Advisory Shares in a Startup – A Complete Guide

In this article, you will find out more about Advisory shares.

This article is a complete guide and packed with knowledge, advice, and information on the benefits of taking an advisor’s shares in the startup. Advisory shares are given to the company’s advisor in exchange for their advice. In this article, you will find out more about Advisory shares.

Advisory shares in startups

Are you interested in becoming an entrepreneur and starting your own business? Advisory shares are one option that may be worth considering, especially if you are looking to start a company and want guidance and mentorship from a successful business leader in return for offering stock options.

What are advisory shares

Advisory shares are equity given to a business advisor in exchange for their advice and skill. They can be issued to startup consultants in place of cash compensation. They are often given to business mentors and general business advisors. It ensures the business is taken care of, and the advisors can share the company’s success if it goes well.

Types of advisors in startups

Business advisors are people who advise companies on a strategic level. They are typical businessmen who have been successful and can lend their expert advice to the company. Business advisors can come in two forms:

- The name advisor – This type of advisor is someone who has been successful in their previous business ventures or worked with and for big companies. Their name and experience give credibility and power to the company. This type of advisor provides more stability and security for the company.

- The practical advisor – This type of advisor is typically a business coach or entrepreneur who has started several companies and worked many jobs throughout their career. They have a wide range of experience in many different fields, which gives them more knowledge about different aspects and areas in a business, which helps both the advisor and the entrepreneur when they come together to create the business.

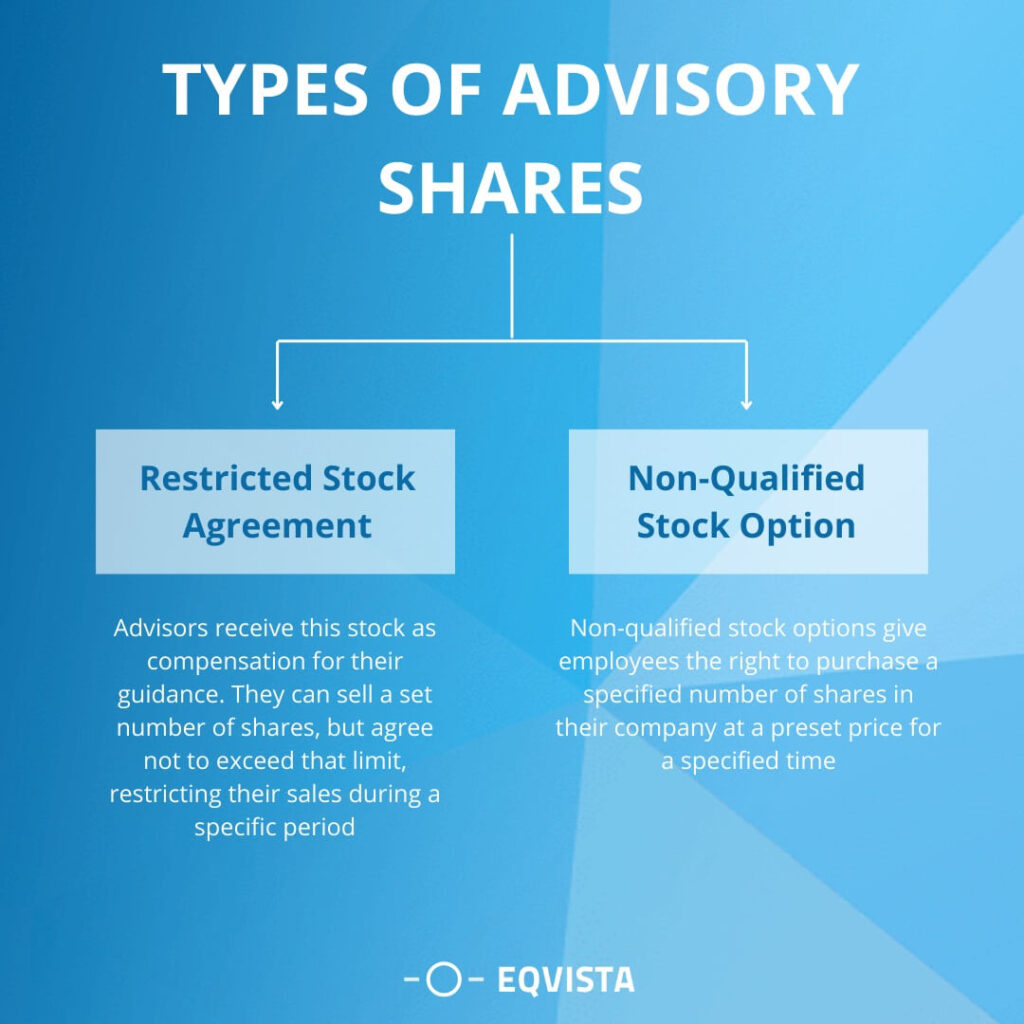

Types of Advisory Shares

Advisory shares are equity issued in return for their advice. Here are two types of advisory shares that are commonly given out:

- Restricted stock agreement – This type of stock is given to advisors as payment for their expertise and guidance. The advisor may have a certain number of shares that they can sell on the market at their discretion. However, the advisor must agree not to sell over the agreed-upon number. In simple words, they are restricted to how many shares they can sell during that period.

- Non-qualified stock option – Non-qualified stock options give employees the right to purchase a specified number of shares in their company at a preset price for a specified time.

Case Studies of Equity Compensation for Startup Advisors

Dropbox and Mark Gores, the “Accidental Advisor”:

- The advisor: Mark Gores, a lawyer, met Dropbox founders at a conference and offered legal advice at a crucial time.

- The equity deal: Gores received 0.75% of the company in exchange for his ongoing legal counsel and mentorship.

- The outcome: Dropbox’s IPO valued Gores’ stake at over $600 million, highlighting the potential rewards of equity compensation for valuable contributions.

Airbnb and Brian Chesky’s College Professor:

- The advisor: Chesky’s design professor at Rhode Island School of Design provided crucial early guidance and feedback on the Airbnb concept.

- The equity deal: The professor received a small, undisclosed amount of equity as a token of appreciation.

- The outcome: Though the exact value is unknown, the professor’s equity likely became significant upon Airbnb’s massive success, demonstrating the impact of even small equity grants.

Difference between advisory shares and regular shares

There are a few ways that you can distinguish between advisory and regular shares. Some areas where the two differ are as follows:

Eligibility

- Advisory Shares – As a matter of fact, advisory shares are issued to advisors in return for their services. In order to meet the eligibility, the advisor must have ties with the company wherein they are offering their services, expertise, advice, etc. The advisors must be an expert in a certain field, be well-versed with the company, be able to offer advice and assistance, and have to have approval from the board of directors of the company. As a result, the company benefits from the expert knowledge of the advisor and thus, they become eligible to receive a certain number of advisory shares.

- Regular Shares – While the eligibility for advisory shares is more focused, regular ones can be issued to anyone. These can be issued by any company and to anyone who is qualified to own regular shares. However, in order to be qualified, the basic requirements include a person that is 18 years of age or older, has no criminal record and is a resident of the United States. It is essential to note that regular shares are generally issued by publicly held companies due to the fact that they are usually allowed to raise capital through the stock market.

Acquisition

- Advisory Shares – Advisory shares are issued in exchange for services offered. The acquisition and issuance take place simultaneously at the company’s discretion. It basically works on a case-by-case basis, and the advisory shares are directly issued to the advisors by the company. Typically, a contract between the advisor and the company is signed as a part of the acquisition. The contract usually contains certain details including the vesting schedule, strike price, expiry date, and the number of shares. Therefore, the issuance of shares to an advisor is entirely under the company’s discretion.

- Regular Shares – Regular shares are issued in accordance with Security and Exchange Commission (SEC) which regulates US securities and the stock market. This can be acquired through an initial public offering (IPO), or in other words, through the stock market. The issuance of regular shares is regulated by the SEC and the company offering them to the public must follow certain guidelines. By registering the company with the SEC and listing on a stock exchange, they become eligible to raise capital through the stock market and eventually.

Stakeholder rights

- Advisory Shares – Stakeholders rights include all the rights, benefits and privileges that a normal shareholder has except for the fact that advisors are required to provide services to the company in order to retain their shares. Essentially, the advisors can exercise all the basic shareholder rights including voting on company matters, selling shares, receiving dividends, etc. In fact, the terms and conditions governing the advisory shares are stated in the shareholders’ agreement of the company.

- Regular Shares – Holders of regular shares have the right to vote, disclosure of information, dividends and any other right related to the company. However, depending on the class of shares issued, the shareholder’s right may vary. For instance, holders of common shares generally have voting right while preferred shares holders might not have voting rights. Therefore, depending on the class of shares issued, holders of regular shares have different rights.

Vesting schedule

- Advisory Shares – The vesting schedule is usually stated in accordance with the terms of the shareholders’ agreement. Well, the vesting schedule refers to the time period during which the advisor needs to provide the company with services in order to actually purchase their shares. As such, after certain achievements, milestones, or performance criteria have been met, the advisor can actually purchase and become a shareholder. Therefore, the vesting schedule varies based on the terms and conditions of the shareholders’ agreement.

- Regular Shares – There is no vesting schedule associated with regular shares because they are not issued in return for services. By simply purchasing through the stock market, there is an instant transfer of ownership from the company to the holder. However, this transfer of shares must be in compliance with the SEC regulations in order to ensure proper disclosure. Thus, holders of regular shares can buy, sell, and trade at any time.

How are advisory shares and regular shares similar?

While advisory and regular shares have their differences, there are some cases when they are similar. Here are some ways the two share some common ground:

- Advisory Shares – Both can be similar in terms of profitability due to the fact that whether the advisor or any other shareholder retains them, the shares will be able to generate the same capital gains. Additionally, both have the same rights and privileges that a shareholder has, including voting and dividends. However, the shareholder’s rights might be different depending on the class they hold.

- Regular Shares – Whether it is regular or advisory shares, the holder will be entitled to become a shareholder of the company. As a shareholder, the dividend, capital gains or loss, and voting rights will be the same. Although the purpose of issuing is different, the two share types are similar in terms of the financial benefits that a shareholder receives.

Difference between advisory shares and employee incentive shares

When a company issues shares to their employees as compensation for their performance are known as employee incentive shares. These are meant to motivate employees and align their interests with those of the company by using a share-based compensation plan. ISOs or Incentive Stock Options are a type of plan that uses employees’ shares as compensation. On the other hand, when a company issues shares to its advisors as a reward for their expertise are known as advisors’ shares. NSOs or Non-Qualified Stock Options are a type of plan that is used as compensation. NSOs are generally used for consultants, partners, advisers, directors, and others in order to attract and retain top talent.

Now, while both advisors’ and employee incentive shares are issued to incentivize and reward them for their performance, their differences lie in the fact that ISOs are issued to employees whereas NSOs are issued to advisors. But, what makes ISOs and NSOs different? Below mentioned is a brief explanation of each type of plan:

- ISOs or Incentive Stock Options – It is a type of employee stock option or stock-based compensation plan that is issued to employees in order to incentivize them and reward their hard work. In addition to this, ISOs are deemed more tax-advantaged than NSOs as they are not taxed at the time of exercise. However, at the time of selling the shares, employees might be taxed under capital gains tax on their ISOs. The rate of capital gains tax on ISOs would differ depending on the holding period and the amount of profit earned.

- NSOs or Non-Qualified Stock Options – The stock options are issued to consultants, partners, advisers, directors, and others in order to reward their expertise. Unlike ISOs, NSOs are subject to tax at the time of exercise, and the difference between the grant price and the strike price is considered to be taxable income. That said, ordinary income tax would be paid on the difference between the strike price and the grant price. Furthermore, the holders of NSOs are subject to payroll taxes.

So, which type of share is better: advisory or employee incentive shares? Well, the answer to this question depends on the requirements, the intended strategy, the goals of the company, and other similar factors. It’s a fact that both types are imperative in order to reward and retain employees or advisors. That said, the vested interests of advisors and employees can be aligned by issuing them shares with value as nothing beats a stake in the company.

How do advisory shares work?

The company gives advisory shares to business advisors, who then use them to motivate and encourage both the company and its employees. The advisors can also profit from the shares, but there is an agreement between them and the company that they will not sell within a certain time limit. A vesting period for advisory shares is typically monthly without any cliff. Furthermore, advisors may have the right to sell their stock before or after the agreed-upon expiration date.

Who receives advisory shares and how much?

Advisers can receive an advisory share based on their relationship with the company and their experience. They are usually issued when a company is getting started and needs preliminary guidance from a good business advisor. When the company’s business is established, the advisor’s stock will vest over time. The amount of the advisory share depends on several factors:

- The amount of time that has passed, and the progress of the company

- The level of expertise and guidance provided by the advisor to the company

- The level of risk the company is exposed to

- The equity plan for the company

Usually, the deal involves an agreement regarding the vested number and the amount of the shares to be issued, and when they will be issued.

Who issues advisory shares?

Advisory shares are issued by the board of directors of a company. They issue this type of stock because they want to acknowledge the efforts of business advisors and leaders, giving them a chance to share in the company’s success. The holders are not shareholders, so they do not have any right to nominate or veto management decisions such as appointing new board members.

Example of advisory shares

Assume that a company is currently in the process of starting up. The business owner and some other key executives have hired a few business advisors to help them develop their business. The company may give 0.10% of equity to an advisor who attends monthly meetings. The 0.10% is a small percentage of the equity, but it can grow over time as its value increases. Thus, the advisor is motivated to participate and help the company grow.

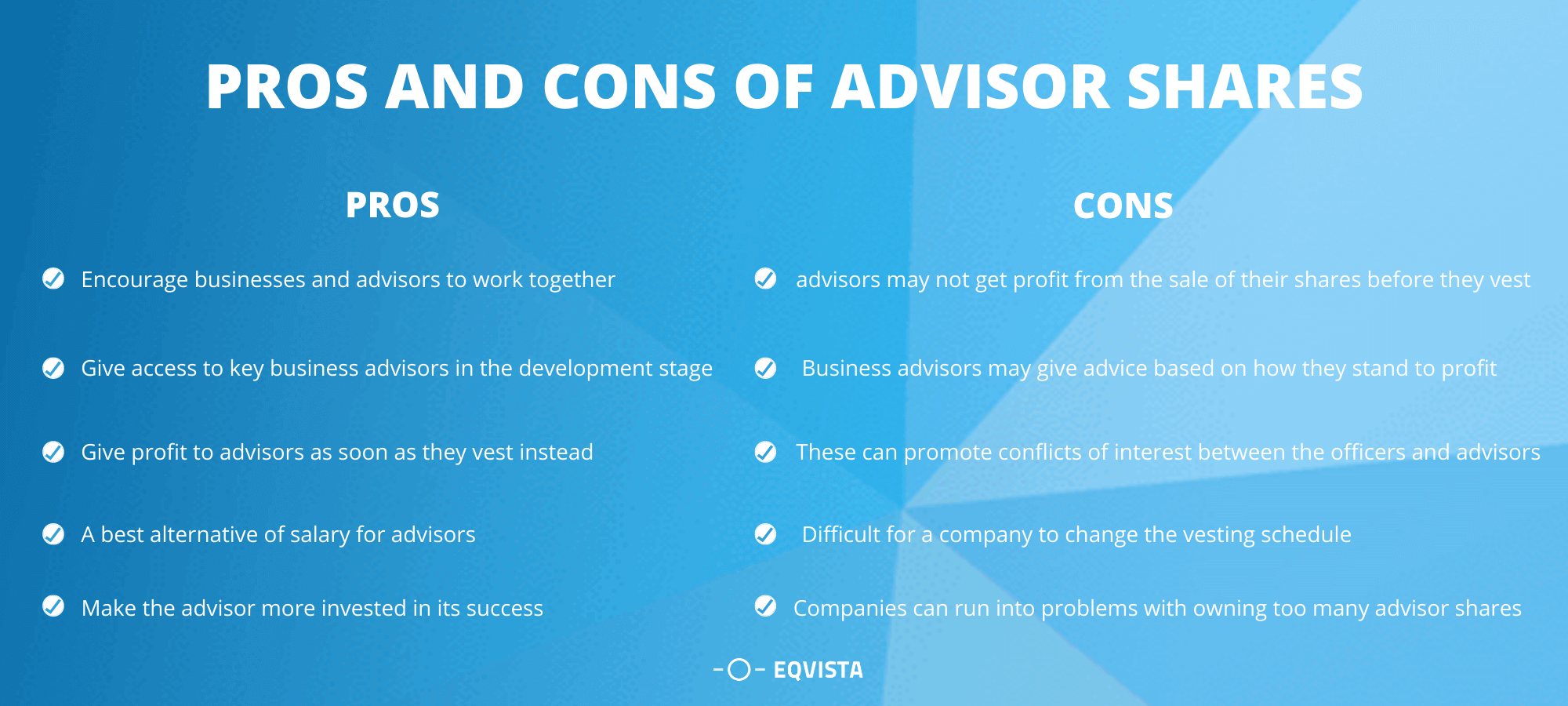

Pros and cons of advisory shares

Advisory shares can provide numerous benefits as well as some negatives. Following are a few pros and cons of using them:

Pros

- Advisory shares can encourage businesses and advisors to start working together.

- These help companies develop by giving them access to key business advisors in the early stages of their development.

- These shares can be structured to give advisors profits as soon as they vest instead of having them wait until several years have passed before profiting from their investment in the company.

- This is the best alternative for companies that do not have enough money to pay business advisors for their services.

- These shares make the advisor more invested in its success and more willing to help it become successful.

Cons

- There is no way of ensuring that advisors will not profit from the sale of their shares before they vest due to high stock volatility or other factors outside of their control.

- Business advisors may give advice based on how they stand to profit rather than on how they think will be best for the company’s growth and development.

- These shares can promote conflicts of interest between the company’s officers and advisors.

- It is difficult for a company to change the vesting schedule to give out more or fewer shares to advisors, so the vesting schedule must be set up accurately from the beginning.

- Companies can run into problems with owning too many advisory shares.

How to approach advisors for conversion about equity?

Now that you know what advisory shares are, how they work, and what they can do, it’s time to find ‘how to approach advisors for conversion about equity?’ The ever-changing and fluctuating economy makes it hard to predict the future. It is important to have business advisors who can help you take advantage of the changes in the business environment. However, approaching business advisors for their support can be a bit challenging. Therefore, some ideas will help you approach advisors for conversion about equity and make them work for your company.

- Referrals – The most common way of approaching business advisors is through your previous clients or customers. If you have worked with them before, they will probably know a good business advisor. Furthermore, if you want to discuss converting their shares into equity without giving them a share in the company, you can discuss it with them as well.

- Trade Shows – Another way of approaching business advisors is through trade shows. Businesses often use these to promote their products and services. Therefore, you can attend the shows used by the business advisors that you’d like to convert. Showing your face at these events will open many doors for you, so it is worth it to put some effort into it.

- Social networks – Social networks have become a powerful marketing tool, and they can help you build relationships with business advisors and their clients. You can see what type of clients and business advisors these people have, which will give you an idea of the type of work they do.

- Online networking – While networking via social media sites is not as effective as traditional networking, it does give you a chance to interact with the people you’d like to convert about equity. Online networking is not just limited to social media sites such as Facebook. No matter where you live, there is a good chance that you can find business advisors on LinkedIn, Twitter, and various other social media sites.

These are a few ideas that might help you approach other business advisors for conversion about equity.

Things to keep in mind while issuing advisory shares

Businesses should always remember that these shares can lead to conflicts of interest. Moreover, they can also pose a risk to the company if they have low value. Following are some strategies that businesses can implement to avoid issues with these types of shares:

- Equity offerings based on advisors’ roles and time commitments are essential for business owners to ensure that advisors are properly compensated for their time. Based on the role of each advisor, businesses can decide how much equity they will offer them after the conversion of the associate’s shares. The higher the role and time commitment of an advisor, the more equity they will receive.

- Prepare company confidentiality, and intellectual property agreements – Businesses should also ensure that confidentiality agreements are in place between the company and its advisors. This way, the company can ensure that it will not have any issues with its advisors revealing confidential information about the business or serving as an advisor without receiving an equity threshold.

Advisor Agreement Template

An advisor agreement is a legal document that outlines the terms of the relationship between a startup and its advisor. The agreement outlines both parties’ responsibilities, duration, and compensation, ensuring mutual understanding.

Here are some typical components that are commonly found in a startup advisor agreement:

- Names: This Includes names of the company and advisors

- Dates: This mentions the date when the document was signed

- Expenses: This part says the person who covers /pays the associated costs.

- Compensation: It mentions how advisors will be paid or compensated for their service.

- Rights Of Property: This clause will cover the rights over intellectual property.

- Dispute resolution: This helps to resolve disputes easily and affordably.

- Roles and responsibilities associated: This clause will explain the expected work from advisors.

- Confidentiality: This clause ensures that any kind of sensitive information will not be disclosed at any cost during the term period.

Here is a sample template for startup advisory agreements for companies.

Certain elements, such as job profile, description, and daily tasks, should not be included in advisory agreements. Most of the time, it also avoids some restrictive clauses that directly affect the personal life of the Advisors. A well-drafted agreement is an added advantage to advisors and companies equally.

Manage your startup equity for advisors with Eqvista!

Advisory shares can be a lucrative investment for business advisors. However, businesses should thoroughly evaluate the circumstances before issuing these to their business advisors. If you want advice on approaching advisors for conversion about equity, please do not hesitate to inquire with Eqvista. We will be happy to help you manage your startup with advisory shares.

FAQs on Advisory Shares

To help you understand further, we have compiled a list of frequently asked questions that startups have about advisory shares:

What is the difference between regular shares and advisory shares?

Regular shares are issued by a company to the general public via an Initial Public Offering (IPO). These represent an interest in the company and are distributed to the public using stock exchanges. In contrast, advisory shares are directly issued to the company’s advisors in return for their services.

How much shares to give to advisors?

The amount of shares that the company gives to its advisors is entirely at the discretion of the company. However, it would be wise for the company to set a ceiling on the number that can be issued to its advisors. Generally, between 0.25% to 1% of the shares of a company should be given to advisors.

Do advisory shares get diluted?

Similar to any other type, advisory shares are subject to dilution. Whenever the company issues additional shares, the existing shareholders’ stake in the company gets diluted. Holders typically do not have the right to control the company; thus, with each new issuance of shares, dilution occurs.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!