Ultimate Guide to Weighted Average Cost of Capital (WACC)

This ultimate guide will explain what WACC is, how it is calculated, and the benefits and disadvantages of it.

One common way to measure a company’s financing costs is to determine the weighted average cost of capital, or WACC. The WACC is a financial ratio that weighs equity and proportionally to their percentage of the capital structure. Investors usually use a company’s WACC to determine the minimum rate of return they are willing to accept if they fund a company’s operations or projects.

Key Takeaways

- WACC represents the average rate a company expects to pay to finance its assets through debt and equity capital.

- The WACC formula is: WACC = (E/V * Re) + (D/V * Rd * (1-T))

- A higher WACC indicates a riskier company with higher financing costs, while a lower WACC suggests lower risk and cheaper financing costs.

- WACC is used as the discount rate to evaluate new investment projects. Projects with returns above the WACC are considered value-creating.

- Calculating WACC requires estimating the cost of equity (e.g., using CAPM) and the after-tax cost of debt based on the company’s existing capital structure proportions.

Weighted Average Cost of Capital

A company’s weighted average cost of capital (WACC) is used to represent the average cost of capital from all financial sources, including common stock, preferred stock, bonds and any other forms of debt. The WACC is used by analysts and investors to examine an investor’s returns on an investment in a business. Since most companies operate on borrowed funds, the cost of capital is an important factor in determining a company’s potential for net profitability.

What is Weighted Average Cost of Capital (WACC)?

WACC is a method of calculating a company’s cost of capital in which each capital type is proportionately weighted. A WACC computation considers all sources of capital, including common stock, preferred stock, bonds, and any other forms of debt. Company management uses WACC in determining where it’s worth going through a project, while investors use WACC to determine whether an investment is worthwhile.

What is a good WACC?

If debtholders demand a 10% return on their investment and shareholders need a 20% return, projects funded by the bag will need to return 15% on average to satisfy debt and equity holders. The best capital structure is determined by finding the debt-to-equity ratio that reduces its WACC while increasing its market value. The lower the cost of money, the higher the WACC-discounted present value of the firm’s future cash flows.

Importance of Weighted Average Cost of Capital

Getting the WACC is to figure out the cost of every part of your company’s capital structure based on the proportion of equity, debt, and preferred stock of the company. WACC is an internal assessment of a company’s cost of money that can be done on a market or book value basis. Incentive compensation programs typically incorporate “return” measurements such as return on invested capital, return on capital employed, return on assets, and return on equity as performance metrics. Directors on the compensation committee of the Board of Directors can utilize the WACC model to determine if an incentive plan’s return performance objective is legitimate and fair by determining whether the return target meets or exceeds the company’s WACC over the performance period.

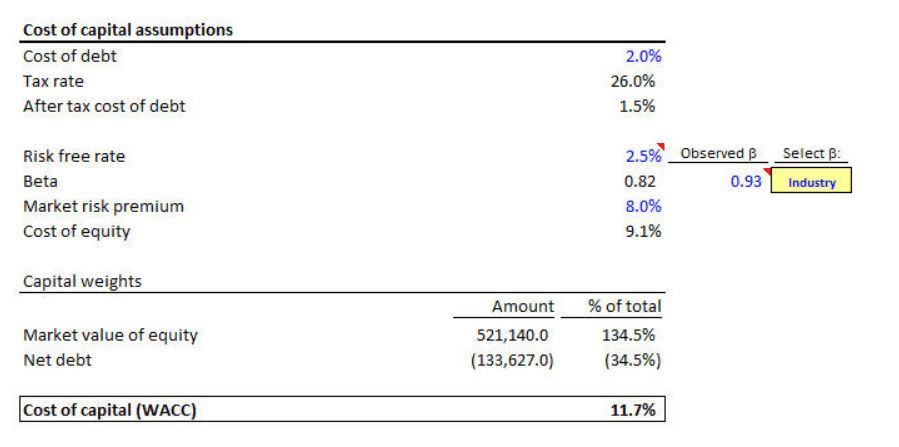

Example of Weighted Average Cost of Capital

In calculating the WACC, all sources of capital (including common stock, preferred stock, bonds, and any other long-term debt) must be included in the computation. The WACC is an important part of a DCF valuation, which means the WACC is important to understand for finance professionals (especially for investment banking and corporate development roles).

Reference: Wall Street Prep

Uses of Weighted Average Cost of Capital

When you get your company’s WACC, there are several instances where you can use it. The WACC can be used by the company and the investors in making decisions regarding any investments or projects.

- For example, securities analysts make use of WACC when valuing and selecting investments. This means, WACC can be used to assess investment opportunities as it represents a company’s opportunity cost.

- Companies can use the WACC to evaluate new projects that have a similar risk level or have the same risk level of existing projects. For example, an automobile manufacturer wants to expand its business in new locations (i.e. setting up another factory in a new location). The company can use the WACC as a hurdle rate to decide whether they should enter into the project or not.

Nominal vs Real Weighted Average Cost of Capital

When considering mergers and acquisitions (M&A), as well as financial modeling of internal investments, a company’s WACC is sometimes used as a hurdle rate. Instead of investing in a project, if an investment opportunity has a lower Internal Rate of Return (IRR) than its WACC, it should buy back its own shares or issue a dividend.

How to Calculate the Weighted Average Cost of Capital (WACC)

Analysts and investors use the weighted average cost of capital (WACC) to calculate an investor’s return on corporate investment. As most businesses rely on borrowed funds, the cost of capital plays a crucial role in determining a company’s net profit potential. WACC is a formula that calculates a company’s cost of borrowing money by considering both debt and equity.

Weighted Average Cost of Capital Formula

The formula to calculate the weighted average cost of capital is as follows :

Where:

- E = market value of the firm’s equity (market cap)

- D = market value of the company’s debt.

- V = total capital value (equity plus debt)

- E/V = equity as a percentage of total capital.

- D/V represents the debt-to-capital ratio.

- Re represents the cost of equity (required rate of return)

- Rd represents the cost of debt (yield to maturity on existing debt)

- Tc is the tax rate.

Calculation Components of Weighted Average Cost of Capital

To get the WACC, multiply the cost of each capital source (debt and equity) by its corresponding weighted average market value, then add the products to get the total.

Cost of Equity

The Capital Asset Pricing Model (CAPM), which links rates of return to volatility, is used to calculate the cost of equity (risk vs reward). The formula for calculating the cost of equity is as follows:

Where:

- Rf stands for the risk-free rate (typically the 10-year U.S. Treasury bond yield) equities beta (levered)

- Rm is the market’s annual return.

- The implied or opportunity cost of capital is the cost of equity. It is the rate of return on investment for shareholders.

Risk-free Rate

The risk-free rate is the return on investment in risk-free security, such as U.S. Treasury bonds. The risk-free rate is usually calculated using the yield on the 10-year U.S. Treasury bill.

Equity Risk Premium (ERP)

The extra yield that can be gained over the risk-free rate by investing in the stock market is known as the equity risk premium (ERP). Subtracting the risk-free return from the market return is a straightforward technique to calculate ERP. For most basic financial analyses, this information will suffice.

Levered Beta

Unlevered beta (asset beta) is calculated to remove additional debt risk to examine pure business risk because various organizations have varied capital arrangements. Levered beta takes into account both company risk and the risk of taking on debt. After that, the average of the unlevered betas is determined and re-levered to match the capital structure of the company being appraised.

Cost of Debt and Preferred Stock

The most specific element of the WACC computation is determining the cost of debt and preferred stock. The cost of debt is the firm’s debt’s yield to maturity, whereas the preferred stock price is the company’s preferred stock’s yield. Multiply the debt cost and preferred stock yield by the debt and preferred stock proportions in a company’s capital structure, respectively. Because interest payments are deductible, the cost of debt is multiplied by (1 – tax rate), resulting in the value of the tax shield. Because preferred dividends are paid using after-tax profits, this is not done for preferred stock.

Pros and Cons of Weighted Average Cost of Capital

For all finance professionals, it’s important to have a good understanding of what WACC is, especially its advantages and disadvantages. Below it a list of the pros and cons of WACC:

Pros

Here are the advantages of getting the WACC of your company:

- Used as a Measure for Inter-Firm Comparison – The business risk is the likelihood that a company’s profits will fall short of what is necessary. This risk may hinder you from meeting your company’s objectives. A business risk might range from one industry to the next, although it is usually the same within a single industry. Compared to other companies in the same industry, a company with a lower WACC is better positioned. It has the potential to add additional value to its stakeholders.

- Used for Valuing a Firm – A valuation team uses WACC to calculate the firm’s value. The cash available to all debt and equity holders is free cash flow to firms (FCFF). Analysts calculate the firm’s value using FCFF, growth, and WACC.

- Used as a Hurdle Rate – To satisfy your company’s shareholders and creditors, it’s important to determine the WACC as it’s the minimum rate of return your company must generate. As a result, WACC serves as a hurdle rate that firms must overcome to generate value for all shareholders and stakeholders.

- A Criterion to Accept or Reject a New Project – The corporate finance team uses the weighted average cost of capital to decide whether to approve or reject a project. To decide whether to accept or reject a project, the IRR (Internal Rate of Return) is compared to the firm’s cost of capital.

Cons

Below are some of the disadvantages of the WACC:

- Cost of Equity is Difficult to Calculate – Before computing for the WACC, the cost of debt and cost of equity must be estimated first. However, the cost of equity is difficult to estimate for private companies as there is a lack of publicly available data. The cost of equity calculation for public companies has various methods and determining which method to use must be well thought out. There is no single formula to calculate the cost of equity. Also, estimating the cost of equity can make calculating the WACC difficult.

- Unrealistic Assumptions: “D/E Mix will Remain Constant” – The debt-to-equity ratio will fluctuate, and the WACC will fluctuate as well. WACC is supposed to be constant for the firm’s entire value, which means that the debt/equity ratio will be constant, which is impossible. When using WACC, the debt-to-equity ratio is assumed to remain constant.

- Increasing Debt to Achieve Lower WACC is Problematic – By putting debt on the balance sheet, WACC can be reduced. In pursuing a lower WACC, adding debt beyond the optimal capital structure might increase the present value of the cost of financial distress more than the value of the levered firm.

Why Assuming a Constant Capital Structure is Important When Calculating WACC

A change in capital structure affects the WACC if the cost of debt is not equivalent to equity capital. Because the cost of equity is usually higher than debt, increasing equity financing frequently raises WACC.

The two types of financing available in capital markets are equity and debt. The word capital structure refers to a company’s entire finance structure. Changes in capital structure can impact a company’s cost of capital, net income, leverage ratios, and liabilities. The overall cost of money for a company is measured by the weighted average cost of capital (WACC).

Get Expert Help from Eqvista to Manage Your Equity Stock!

If you’re looking for an expert to manage your equity stock. Eqvista is here to assist you, and don’t hesitate to get in touch with us, fill the contact form now. All you have to do now is contact us to start talking about creating a plan, learning everything there is to know about managing your stock.

Eqvista offers tools and models that automate the calculation of WACC based on the company’s financial data. These tools can handle complex capital structures, multiple debt instruments, and different tax scenarios, ensuring accurate WACC calculations. Eqvista’s WACC calculations can seamlessly integrate various valuation models, such as discounted cash flow (DCF) analysis, enabling more accurate company valuations and investment analysis. Contact us to know more.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!