How A Valuation Can Help You in Seed Funding Negotiation

This article provides a generic framework of valuation for seed funding and the importance of seed funding negotiation valuation.

Raising capital is an essential component of any business journey. And to build a successful company, businesses must go through the pre-seed, seed, and series stages of capital raising. The time of raising money and the precise quantity one wishes to raise are crucial when it comes to the seed stage. Start-up valuation, often known as a company’s valuation, is the process of determining the value of a business. An investor invests money in a firm at the seed fundraising round in exchange for a portion of the company’s stock. This article provides a generic framework of valuation for seed funding, seed funding negotiation, and the importance of seed funding negotiation valuation. It also addresses the common mistakes to avoid in negotiation seed valuation.

Seed funding negotiation and valuation

Analysts do a company valuation before the start of every round of fundraising. The management, track record, market size, risk, and many other criteria go into determining valuations. The valuation of the business, along with its stage of development and future potential for growth, is one of the fundamental differences between investment rounds. The initial step of formal equity fundraising is called seed funding. It usually denotes the initial formal funding that a firm or enterprise raises. Several businesses never raise Series A or higher rounds of funding after receiving seed money.

Understanding valuation

The analytical process of estimating the worth of a company or an asset is known as valuation. There are numerous methods for performing an evaluation. When determining a firm’s value, an analyst considers a variety of factors, including the management of the company, the composition of its capital structure, the likelihood of future earnings, and the market value of its assets. Fundamental analysis is frequently used in valuation, but alternative techniques, such as the capital asset pricing model (CAPM) or the dividend discount model (DDM), may also be used. An asset, investment, or company’s fair worth can be determined quantitatively through valuation. In general, a company’s worth can be determined either on an absolute basis, concerning other similar companies or assets or on a relative basis.

What is a seed or pre-money valuation?

A company’s value before going public or receiving additional investments like finance or outside capital is referred to as its pre-money valuation. Venture capitalists and other investors who aren’t immediately invested in a company frequently use the phrase, which is also known as seed or pre-money.

Post-Money Valuation – Investment Amount = Pre-Money Valuation

So, a company with a pre-money valuation of $17 million has a post-money valuation of $20 million after receiving an investment of $3 million.

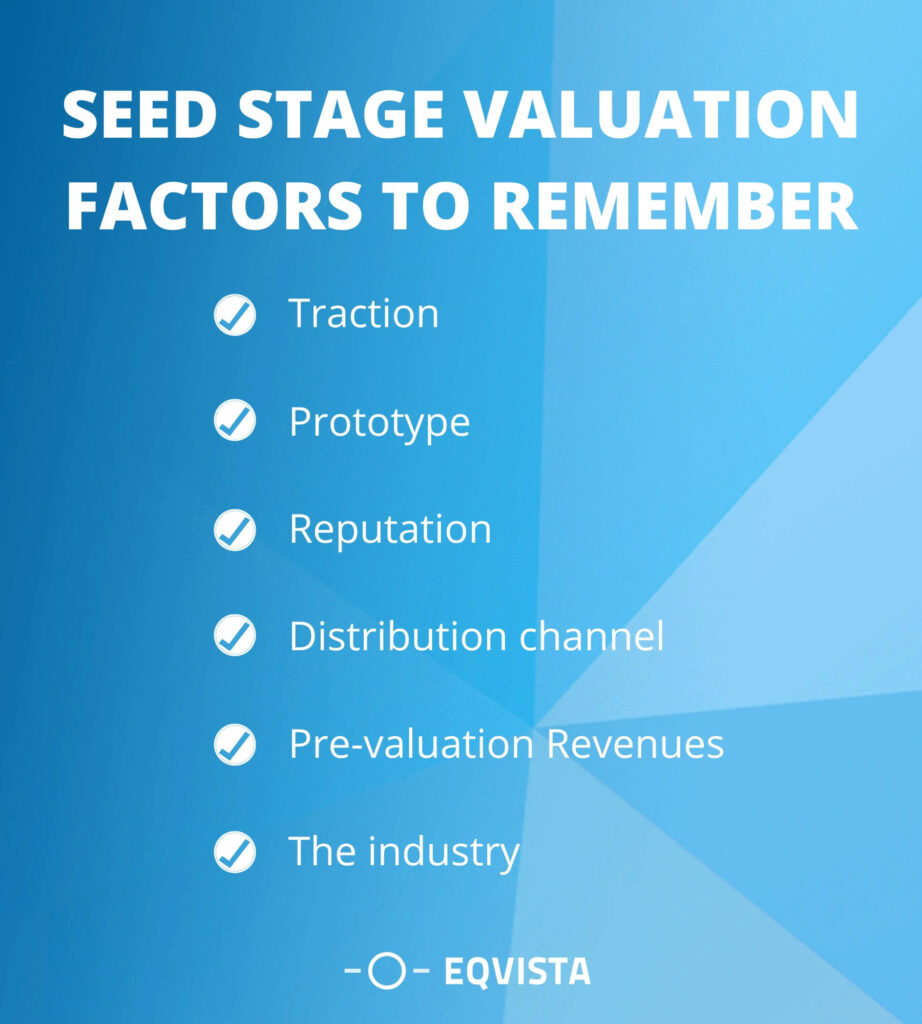

Seed stage valuation factors to remember

Making an informed choice about whether to participate in seed stage valuation requires taking into account several criteria. Here, we examine some of the most crucial aspects to consider when assessing seed-stage valuation:

- Traction – Traction primarily serves as the quantitative indicator of growing client demand for a start-up. This is one of the key elements affecting seed stage valuation. It is the most crucial factor in persuading investors to put money into a company since it plainly shows expansion and growth.

- Prototype – Interactive prototypes enable the discussion of early-stage company concepts and precisely convey to investors the entire idea of a future product. They also illustrate the user interface level. It provides the opportunity to present a practical and appropriate product that is suitable for the target market. A key element that can affect an investor’s choice is the creation of a prototype. Hence, make sure the prototype is ready before preparing to pitch to an investor.

- Reputation – The founders must make sure they have a good reputation in the market before moving forward with the valuation round. The founder’s reputation and abilities are some of the most crucial factors that investors consider before investing.

- Distribution channel – Probably, the product or service will also be in its early stages throughout the start-up phase. So, founders must exercise caution when choosing a distribution channel because it can directly affect the company’s valuation.

- Pre-valuation Revenues – Revenues are vital to any company since they simplify the assessment process for investors. So, if a product has already been launched and is making money, it may influence an investor’s choice in favor of that firm and serve as a true deal-breaker.

- The industry – Investors are quite willing to hand over more money for a company if its sector is experiencing rapid growth. This suggests that selecting the appropriate industry is critical because doing so will raise a company’s value.

Why is seed funding important?

For any business, seed funding proves to be crucial. You can raise money through seed fundraising even before your company starts making money. It assists in supplying your financial necessities and makes up for any shortfall you may be experiencing. It gives you operating money so that you can manage the day-to-day operations of your firm. Also, it makes expanding your firm much simpler. The founders’ risk is diminished, and you get to work alongside partners. Overall, it covers all of your expenses, including hiring, marketing, and development.

When and how much should start-ups raise in the seed round?

An investment made during the start-up’s early stages is known as seed capital. This assists the company in determining and developing the ideal direction for its start-up. The money raised at this point is utilized to research customer needs, tastes, and preferences to create a product or service that meets those needs. Four to six months before using up the money from the pre-seed round, you should begin raising seed funding. The amount of initial capital needed also fluctuates significantly depending on the company’s current vision. Be sure to conduct an accurate seed financing valuation before making your presentation to the investors.

In the seed round, founders should ideally forfeit stock or shares worth no more than 10% of the firm. Although the majority of circumstances call for up to 20% dilution, it’s vital to remember that anything above 25% might not be good for the founder. Founders may benefit from knowing the investor’s goals when negotiating. A sufficient amount of seed capital can work wonders for start-ups, enabling them to make a meaningful impact and expand beyond all expectations.

How much should a valuation be for a seed round?

Valuation is one of the most critical factors in seed funding. The value will define how much stock will be forfeited in exchange for the investment. There are several approaches to valuing a business for seed capital. Using a multiple of a company’s monthly recurring revenue is the most popular strategy (MRR). Thus, if MRR is $10,000 and the industry-standard multiple is 3 times, the company would be valued at $30,000. Using a multiple of annual run rate is another technique to determine the value of a company.

In contrast to the MRR method, this one bases its calculations on monthly revenue multiplied by 12. Hence, if monthly revenue is $12,000, the yearly run rate is $144,000, and a 3x multiple would value the company at $432,000 for the same scenario. This is frequently applied to later-stage businesses that have already raised a significant sum of capital from investors. The multiple for your business would be 10x, for instance, if you raised $1 million at a $10 million valuation.

Negotiating a seed funding valuation

When it comes to raising funds for a business, one of the first decisions to make is what type of financing to pursue. Early-stage businesses frequently look for a seed round of money, which is frequently given by angel investors, venture capitalists, or other wealthy people. It’s crucial to be able to negotiate effectively when you’re seeking to raise millions of dollars.

Why is it important to negotiate a seed funding round valuation?

Pre-money valuation for seed financing is crucial since it will define how much stock you are giving up in your business. When too much equity is given up there is a risk of becoming diluted and losing control over the business. Understanding the core values of the business is crucial. This can be done by examining the company’s financials as well as those of similar businesses in the industry. In addition, it’s crucial to keep in mind that pre-money valuation is negotiable and not final.

Successful negotiation is essential for the seed investment round. The use of these strategies is necessary for start-up funding. Negotiating initial funding terms with investors involves several variables that must be carefully controlled to produce the intended results. In the extremely competitive market of today, having strong negotiating skills is highly valued. Businesses suffer significant losses as a result of poor negotiation skills, but better negotiation skills can increase profitability.

What are the disadvantages of not negotiating the seed round valuation?

Understanding how to negotiate a seed round pre-money valuation is crucial for an entrepreneur looking to obtain capital for the firm. Failure to do so could result in a lower valuation than could have otherwise been obtained and an excessive dilution of the equity. Additionally, the growth of the firm will be curtailed eventually as a lack of negotiation results in the devaluation of the firm. The true value for the firm cannot be established without proper negotiation.

How to determine a company’s valuation or worth?

A company’s management, financial structure, potential for future earnings, and market worth of its assets could all be examined as part of a business valuation. Depending on the evaluator, the company, and the industry, many tools may be employed for appraisal. Examining financial records, discounting cash flow models, and similar company comparisons are common methods for valuing businesses.

How to negotiate a seed funding round with valuation?

Around 20% of the shares in the firm will typically be sold in a seed round. The amount of capital that can be raised for that 20% stake depends on valuation, which makes it one of the most important components. The value of the business as determined by the investor and founder constitutes the valuation. The negotiation process of a seed funding round is completed when the investor and founder discuss this valuation.

Mistakes to avoid in negotiating seed funding round

It’s vital to keep in mind that not all rounds of funding for companies are made equal. In actuality, underestimating the value of a pre-seed round might be a significant error. We must offer investors ample time to decide while soliciting their financial support. Making rounds quicker prevents them from having adequate time to conduct their research and decide whether they want to invest. Investors want to know that there is a long-term strategy and dedication in the start-up they are planning to invest in. This is possible by providing them with the adequate time required to analyze the same.

Get a valuation for your seed funding with Eqvista!

Seed funding valuation helps to know the accurate value of the business which is crucial for the negotiation process. Eqvista can provide you with a valuation for your seed funding round. With an expert team, Eqvista can offer high-quality valuation reports for your seed funding valuation. For more details on seed funding valuation contact us. You can also try signing up with our free app. To avail of all these services click here!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!