Mergers and Acquisitions Valuation Multiple 2026

In the M&A market, understanding where your target company sits on the valuation spectrum is half the battle. This analysis provides a practical roadmap for investors, founders, and acquirers, mapping valuation multiples across 11 major sectors and over 170 sub-industries. Whether you’re screening potential acquisitions, negotiating price, or setting fundraising expectations for 2026, these benchmarks offer essential context for informed decision-making.

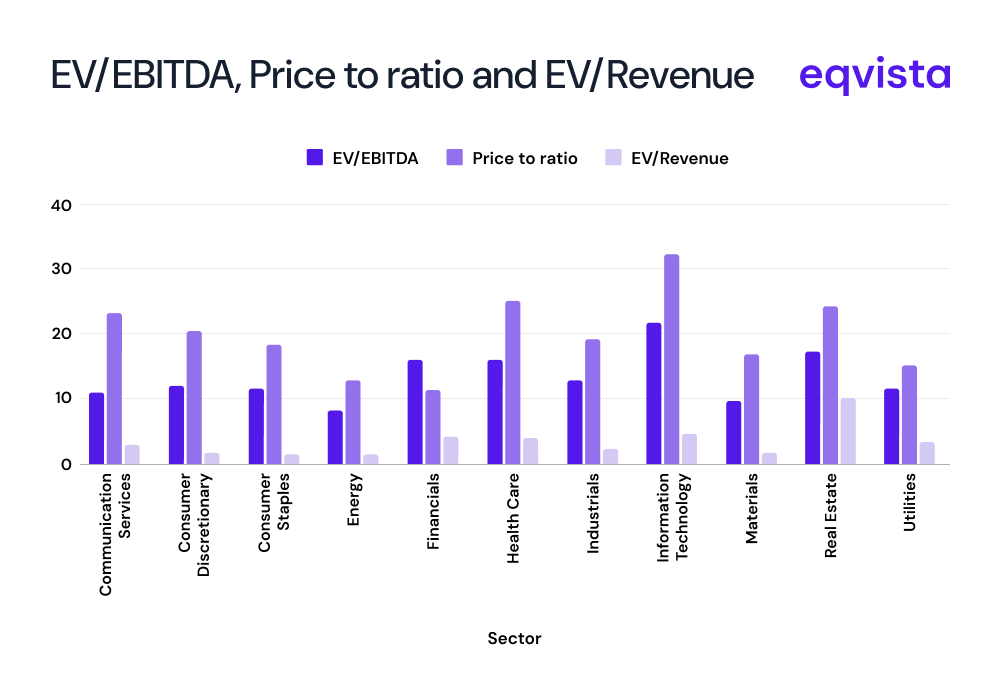

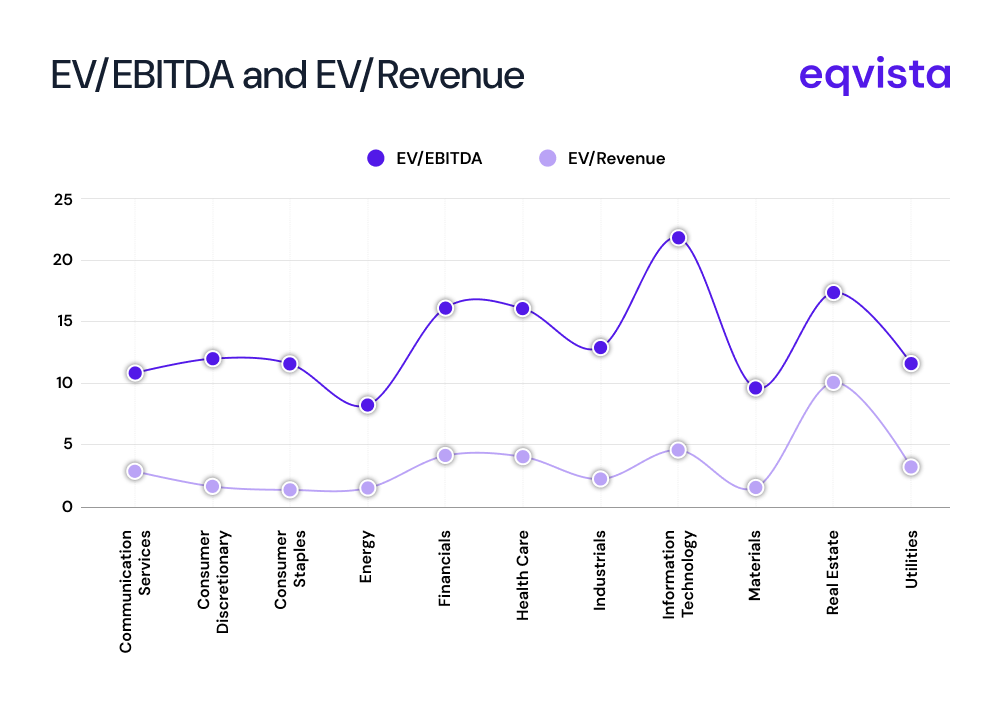

We focus on three key metrics, EV/EBITDA, P/E Ratio, and EV/Revenue, to reveal which sectors command premium valuations and which trade at more modest multiples.

The insights help answer critical questions: Are you overpaying? Is your asking price realistic? How does your sector compare to others?

Key Takeaways

- Information Technology and Real Estate command 2-3x higher multiples than Energy and Materials

- Outliers can distort sector averages, build custom peer groups for accurate comparisons

- When metrics disagree, investigate profitability, quality, and margin sustainability

- Match metrics to company stage: EV/EBITDA for mature, EV/Revenue for high-growth

- Sector label alone doesn’t justify premium pricing; performance metrics must align with premium peers

The Big Picture: Where Sectors Stand Today

| SECTOR | INDUSTRY | EV TO EBITDA | PE RATIO | EV TO REVENUES |

|---|---|---|---|---|

| Communication Services | 13.09 | 19.83 | 4.45 | |

| Communication Services | Advertising | 10.79 | 20.34 | 1.57 |

| Communication Services | Broadcasting | 8.84 | 14.63 | 1.75 |

| Communication Services | Publishing | 13.20 | 28.68 | 1.92 |

| Communication Services | Cable & Satellite | 6.08 | 5.05 | 2.01 |

| Communication Services | Integrated Telecommunication Services | 6.39 | 8.62 | 2.41 |

| Communication Services | Wireless Telecommunication Services | 9.59 | 8.37 | 3.33 |

| Communication Services | Alternative Carriers | 10.84 | 33.25 | 3.45 |

| Communication Services | Movies & Entertainment | 15.49 | 29.82 | 4.08 |

| Communication Services | Interactive Home Entertainment | 23.24 | 25.78 | 5.97 |

| Communication Services | Interactive Media & Services | 21.34 | 29.97 | 8.06 |

| Consumer Discretionary | 14.32 | 24.42 | 1.96 | |

| Consumer Discretionary | Motorcycle Manufacturers | 6.13 | 8.05 | 0.81 |

| Consumer Discretionary | Textiles | 5.86 | 9.60 | 0.63 |

| Consumer Discretionary | Homebuilding | 10.35 | 11.73 | 1.20 |

| Consumer Discretionary | Tires & Rubber | 6.03 | 11.97 | 0.96 |

| Consumer Discretionary | Household Appliances | 9.15 | 12.19 | 0.81 |

| Consumer Discretionary | Specialized Consumer Services | 7.79 | 12.50 | 2.54 |

| Consumer Discretionary | Automotive Parts & Equipment | 6.97 | 13.97 | 0.78 |

| Consumer Discretionary | Casinos & Gaming | 12.23 | 14.23 | 3.13 |

| Consumer Discretionary | Distributors | 9.99 | 15.58 | 0.74 |

| Consumer Discretionary | Hotels, Resorts & Cruise Lines | 13.68 | 17.67 | 3.48 |

| Consumer Discretionary | Education Services | 11.98 | 17.96 | 2.08 |

| Consumer Discretionary | Homefurnishing Retail | 13.82 | 18.33 | 1.69 |

| Consumer Discretionary | Consumer Electronics | 10.13 | 20.30 | 1.65 |

| Consumer Discretionary | Leisure Products | 11.55 | 20.50 | 1.67 |

| Consumer Discretionary | Computer & Electronics Retail | 9.83 | 21.21 | 0.48 |

| Consumer Discretionary | Home Furnishings | 11.34 | 21.22 | 1.40 |

| Consumer Discretionary | Apparel, Accessories & Luxury Goods | 12.37 | 21.54 | 1.83 |

| Consumer Discretionary | Other Specialty Retail | 13.16 | 22.14 | 1.43 |

| Consumer Discretionary | Home Improvement Retail | 15.24 | 22.81 | 2.27 |

| Consumer Discretionary | Automotive Retail | 15.86 | 23.29 | 1.16 |

| Consumer Discretionary | Housewares & Specialties | 8.47 | 23.52 | 0.95 |

| Consumer Discretionary | Leisure Facilities | 12.49 | 27.19 | 3.93 |

| Consumer Discretionary | Apparel Retail | 17.09 | 27.97 | 2.25 |

| Consumer Discretionary | Broadline Retail | 19.12 | 28.12 | 2.80 |

| Consumer Discretionary | Footwear | 19.27 | 29.10 | 2.31 |

| Consumer Discretionary | Restaurants | 17.65 | 29.46 | 3.21 |

| Consumer Discretionary | Automobile Manufacturers | 13.54 | 30.80 | 1.63 |

| Consumer Staples | 13.52 | 22.78 | 1.42 | |

| Consumer Staples | Food Distributors | 10.92 | 22.96 | 0.45 |

| Consumer Staples | Drug Retail | 9.63 | 17.31 | 0.63 |

| Consumer Staples | Agricultural Products & Services | 12.42 | 17.16 | 0.66 |

| Consumer Staples | Food Retail | 9.32 | 19.68 | 0.68 |

| Consumer Staples | Packaged Foods & Meats | 10.12 | 17.31 | 1.21 |

| Consumer Staples | Consumer Staples Merchandise Retail | 20.50 | 36.69 | 1.27 |

| Consumer Staples | Brewers | 7.65 | 11.50 | 1.46 |

| Consumer Staples | Personal Care Products | 14.18 | 19.14 | 2.10 |

| Consumer Staples | Distillers & Vintners | 9.29 | 15.97 | 3.04 |

| Consumer Staples | Household Products | 13.56 | 19.39 | 3.21 |

| Consumer Staples | Soft Drinks & Non-alcoholic Beverages | 16.81 | 26.47 | 3.65 |

| Consumer Staples | Tobacco | 12.20 | 15.07 | 5.03 |

| Energy | 6.64 | 12.84 | 1.36 | |

| Energy | Oil & Gas Refining & Marketing | 8.43 | 15.76 | 0.54 |

| Energy | Integrated Oil & Gas | 5.46 | 11.69 | 1.11 |

| Energy | Oil & Gas Drilling | 5.40 | 8.35 | 1.41 |

| Energy | Oil & Gas Equipment & Services | 8.23 | 17.25 | 1.52 |

| Energy | Oil & Gas Storage & Transportation | 12.11 | 14.44 | 2.62 |

| Energy | Oil & Gas Exploration & Production | 5.09 | 12.82 | 2.65 |

| Energy | Coal & Consumable Fuels | 9.19 | 12.35 | 2.74 |

| Financials | 20.04 | 11.07 | 4.47 | |

| Financials | Diversified Capital Markets | -2.42 | 11.78 | 4.64 |

| Financials | Diversified Financial Services | 10.55 | 11.33 | 2.60 |

| Financials | Mortgage REITs | 10.66 | 8.58 | 9.72 |

| Financials | Consumer Finance | 10.93 | 18.09 | 3.42 |

| Financials | Investment Banking & Brokerage | 14.12 | 15.39 | 3.79 |

| Financials | Specialized Finance | 15.75 | 0.51 | 20.79 |

| Financials | Multi-Sector Holdings | 16.07 | 12.27 | 3.40 |

| Financials | Insurance Brokers | 16.59 | 27.14 | 4.64 |

| Financials | Transaction & Payment Processing Services | 17.53 | 26.61 | 7.34 |

| Financials | Asset Management & Custody Banks | 17.64 | 18.58 | 5.81 |

| Financials | Financial Exchanges & Data | 19.85 | 28.21 | 9.78 |

| Financials | Commercial & Residential Mortgage Finance | 28.35 | 2.08 | 24.85 |

| Financials | Property & Casualty Insurance | 74.35 | 9.35 | 1.39 |

| Financials | Multi-line Insurance | - | 8.66 | 0.92 |

| Financials | Reinsurance | - | 8.68 | 1.08 |

| Financials | Life & Health Insurance | - | 6.25 | 1.34 |

| Financials | Regional Banks | - | 11.23 | 3.68 |

| Financials | Diversified Banks | - | 9.94 | 4.49 |

| Health Care | 14.57 | 23.09 | 2.14 | |

| Health Care | Health Care Distributors | 14.12 | 25.11 | 0.26 |

| Health Care | Managed Health Care | 19.00 | 17.33 | 0.60 |

| Health Care | Health Care Services | 10.83 | 15.19 | 0.65 |

| Health Care | Health Care Facilities | 10.22 | 13.40 | 1.79 |

| Health Care | Health Care Supplies | 15.88 | 24.82 | 3.54 |

| Health Care | Health Care Equipment | 19.90 | 36.20 | 4.57 |

| Health Care | Health Care Technology | 23.43 | 42.65 | 4.62 |

| Health Care | Pharmaceuticals | 12.63 | 19.54 | 4.67 |

| Health Care | Life Sciences Tools & Services | 21.13 | 36.85 | 5.22 |

| Health Care | Biotechnology | 16.17 | 26.59 | 7.12 |

| Industrials | 14.01 | 21.40 | 2.10 | |

| Industrials | Commercial Printing | 9.47 | 16.04 | 1.02 |

| Industrials | Passenger Airlines | 7.12 | 7.99 | 1.05 |

| Industrials | Air Freight & Logistics | 9.68 | 18.81 | 1.14 |

| Industrials | Construction & Engineering | 13.71 | 19.03 | 1.18 |

| Industrials | Security & Alarm Services | 8.44 | 16.39 | 1.18 |

| Industrials | Office Services & Supplies | 9.17 | 15.12 | 1.25 |

| Industrials | Marine Transportation | 6.43 | 8.67 | 1.29 |

| Industrials | Trading Companies & Distributors | 14.13 | 14.98 | 1.40 |

| Industrials | Cargo Ground Transportation | 10.62 | 29.39 | 1.75 |

| Industrials | Human Resource & Employment Services | 14.64 | 23.88 | 1.87 |

| Industrials | Construction Machinery & Heavy Transportation Equipment | 14.09 | 22.09 | 2.10 |

| Industrials | Building Products | 12.69 | 23.16 | 2.12 |

| Industrials | Data Processing & Outsourced Services | 11.77 | 21.09 | 2.13 |

| Industrials | Industrial Conglomerates | 13.49 | 17.35 | 2.25 |

| Industrials | Research & Consulting Services | 15.09 | 26.70 | 2.44 |

| Industrials | Agricultural & Farm Machinery | 12.88 | 20.30 | 2.50 |

| Industrials | Passenger Ground Transportation | 17.23 | 14.59 | 2.51 |

| Industrials | Heavy Electrical Equipment | 28.59 | 44.77 | 2.52 |

| Industrials | Industrial Machinery & Supplies & Components | 15.34 | 26.53 | 2.59 |

| Industrials | Aerospace & Defense | 22.61 | 33.99 | 3.35 |

| Industrials | Electrical Components & Equipment | 18.22 | 30.35 | 3.43 |

| Industrials | Marine Ports & Services | 9.30 | 11.72 | 3.57 |

| Industrials | Environmental & Facilities Services | 15.28 | 33.80 | 3.68 |

| Industrials | Diversified Support Services | 16.73 | 29.86 | 3.75 |

| Industrials | Rail Transportation | 12.26 | 18.42 | 4.20 |

| Industrials | Airport Services | 11.24 | 16.75 | 5.29 |

| Industrials | Highways & Railtracks | 12.27 | 6.44 | 5.92 |

| Information Technology | 24.33 | 36.83 | 6.57 | |

| Information Technology | Technology Distributors | 10.20 | 16.26 | 0.43 |

| Information Technology | Electronic Manufacturing Services | 14.75 | 23.53 | 0.92 |

| Information Technology | IT Consulting & Other Services | 14.85 | 27.74 | 2.72 |

| Information Technology | Electronic Components | 17.62 | 36.61 | 3.31 |

| Information Technology | Electronic Equipment & Instruments | 17.67 | 31.29 | 4.31 |

| Information Technology | Technology Hardware, Storage & Peripherals | 21.68 | 32.00 | 4.56 |

| Information Technology | Communications Equipment | 21.97 | 31.75 | 4.62 |

| Information Technology | Application Software | 26.70 | 32.41 | 7.74 |

| Information Technology | Semiconductor Materials & Equipment | 26.21 | 35.63 | 8.12 |

| Information Technology | Internet Services & Infrastructure | 48.21 | 72.79 | 10.65 |

| Information Technology | Systems Software | 21.83 | 36.24 | 11.56 |

| Information Technology | Semiconductors | 30.65 | 45.32 | 13.15 |

| Materials | 10.26 | 17.19 | 1.84 | |

| Materials | Steel | 8.29 | 12.95 | 0.92 |

| Materials | Aluminum | 7.85 | 10.17 | 0.92 |

| Materials | Diversified Chemicals | 7.58 | 17.10 | 0.99 |

| Materials | Commodity Chemicals | 8.73 | 16.90 | 1.04 |

| Materials | Paper Products | 9.28 | 11.01 | 1.38 |

| Materials | Metal, Glass & Plastic Containers | 8.60 | 14.52 | 1.45 |

| Materials | Forest Products | 16.76 | 23.48 | 1.45 |

| Materials | Paper & Plastic Packaging Products & Materials | 9.76 | 20.95 | 1.54 |

| Materials | Fertilizers & Agricultural Chemicals | 7.12 | 12.24 | 1.56 |

| Materials | Copper | 11.29 | 18.80 | 1.98 |

| Materials | Specialty Chemicals | 12.63 | 23.86 | 2.22 |

| Materials | Construction Materials | 11.97 | 21.07 | 2.50 |

| Materials | Diversified Metals & Mining | 9.61 | 15.80 | 2.60 |

| Materials | Precious Metals & Minerals | 8.79 | 11.85 | 2.98 |

| Materials | Industrial Gases | 15.04 | 23.80 | 4.96 |

| Materials | Gold | 11.06 | 16.58 | 5.18 |

| Materials | Silver | 17.68 | 39.89 | 7.90 |

| Real Estate | 18.67 | 21.81 | 5.71 | |

| Real Estate | Real Estate Services | 25.18 | 38.31 | 1.45 |

| Real Estate | Real Estate Development | 12.22 | 10.92 | 2.12 |

| Real Estate | Diversified Real Estate Activities | 13.69 | 13.95 | 2.56 |

| Real Estate | Hotel & Resort REITs | 12.04 | 18.86 | 3.08 |

| Real Estate | Timber REITs | 16.14 | 24.14 | 3.48 |

| Real Estate | Office REITs | 15.70 | 14.55 | 7.98 |

| Real Estate | Other Specialized REITs | 15.00 | 17.81 | 8.60 |

| Real Estate | Single-Family Residential REITs | 18.06 | 26.22 | 8.72 |

| Real Estate | Real Estate Operating Companies | 21.99 | 7.94 | 10.06 |

| Real Estate | Health Care REITs | 23.96 | 65.82 | 10.30 |

| Real Estate | Multi-Family Residential REITs | 17.33 | 21.58 | 10.31 |

| Real Estate | Diversified REITs | 15.61 | 15.93 | 10.60 |

| Real Estate | Data Center REITs | 30.88 | 46.84 | 11.06 |

| Real Estate | Retail REITs | 17.21 | 25.70 | 11.87 |

| Real Estate | Self-Storage REITs | 18.24 | 27.34 | 12.11 |

| Real Estate | Industrial REITs | 21.58 | 31.03 | 12.18 |

| Real Estate | Telecom Tower REITs | 19.91 | 28.64 | 13.29 |

| Utilities | 10.86 | 14.83 | 3.11 | |

| Utilities | Independent Power Producers & Energy Traders | 11.52 | 10.93 | 2.07 |

| Utilities | Electric Utilities | 10.10 | 14.51 | 3.13 |

| Utilities | Gas Utilities | 10.33 | 14.85 | 2.36 |

| Utilities | Water Utilities | 11.65 | 15.60 | 5.53 |

| Utilities | Multi-Utilities | 12.07 | 17.65 | 3.31 |

| Utilities | Renewable Electricity | 15.80 | 24.26 | 7.97 |

Not all revenue is created equal. On EV/EBITDA, sectors like Information Technology and Real Estate sit near the top, with median multiples in the high teens to low-20s, while Energy and Materials are closer to the high single digits. This means investors are paying roughly 2x-3x more for each unit of earnings in the richer sectors than in the cheaper ones.

On EV/Revenue, the gap is even clearer. Real Estate has a median EV/Revenue of about 10x, and Information Technology is around 4.5x-5x, versus roughly 1.5x-2x for Energy and Materials. In simple terms, revenue in Real Estate and Technology is valued at several times the revenue in more cyclical, asset‑heavy sectors.

M&A Sector Highlights

The scatter plot analysis reveals clear clustering patterns across the valuation spectrum. This gives readers a quick visual map of which sectors are rich and which are modest on both metrics at the same time.

- Information Technology(EV/EBITDA: 24.3x, EV/Revenue: 6.6x): Commands the highest multiples, driven by strong growth, scalability, and margin expansion.

- Real Estate(EV/EBITDA: 18.7x, EV/Revenue: 5.7x): Premium revenue multiples reflect stable, contracted cash flows rather than rapid growth.

- Financials(EV/EBITDA: 20.0x, EV/Revenue: 4.5x): Valuation varies by metric, with earnings-based measures more reliable than EBITDA.

- Energy(EV/EBITDA: 6.6x, EV/Revenue: 1.4x): Discounted multiples reflect cyclical earnings and commodity-driven volatility.

- MaterialsMaterials (EV/EBITDA: 10.3x, EV/Revenue: 1.8x): Moderate pricing reflects capital intensity and uneven profitability across sub-sectors.

Beware the outliers: When Averages Mislead

While sector medians provide useful benchmarks, certain sub-industries trade at extreme multiples that can distort comparisons if used carelessly. These outliers demand special attention during valuation work:

Financials: In Financials, Property & Casualty Insurance has an EV/EBITDA of 74.35x, versus most Financials sub‑industries below 30x, and Specialized Finance and Commercial & Residential Mortgage Finance show EV/Revenue above 20x, far higher than the rest of the sector.

Materials: In Materials, precious‑metal names such as Silver and Gold trade on EV/Revenue of about 7.9x and 5.2x versus many other Materials industries closer to 1-3x, and Industrial Gases also reach at roughly 5.0x revenue.

Real Estate: Within Real Estate, several REIT categories (Telecom Tower, Industrial, Self‑Storage, Retail and Data Center REITs) carry EV/Revenue multiples above 11-13x, compared with a sector median of about 10.1x, and Renewable Electricity in Utilities also trades on an EV/Revenue multiple more than double its sector aggregate.

Where Metrics Disagree: Tension Points

Sometimes, P/E, EV/EBITDA, and EV/Revenue tell different stories about the same company or sector. These tension points reveal important nuances about profitability, cash flow quality, and growth sustainability:

High Revenue Multiples, Low Earnings Multiples: In Financials, Specialized Finance and Commercial & Residential Mortgage Finance show very high EV/Revenue (20-25x) but low P/E (near or below 2x), which suggests strong revenue optics but weak or volatile earnings. Here, EV/Revenue looks rich, but the P/E tells you profitability is thin or unstable, so a buyer should not simply pay 20-25x revenue.

Wide P/E Dispersion With High Revenue Multiples: In Real Estate, several REITs (Data Center, Telecom Tower, Self‑Storage and Retail) have EV/Revenue above 11-13x, while P/E ratios range widely from the mid‑teens to very high levels above 40x. This means revenue and earnings both look expensive, but the spread in P/E shows that earnings quality and growth expectations differ a lot within the same sector.

Uniform Premium Across Metrics: In Materials, precious metals like Silver and Gold trade on EV/Revenue of about 5-8x with P/E near or below 40x, compared with other Materials names closer to 1-3x revenue and mid‑teens P/E. Here, all metrics sit well above the sector, so a buyer using “average Materials multiples” would severely under-value these assets if they are true peers.

Using Multiples in Real Deals

For Buyers and Investors

These sector medians establish your valuation lane before detailed modeling begins. If your target operates in a sector where median multiples are 8-10x EBITDA and 1.5-2x revenue, proposing 20x EBITDA or 4x revenue requires compelling justification, exceptional growth rates, margin expansion potential, or strategic synergies that fundamentally differentiate the asset.

Conversely, if evaluating a high-growth software company or infrastructure REIT, paying sector-median multiples might mean missing the boat. Premium sub-sectors exist for good reasons: superior unit economics, network effects, or defensive moats that justify above-average pricing.

For Founders and Sellers

This data provides a reality check for fundraising conversations. A sector label alone doesn’t command premium multiples; your actual performance metrics must align with the premium peer group. The most effective pitch connects your company’s growth rate, margins, customer retention, and capital efficiency to specific comparable companies in the dataset, then anchors valuation expectations to that cluster’s range rather than broad sector averages.

Metric Selection: Matching Tools to Situations

Each metric has a role, and the choice depends on the company’s stage and stability.

- EV/EBITDA works best for profitable, steady‑margin businesses where depreciation and capital structure do not dominate the story (for example, mature Industrials or Consumer Staples).

- P/E Ratio is easy to understand but can be misleading when earnings are temporarily depressed or inflated, or when leverage is high.

- EV/Revenue is more useful for high‑growth or early-stage names where EBITDA is still ramping, such as some software, payments and renewable‑heavy utilities, but it needs a clear view on future margins to avoid overpaying.

Handling Data Challenges

Outliers and data caveats can move medians by several turns if left unchecked. Very high EV/EBITDA (for example, 70x+ in some Financials) and very high EV/Revenue (for example, 20x+ in some Financials, premium REITs, precious‑metal names, and Renewable Utilities) can pull sector numbers up and make the whole sector look more expensive than it really is.

Missing or negative EBITDA entries in parts of Financials make EV/EBITDA hard to use, so in those cases, it is safer to lean on P/E and EV/Revenue, and on qualitative checks of earnings quality.

Partner with Eqvista: Your Valuation Advantage

M&A valuation is part science, part art. The multiples in this analysis provide the science and empirical benchmarks grounded in current market pricing across sectors and industries. But the art lies in understanding why certain sectors trade at premiums, recognizing when outliers matter, and knowing which metrics matter most for your specific situation.

Whether you’re an investor, a founder, or an advisor, these benchmarks offer a starting point, not a final answer. Use them to establish initial ranges, challenge assumptions, and frame productive negotiations. But always remember: the best valuation combines quantitative rigor with qualitative judgment about growth potential, competitive position, and strategic value.

At Eqvista, we go beyond generic benchmarks to deliver valuations tailored to your unique business context. From 409A valuations to M&A advisory, equity management to fundraising preparation, Eqvista provides the expertise and technology platform you need to make informed decisions with confidence.

Ready to unlock your company’s true value? Schedule a consultation with Eqvista’s valuation experts today.