How do ESOPs benefit small businesses in competitive industries?

This article highlights the advantages of ESOPs for small businesses and describes the major challenges of implementing ESOP in their system.

ESOPs offer employees in a company equity shares in place of partial compensation. The National Center for Employee Ownership (NCEO) data for 2022 estimates nearly 6,548 active ESOPs with 14.9 million participants, valued at nearly $1.8 trillion. Most of the ESOPs were offered by privately held companies (~6,016) while public companies with ESOPs numbered only 533.

The number of ESOPs offered remained approximately the same from 2014 to 2022, with slight deviations for each year. 2025 looks like a positive year for ESOP growth due to factors such as lower cost of debt, which helps in buybacks. Valuation multiples remain flat, and undergoing an M&A is still profitable. This suggests a rise in the price of ESOPs as well as new ESOP offerings.

This article highlights the advantages of ESOPs for small businesses and describes the major challenges of implementing ESOP in their system.

ESOP benefits to small businesses

A majority of startups are small businesses before the big guns swoop in with their dry powder. Small businesses do not have a large amount of cash flow at their disposal to pay their employees competitive wages. To retain talent, they need to offer stock options which enhance the remuneration and can be a win-win situation for both employee and the employer.

Other ESOP benefits for small businesses are highlighted in the following sections.

Increased Employee Motivation and Productivity

With ESOPs, employees take part in the increase or decrease of the value of the business and are hence motivated to do well. This is backed up by academic studies from Fang et al, (2015) and Blasi et. al. (1996), which indicates a 4 – 5% increase in productivity among workers with ESOPs for small businesses.

Based on a general social survey (GSS), employees with ESOPs were 20% – 50% less likely to seek a job change. The same survey suggested that nearly 2/3rd of the employees choose jobs with ESOPs or performance-linked incentives. The results of these surveys indicate what we already know. If employees have skin in the game, they are likely to be motivated to perform better.

Enhanced Employee Retention and Attraction

Common wisdom would suggest that employees remain in a company that offers stock options. With vesting periods and considering a company’s private equity cycle of 3 – 5 years, employees would remain to get the most benefit until the company is sold to large groups or goes public. This is also backed by the 2017 NCEO study, which states that the median tenure at a company offering ESOPs is 5.2 years versus 3.4 years in the comparison group.

In addition, some studies, such as the Employee Ownership Foundation study in 2020, suggested that the ESOP offering companies are much more likely to maintain standard working hours, which enhances retention and attraction.

Improved Financial Performance

Financial performance is directly related to efficiency. Blasi et. al. reported a 2.4% increase in output for companies offering equity when compared with their non-ESOP peers. The authors also reported a statistically significant 2.3% increase in sales for ESOP vs non-ESOP companies. In addition, ESOP companies are nearly 50% less likely to go bankrupt.

Enhanced efficiency is also linked with motivation. Employees with equity shares are likely to work more efficiently for the good of their company. Increased motivation would ideally lead to enhanced revenue.

One of the economic benefits of the ESOP is that bankruptcy is significantly less likely, as ESOP companies save on cash for remuneration and also attract better talent.

Tax Benefits and Cash Flow Advantages

ESOPs offer tax benefits for both employers and employees. To begin with, C-Corps can deduct 25% of the contribution towards payroll or ESOP acquisition loans. Any capital gains applicable can be deferred and waived if certain holding period and reinvestment conditions are met. In addition, ESOP transactions are tax-free.

For employees, too, taxes on the sale of ESOPs to the employer can be deferred based on periodic conditions. Up to 50% of the ESOP can be converted to tax-advantaged plans such as a 401(K).

Succession Planning and Business Continuity

ESOPs can be an alternative way of handing over the company to employees instead of selling to competitors. The founder can still retain some control, which is usually not possible when a startup is sold to a fund or a competitor. Retaining a minority interest can be a good diversification tool for the retirement phase of the founder. The business can be run the way it was without drastic changes.

This could also help avoid estate taxes and provide a tax advantageous sale of the company. A founder will generally use cash from the company to buy their shares that are held in ESOP. The company can also take a loan for the buyback, which again provides certain tax advantages.

Fostering Innovation and Efficiency

Usai et al. (2021) contend that ESOPs foster innovation in companies by allowing employees to partake in the residual income of the company and mitigating the agency problem. This was supported by Sun et. al. (2024) in their most recent research. One of the reasons is that ESOPs concentrate talent at the company, enhancing collaboration and innovation.

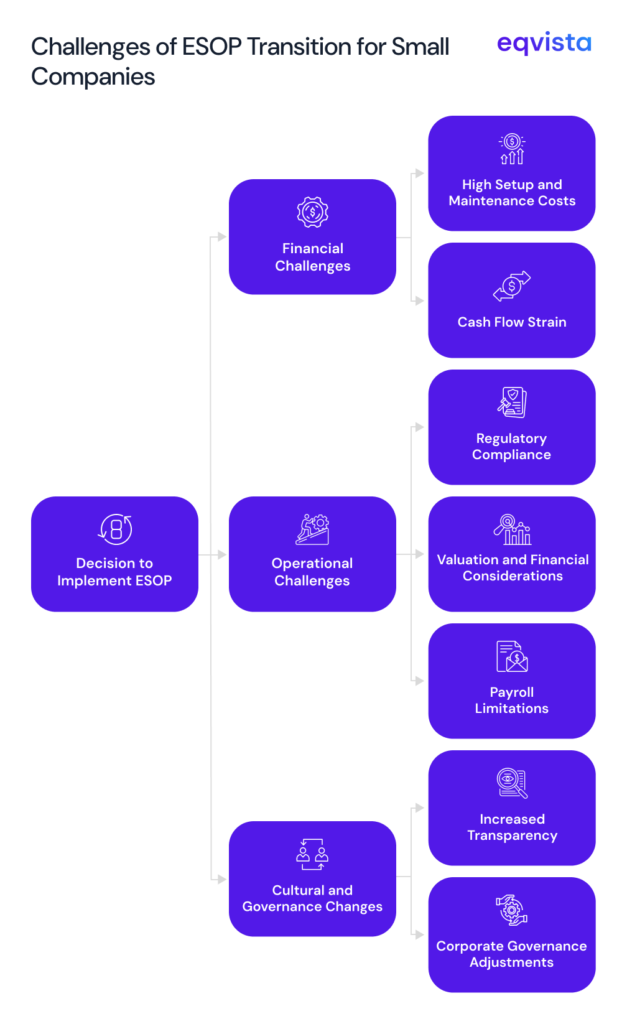

Challenges small companies face when transitioning to an ESOP

Small companies transitioning to an Employee Stock Ownership Plan (ESOP) often encounter several challenges. Addressing these challenges requires careful planning, expert advice, and a clear understanding of the benefits and drawbacks of ESOPs for small businesses.

Financial Challenges

- High Setup and Maintenance Costs – ESOPs can be expensive to implement as they can cost anywhere from $150,000 or more to implement in the first year. For a small company with cash flow constraints, this could break the company. Eqvista’s stock based reporting can help and provide you with clarity on your holdings. It can be used as a base for final ESOP implementation, reducing the time, effort, and money required. Adhering to regulations and legal costs can be cumbersome and can affect the balance sheet significantly. Eqvista offers ESOP plans that are significantly lower than the usual market rates and also offers freemium plans if there are fewer than 20 shareholders. A cap table can be onboarded at only $2 per shareholder. This could save startups a significant amount of cash outflow and avoid financial insolvency.

- Cash Flow Strain – For a startup or a small business, cash flow problems are very common and can further be exacerbated if any large expense comes due. In addition to implementation cost, a number of cash flow issues can arise. Some employees may cash out in the beginning, leading to cash flow strain. Tax liabilities can also cause a cash flow strain. Eqvista’s stock based reporting can help small businesses set up a stock compensation plan so that the founders can analyse cash flow requirements, preventing and planning for constraints.

Operational Challenges

- Regulatory Compliance – ASC 718 lists requirements for stock compensation plans and reporting, and can be tricky for a business that is raising capital with ESOP. It requires a business to provide detailed information on ownership, pricing, date of issue, valuation, vesting schedule, and other details for ESOPs issue. The reporting needs accounting for expenses, valuation as well as a list of disclosures. Again, Eqvista’s stock-based compensation reporting can help founders of small businesses navigate operational challenges with ease so that they can focus on getting their business to new highs.

- Valuation and Financial Considerations – Valuation guidelines for ESOPs can be stringent and are kept in place to prevent arbitrary valuation from scrupulous stakeholders at the expense of other stakeholders. Fair market valuation reporting is carried out for a business issuing ESOPs. This is important even if no ESOP issue is being considered. A 409A valuation is a necessary step for ESOP issues, and Eqvista’s expert valuation and consultation services can help determine the best price for small businesses that is in line with the regulations.

- Payroll Limitations – ESOPs are subject to annual compensation limits for tax benefits. The highest per-employee payroll for 2024 is $345,000. The limit for annual addition to defined contribution plans (employee+employer) stands at $69,000. This limits the tax-advantaged compensation that can attract talent for small businesses, but does not limit the compensation to this level. Eqvista’s services can help founders as well as employees plan their payroll with tax-advantaged limits.

Cultural and Governance Changes

- Increased Transparency – With ESOPs, regulatory compliance related to expenses, pricing, valuation, etc. kicks in even if the company is not public. It fosters a culture of trust, and the employees are clear about the financial performance, challenges, and potential of the business. Eqvista offers a cap table to provide transparency on ownership to help employees stay informed about their holdings, vesting schedule, exercise rights, and other details.

- Corporate Governance Adjustments – Major corporate governance adjustments that arise after the ESOP issue include conflict of interest, ESOP trustee, and fiduciary. If the founder or the manager is involved in ESOP management, a conflict of interest is highly likely, and this should be avoided. An ESOP trustee will oversee the shares and provide an independent appraisal, manage ESOP assets, and ensure compliance. The trustee is also the fiduciary for the ESOP. Eqvista can help businesses issue shares, do ESOP reporting, and handle other required compliances.

Remain competitive in ESOP markets with Eqvista

As a small business, founders cannot always match the resources of large private equity firms. ESOPs offer a way to attract and retain top talent that will help small businesses provide innovative products and services. Aligning the interests of the employers and the business also helps enhance efficiency, further increasing competitiveness.

Eqvista offers a spectrum of services for startups and small businesses alike. Issuing shares and managing shareholders with a cap table can help small businesses have an idea of their shareholdings. Valuation can help enhance transparency for shareholders and employees. In addition, here is a list of comprehensive services for small businesses that will help them remain competitive.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!