ESOP or Employee Stock Ownership Plan

ESOP is the most common kind of employee ownership plan used in the US.

Are you considering offering ESOPs (Employee stock ownership plans) to your employees, or are you an employee and about to receive ESOP as a bonus from your company? You may have many questions about what an ESOP is and how it works. Regardless of if you are an entrepreneur, employer or employee, you should know all about the benefits of ESOPs along with all the ESOP rules and regulations.

To begin with, an ESOP is the most common kind of employee ownership plan used in the US. In fact, there are about 6,669 ESOP plans all around the US, covering about 14.4 million people nationwide. So, as ESOPs are becoming increasingly more popular among companies, it is high time for you to take advantage of this. Here, you will learn all you need to know about ESOPs.

What is an ESOP or Employee Stock Ownership Plan?

An ESOP, or employee stock ownership plan, offers workers ownership interest through employee stock options in the company. This plan is created to offer the employees the chance to purchase stock in a closely held company to promote company growth.

Since ESOP shares are a part of a bonus package for an employee, companies use ESOPs to keep the plan participants focused on share price appreciation and corporate performance. ESOPs encourage employees to do what is best for both the company, and in turn, the shareholder with the appreciation of their stock. The owners also enjoy tax benefits by offering ESOPs to their employees. And with these share plans, employers can retain the best talent by offering extra incentives for their staff, which would help grow the company.

But just to be on the safe side, these companies usually add a vesting schedule within the ESOP. This helps protect the company in case the employees leave the company before the ESOPs fully vest. When the shares become fully vested and if the employees choose to stay with the company, they can keep the shares and become a shareholder. If they choose to resign or retire from the company, and the shares are fully vested, the company can repurchase the shares. Otherwise, these shares are automatically forfeited and taken back from the shareholder.

Note: Employees that retire or resign usually cannot take the shares from the ESOP with them. They are only allowed to take a cash payment obtained from it. On the other hand, the employees that have been let go usually qualify for the amount that they have vested in the plan.

How do ESOPs work and its rules?

ESOP or Employee Stock Ownership Plan is a way for employees to own stock in their company. The purpose of the ESOP is for the benefit of the employees and in order to encourage, motivate and retain employees to work for a long time. Similar to usual stock options in private companies, employees can acquire the shares of the company after a certain period of time at a predetermined price (strike price). In ESOPs, there is a vesting period, which is the period that an employee must stay in a company before they can own the shares.

To better understand the process, let’s go through an example of an ESOP. Assume that a company grants 1,000 shares under employee stock options. Let’s say that the strike price is $30 a share and the employee will acquire his ownership of the 1,000 shares after 5 years of employment. That means that at the end of 5 years, the employee can pay the strike price of $30 per share in order to own the 1,000 shares fully.

Note: The strike price or exercise price is usually based on the fair market value of the company’s shares at the time of grant.

ESOP Pros and Cons

ESOPs benefit employees and employers and can be an alternative exit strategy for business owners. Even though ESOPs are widely used, they are only sometimes suitable for some organizations. When considering if an ESOP is right for your company, weighing the pros and cons is important:

Advantages of Implementing an ESOP

- Attracts and Retain Talents – The Employee Stock Ownership Plan (ESOP) is an effective tool for attracting and retaining talented employees.ESOPs can align the interests of employees and shareholders, leading to a more cohesive and unified team.

- ESOPs offer wealth-building opportunities to employees -Employee Stock Ownership Plans can be an excellent way for employees to build wealth over time. Employees can benefit from this growth by receiving dividends and/or selling their shares back to the company or on the open market.

- ESOPs are an effective way to save for retirement – ESOPs provide a valuable opportunity for employees to invest in and enable them to build retirement savings along with the growth of the business. Employees aged 55 or older, with ten or more years of participation in the ESOP, must be allowed to diversify a portion of their ESOP benefit accounts.

- Employee Ownership improves Performance of business – ESOPs allow employees to buy company stock at a fixed price, giving them a stake in the company that appreciates over time, resulting in significant wealth generation.

Understanding ESOP Disadvantages

- Maximizing the proceeds of an ESOP can be challenging – ESOP plans limit shareholder profits as ESOP buyers pay only up to FMV. In contrast, strategic buyers pay more to recoup future growth opportunities. So, the type of buyer is important when selling a company.

- Numerous recurrent expenses are present – ESOPs have ongoing administrative costs, including legal, trustee, and administration fees and annual valuation. Launching an ESOP smartly is crucial to avoid unexpected expenses.

- 100% employee stock ownership plan (ESOP) could discourage potential investors – If a company decides to sell 100% of the outstanding shares via an ESOP, the outside lenders become less motivated to offer funding opportunities.

- Regulatory issues are possible – An ESOP must comply with all laws and regulations. Proper administration is essential to ensure compliance. Non-compliance could render the project worthless, leading to low morale and a loss for the company.

Why do companies offer ESOPs to their Employees?

The answer to this question is very simple; employers use ESOPs to attract and retain the highest quality employees by offering them employee stock options in the company. And these shares are distributed by the employer in a phased manner. For example, the employer can grant their employees with stock options at the close of the financial year. This would incentivize the employees for staying with the company longer to get the option grants.

In fact, most IT companies have alarming attrition rates (staff turnover rates). And by offering employee stock option plans to the employees, it would help the company bring down the heavy turnover. Moreover, many startups like these are cash-strapped and aren’t able to offer a high starting salary. Due to this, they offer a stake in their organization, making their package highly competitive in the market and attracting talented people.

How does corporate performance increase with ESOP?

ESOPs can greatly benefit from a corporate performance standpoint. When employee stock ownership plans are granted, the vested interest in the company increases among the employees, which leads to a more productive workforce. Here are a few more benefits of ESOPs from a corporate performance perspective:

- It builds loyalty among employees toward the company by giving them an opportunity to earn equity for their work. This helps build a more loyal workforce and encourages employees to stay with the company longer.

- ESOPs are often used as a means for developing a more strategic workforce, as it enables management to think about the long-term goals of the company and develop strategies in order to achieve them.

- ESOP can allow a company to attract and retain highly qualified employees. As such, ESOPs generally reduce employee turnover costs by giving employees more of a vested interest in the company and its future success.

How do Employees Benefit from an ESOP?

We now know why ESOPs are great for employers, but what benefit does it offer to employees? Before we cover the benefits, let us understand how an employee needs to look at these employee stock options. When an employee is offered a job that includes ESOPs, they should analyze how the long-term value of the employee stock ownership plan compares to the earning opportunities in other companies.

Basically, the employee has to access the number of stocks they can get in their time with the company and how it would benefit them in the long-term. And if it is seen that the ESOP offering would benefit the employee in the long-term, that is when it makes sense to stick with the company. Otherwise, the employee should consider other options if the stock options are not worth it.

Here are some of the basic benefits of an ESOP for employees:

- ESOPs offer job security, non-monetary benefits, and satisfaction to the employees.

- Responsibility of the employees towards the company elevates, which also motivates them to participate in the decision making of the company actively.

- Assurance of a comfortable retirement for employees.

- Financial benefits in the form of share benefits, higher pay, and wealth generation.

There are a lot of success stories of employees who have become rich after they were offered employee stock options in their company. One such example is Google. Here, both the founders and the stockholder employees became millionaires. The chief executive of Google, Charlie Ayers, obtained employee stock options from the company worth $26 million.

Best uses of ESOP

Well, ESOPs are intended to encourage the employees’ loyalty to their company. It is a way to motivate employees by rewarding them for their efforts. But how do you know if an employee stock ownership plan is the right choice for your company? Here are some of the best uses of ESOP plans that you can consider:

- To attract and retain good talents – An ESOP may be a good way to grab the attention of potential employees. When an employee becomes a shareholder of the company, it is very likely that they will put in their best efforts and work harder to help the company grow. Essentially, ESOPs can be a very effective way to attract and retain talented employees and ensure they stay with the company for a long time.

- To increase equity capital – ESOPs can offer an additional source of financing for various business goals. Under an employee stock ownership plan, employees typically acquire company shares as part of their compensation package by paying an exercise price. This, in turn, helps the company to increase equity capital for various business needs. Therefore, ESOPs provide a win-win situation for both the company and the employee.

- To have tax advantages – At the time of granting the ESOPs, there is no taxable event. However, when the employee exercises the stock options and the shares of the company are issued to the employees by way of an ESOP, they are classified and taxed as income tax. While the employer is only required to withhold tax on such salaries. As such, the company is not required to pay any federal or state tax on such grants.

- To purchase shares when employees leave – Generally, ESOPs have a vesting schedule so that employees have the opportunity to acquire shares if they stay with the company for a certain period of time. However, in case of an employee termination before their ESOPs are fully vested, then the shares are held back by the company and forfeited. This provides the company added protection against employees leaving the company prematurely, and thereby not creating a void in the company’s equity.

- To make no changes in governance – Privately held companies are reluctant to make changes in their corporate governance when they sell shares to outside investors. However, when an employee acquires shares through an ESOP, there is little to no change in their governance structure, even after the shares are issued. This makes it ideal for privately held companies to grant ESOPs to their employees as an effective means of growth and development.

- To borrow money at a lower rate – Often, employees may require ESOP financing in order to exercise their stock options. Because of their ability to borrow funds, ESOPs are unique in the sense that they offer an effective and efficient way to borrow funds. In this case, the company can borrow money at a low interest rate through its ESOP, and then use the proceeds to issue stock to the employees.

- To prepare employee benefits – Companies can directly issue new or treasury shares to an ESOP and deduct their value from taxable income (up to 25% of covered pay). This is an effective way to prepare employee benefits, provided sufficient treasury shares support the ESOP. Hence, ESOPs are a great way for companies to either boost growth of companies or offer employee benefits.

ESOP Terms you should know

Now that you know the uses of ESOPs, let’s take a look at some terms you need to know about ESOPs. Here are some of the common terms related to ESOP:

- Vesting – Vesting is a term used to describe the amount of time an employee has to stay with the company before they become a shareholder of the company. As a general rule, once the vesting period is completed, the employee is eligible to exercise their stock options and claim their shares of the company.

- Grant date – It is the date on which the employees become eligible for the ESOPs. This date is typically filed with the company’s official records and an agreement is formed between the company and its employee. The grant date is typically the first day on which the employee becomes a part of the ESOP plan.

- ESOP agreement – This legal document outlines the terms and conditions under which an ESOP is created. As such, it provides employees with information regarding their vesting period, exercise price, number of shares, etc. It is usually signed by the employer and the employee in order to set up the conditions of the ESOP.

- Strike price – This is a term that refers to the predetermined price at which the employees can exercise their stock options to acquire shares in their company. While the strike price is based on the fair market value (FMV) of the share at the time of grant, and thereby 409A valuation is conducted to measure the FMV.

- Exercise price – Similar to the strike price, this is the price at which an employee must pay in order to exercise the options and claim their shares in their company. Well, the other name of the exercise price is the strike price and hence, they are used interchangeably.

- Exercise period – This is the duration in which employees have to exercise their stock options and acquire their shares in their company. After the vesting period is completed, the employees will be given a certain amount of time to exercise their options, known as the exercise period.

- Purchase price – This is the amount that an employee must pay to acquire their company shares. It is also called the exercise price and strike price. This price is decided at the time of granting the ESOPs and is based on the share’s fair market value.

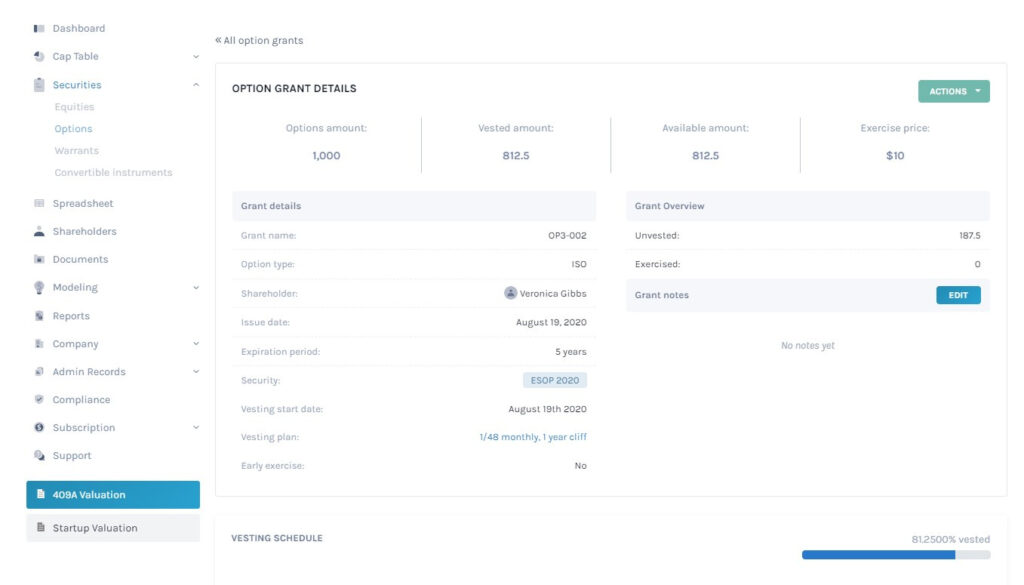

Example of a company offering ESOP to their employees

To better understand how companies use ESOPs, let’s take a look at an example of a company offering their employees ESOPs. The below image is an example of a company offering employee stock options to their employees, which details the number of options, exercise price, vesting schedule (if any), name of the employee (shareholder), the type of stock option, and the issue date. As you can see, the company was offering 1,000 shares ESOPs with a vesting period of 4 years at an exercise price of $10 per share. The employee, Veronica Gibbs, was granted the ESOPs on August 19th 2020 and can no longer exercise the options after 5 years. Thus, the ESOPs can be seen as an effective way for privately held companies to offer their employees a company’s ownership.

How does ESOP distribution work?

The ESOP distribution works in a similar way to how stock options work in privately held companies. However, ESOP is considered stock-based compensation, and some rules and requirements must be met when distributing ESOPs. Following are the rules that must be followed when distributing ESOPs:

1. Vesting

As you may have already understood, the vesting period is the amount of time required for an employee to wait before acquiring their shares in their company. However, an ESOP must adhere to one of the two minimum schedules listed below for vesting.

- Cliff vesting, which is a sudden 100% vesting after no more than three years of service and no vesting at all during the initial years

- After the second year of service, there is a 20% vesting; after the sixth year of service, there is a 100% vesting known as graded vesting.

2. ESOP distribution

There is a defined contribution plan governed by the federal Employee Retirement Income Security Act of 1974 (ERISA). The number of shares allotted to an employee, the value of those shares, and whether the person is fully vested in their account will all affect how much of an ESOP distribution they will receive. Plan documentation should specify whether a company employs a cliff vesting schedule or a graded vesting schedule.

3. When an employee terminates

Employees must remain with the company for a certain period before they can exercise their stock options and claim their shares in their company. However, in case the employee decides to leave the company, then the shares will be forfeited. While, in some cases, no later than the sixth plan year after the plan year in which termination occurred, the participant is given the right to start with the distributions.

4. Pre-1987 rules

Company stock acquired prior to 1987 by the ESOP may be distributed in accordance with the rules governing qualified benefit plans. Based on the circumstances, these rules allow distributions to take place later than under the special ESOP rules. For instance, participants may leave now but have to wait many years until retirement age to receive the stock in pre-1987.

5. Employed employees

The employees who are vested in their accounts and still working for the company can gain access to additional benefits. After a specific amount of time, these employees may diversify their accounts and directly get cash or stock. In addition to this, for the company’s equity that is allotted to the ESOP members, the employer may decide to pay dividends to them directly.

How does selling Stock options work in private companies?

Unlike public companies, private companies are not listed on the stock exchange and hence, buying, selling, and trading of shares is restricted. When the stock options are exercised, the participant actually purchases the shares and is entitled to become a shareholder. While the process of selling shares will depend on the company, terms and conditions, and other related factors.

Generally, in private companies, there is a tender offer process to sell the shares. Tender offers are usually approved business transactions that let shareholders of private companies sell all or part of their shares. Additionally, the shares can be sold by means of a secondary transaction where shareholders can connect with investors to sell the shares. Thus, in private companies, the selling of stock options is subject to various processes and restrictions.

How does ESOP taxation work?

Well, there are two ESOP taxation events that will occur when an individual exercises their ESOPs and at the time of selling the shares. In general, a company offering ESOPs is required to deduct income tax at the time of an employee exercising their options. The difference between the exercise price and the share’s fair market value at the time of the exercise will be taken as a taxable amount.

Secondly, when an employee sells the shares, there is a capital gains tax consideration. This will be determined according to the amount of money that is to be paid for the shares and over which period of time the sale took place. As a result, ESOPs are generally considered a taxable event by the IRS and any related taxes must be paid by the employee.

Benefits of ESOP taxation

As you might have noticed, ESOPs in the United States are subject to income and capital gains taxes, however, companies offering them provide several benefits to the employees to offset this tax liability. Below are enumerated some of the benefits that ESOPs provide:

- Since stock contributions are tax-deductible, businesses can issue new shares or treasury shares under ESOP and benefit from the cash flow increase. Although doing so will decrease existing shareholders’ equity.

- Dividends are tax-deductible if they are used to repay ESOP loans, distributed to employees, or reinvested in company stock by employees. Companies will thus pay less in taxes and realize gains from shares held by the ESOP.

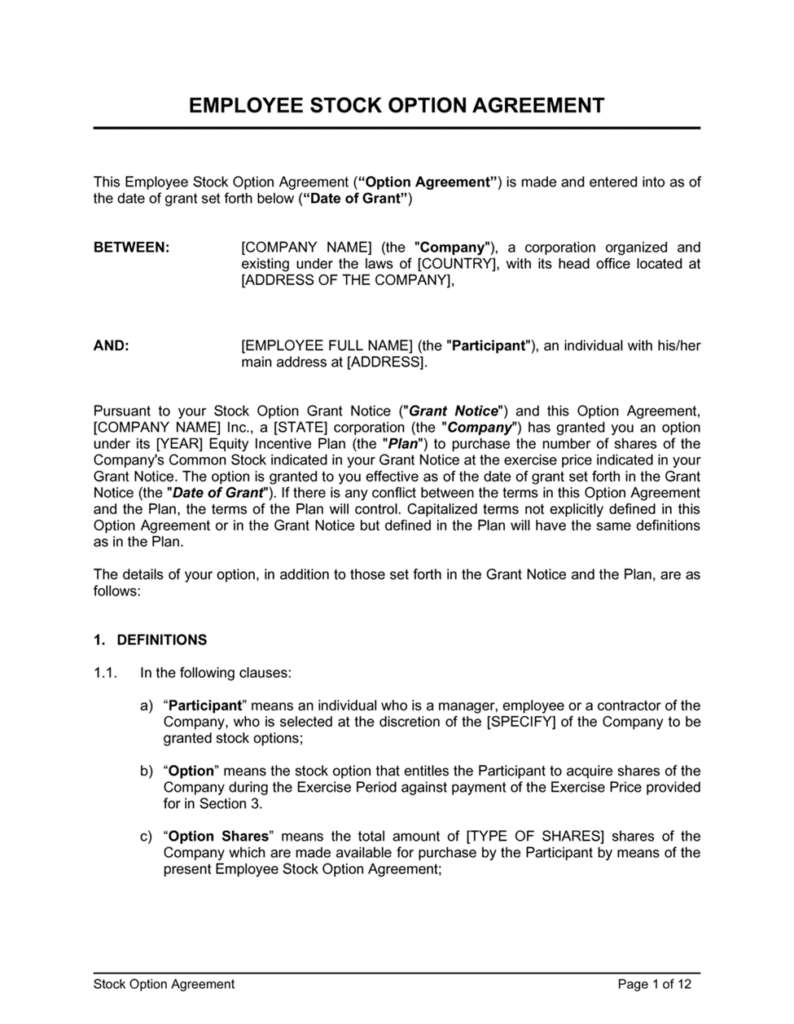

ESOP Agreement

The basic agreement consists of two parties: the employee, who is granted stock options and the company. This agreement is essential for the parties to be accountable for their actions and determine how the stock options will be handled. Typically, the agreement will include some of the different clauses that will be agreed upon. At the time of granting the options under ESOP, this agreement will be signed by the employer and employee.

What does the ESOP agreement include?

Under the agreement, from basic details to the material elements of the plan, everything is included in the agreement that will comprise the ESOP. The basic details, however, include the name of the ESOP participant, the type of stock option, and the grant date. In addition, the ESOP’s material terms and conditions will be included in the agreement. These terms will include the vesting schedule, exercise price, details related to early termination, the number of shares they will be allotted and other related terms. Consequently, the agreement will outline every detail of the ESOP plan.

ESOP template example

ESOP vs 401(k) plan

Now that you know about the ESOP, do you know how it is different from 401(k) plans? ESOP vs 401k plan, it is a very common question that arises in situations when both plans are available for employees. Well, both plans aim to facilitate employee benefit in the long run, typically with a vested interest. But, there are differences between ESOPs and 401(k) plans in terms of their structure, terms and conditions, and processes. Here are some of the key points regarding this comparison:

- A 401(k) plan is a retirement program that enables employees to contribute annually from their income up to a certain level and invest the same in the company for their future benefit. On the other hand, an ESOP is a company benefit plan that provides an opportunity for employees to benefit from the share ownership in the company.

- Under the 401(k) plan, the employer will deduct a fixed amount from the employee’s annual income and contribute it towards the employee’s retirement fund. In comparison to this, under ESOPs, there is no cost incurred by the employer till the time the ESOPs are not exercised. However, when they are exercised, the employee is required to pay the exercise price to acquire the shares.

- Even before the income tax is deducted, employees under 401(k) plans can contribute the amount of money and are considered as tax-deferred contributions. While under ESOP, the employees are not required to pay any taxes at the time of grant, however, at the time of the exercise, they are subject to certain taxes depending on the types of options they possess.

Common Questions Asked about ESOP

For those who have some doubts, here are some common questions that will help you understand ESOPs better:

#1 What is an ESOP?

An ESOP (employee stock ownership plan) is an employee benefit plan that offers workers in a company with an ownership interest in the company. The owners in the company set up the ESOP plan to attract and retain the best talent in the industry. Read this article from the beginning to understand ESOPs better.

#2 What happens to ESOP if your company Sold?

There are a lot of cases that can take place when your company is sold. In the first case, let us say that your company is sold to another ESOP company. Here, you would have your ESOP shares rolled over into the shares of the new company employee stock ownership plan. In other cases, the acquiring company would cash out all your shares and roll the proceeds into an account in your name in their 401(k) plan. There are cases where the company might buy your shares and give you the cash.

Regardless of whatever happens, you need to know that most acquisitions take time. Even if a company has been purchased, the funds in the ESOP can be held in an escrow account until all the remaining issues in the sale are complete, such as satisfying certain conditions for the sale or resolving any liabilities the company may have.

#3 How to cash out an ESOP after quitting?

With an employee stock ownership plan, you would get stock of your company for free as per the ESOP plan. And if you decide to leave the company, have become disabled, or retire from your job, you can expect to get the distributions from the beginning of the next year based on the ESOP plan document. If you pass away at any point, your beneficiaries would get the distributions in the next year. And if you are laid off or quit your job, you might not get the distributions for up to six years.

Here are some additional points you should keep in mind:

- Your Annual Account Statement: According to the law, your company has to send you an annual statement that reports the amount of stock and cash in your ESOP account. This will also have all the details of the vesting schedule and how many shares have vested. You can get a copy of this from your HR department.

- Deferred ESOP Distributions: As mentioned above, if you are laid off or quit, the ESOP distributions are deferred for six years under IRS regulations. After six years, you will get the value of your ESOP in either partial payments over five years or in one lump-sum. The lump-sum distribution can consist of stock, shares or a combination of both, and the annual portion would be in stocks.

- Your ESOP Distribution Policy: Ensure that the ESOP has a distribution policy that outlines exactly how the shares, stock or cash will be distributed.

- Retirement Account Transfers: If you want to stay safe from paying a 10% penalty on your early ESOP withdrawal, it is better to roll over the money in your ESOP into a retirement account (such as an IRA). And once you become 59 ½ years old, you can withdraw it and avoid penalties. But remember that you will still have to pay the income tax for the profits gained.

Manage your ESOP with Eqvista!

As you might have observed, there are a lot of considerations related to the ESOP. A successful ESOP plan is only possible if you choose the right people to help you manage it. This can be done by choosing professionals like Eqvista who understand ESOP and its requirements. At Eqvista, our team is highly expert in dealing with companies with an ESOP and managing the same. With the right tools and guidance from our professionals, you can rest assured of an effective ESOP plan. To know more about our services, visit Eqvista and get in touch with us.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!