Benefits of Venture Debt – Everything You Need To Know

In this article, you’ll learn venture debt and its importance, why it’s essential for entrepreneurs and investors, and how to use it in your own business.

Venture debt has emerged as an essential part of an entrepreneur’s toolbox when it comes to securing financing for their company. In order to succeed, a startup must first secure the right amount of capital. It’s also important to keep costs in mind, as many entrepreneurs and investors have built successful businesses only to discover that their hard work has been significantly diluted. In this article, you’ll learn venture debt and its importance, why it’s essential for entrepreneurs and investors, and how to use it in your own business.

Venture Debt Benefits

The benefits of venture debt can be seen in a number of different circumstances. Unlike equity financings, venture loans can be obtained much more quickly, saving time and money for the company’s management (e.g., an acquisition).

Types of venture debt a business need

There will be conditions attached to the provision of funds because of the risky nature of venture debt. ‘Debt’ and ‘equity’ components will play different roles in the financial instruments used to facilitate startup venture debt. The most common types of venture debt are warranty-backed term loans, convertible notes, and revenue-based lines of credit.

Warrant-backed Term Loans

An existing venture capital fund can seek out term loans from venture debt providers to extend their runway to the following equity fundraising round, lease equipment, or purchase insurance in the event of a need for additional funding.

There is a wide range of terms for short-term to medium-term loans, including one to five years. The principal loan amounts are typically 20% to 35% of the total equity funds raised in the previous equity fundraising round. Startup founders can expect interest rates of 9–15 percent higher than traditional bank debt because of the inherent risk in this arrangement and the lack of tangible collateral as security.

There will be “warrants” on common stock issued to venture debt providers, which gives them the right to purchase startup stock at a predetermined “strike” price in the future. In exchange for taking on the risk of providing a term loan, venture debt providers reap the startup’s future growth benefits.

Convertible Notes

With this short-term debt instrument, instead of making regular interest payments, the holder receives preferred shares in the company upon a future fundraising round, rather than paying back the principal and interest on the loan. Due to this, most convertible notes have an expiration date, which must be paid back in full if the company does not raise additional funds.

There’s a big benefit to convertible notes when it comes to startup valuation: “kicking the can” forward. When a startup raises a Series A round, the startup’s debt is converted into equity at a discount (typically 15% to 20%). For taking on the risk of lending, the convertible note holder is rewarded.

Revenue-based Lines of Credit

There has been a rise in venture debt providers offering revenue-based loans like Monthly Recurring Revenue Lines of Credit, which are based on the monthly recurring revenue of the borrower-startup (MRR).

It is common for startups to use MMR Lines of Credit to help with sales and marketing as well as product development. The venture debt provider sees the MRR as an ‘asset’ that serves as collateral. Borrowers’ MRR is multiplied by their customer retention rate or churn rate to determine the maximum loan amount that can be borrowed (i.e., customer attrition).

High customer retention rates are a common requirement of venture debt providers, and financial covenants will likely include this requirement. Examples of financial covenants may include customer retention of at least 70 percent, annual growth of at least 20 percent, and a 70 percent gross margin.

Uses of venture debt in a business

Loans from venture lenders can be used for a wide range of purposes by borrowers, including growth and acquisition financing, as well as for general corporate purposes, funding to profitability, and cushioning for the unexpected. Taking out a venture capital loan can help a company grow faster, raise its valuation, and/or provide a safety net in the event of an unexpected event. Existing stockholders benefit from venture loans because they can raise money without sacrificing additional equity.

How does venture debt financing help in business growth?

In business cycles in the innovation economy, the cost of equity changes a lot. One thing that always stays the same: debt is cheaper than equity. Thus, venture debt is a big help to startups because it helps them get more value for their equity and lowers the average cost of capital when a company is “burning” more money than it is making. The second benefit of venture debt is that it can be used to cover problems with operations, fundraising, and unexpected capital needs, like performance bonds.

Understand Venture debt financing

Usually, one round of venture capital funding is not enough to solve all of a startup’s difficulties. Aside from hiring employees, promoting the company, and acquiring the supplies you’ll need in the short term, it’s entirely possible that you’ll need additional funding for long-term investments or strengthening your operations in areas that will bear fruit in the long term.

Venture debt financing is often used to fill this gap, often in conjunction with an equity round. It’s venture-backed debt, as the name implies. Traditional business loans, on the other hand, are arranged differently.

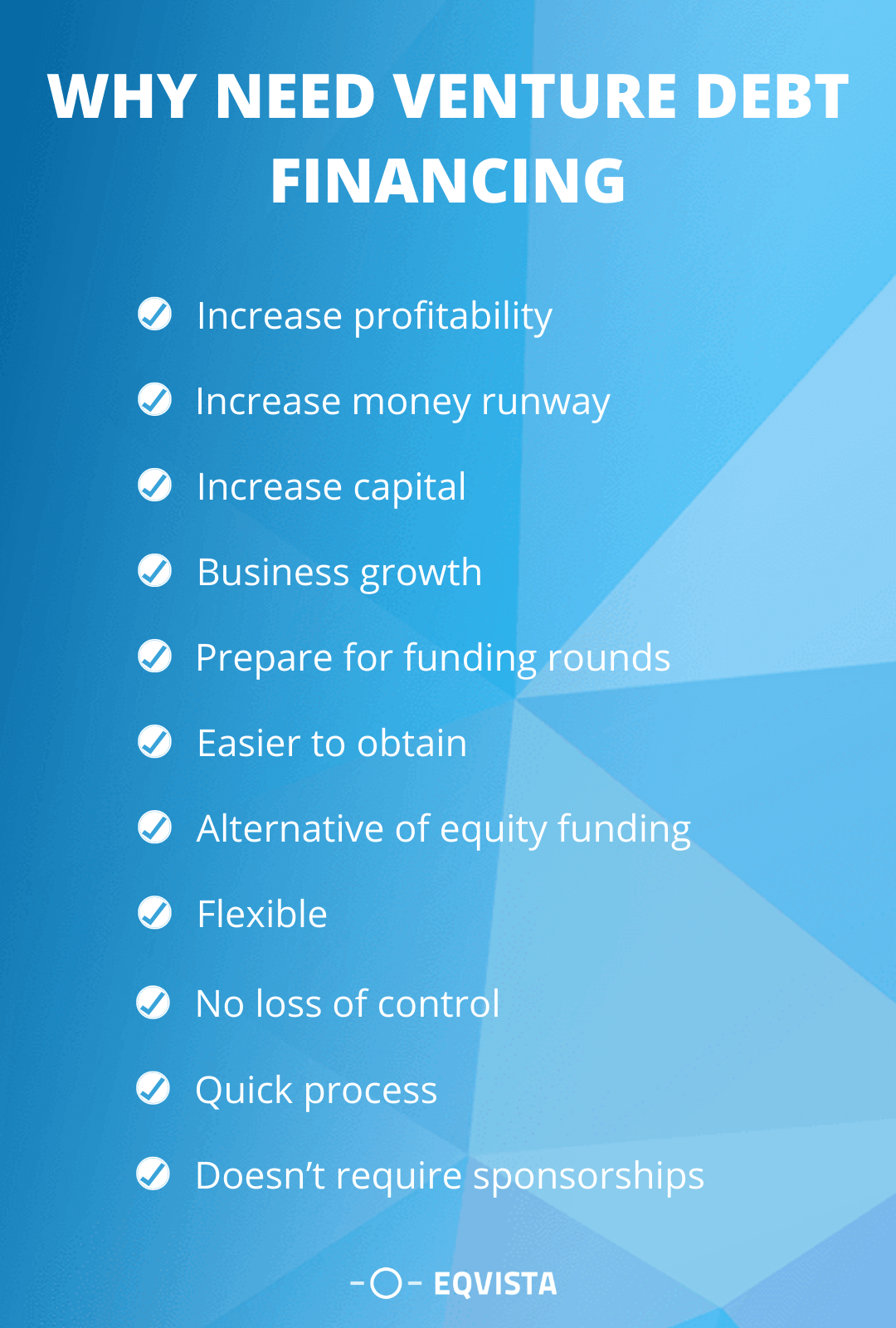

Why need venture debt financing?

If you’re a startup and you’re looking for a less-dilutive way to get money into a growing business, venture debt is the way to go. As a complementary form of financing to equity, venture debt can help a company grow more quickly. Listed below is an explanation of how venture debt helps a business.

- Increase profitability – Growth capital is obtainable while minimizing or avoiding equity dilution.

- Increase money runway – It acts as an intermediary between equity financing rounds, helping a company to achieve key milestones and a higher valuation in the subsequent equity round. Allows them to avoid raising additional equity or reach a point where less expensive capital is available until they are profitable.

- Increase capital – One of the advantages of using debt financing is that it allows a company to turn a small sum of money into substantially more money to increase capital. As a further benefit, debt repayments are often tax-deductible.

- Business growth – For venture debt, borrowers’ ability to raise additional equity and repay the loan for business growth is more important than their ability to generate past cash flow or working capital assets. A growth capital term loan is the most common form of venture debt.

- Prepare for funding rounds – In the case of an unfunded startup, raising venture debt may be a good option. It is possible to accelerate growth and improve operations by working with an experienced debt investor. These alterations should make the company more enticing to venture capitalists and increase its valuation in the upcoming Series A round of equity.

- Easier to obtain – It’s unnecessary to have a steady stream of income or substantial assets to use as security.

- Alternative of equity funding – Private equity can be a great option for businesses that need growth capital but aren’t growing fast enough to attract venture capital or aren’t satisfied with the terms.

- Flexible – Loan amounts, terms, amortization, covenants, and personal guarantees are less troublesome to negotiate with than they are with banks.

- No loss of control – For the most part, lenders will not demand board seats or any other direct involvement in the company’s governance or operational activities.

- Quick process – Due diligence can be completed in as little as 30 days, compared to 3-6 months for equity.

- Doesn’t require sponsorships – If you’re looking for financing, it’s not always necessary to have VC or PE backers. Many people will take into account both sponsored and non-sponsored businesses when making a decision.

How do venture debt financing benefit companies and investors?

Venture debt is often referred to as a “bonus round” or an “insurance policy”, but its true value is that it makes the venture more efficient. The value of a startup can be measured by the amount of money that is invested in the company, either in future rounds of financing or at the time of its sale or initial public offering (IPO).

Specifically, consider $1 of venture debt with 8% warrant coverage and interest and principal repayment terms that require 20 cents to be paid before the next round. An 80-cent investment has resulted in a reduction in dilution of approximately 90 percent. Suppose the company raises additional capital to repay the debt in the future. In that case, dilution is reduced by 45 percent compared to raising more equity at the outset, based on standard repayment terms and average increases from round to round.

Get your business valuation done by experts at Eqvista!

As a financing option for startups, venture debt will continue to be a viable option for investors. The need for longer-term financings, such as venture debt, has grown as a result of the expanding timeframe. With Eqvista, find the best venture debt lender that suits your needs. Get our expert’s help in business valuation for funding rounds with Eqvista.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!