VC Term Sheet (Venture Capital Term Sheet)

VC term sheets are used in the VC funding process. They are prepared by the investor ‘leading’ the funding round.

Startups that make it to the venture capital round become well aware of the fundraising process. Ideally, they would have crossed the angel investment stage to reach here. By this time, they would have realized that the fundraising process is almost like continued education. Every step you cross, there are many more, and the key to acing those is to learn and adapt.

Venture Capital

Startup funding follows an organic progression. Founders enter the business by personal pooling funds and whatever they can manage from close family and friends. This funding amount is pretty small and just enough to get the startup in business. This is followed by the seed round supported by angel investors. This money supports all the formative functions. Once an MVP is ready for a scale-up and expansion, large funding grants such as venture capital becomes the need of the hour.

What is Venture Capital?

Venture capital is a compilation of funds from wealthy individuals or financial institutions to invest in startup ventures. They always operate as VC firms and follow strict procedures to analyze, evaluate, and fund startups.

Venture capitalists enter the startup lifecycle at the Series A stage and most often continue through Series B and C. The intention is to support promising startups and make massive profits from their success over a short period.

A VC funding round can be anywhere between $10M to hundreds of millions. These are always granted in exchange for equity. The funding size increases from Series A and usually is the highest at Series C and beyond.

A fast-growing startup needs this kind of money to burn, accelerate, and expand. Besides, VC funds not only bring money but industry expertise as well. They take a prominent position in startup management as an active board member and oversee daily operations until it is time for an exit.

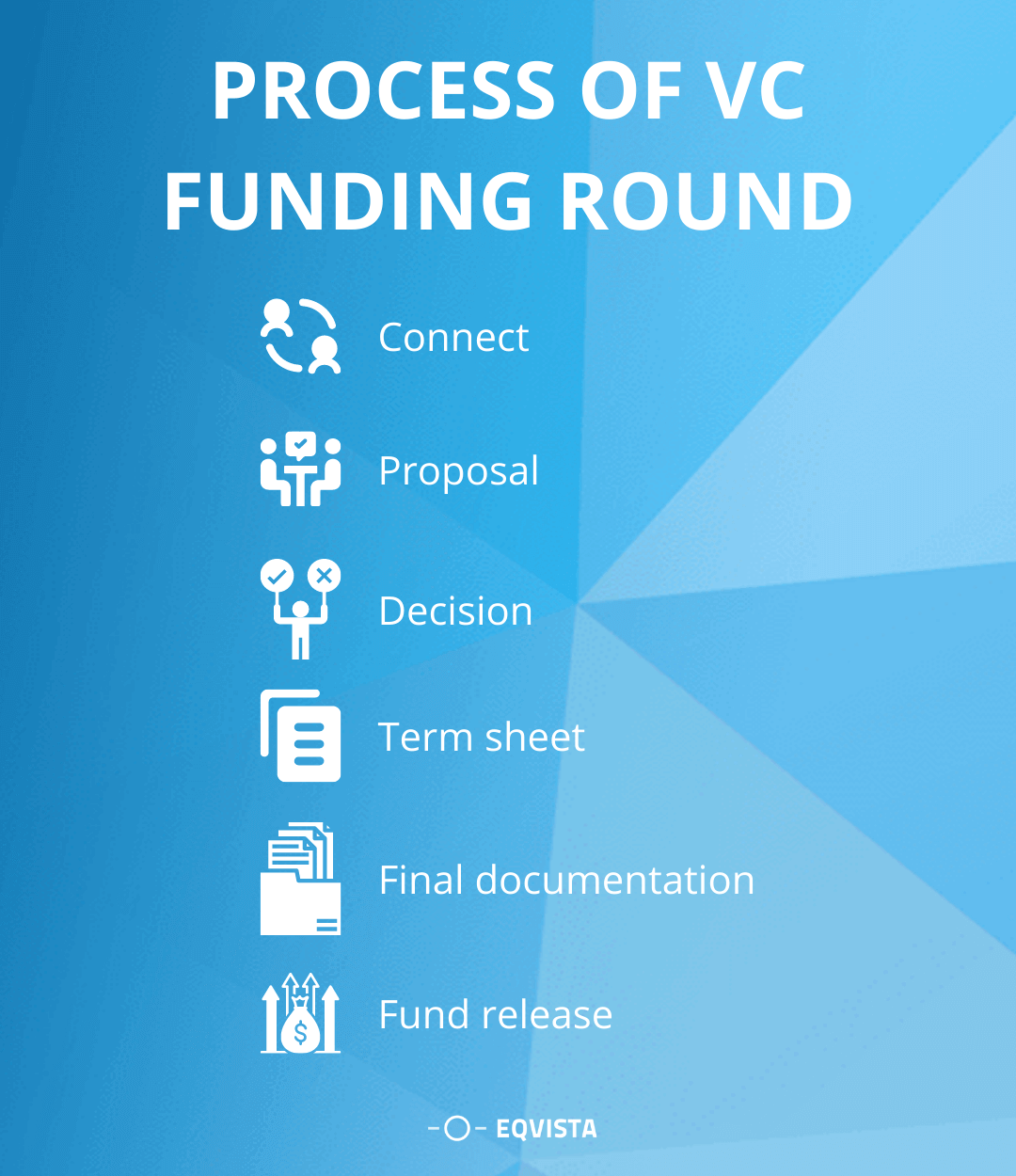

Process for VC Funding Round

Every VC firm receives hundreds of proposals each day. Of them, only 1 – 3% are asked for a proposal. The next steps leading up to the fund release can easily take 6 – 12 months. Thus founders must plan ahead. Here are the steps in the VC funding process:

- Connect – Introduction to the VC of choice is the most challenging part of the process. In this sea of high-potential startup ventures, all founders are eyeing the best VC. Thus personal introductions and recommendations go a long way to cut through the maze. Angel investors who have already funded the startup are also a good touchpoint. So are startup accelerators.

- Proposal – After the initial connection, if the VC is interested in the business idea, the startup is invited to present its proposal in the form of a pitch deck. A pitch deck is a brief presentation covering all the important aspects of the startup. The purpose is to excite the investor and push them to grant further appointments to discuss the business plan and funding options at length.

- Decision – After consecutive meetings, the investor finalizes the decision to fund the startup. Meanwhile, a due diligence process is continued to cross-check the authenticity of the startup. A VC funding round moves to the next stages of negotiations only after the startup’s background checks out.

- Term sheet – After the decision is made, the investor shares this formal document with the startup. The first official communication clarifies a VC’s intent to fund a startup. It mentions all the terms and conditions (valuation, equity share, investor rights, etc.) that would govern the funding deal. A startup must review this document thoroughly and get back to the investors for further edits or negotiations. Once mutually agreed upon, this will become the reference document for a legal contract. Since it is not legally binding yet, founders can choose to exit the deal at this stage.

- Final documentation – Based on the VC term sheet a legal contract is created by the investor. Both parties sign this, and the deal is sealed. Meanwhile, further due diligence is carried out to ensure all processes are clean. Before releasing the funds, both parties must ensure that all the necessary government filings are in order as well.

- Fund release – This is the final stage. VCs usually release funds on a schedule. Unlike private equity, the entire money is not transferred at once. Sometimes, investors and founders might mutually agree to set up a milestone-based fund release mechanism.

Importance of Venture Capital

Sometimes, startups might feel a bit tied up because of venture capital participation. VCs expect a certain standard of operating efficiency and reporting that might be too much to handle for a young startup team. But in the long run, their involvement outweighs the restrictions. Some stark advantages of VC funding are:

- Startups receive collateral-less, interest-free funds

- VCs provide money as well as mentorship and introduction to industry networks

- Startups need not return VC money in case the business fails. VCs take calculated risks

- VCs possess evolved analytical tools and metrics that help the young startup build efficient business models

- VC grant authenticates a startup’s credibility in the market

Example of Venture Capital

Once a startup crosses the angel funding stage, the journey becomes explosive as well as arduous at the same time. The right frequency of fund inflow becomes a crucial part of this phase. Thus venture capital as a whole is being an umbrella term is further categorized into three types based on the stage of business they are supporting:

- Early-stage VC funds – This further covers three areas: seed money, funds to develop new products or services, and funds for startups ready to enter the market with an MVP

- Expansion stage VC funds – This is otherwise also known as mezzanine financing. These funds are a brief injection for expanding startups heading towards an IPO.

- Acquisition or buy-out stage VC funds – These funds are the largest and help businesses to acquire new companies or business units. Another scenario supported by this category of VC funding round is a leveraged buyout.

VC Term Sheet

With this brief understanding of VC funding, let’s move on to the concept of venture capital term sheet. What is the purpose of it? How does it help to facilitate the funding process between an investor and a startup?

What is a Term sheet?

Startups will come across term sheets right from the time they start working with external investors. This type of interaction begins with the angel investors and proceeds on to venture capitalists.

With this document, an investor formally notifies a startup about their intent of funding. It forms the foundation for negotiations and opens a cordial communication channel between the two parties. Until this time, most conversations about the funding deal remain at a verbal stage.

What is a Venture Capital (VC) Term Sheet?

VC term sheets are used in the VC funding process. They are prepared by the investor ‘leading’ the funding round. They usually are 10 pages long and not binding in nature. Yet they carry equal importance in negotiations.

Though not a legal document, the terms will include a confidentiality clause that ensures that both parties keep the negotiations private until the deal is finalized. This document forms the basis of some important legal ones, such as the voting agreements and stock purchase agreements. They also lead to the development of a VC cap table.

Funding Round in VC Term Sheet

If required, a startup will come across VC funding rounds throughout Series A, B, C, and further stages. It all begins with the investor pitch. After a series of negotiations, the term sheet is issued. Beyond this stage, the lawyers of both parties enter a negotiation over the terms mentioned in this document.

There might be some back and forth to clarify and re-negotiate certain aspects. Founders ultimately want to receive optimum funds at the best deal, and investors want to ensure their money is put to good use, and the startup is on track to deliver what they promised.

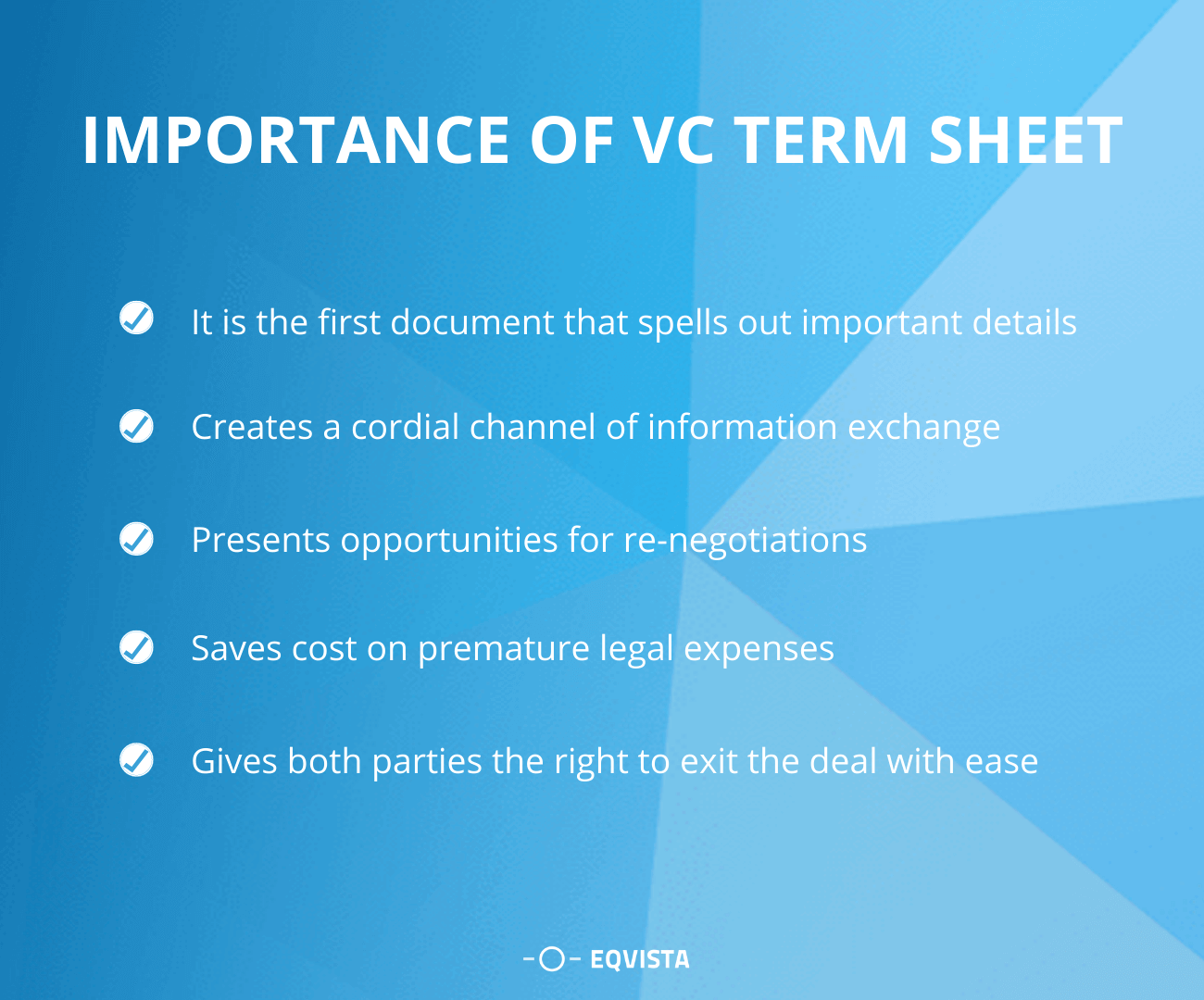

Importance of VC Term Sheet

A VC funding round can extend for months. Unless planned ahead, startups may find themselves in a difficult position. Besides, VC funds come with a certain amount of control in the management. Irrespective of all these factors that may seem to deter at first, VC funds are important. More so are the term sheets that help formalize these discussions. One can’t deny the need for a terms sheet because:

- It is the first document that spells out important details such as company valuation, funding amount, investors’ rights, investor protection clauses, etc.

- Creates a cordial channel of information exchange

- Presents opportunities for re-negotiations before drawing the final legal contract

- Saves cost on premature legal expenses

- Gives both parties the right to exit the deal with ease in case terms do not go their way

Preparing a VC Term Sheet

Now that we have a fair idea about VC term sheets let’s explore how investors create this document. At this stage, startups are at the receiving end of the deal. They should be as prepared as possible so that they can agree to what is possible and confidently negotiate or deny terms that would be a far stretch.

3 Main Sections of a VC Term Sheet

A venture capital term sheet template should carry details covering all aspects of the following three functions. Any investor entering a funding deal would want clarity on these basic points – what happens to their money? How much control will they have in the startup? And what happens at an exit?

- Funding – Terms governing the ‘funding’ aspect indicate how much money is granted in exchange for how much equity. This is pretty much the essence of any funding transaction. Investors and startup founders must have clarity about the extent of their financial exchange. Since venture capital involves large sums and is granted over an extended period, these terms are foundational to any funding deal.

- Corporate Governance – Corporate governance is all about the power structure in a funding deal. Terms governing this aspect create a fair play between founders and investors and ensure no one is being exploited. Investors need to know the extent of their representation and involvement in management decisions. This automatically involves voting rights. And the other aspect is the reporting structure and frequency. Both parties must mutually agree on an arrangement that truly reflects the spirit of partnerships.

- Liquidation and Exit – Terms that determine liquidation and exit scenarios in a VC term sheet basically protect investor rights. These act as a safety net in case their funded startup fails to perform well and, as a result, must liquidate. These terms define the priorities of receiving company profits in such situations. The same is extended towards exit scenarios.

Key Provisions

Now that we know the three broad thematic areas governing venture capital, here is a list of key provisions to such funding deals. These terms are the foundation of any legal funding contract. Thus both parties should encourage talks that would clarify all the nitty-gritties of these aspects before the legal contract is created.

- Investment Structure – This section indicates which financial instruments are being used for the funding deal. The popular ones in the VC circle are convertible preferred shares. They eventually convert into equity at a milestone event and fetch massive profits. This section also mentions the pre-valuation of the startup and the price per share.

- Key Economic Terms – The two key economic terms covered in a venture capital term sheet template are the ‘preferred returns’ and the ‘accruing returns’. Preferred returns are the amount of funds founders owe investors before distributing profits among other stakeholders. It is usually the original funding value. While accruing returns are basically accrued dividends. Founders normally don’t agree to this clause. Even if they do, it all becomes part of the converted equity package of preferred shares.

- Corporate Governance and Shareholder Agreements – The ‘corporate governance’ provision determines the founder-investor’s representation of the board of directors. It is a popular practice to have a board with odd numbers so that they have a provision for a deciding swing vote. This odd member is nominated both by founders and investors and must not belong to either camp. Beyond this, investors have the right to certain reporting structures, such as those involving financial progress and any sudden legal proceedings. Meanwhile, shareholder agreements in the context of the United States include a share purchase agreement, ROFR or the right-of-first-refusal agreement, co-sale agreement, investors’ rights agreement, and a voting trust agreement. All of these protect the rights of a venture capital investor.

- Due Diligence, Exclusivity, and Closing – These provisions draw boundaries to the funding deal. They cover the dos and don’ts. A strict ‘due diligence process is followed to ensure there is no foul play from either side. ‘Exclusivity’ clauses draw limits to actions on the part of a founder while the current negotiation is going on. While ‘closing’ determines the validity of the offer, both parties must arrive at a consensus and mutually agree on the terms.

Venture Capital (VC) Term Sheet Template and Example

As the investor always issued the VC term sheet, founders need not worry about creating one. But they must understand all the provisions listed in this document and their role in response to it. Two of the most popular templates are:

- NVCA template – NVCA stands for National Venture Capital Association. This is the USA’s largest network of venture capitalists and functions with the sole aim of nurturing growing businesses. Venture Capital Term Sheet Template.

- Y Combinator template – Y Combinator is one of the first and most popular global startup accelerators. Since its inception, they have nurtured 1500+ startups. Their template is one of the easiest to understand and deal with. Venture Capital Term Sheet Template.

Record & Manage your Venture Capital term sheet in Eqvista!

Venture Capital is the lifeline for every successful startup business. How a startup works with VCs and develops a healthy relationship will determine their professional reputation in the industry. One of the most important aspects of this is documentation. It is in the best interest of startups to ensure all formative documents are in place, especially the ones regarding equity management. Eqvista is a pioneer in this sector. Starting with company incorporation and leading on to company valuation, issuing shares, and cap table management, the expert team at Eqvista are adept at all these activities. For further information, reach us today.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!