value of Company Before DLOM | $10,000,000 | $10 |

| DLOM (32%) | -$3,200,000 | -$3.20 |

| Ending Value | $6,800,000 | $6.80 |

From here we can find the total value of the company after applying the DLOM to be $6,800,000, as well as the share price to be $6.80. Of course with most companies, they have more complex capital structures than just common shares, but hopefully this simple scenario can give you some practical knowledge on how to calculate the discount for lack of marketability and use it to find a company’s value.

Looking for a Reliable Valuation Partner?

Now that you know what discount for lack of marketability is, you can clearly understand how your company is valued and how you can easily get the right discount rate for your company. For more help and to understand things better, contact Eqvista today. It is advised to not work on valuing your company on your own as you might not get it right and it would not comply with the IRS rules. That is where Eqvista can help you. Eqvista is a leading valuation service provider and has a team that would take care of your business valuation and 409A valuation professionally. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!