What is a share certificate or stock certificate?

We will discuss some important aspects of share certificates, especially digital shares and learn how to issue and track electronic shares.

Investing in company shares, though subject to market risks, can be a lucrative investment option. If timed well, profits can be substantial. But ever wonder how to document your shareholdings? Or if you own a company, how to track your ownership with stock certificates?

Share Certificate (Stock certificate)

Owning shares means owning equity in a company. Typically, a shareholder purchases a certain number of shares from a company at a fixed rate on the grant date. The idea is that the business will grow over the years increasing the overall share price. The shareholder will then profit from the difference in price by selling these shares at the prevalent market price at a later date. Since shareholding is subject to time, documentation is important. This is where the concept of a share certificate comes into play.

What are share certificates?

A share certificate, also known as a stock certificate, is a documented proof of shareholding in a company. It can be a physical document or an electronic one, issued to a shareholder and signed on behalf of the corporation. This certificate is legal proof of ownership of a certain number of company shares. It certifies registered share ownership of a certain number of shares from the grant date and also acts as a receipt of share purchase. However, a share certificate merely contains details of the shareholder and the number of shares they own, it is not the stock itself.

Share certificates are issued based on asset classes. Usually, one certificate is issued to each shareholder containing details of the total number of shares of a particular asset class. Multiple certificates are issued only in case of shareholdings across both asset classes A & B. A company must issue a share certificate within two months from the date of the issue or transfer of shares. Similar to currency notes, companies use intricate designs in their paper stock certificates to restrict fraudulent replications.

Image credits: UTA Libraries Digital Gallery

How are stocks held?

The ownership of company stocks can be of different types, and share certificates are released based on the mode of ownership in the company. Since these are also proof of investments, it is important that a corporation clarifies the mode of shareholding with its respective shareholders before issuing share certificates. The three types of shareholding are:

- Physical certificate – As the name suggests, a physical copy of the share certificate is provided. The shares are directly registered in the name of the investor and all documents and dividends are sent directly to this shareholder.

- “Street name” registration – Stocks are registered in the name of a brokerage firm. All documents and dividends are sent to this firm who then distributes it to their individual shareholders. This is the most common type of shareholding. Brokerage firms and their shares are listed in the company books and no physical copy of the share certificate is provided.

- Direct Registration System – The individual’s name is registered in the stock issuer’s records. They deal directly with the company’s transfer agent. There is no necessity to involve brokerage firms and share certificates are not provided.

How is a share certificate issued?

A share certificate is typically prepared and issued by the company secretary based on details provided by the company and shareholders. It is the primary duty of the company secretary to check all information for accuracy before publishing the certificate. The three most important details to be checked are:

- Serial number of the share certificate

- Number of shares being issued or transferred

- Details of the shareholder

We will discuss this in detail in the later sections. However, an important point to be noted at this juncture is that a share certificate can be issued only:

- As per company bylaws, company directors are vested with the authority to issue new shares with the approval of shareholders.

- Articles of Association and the company Memorandum outline the processes to issue new shares or transfer their ownership.

Why is a share certificate important?

The primary role of a share certificate is documentation. All shareholder details must be updated periodically to track any changes in stock ownership. Suppose an investor buys 100 shares of a company today. A week later she might choose to sell 20 shares to another investor. A month later she might want to buy 100 more shares of the same company. All details of this shift in ownership must be tracked for auditing purposes.

A share certificate is also a legal proof of stock purchase and the shareholder’s entitlement to dividends. To protect the interests of shareholders, all companies must maintain good record keeping practices of share certificates issued by them over the years. A share certificate is typically issued in the following three scenarios:

- Issuing new shares – New shares are issued to new shareholders. Company directors are vested with the power to create new shares without affecting the existing number of shares.

- Transferring shares – Suppose a shareholder sells a part or all of their shares. The sale could be to an individual, an investor, or another company. Either way, a new share certificate has to be issued to both parties with revised shareholding details.

- Loss or damage of certificate – Loss or damage to an existing share certificate has to be reported immediately. Except in case of loss of certificate, the damaged document must be returned to the issuing company before collecting a new one.

Now that we have a fair idea about the concept of share certificates, let us move on to the actual structure of it. How does it look? What information is added to it? Is there a simple way to create it? The next section explores these ideas.

Share Certificate Template

What information is added to a share certificate?

Though the design, layout, and mode of issuing share certificates (paper or digital) have evolved over time, the basic details included in it have mostly remained the same. The need for the accuracy of these details cannot be stressed enough. Broadly, share certificate templates across different businesses include the following information:

- Full name of the company

- Registered address of the company head office

- Registration number of the company

- Number of shares issued, in numerical and full word form

- Name of the shareholders

- Contact details of the certificate owner. In case of joint ownership, contact details of the first-named shareholder are only included

- For limited companies, include the company seal, if any

All share certificates are signed by at least two company directors. Alternatively, it can be signed by one director and the company secretary. In the case of companies with one director, share certificates need to be signed in the presence of a witness who has to attest his signature. In a share certificate template, usually, all signatures are printed. In rare cases, share certificates are physically signed by the directors.

Paper Stock Certificate vs Digital Stock Certificate

A traditional paper stock certificate is almost a collectible item. Apart from being proof of shareholding, it is a prestigious trophy with sufficient branding worth being a decorative piece in a shareholder’s home. It is also passed down generations with the same respect as a family heirloom. But over the years, many businesses have stopped issuing paper stock certificates and transitioned to digital share certificates. Let us understand why.

Why do companies prefer issuing digital certificates?

Paper share certificates, as novel as they may be, have several drawbacks. Though the arguments in favor of this practice still have solid ground, in foresight, digital certificates seem to be the future of equity documentation. Here are some common irregularities with paper stocks:

- It is hard to track and manage as shareholdings do not remain constant. Shareholders will trade their stocks based on market fluctuations. Documenting every single move is a challenge with paper stocks. Also, the initially issued certificate will not reflect the shareholder’s actual ownership and the dividends they will receive on liquidity

- Shares can be transferred to new owners without the company’s knowledge

- Difficult to organize all certificates making audit cumbersome

- The process of selling the company becomes complicated

- Compliance becomes harder

- Difficult to integrate into electronic systems

- May get lost, damaged, or stolen

Owing to the afore-mentioned reasons, the business world is gradually moving away from paper share certificates. Non-LLC private companies who were initially hesitant to make this shift are now considering it as well. This movement towards uncertificated, paperless shares is called ‘dematerialization’. In this process, all existing paper share certificates are converted to uncertificated securities using a centralized company ledger. All 50 States now have laws that recognize digital shares as a legally approved and preferred method of share issuance.

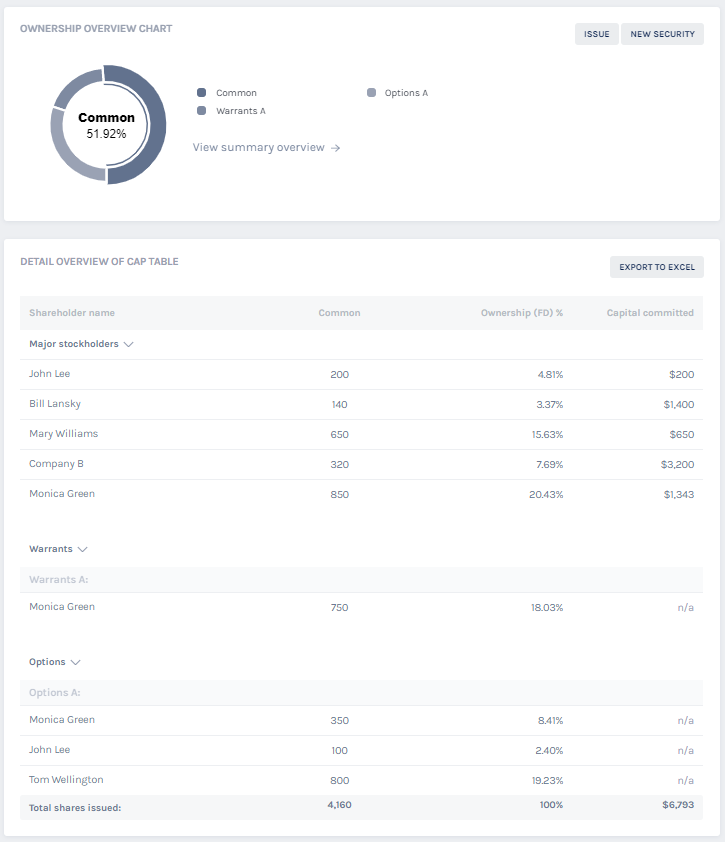

Web-based equity management systems make the shareholding tracking process paperless, efficient, and economical. Thus, more and more private companies are shifting their processes to issue electronic share certificates. Before diving deeper into this aspect, we must also know that digital shares can be certificated or uncertificated. Let us understand the difference between these two.

Certificated shares vs. uncertificated shares

Issuing paper stock certificates is a linear process. A physical document is presented to the shareholder that certifies their share ownership. But with electronic share certificates, a company may choose to provide a certificated share document or simply record it in the company books. Shares issued on paper or digitally (PDF document) are known as certificated shares, while shares issued by book-entry without any document (physical or digital) are known as uncertificated shares.

In the book-entry process, shares are not physically transferred to the owner. Ownership of securities is only exchanged by updating their details in the company ledger maintained by the financial institutions that handle investor accounts. It is similar to maintaining credit and debit records of bank accounts. Let us now see how these electronic share certificates are issued.

How to issue electronic shares?

In the United States, the Central Securities Depository (CSD) electronically holds both certificated and uncertificated shares. Share ownership is easily transferred through a book entry rather than the transfer of physical certificates. Meanwhile, electronic share certificates are stored as a digital copy on cloud servers. These are electronically signed by the company directors. Here are the three ways of issuing electronic shares:

Digitally signed certificated shares in PDF

These are the only certificated form of digital shares. It is comparatively a new approach and has not been officially ratified by law, however this practice of issuing electronic share certificates is based on the pretext that the law does not prohibit them either. To convert all physical share certificates to digitally signed PDF copies, companies have to track down all share certificates issued so far and re-issue them digitally.

Uncertificated shares using spreadsheets

This is the commonly used mode of issuing electronic shares. Share certificates are not issued. Rather it takes the most basic form of maintaining a simple stock ledger and the operating cost is almost zero. Usually, an attorney is appointed to certify the existence and authenticity of these shares. The audit becomes easy as well. All that is needed is access to this online spreadsheet. However, the biggest drawback is that shareholder’s access is restricted. In large companies, with thousands of shareholders, it is truly impossible to grant shareholders with personalized access to this document.

Uncertificated shares using software like Eqvista

This is an advanced version of using spreadsheets. No share certificate is issued. But specially designed software provides all the advantages of the spreadsheet method with the additional flexibility of a web-based, personalized system. An equity management software like Eqvista helps companies easily track, manage, and issue shares. It smoothly manages automation and compliance aspects as well. Some important features of such software are:

- Equity ledger is web-based

- Easy issuance of electronic shares

- Personalized portals for shareholders

- Accounting equity is automated

- Compliance of equity is automated

- Provides special tools for issuing Pro-forma

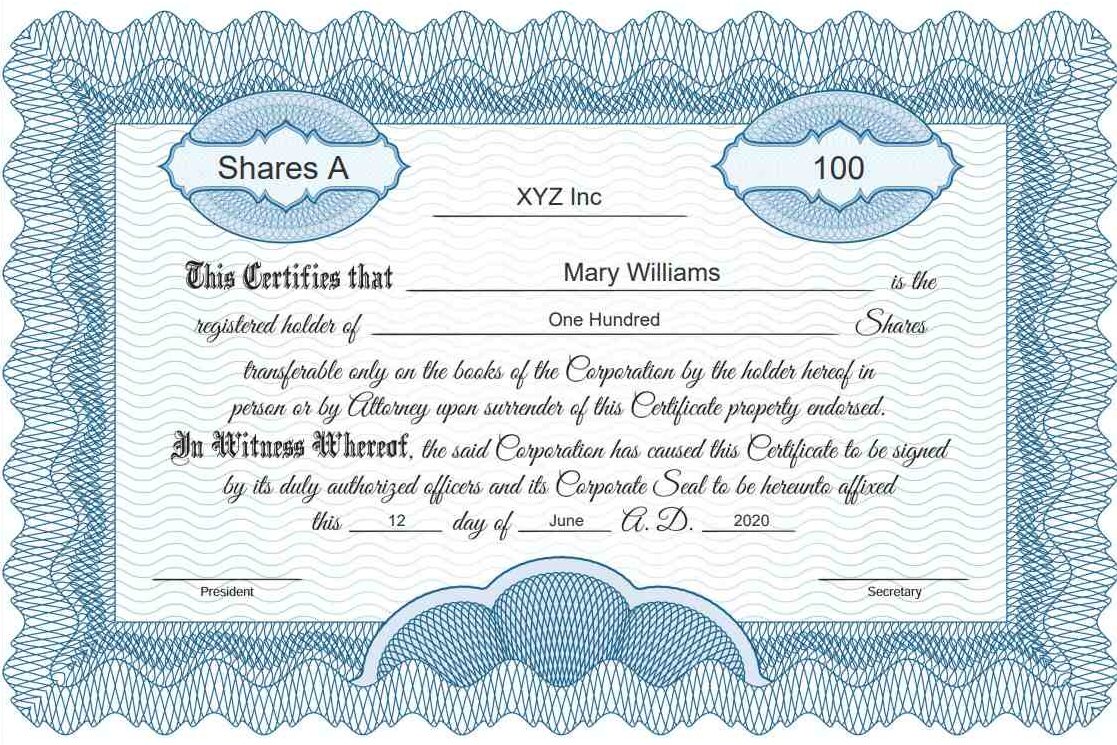

Despite the advantages of issuing uncertificated shares, Eqvista can still generate downloadable digital certificates for use by your shareholders. They look like this:

Clearly, the advantages of going digital with electronic shares are quite evident. Then why are companies not making the absolute shift? In spite of being legally valid in all 50 states, why are companies and investors still skeptical about issuing electronic share certificates and going completely digital with their equity management?

Here are some possible misconceptions

- Difficulty in absorbing legacy papers into a digital platform – A company can legally have both paper certificated shares and uncertificated digital shares. If a private company wants to shift to digital shares, they simply have to opt for a system that accommodates both. However, there should be a way built-in the share registry to track which shares certificates are issued on paper and which are digital.

- Reservations of Investors – It is proclaimed that reliable investors prefer physical documents for share ownership. This can’t be further from the truth. In reality, most sophisticated and experienced investors prefer digital shares. If at all any concerns are raised, it is mostly from the legal perspective. Make sure you have enough references to prove otherwise. In spite of this, if an investor insists on a paper share certificate, make sure that your equity management system is able to accommodate this request.

- Reservation of Auditors – Similar to investors, old school equity management vouches for paper share certificates. However paper stocks are not centralized and tracking each one of them could derail auditors. Also, over the years, ownership information might not be updated thus providing inaccurate stock ownership data. Whereas, auditing uncertificated stock, especially with software like Eqvista, is just a matter of a button click. The auditor is simply granted access to the centralized database to view all updated share ownership information.

- Enforcement of restrictions – A common misconception with digital shares is regarding the enforcement of restrictions on share trading. It is assumed that the extent of restrictions enforced on digital stocks is not the same as paper stocks. The truth is, there is no law stating so. Public and LLC companies have been issuing uncertificated shares for decades without any enforceability issues. As long as the ‘opening statement’ is communicated via physical letters or email to the shareholder (a process similar to issuing paper share certificates), there should not be any problem.

- US specific state level legality – Almost every state in the US is pushing hard for ‘dematerialization’. Some have even introduced laws that better accommodate digital equity management. Unless specifically stated otherwise, the rights and obligations of uncertificated shares are identical to those of certificated shares.

- Custody concerns – The concept of perfecting a security interest is particularly debatable and a matter of concern in the case of uncertificated shares. As we know, it is a common practice to use shares as collateral. The concept of perfecting a security interest simply allows a lender or a creditor to make sure that no one else can use the same pledged share as collateral. Here paper share certificates are the most preferred option because the shareholder can directly provide the certificate which is not possible with uncertificated digital shares. The present equity management technologies have taken care of this issue with the Uniform Law Commission’s ruling making it legal and acceptable that perfecting a security interest can now be done by simply transferring the ownership record from the holder’s name to the person or the organization who will control this security as collateral.

- Tendering shares – By tendering, a shareholder trades his share ownership with another shareholder or firm mostly in exchange for cash. This happens when the shareholder is selling shares to a bigger company or an investor is willing to buy out some existing shares. If paper stocks are tendered, all share certificates have to be collected and verified from each shareholder. If a shareholder wants to sell one part of his shares, multiple share certificates have to be cut and re-issued. This process is cumbersome and will cause severe delays in the tendering process.

Issue electronic shares and share certificates on Eqvista

By now you may be convinced to make the shift to electronic shares. You are now a part of the future of equity management systems! So how should you go about it? The process is quite simple but it is better to engage an attorney for suitable advice throughout this shift. Here is where you should begin:

- Step 1: Organize the board of directors to authorize the issuance of uncertificated shares

- Step 2: Create a board resolution stating that the company now has the authority to issue uncertificated shares

- Step 3: Amend the company bylaws and articles of association to accommodate this change

- Step 4: Issue and track uncertificated shares electronically on a company ledger.

Even better, explore Eqvista equity management software for easy issuance and tracking of shares to multiple shareholders, each having access to a personal user interface. To learn more, connect with us today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!