HMRC Valuation

Expert valuation services for EMI, SIP, and CSOP, helping you achieve HMRC compliance and ensure tax-efficient solutions for your UK business.

What is HMRC Valuation?

An HMRC (His Majesty’s Revenue and Customs) valuation is a formal share price assessment required when UK companies grant employee share options under approved schemes: EMI (Enterprise Management Incentives), CSOP (Company Share Option Plans), or SIP (Share Incentive Plans). Granting share options without proper HMRC Valuation can trigger unexpected tax bills of up to 47% for your employees and penalties for your company.

Eqvista’s expert valuation ensures you stay compliant while maximizing tax advantages.

2026 Update: Upcoming Changes in 2026

HMRC is expanding EMI eligibility:

- Gross asset limit: Increasing from £30M to £120M

- Employee limit: Increasing from 250 to 500 employees

This means more companies will qualify for the UK’s most tax-advantaged share scheme. If you have formerly been ineligible, you may want to reconsider EMI options in 2026.

We are keeping track of these changes and will update our processes accordingly.

When do you need HMRC Valuation?

HMRC valuation’s major advantage is that it can help your company acquire a fair valuation of its shares before providing options to workers. In addition to these advantages, HMRC valuation is also very important when:

- Before granting EMI, SIP, or CSOP options to employees

- When setting the exercise price for share options

- Before shares cease to be subject to a SIP

- When HMRC challenges your share valuations

- During fundraising rounds, affecting option pricing

Without a proper HMRC valuation, you and your employees could face unexpected tax bills, penalties or scheme disqualification.

Eqvista HMRC Valuation Services

Eqvista specializes in providing various HMRC valuation services, including:

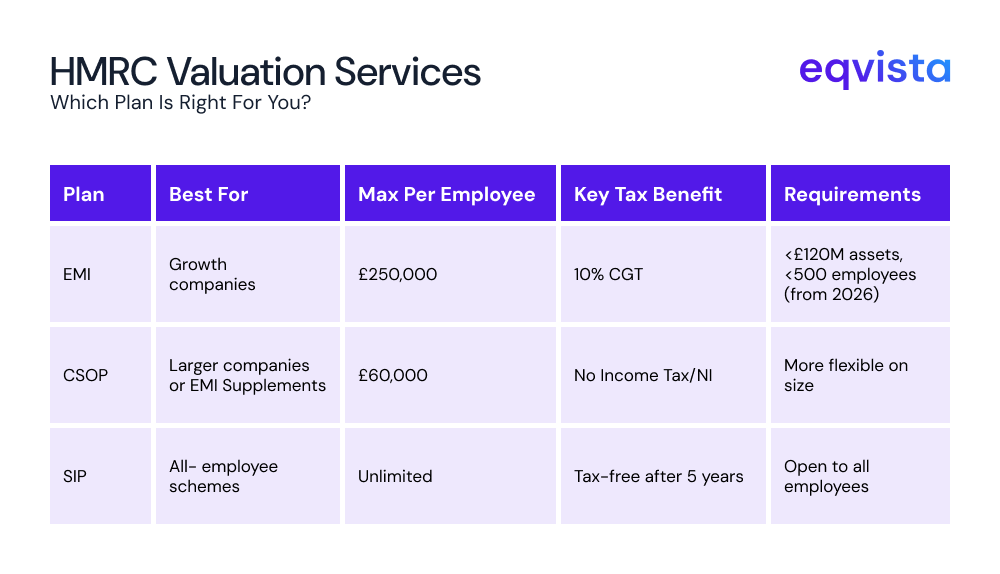

Enterprise Management Incentive (EMI) Valuation

HMRC launched the EMI program to incentivize businesses to offer employees share options. Both the company and the employee benefit from the scheme’s tax advantages.

Best For: Early-stage and growth companies (under £30M gross assets, fewer than 250 employees)

Key Benefits:

- Employees pay no income tax if exercised above the valuation price

- No National Insurance contributions on gains

- Only 10% Capital Gains Tax on exit (vs 20% normally)

- Up to £250,000 per employee, £3M company-wide

What You Get:

- Unrestricted Market Value (UMV) calculation

- Actual Market Value (AMV) with marketability discounts

- 90-day validity from valuation date

- Full supporting documentation for HMRC

Share Incentive Scheme(SIP) Valuation

A share incentive plan (SIP) allows workers to buy shares of their business or its parent company while receiving favorable tax treatment.

Best for: Larger companies offering all-employee share schemes.

Key Benefits:

- Income tax and National Insurance are free if held correctly

- No Capital Gains Tax if shares held in a plan for 5+ years

- Available to all employees (democratic incentive)

- Free shares, partnership shares, matching shares, and dividend shares

What You Get:

- Formal share price for award dates

- Valuation valid for up to 6 months

- SIP trust-ready documentation

- Annual revaluation services available

Company Share Option Plan (CSOP) Valuation

CSOP is an alternative HMRC-sponsored initiative for businesses not qualifying for EMI. The tax approach is much like EMI, but the awarded money is much less.

Best for: Companies that don’t qualify for EMI or want additional option grants.

Key Benefits:

- No income tax or National Insurance if exercised at or above the grant price

- Only Capital Gains Tax on sale (10-20%)

- £60,000 per employee limit (increased from £30,000 in April 2023)

- More flexibility than EMI on company size

What You Get:

- Market value assessment at grant date

- 90-day validity period

- HMRC-defensible methodology

- Option to combine with EMI for maximum benefit

Eqvista’s Process: Simple, Fast & Expert

Eqvista maintains the highest levels of accuracy and expertise. We use HMRC-approved valuation methods to comply with the tax authority.

- Free Consultation: After an initial consultation on information about your business and finances, we begin our simplified procedure.

- Documentation and Analysis: Our experienced valuation team conducts a thorough investigation considering the company’s financial standing, its assets, and the particulars of the transaction, among other variables that affect the value.

- Report: You’ll get a detailed valuation report that you can use to make tax-wise and well-informed decisions. There are two primary metrics in this report:

- Unrestricted Market Value (UMV) is the free and open market price of the assets or transactions under consideration. It provides an accurate and impartial valuation of the situation.

- Actual Market Value (AMV) shows the fair market value of an asset or transaction, adjusted for any constraints, special circumstances, or other factors.

- Delivery: You will receive the finished and finalized valuation report, usually in a format that makes it simple to submit to HMRC or utilize it for your financial decision-making and tax compliance.

How Long Does it Take?

We typically finish your estimate in around 5 business days. HMRC estimates are time-sensitive and usually only work for a certain time.

The validity period for an HMRC valuation varies by scheme type. EMI valuations are valid for 90 days from the valuation date, while SIP valuations can remain valid for up to 6 months. Hence, responding promptly to the valuation results and executing any required measures within this span to guarantee adherence to HMRC regulations and guidelines is critical.

Why Choose Eqvista for HMRC Valuation?

- HMRC-approved methodology: Our valuations are built using HMRC-approved methodologies with comprehensive documentation to withstand scrutiny.

- Specialized Team with Professional Credentials: Eqvita’s internal valuation specialists hold recognized qualifications and have years of experience in UK share scheme valuations.

- 23,000+Business Trust Us: From seed- stage startups to established SMEs, we’ve delivered accurate, legally compliant valuations across every industry.

- Full support if HMRC challenges included in every valuation.

- Transparent, Competitive pricing and No hidden fees: We provide quality valuations at prices that work for growing companies.

FAQs

Do I legally need an HMRC valuation?

While not always legally required, obtaining a formal valuation is strongly recommended and often necessary to:

- Establish the correct exercise price for tax purposes

- Protect against HMRC challenges

- Give employees confidence in their option value

- Qualify for EMI tax advantages

What if HMRC disagrees with the valuation?

With our HMRC-approved methodology and thorough documentation, challenges are extremely rare. If HMRC does question the valuation, we provide full support, including:

- Detailed technical responses

- Additional supporting analysis

- Expert witness services if needed (additional fees may apply)

Can I do an HMRC valuation myself?

Technically, yes, but not recommended. HMRC valuations require:

- Knowledge of acceptable methodologies

- Understanding of marketability discounts

- Proper documentation and supporting evidence

- Professional credentials to withstand scrutiny

Do you offer rush services?

Yes. We offer 3-business-day priority service for an additional fee. Contact us and receive a priority service quote.

What if my company situation changes after the valuation?

Minor changes usually don’t affect validity. Major changes (new funding round, significant revenue changes, M&A activity) may require a new valuation. We offer discounted re-valuations for existing clients.

Get Your HMRC Valuation Today!

Hiring an HMRC valuation firm to determine your company’s worth will greatly reduce your risk exposure. Given the significance of obtaining a value and the associated expense, we have set our rates at extremely competitive levels to assist your business better.

Our competitive price and fast turnaround make compliance easy and affordable. We will assess your needs and explain which plans fit for your company. We offer quick turnaround times and accurate, audit-ready, cost-effective valuation services. Get your HMRC Valuation in 5 days.