Term Sheet for Angel Investment

In this article, we specifically discuss the angel investors term sheet, an important document that is a precursor to funding contracts from Angel investors.

Are you a startup founder? Wondering about fundraising, especially Angel Investments? It is natural for young founders to feel daunted by the various terms involved in startup fundraising. With seeds, to angels, to VCs, and multiple series of funding, it is normal to feel overwhelmed. The key is to break down each stage and gather as much information as possible about the nuances. The deeper the founders’ understanding, the better are their chances of securing the right amount of funds from suitable sources.

Angel Investment

Startup funding follows an organic progression. Unless the founder is a serial entrepreneur with a deep pocket and is extending the business line, a fresh young startup has to follow all the stages, one at a time. Angels and venture capitalists are the investors involved in these stages. They not only provide money but the much-needed business mentorship as well.

What is Angel Investment?

In the context of startup fundraising, angel investment comes second in line. This is just after the initial ‘bootstrapping’ stage, when the founder uses all personal sources to gather the initial funds required to form the startup.

Investors who enter this stage are called Angels. It is a crucial and formative juncture for any business, and the right amount of funds, at the right time can make all the difference in the success or failure of a brilliant idea.

Angel investors are experienced individuals: they are HNIs from the industry that have either been serial entrepreneurs, business heads, C-Suite executives, and the likes and have accumulated a lot of wealth. They invest personal funds into growing startups to gain high returns from the exponential growth of these businesses. Angel investors grant funds in exchange for equity in the startup.

The funding size can vary from $5,000 to $250,000. These funds are also known as seed money. The equity demand from Angels usually ranges between 10% to 20%. They are active participants in the well-being of the company. Angels prefer not to take up too much space in the day-to-day functioning of the startup. They enable founders to lead the way with the right guidance at this stage.

How does Angel Investment Work in Startup Funding?

Founders must realize that Angel investors are seeking them out as much as they are. If a startup needs funds to grow, investors need the right business to multiply their assets within a short span. Sometimes, startups are so caught up in their rush to create and expand that they fall short in the way they present themselves to the industry. Founders must know when and how to approach the right investors. So, keeping these aspects in mind, here is a snapshot of how the process of angle investment works:

- Connect – Startup funding is best done by referrals and introductions. As these are high-risk investments, Angels prefer to connect with founders who have goodwill in their network. Another reliable connection point is the startup accelerators. These programs induct founders after a rigorous due diligence process, making them reliable platforms for connection. Other than personal introductions and accelerator programs, there are always opportunities to network at industry events and seminars.

- Pitch – After a mutual connection is made, interested investors invite startups for a formal funding pitch. This is when verbal negotiations occur between the investors and founders. Startups must have all their documentation in place to qualify for further discussions.

- Term Sheet – This is the first official document shared by investors to indicate their intention of funding a startup. It is a blueprint of the actual terms that will be included in the final contract. It gives both parties a chance to review the terms regarding funding type, funding size, equity stakes, stakeholder rights, liquidation, and exit scenarios.

- Due Diligence – After the basic terms are agreed on, investors will conduct a rigorous check on all documents authenticating the startup’s operations. This stage is a decisive factor in the funding process. If any document fails to measure up to standard checks, angel investors reserve the right to withdraw their offer.

- Final Contract & Fund Transfer – After all the verifications, the final legal contract is signed, and funds are released for use.

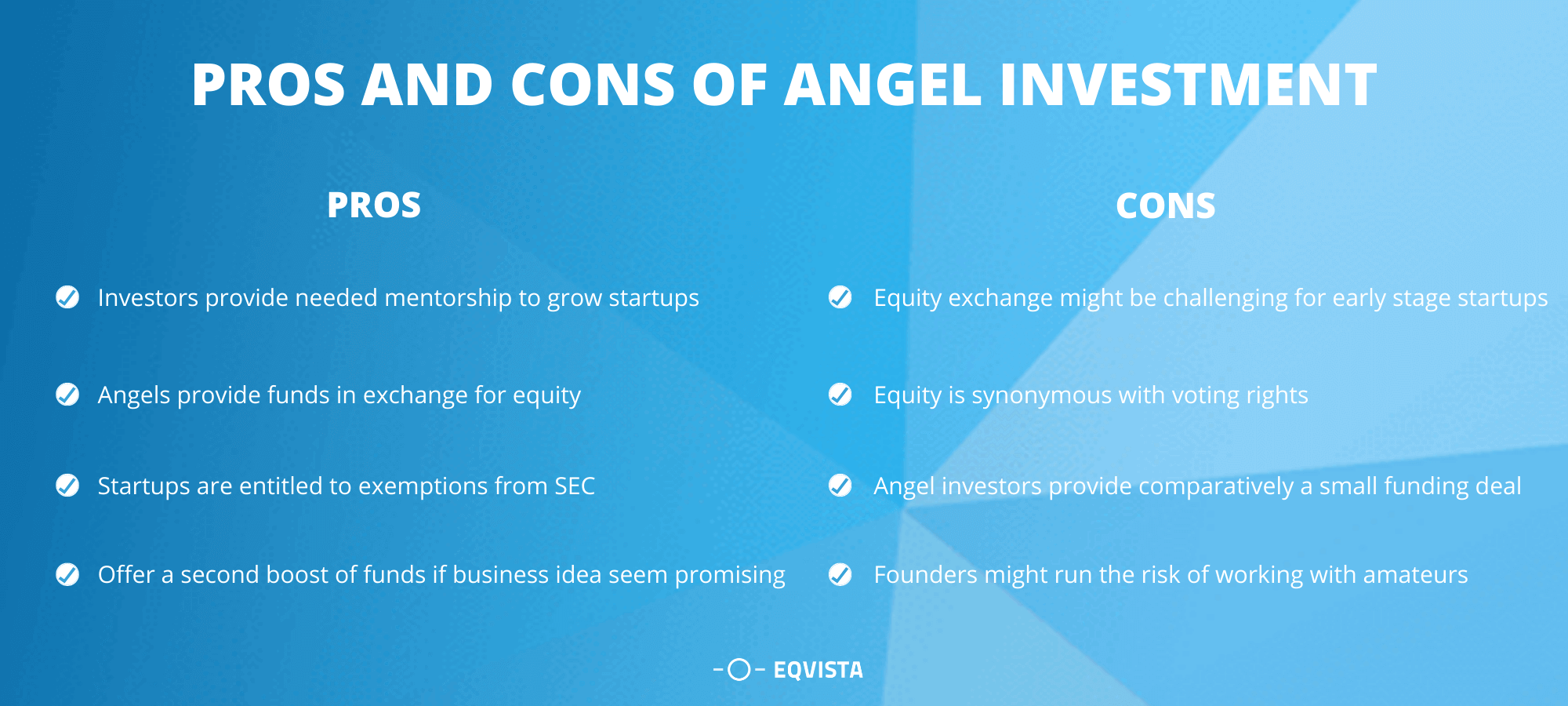

Pros and Cons of Angel Investment

Angel investments enter a startup’s lifecycle at a crucial juncture. They provide startups with the much-needed funding boost at this stage. But there are some drawbacks to this mechanism as well. Here are some observations:

Pros of Angel Funds

- Angel investors are experienced industry experts and provide much-needed mentorship to growing startups.

- Angels provide funds in exchange for equity. Startups need not pay back the principal amount or any form of interest.

- Startups using funds from Angel investors are entitled to exemptions from SEC, especially while filing for an IPO.

- Some Angels may stay along the growth cycle of startups and offer a second boost of funds.

- Some VCs may come in early as angel investors if they see promise in the business idea. Eventually, they may lead further rounds of investment.

Cons of Angel funds

- Angel investment happens in exchange for equity in startups. This might be a challenge in the early stages as founders don’t know how many more rounds of investments they would need in the future. Every funding round shaves off equity from their share.

- Equity is synonymous with voting rights. This may become an issue down the line as founders will be obligated to involve investors in important business decisions.

- Angel investors provide comparatively a small funding deal as compared to venture capitalists. Thus, founders might run the risk of working with amateurs who don’t really understand this deal’s gravity and mutual nature.

Some of the Most Well-Known Angel Investors

Since angel investments are targeted towards the earliest startup stages, both investors and founders must proceed carefully before finalizing deals. Seed money provided by Angels forms the foundation for further funding rounds. Thus working with the most reliable and well-networked parties is the best way forward. Here is a basic list to start with:

- Top 10 influential angel investors – Fabrice Grinda, Paul Buchheit, Alexix Ohanian, Naval Ravikant, Daniel Curran, Scott Banister, Marc Benioff, Mark Cuban, Simon Murdoch, and Ron Conway.

- Popular Angel Investor Networks

- Angel Capital Association (ACA) – This is a network of 14000+ private investors. It is the most advanced and extensive network of angel investors and operates across the Middle East, Canada, South America & USA.

- Angel Messenger Forum (AMA) – This is a network of pre-screened private investors. New startup founders can access this network for reliable funders. They provide funds ranging from $100,000 to $1 million. Many corporate angel investors are part of this network as well.

Term Sheet for Angel Investment

What is a Term sheet?

An angel investor’s term sheet is a non-binding document that functions as a letter of intent proposing a funding deal. This is not a legal document but is treated with utmost priority. Once an investor presents this document to a startup, they automatically share a bond of confidentiality. A startup can acquire multiple term sheets, but they are not allowed to disclose details of the deals to anyone. The fundamental details covered in this document are:

- Details of the startup

- Details of the investor

- Pre-money valuation

- Types of shares proposed for issue

- % of equity share

- Outline of the cap table

- Effect of dilution

- Dividends if any

- Confidentiality

- Exit and liquidation clauses

How does a term sheet for angel investment work?

Angel investors proceed with utmost caution while funding startups. They grant interest-free funds with the complete knowledge that in case the startup fails, they will lose all the money. This is a high-risk investment game. Thus it is only expected out of them to be extra careful. The term sheet for angel investment is the primary step towards ensuring a safe deal.

This document is issued to a startup by the angel investor only after they are completely sure about the authenticity and future potential of the business. After multiple rounds of verbal negotiations, a term sheet is a document that commits all ideas to paper. It gives both parties a fair chance to review and dwell on the funding deal terms. This document enables further discussions and negotiations of the terms. If they reach a tipping point where they cannot mutually agree on an idea, either party can choose to exit the deal without worrying about legal repercussions.

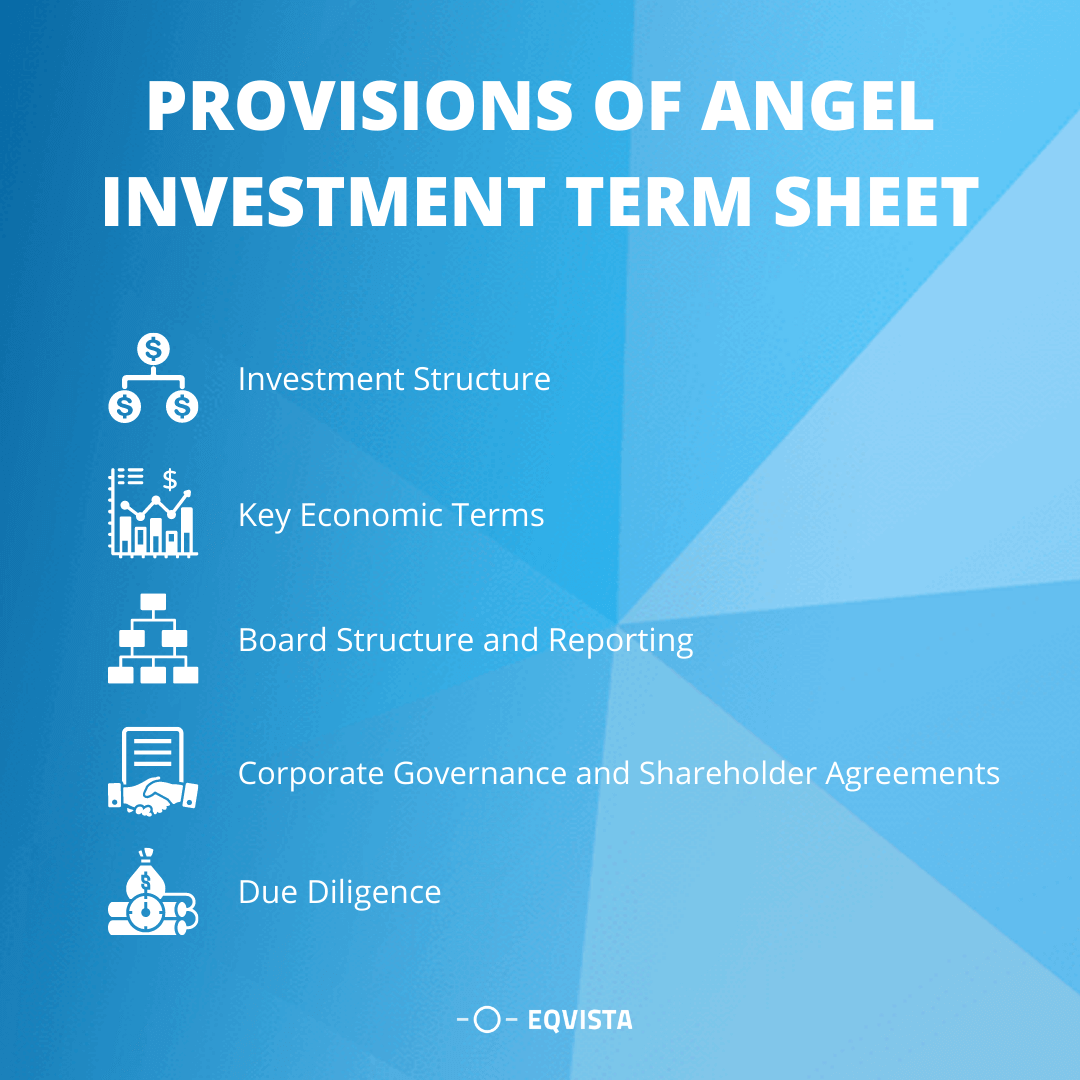

Provisions of Angel Investment Term Sheet

Angel investor’s term sheet is a preliminary document. It should be brief as well as carry all the defining details of the funding agreement. The most important provisions that must be included are:

- Investment Structure – This is the basic feature to be clarified and agreed upon. An Angel round can happen in exchange for common shares, preferred shares, or convertible debt. Each one has its unique significance. While common shares are intended for founders and startup employees, preferred shares and the convertible notes that eventually mature into preferred shares are issued to investors. A term sheet must carry details of who would own how much as a result of the new investment.

- Key Economic Terms – In the context of angel investment, investors and founders must agree on two basic terms that would define the nature of this financial arrangement. One is how much would be the ‘preferred returns’, and the second is how much would be the ‘accruing returns’. In simple terms, ‘preferred returns’ is the amount founders must return to investors before distributing payments to other stakeholders. While ‘accruing returns’ is the amount that would accrue throughout the investment. This usually ranges between 5 – 12% of the funding amount. Founders are expected to pay this value either in the form of dividends or equity.

- Board Structure and Reporting – Unlike venture capitalists, Angels have a ‘hands-off’ approach with the startup management they are funding. This is an accepted practice for a business is the nascent stages, and the complete onus of how it will grow lies with founders and the immediate team. In the case of experienced Angel investors, founders might willingly involve them in a role more than an ‘observer’. But other than that, even with a position as a board member, angel investors do not demand too much involvement in the daily operations of a startup business. They are content with the reporting structure agreed mutually.

- Corporate Governance and Shareholder Agreements – The term sheet for angel investment is one of the first official fundraising documents a founder will deal with in the early stages of operations. This is why they must choose angel partners carefully. The right ones will make the entire process of designing terms for corporate governance and shareholder agreements smooth and fair. Founders must remember the importance of these clauses as angels might extend their funds, inject new funds, or even lead the next round in case a VC has entered the cycle early. On one side, it is important to recognize the rights of all stakeholders. Simultaneously, there must be checks and balances in place to avoid instances of opportunism from either party. Beyond this, the most important aspect that ties all aspects of this process is the inter-personal relationship shared by founders and investors.

- Due Diligence – Due diligence is a popular term in investment markets. It involves a set of processes that minimize the chances of foul play. But every term sheet must define the boundaries of the due diligence process. This includes aspects like signing date, closing date, confidentiality, exclusivity, and the conditions that will define the due diligence process. Both parties shall mutually agree to these terms so that the process does not overstep either of their operating limits.

Term Sheet for Angel Investment

Preparing a term sheet for angel investment is an exclusive process. The investors mostly handle it. In some cases, the startup might take the lead. But whoever takes responsibility handles this document’s end-to-end planning and execution with room for negotiations and edits at a later stage.

How to prepare a term sheet for angel investment?

Irrespective of who takes responsibility for preparing a term sheet, it always helps to understand the process behind drawing up the terms. Here is a brief about the steps followed in creating this document:

- Identify the Purpose of the Term Sheet Agreements – One of the first things to clarify on an angel investor’s term sheet is its purpose. What is the fund granted for? Is it for a sale, new business unit acquisition, or merger? This intent must be clarified in the document. Details of the stakeholders involved follow this. Who is granting the money, and who is receiving it? What are the starting and ending dates of this deal? Which category of financial instruments will be used to disburse these funds? What are the important negotiation points? And the likes.

- Briefly Summarize the Terms and Conditions – Once the funding intent is identified, plus there is clarity about the identity of stakeholders, these terms are spelled out on paper and form the first paragraph of a term sheet for angel investment. Apart from these details, this is the section where the issuing party declares the extent of this document’s binding or non-binding nature. Though it is not a legal document, it does demand a certain extent of exclusive commitment from both parties throughout the negotiation process.

- List the Offering Terms – This section is designed to provide a snapshot of the funding deal terms. Unlike a final contract where every term is spelled out in a complicated legal language and runs for pages, the offering terms on this document are concise and to the point. Here is a list of the common aspects covered in this section:

- Details of the issuer

- Signing date

- Closing date

- Pre-money valuation

- Types of shares being granted

- Funding amount

- Price-per-share

- Include Dividends, Liquidation Preference, and Provisions – ‘Dividends’ are the profits that investors are entitled to in return for the invested money. ‘Liquidation preference’ defines what happens to the invested money in case the startup faces a liquidation scenario. ‘Provisions’ are the protective measures used especially by investors for worst-case scenarios when the startup can’t continue to function anymore. These three aspects are important to safeguard investor interests and to protect founders in case of unprecedented scenarios.

- Identify the Participation Rights – This is not a mandatory feature. Participation rights favor the investors only and entitle them to receive profits on investment, on priority, before anyone else. As expected, this section is not an easy one to negotiate. In case this term is included, founders will get the raw end of the deal.

- End with the Voting Agreement and Other Matters – The final section of a term sheet for angel investment involves terms defining:

- Extent of voting rights

- Extent of investor involvement in management decisions

- Details of an option pool

- Details of the document processing fee, if any

- Signatures of both parties

Record & Manage your Angel Investment Term Sheet with Eqvista!

Angel investment is one of the foundational moves in a startup journey. With this round of external funding begins a startup’s formal journey into equity distribution and management. To ensure that all equity-related processes are accurate and streamlined from the beginning and are quickly available for customized access as well, sophisticated cap table software like Eqvista is of great help. Read more for a detailed view of Eqvista services. For further information or demos, reach us today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!