How do Stock Options Work in a Startup?

Stock options in startups are becoming increasingly popular by the day, and most people applying for a job at a startup receive stock options from their potential employer.

Stock options are essentially a form of alternative compensation provided by some companies. Startups, in particular, are quite famous for offering stock options when offering employees their packages. It is a big reason why many workers come on board on relatively lower salaries, as stock options give them a chance to earn more down the line.

Stock Options in Startups

There has been a lot of discussion around how stock options work in a startup, and how this type of compensation is feasible for founders just starting off. However, once you know how to fully utilize this type of equity incentive, this form of compensation can be your lifeline when it comes to retaining talented individuals.

Let’s cover what stock options are and why founders issue stock options in their startups.

What is a Stock Option in a Startup?

As mentioned earlier, stock options are a type of payment given by startups and other types of companies. They grant them to a variety of individuals such as investors, consultants, contractors, and most commonly, employees. The options are essentially contracts that give workers the right to exercise or purchase a particular amount of shares from the organization’s stock at pre-determined prices, also referred to as “grant price”.

That said, this offer has an expiry date, which is why the people who receive it should utilize it at the right time. Some startups even ask their employees to exercise their options within a particular period after departing the company.

The quantity of options a startup grants tends to vary according to the employee and their particular role. It may also depend on things like the worker’s special skills or seniority. Stakeholders and investors also play a part in an employee’s stock option as their approval is necessary before an employee can exercise their stock option.

Why do Startups Issue Stock Options?

Making employees sign off on a stock option agreement gives startups much needed flexibility in terms of offering salaries and other financial aspects. You’d be surprised to learn that, if used correctly, stock option plans are capable of contributing capital to startups as workers have to pay for their option’s exercise price.

That said, entrepreneurs do have to endure a disadvantage when they issue stock options in a startup, and that is the potential dilution of the equity belonging to other shareholders once the workers exercise stock options. The only disadvantage employees could face with stock options is the absence of liquidity. The stock options will not be equal to cash benefits unless the company forms a public market dedicated to its stocks.

Also, if the company fails to grow, its stocks will not increase in value, making the options worthless. Fortunately, there have been very few cases where people faced massive losses by option for stock options. In fact, thousands of people ended up earning millions of dollars, proving that options provided by startups can indeed be profitable in the long run. Social media giant Facebook, is a shining example that showcases why stock options are so appealing for employees.

The remarkable success of startups in Silicon Valley, along with the economic growth of employees who opted for stock options, proves that startups can indeed achieve short and long term success by making stock options an integral part of their compensation packages.

Types of Stock Options

Companies offer two main types of stock options, they are: incentive stock options and non-qualified stock options. Both of them have something unique to offer. Let us take a closer look to understand their specifics.

Incentive Stock Options

Short for ISOs, incentive stock options are applicable for special tax treatments according to the Internal Revenue Code. What’s more, Incentive Stock options are not subject to withholding taxes, Medicare, or even social security. That said, they must fulfill a certain criteria relating to the tax code in order to qualify.

Startups can only offer Incentive Stock Options to employees. They cannot offer it to contractors or consultants. In addition there is a $100K limit on the ISOs aggregate grant value, which may be exercisable or vested in any year. Plus, if an employee plans to retain the tax benefits provided by Incentive Stock Options, they must exercise them within three months following their employment’s termination date.

Remember, incentive stock options taxation is not as straightforward as it seems. Why? Because you have to understand the impacts of alternative minimum taxes and learn to address the issue. Once you exercise the incentive stock options and hold the shares you received for more than two years following the grant date and more than a year following the exercise date you receive favorable capital gains tax for the long-term instead of traditional income tax on each appreciation exceeding the exercise price.

Non-Qualified Stock Options

Non-qualified stock options are vastly different from ISOs discussed previously. Unlike incentive stock options, NSOs don’t qualify for the US Revenue Code’s favorable tax treatment. It is the main reason people use the term “non-qualified” for this type of option. However, non-qualified stock options are arguably the most popular stock option type out there. Startups often grant it to consultants, directors, officers, contractors, and employees.

Anyone who exercises non-qualified stock options has to pay taxes. Because of this reason, the exercise is reported on your IRS tax forms. Any company that exercises non-qualified stock options gets to withhold taxes such as Medicare tax, social security, income tax etc. And, once someone decides to sell these shares (could be once the holding period is over or it could be immediately) your proceeds will be taxed under the capital gains and losses rules.

Factors to Consider Before Issuing Stock Options

Startups must address several important issues before implementing a stock option plan. In most cases, companies want to incorporate a plan that provides them maximum flexibility. So without further ado, let us discuss some things to consider before issuing stock options.

- Total Authorized Shares: The stock option plan in question should have a maximum amount of shares that the company could issue without any hassle. Companies mostly base the total number according to what the board of directors deems to be appropriate. However, it generally ranges anywhere around 5-25% of the organization’s outstanding stock. Sure, the company does not have to grant every option. It is also worth noting that the company’s investors could have some restrictions on the option pool’s size to steer clear from excessive dilution.

- Amount of Options: Determining the right amount of options to grant an employee can be quite hard, as there isn’t any formula for it. This is why, options are mostly negotiable. However, the startup can create internal guidelines according to the job positions. Also, the amount of options is not as important compared to what it represents in terms of the total number of diluted shares outstanding. For instance, if you receive 100,000, with only 100 million outstanding shares, it will only represent 1/10th of the company.

- 409 A Valuation: The startup must make a fair market value determination of common stock to set the option’s exercise price, in accordance with the Internal Revenue Code section 409A. Most companies do this by acquiring the services of a third-party valuation provider.

- Termination: With stock options, employees often get the impression that they will remain employed. However, this is not the case, which is why startups should prevent the implications by stating that the plan does not guarantee continued relationship or employment.

- Security Law Compliance: The issuance of underlying shares and options requires companies to comply with state and federal security laws. In cases like these, startups should consider involving professional corporate counsel to steer clear from trouble.

- Exercise Time: Stock option agreements generally provide a date within which you can exercise it. It is also worth noting that the date becomes short in cases of death or termination of employment. In most cases, employees have around 1-3 months to exercise their option following their termination from a startup. This can be incredibly burdensome, especially since the employee may not have been able to pay the taxes that resulted from exercising their option.

- Vesting Time: Many companies tend to offer employees with a vesting schedule. In this, the advisor or employee continues to work for their organization for a particular period before their rights vest. For instance, a startup may award a worker with 10,000 shares with 25% vested only after the completion of a full year, followed by the remaining shares vested over a period of 36 months.

- Issuing Options with a Stock Option Agreement: People often confuse stock option agreements with their offer letters, when in fact, they are completely different. An offer letter may mention the amount of stock options your potential employer is offering. However, you have to sign the option grant or stock option agreement to be able to buy your shares. Every company uses a stock option agreement to issue options. The document often includes important details like the kind of stock options the company will offer you, the vesting schedule and other pertinent information. When a company issues options with a stock option agreement, they mention its expiry date, which is mostly around 10 years. However, some grants also expire once the recipient departs the company.

- Vesting Schedule in Stock Options: As discussed earlier, vesting schedules are applicable to most stock options. There are three main vesting schedule types.

- Immediate vesting schedule. It doesn’t have a waiting period or time for employees. Instead, they can own their asset immediately.

- Graded vesting. It gives the recipient incremental ownership as time passes by, eventually making them full owners of their asset.

- Cliff vesting. It offers recipients a flat rate benefit at a particular date specified on the agreement.

- Exercising Stock Options: When an organization gives stock options to an employer, it does not offer the shares right away. Instead, the employer gets the right to purchase the company’s shares for a specified rate, known as the strike price. You receive these options hoping that their share’s value will increase and you will sell them for a higher amount than what you paid. Exercising stock option basically means buying an issuer’s common stock shares for the price specified in your stock option agreement. You will own a portion of the company if you buy these shares. That said, exercising your options is never a requirement.

Stock Option Taxation

Stock option taxation works quite differently compared to taxation with other forms of compensation. This tax on stock options taxes usually takes many factors into consideration, such as the grant date, vesting period, exercise date, exercise price, fair market value on exercise and sales, and other factors as well.

Here is a close look at the two main taxation forms with stock options.

ISO Taxation

Any employee who holds tax advantaged ISOs or incentive stock options doesn’t have to worry about a tax withholding (or tax) event whenever they decide to exercise. You only have to report the taxable income once you decide to sell your stock. However, you will need to mention the difference between the current fair market value and exercise price during the spread (or the time you exercise).

This process is necessary for calculation added tax obligations for the rules pertaining to alternative minimum taxes. If you meet some holding periods prior to selling the stock, you may have the gains taxed at long-term capital gain rates that are more favorable.

NSO Taxation

Any option that is not a tax advantaged ISO is a non-qualified stock option. With NSOs, the spread after one exercises their option yields unfavorable taxes. In addition, the exercise date with NSOs is a taxable event, which is why the organization must report their spread in the form of taxable income on their employee’s W2 form during the exercise year.

Interested to Issue Stock Options for your Startup?

Stock options can be incredibly advantageous for startups and their employees, as long as they know how to utilize them. With the information covered in this piece, you will get a full lowdown of how stock option agreements at startups work and how to make the most of them for long-term profitability. Be sure to your stock options for your startup in platform that can help manage all the details.

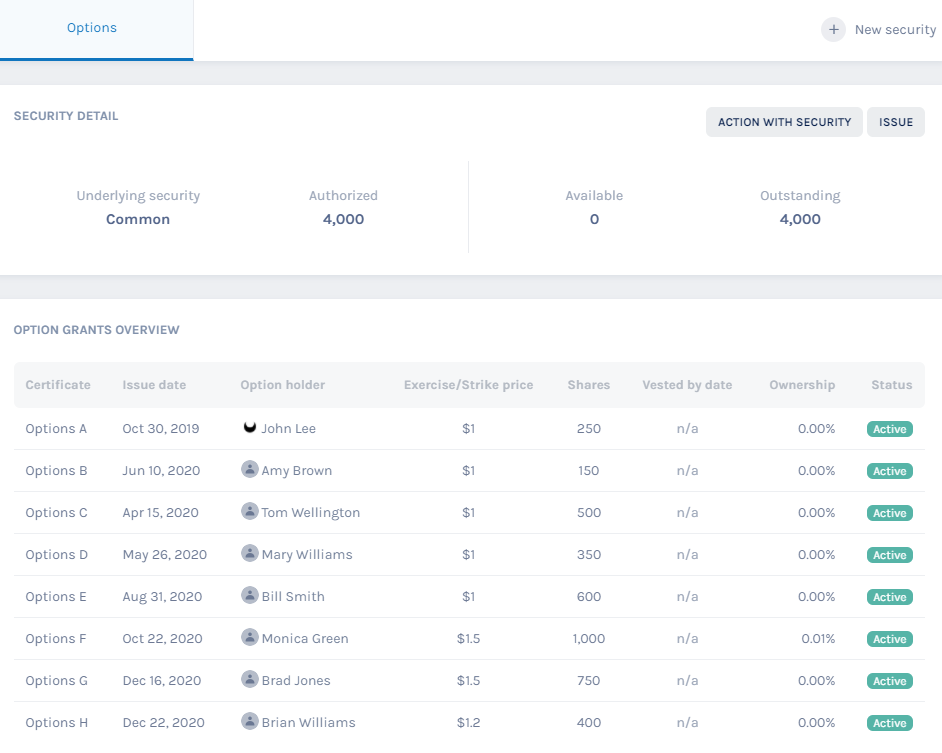

Eqvista is advanced equity management software that records and manages share and options for a company. Our platform can assist company founders and startups with all their equity needs, and share the details of their option plans seamlessly with their employees.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!