Reliable valuation in the healthcare industry

In this article will discuss techniques that can help you confidently uncover valuation insights in such a varied sector.

Healthcare is an extremely diverse sector that encompasses a wide range of industries with unique capital expenditure patterns, cash flow sources, and vulnerabilities. For example, in the pharmaceuticals value chain, you will find both drug developers and contract development and manufacturing organizations (CDMOs).

Drug developers make massive research and development (R&D) investments to build patent portfolios that can generate millions, if not billions, in licensing income. In contrast, a CDMO’s R&D expenses are aimed at developing cost-effective methods for manufacturing existing drugs.

This difference is directly reflected in the financials. In Q1 2025, Pfizer’s R&D expenses amounted to 16.06% of its revenue. In contrast, this figure stood at only 3.3% for Thermo Fisher Scientific, a leading CDMO. Interestingly, this sector also includes institutions such as nursing homes, whose business models can resemble those of rental properties or hotels.

Given these diverse characteristics, this article will discuss two techniques that can help you confidently uncover valuation insights in such a varied sector.

Which Valuation Method Provides Accurate Healthcare Company Valuations?

The discounted cash flow (DCF) method. The DCF method can produce accurate valuations for any company with an extensive financial history, not just healthcare companies. This valuation method involves forecasting future cash flows and discounting them.

Since the cash flow forecasts are based on observed trends, this approach effectively captures the unique characteristics of each business. Therefore, it is particularly useful for valuing healthcare companies, which vary widely in size and business model.

Example

Altrua Care develops and markets proprietary drugs. Its financial performance over the past five years is summarized below:

| Particulars | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | $540,000,000 | $648,000,000 | $777,600,000 | $1,010,880,000 | $1,263,600,000 |

| Cost of sales | $120,000,000 | $168,000,000 | $193,200,000 | $212,520,000 | $244,398,000 |

| Research and development (R&D) expenses | $1,500,000 | $1,950,000 | $2,730,000 | $4,095,000 | $4,914,000 |

| Selling, informational, and administrative expenses | $80,000,000 | $92,000,000 | $115,000,000 | $132,250,000 | $152,087,500 |

| Earnings before interest and taxes (EBIT) | $338,500,000 | $386,050,000 | $466,670,000 | $662,015,000 | $862,200,500 |

| Effective tax rate | 25% | 25% | 25% | 25% | 25% |

| Earnings before interest after taxes (EBIAT) | $253,875,000 | $289,537,500 | $350,002,500 | $496,511,250 | $646,650,375 |

| Depreciation and amortization (D&A) | $60,000,000 | $60,000,000 | $60,000,000 | $60,000,000 | $60,000,000 |

| Capital expenditure | $15,000,000 | $17,250,000 | $24,150,000 | $33,810,000 | $43,953,000 |

| Change in Net Working Capital (NWC) | $20,000,000 | $22,000,000 | $24,200,000 | $26,620,000 | $29,282,000 |

| Unlevered Free Cash Flow (UFCF) | $278,875,000 | $310,287,500 | $361,652,500 | $496,081,250 | $633,415,375 |

Since the effective tax rate has stayed constant at 25%, we will assume the same for our forecast period.

By applying the formula for compound annual growth rate (CAGR), we can calculate the growth rates for the above cash flow items as follows:

| Particulars | CAGR |

|---|---|

| Revenue | 23.68% |

| Cost of sales | 19.46% |

| Research and development (R&D) expenses | 34.54% |

| Selling, informational, and administrative expenses | 17.42% |

| Depreciation and amortization (D&A) | 0.00% |

| Capital expenditure | 30.84% |

| Change in Net Working Capital (NWC) | 10.00% |

Furthermore, Altrua Care’s weighted average cost of capital can be calculated as follows:

| Particulars | Amount |

|---|---|

| Equity (E) | $1,500,000,000 |

| Debt (D) | $300,000,000 |

| Cost of equity (CE) | 15% |

| Cost of debt (CD) | 36% |

| Tax rate (T) | 25% |

| Weighted average cost of capital (WACC) | 17% |

Note: WACC is calculated as per the following formula:

WACC=E/E+D x CE+{D/E+D x C x 1-T}

Let’s assume that Altrua Care can be expected to be in operation for 10 years.

So, we will forecast cash flows for the next 10 years based on the CAGRs of cash flow items and discount them with the WACC. Also, we will calculate the terminal value as the expected asset-based valuation at the end of the forecast period.

The cash flow forecast based on the abovementioned method is as follows:

| Particulars | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | $1,562,820,480 | $1,932,896,370 | $2,390,606,230 | $2,956,701,785 | $3,656,848,768 | $4,522,790,556 | $5,593,787,360 | $6,918,396,207 | $8,556,672,429 | $10,582,892,460 |

| Cost of sales | $291,957,851 | $348,772,849 | $416,644,045 | $497,722,976 | $594,579,867 | $710,285,109 | $848,506,592 | $1,013,625,974 | $1,210,877,589 | $1,446,514,368 |

| Research and development (R&D) expenses | $6,611,296 | $8,894,837 | $11,967,114 | $16,100,555 | $21,661,687 | $29,143,633 | $39,209,844 | $52,752,924 | $70,973,784 | $95,488,129 |

| Selling, informational, and administrative expenses | $178,581,143 | $209,689,978 | $246,217,972 | $289,109,142 | $339,471,955 | $398,607,969 | $468,045,478 | $549,579,000 | $645,315,662 | $757,729,650 |

| Earnings before interest and taxes (EBIT) | $1,085,670,191 | $1,365,538,706 | $1,715,777,100 | $2,153,769,112 | $2,701,135,259 | $3,384,753,844 | $4,238,025,447 | $5,302,438,308 | $6,629,505,394 | $8,283,160,313 |

| Effective tax rate | 25% | 25% | 25% | 25% | 25% | 25% | 25% | 25% | 25% | 25% |

| Earnings before interest after taxes (EBIAT) | $814,252,643 | $1,024,154,030 | $1,286,832,825 | $1,615,326,834 | $2,025,851,445 | $2,538,565,383 | $3,178,519,085 | $3,976,828,731 | $4,972,129,045 | $6,212,370,235 |

| Depreciation and amortization (D&A) | $60,000,000 | $60,000,000 | $60,000,000 | $60,000,000 | $60,000,000 | $60,000,000 | $60,000,000 | $60,000,000 | $60,000,000 | $60,000,000 |

| Capital expenditure | $57,508,105 | $75,243,605 | $98,448,733 | $128,810,322 | $168,535,425 | $220,511,750 | $288,517,574 | $377,496,393 | $493,916,281 | $646,240,062 |

| Change in Net Working Capital (NWC) | $32,210,200 | $35,431,220 | $38,974,342 | $42,871,776 | $47,158,954 | $51,874,849 | $57,062,334 | $62,768,568 | $69,045,424 | $75,949,967 |

| Unlevered Free Cash Flow (UFCF) | $784,534,338 | $973,479,205 | $1,209,409,750 | $1,503,644,736 | $1,870,157,066 | $2,326,178,784 | $2,892,939,177 | $3,596,563,770 | $4,469,167,340 | $5,550,180,206 |

We will assume that, at the end of the forecast period, the balance sheet items for Altrua Care will be as follows:

| Particulars | Amount |

|---|---|

| A. Assets | |

| Cash and equivalents | $2,500,000,000 |

| Accounts receivable | $850,000,000 |

| Inventory | $500,000,000 |

| Property, plant, and equipment | $3,900,000,000 |

| Intangible assets | $1,500,000,000 |

| Other long-term assets | $750,000,000 |

| Total assets | $10,000,000,000 |

| B. Liabilities | |

| Accounts payable | $650,000,000 |

| Accrued expenses | $400,000,000 |

| Long-term debt | $1,500,000,000 |

| Deferred tax liabilities | $450,000,000 |

| Total liabilities | $3,000,000,000 |

| Asset-based valuation (Terminal value) | $7,000,000,000 |

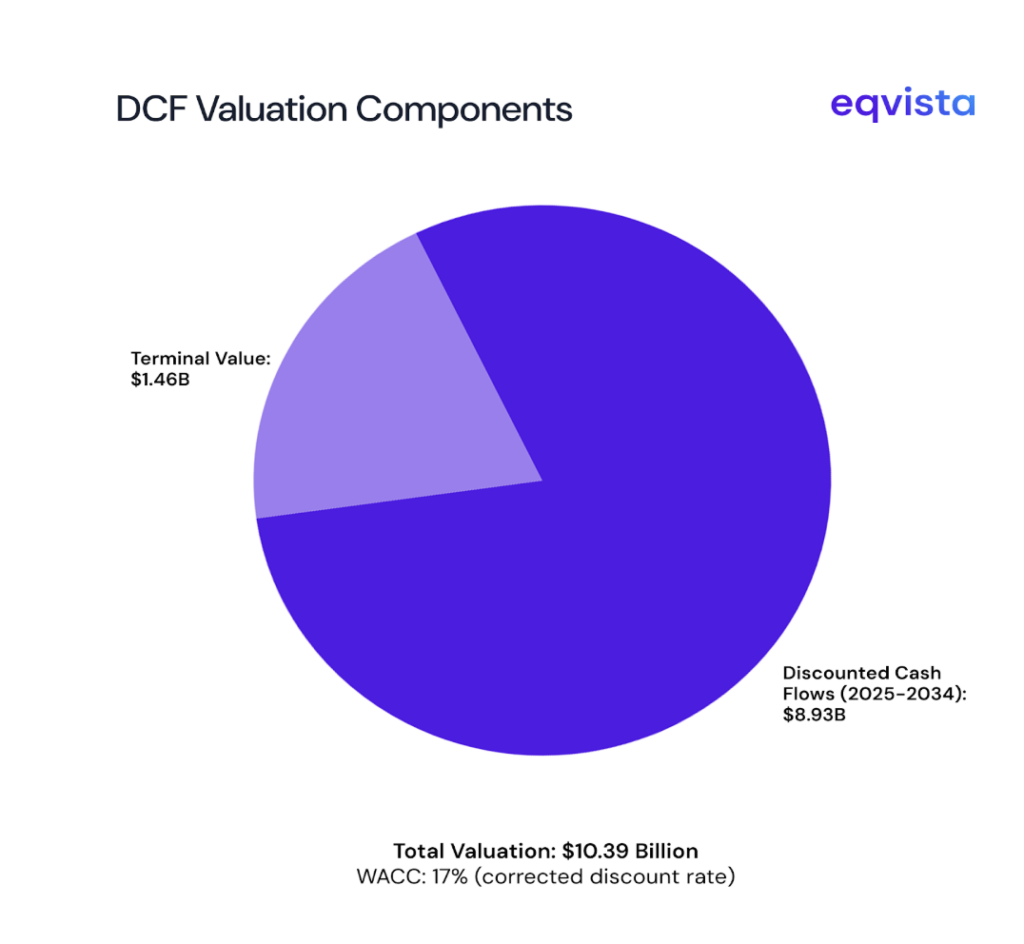

Finally, Altrua Care’s valuation can be calculated by discounting the cash flows and terminal value in the following manner.

| Year | Unlevered free cash flows (UFCF) | Discounting factor | Discounted cash flow |

|---|---|---|---|

| 2025 | $784,534,338 | 1.17 | $670,542,169 |

| 2026 | $973,479,205 | 1.3689 | $711,139,751 |

| 2027 | $1,209,409,750 | 1.601613 | $755,119,839 |

| 2028 | $1,503,644,736 | 1.87388721 | $802,420,086 |

| 2029 | $1,870,157,066 | 2.192448036 | $852,999,494 |

| 2030 | $2,326,178,784 | 2.565164202 | $906,834,261 |

| 2031 | $2,892,939,177 | 3.001242116 | $963,913,961 |

| 2032 | $3,596,563,770 | 3.511453276 | $1,024,237,969 |

| 2033 | $4,469,167,340 | 4.108400333 | $1,087,812,038 |

| 2034 | $5,550,180,206 | 4.806828389 | $1,154,644,967 |

| 2034 (Terminal value) | $7,000,000,000 | 4.806828389 | $1,456,261,683 |

| Altrua's valuation | $10,385,926,219 |

Thus, Altrua Care’s valuation can be estimated as $10.39 billion.

How To Value Healthcare Companies Which Lack Sufficient Financial History?

When you need to value a healthcare company with an insufficient financial history, you can use the comparable company analysis (CCA) method. This valuation technique attempts to estimate a company’s worth by analyzing how the market values comparable companies.

In this method, you must start by listing companies with similar products, size, geographical diversification, and growth rate. Then, you will need to gather the market capitalization and other financial information of the companies on your list.

Investors typically value early-stage companies based on metrics such as sales or revenue, as these businesses often have not yet achieved profitability. However, more mature companies would be valued based on EBITDA or net income. Then, you need to establish the valuation multiple for each company in the list. You can achieve this by simply dividing the market capitalization by the revenue, sales, EBITDA, or any other financial metric that you have chosen. The next step would be to remove any outliers and calculate both the average and the median.

Finally, you can estimate the target company’s valuation by simply applying the average or median valuation multiple to its financial figures.

Example

Suppose you are valuing MacroHeal, an American drug manufacturer focusing on specialty and generic drugs. You also know that its sales were $3.5 billion in 2024.

When you screen for similar companies online, you can gather the following information:

| Company | Market capitalization | Sales |

|---|---|---|

| Zoetis Inc | $69,300,000,000 | $9,290,000,000 |

| United Therapeutics Corp | $13,430,000,000 | $2,990,000,000 |

| Neurocrine Biosciences, Inc | $13,370,000,000 | $2,410,000,000 |

| Viatris Inc | $10,730,000,000 | $14,260,000,000 |

| Elanco Animal Health Inc | $7,400,000,000 | $4,430,000,000 |

| Lantheus Holdings Inc | $5,750,000,000 | $1,540,000,000 |

| Prestige Consumer Healthcare Inc | $3,760,000,000 | $1,140,000,000 |

| Amneal Pharmaceuticals Inc | $2,640,000,000 | $2,830,000,000 |

At this stage, you can exclude outliers by establishing upper and lower bounds for market capitalization as well as sales using quartiles and interquartile range (IQR).

| Particulars | Market capitalization | Sales |

|---|---|---|

| First quartile (Q1) | $5,252,500,000 | $2,192,500,000 |

| Third quartile (Q3) | $13,385,000,000 | $5,645,000,000 |

| IQR (Q3 - Q1) | $8,132,500,000 | $3,452,500,000 |

| Lower bound (Q1 − 1.5×IQR) | -$6,946,250,000 | -$2,986,250,000 |

| Upper bound (Q3 + 1.5×IQR) | $25,583,750,000 | $10,823,750,000 |

Based on these bounds, you can exclude Viatris Inc and Zoetis Inc. The price-to-sales (P/S) ratio for all remaining companies is as follows:

| Company | Price-to-sales (P/S) ratio |

|---|---|

| United Therapeutics Corp | 4.49 |

| Neurocrine Biosciences, Inc | 5.55 |

| Elanco Animal Health Inc | 1.67 |

| Lantheus Holdings Inc | 3.73 |

| Prestige Consumer Healthcare Inc | 3.3 |

| Amneal Pharmaceuticals Inc | 0.93 |

The average P/S ratios for these companies is 3.28. Based on this, MacroHeal’s valuation can be estimated as follows:

Valuation = Sales × Average P/S ratio = $3,500,000,000 × 3.28 = $11,480,000,000

Thus, MacroHeal’s valuation can be estimated as $11.48 billion.

Eqvista – Accuracy through diligence!

Due to diverse business models, in-depth research is required to accurately value healthcare businesses. If the target company has an extensive financial history, you can use the discounted cash flow (DCF) method to capture all its unique characteristics. To value a company with limited financial history, you must rely on the comparable company analysis (CCA) method.

But even the CCA method relies on abundant market data.

Hence, the challenges in valuing healthcare companies are even more pronounced when dealing with healthcare startups. Due to their small size and novel business models, it can be impossible to find comparable listed companies.

For such complex valuations, consider relying on Eqvista. Due to our deep expertise in startup valuations, clients trust us to deliver accurate assessments for assets totaling about $3 billion each month. Contact us to see how we can support your valuation needs!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!