What Future Events Trigger SAFE Conversion into Equity for Investors?

Start-up capital flows increasingly through Simple Agreements for Future Equity (SAFEs), yet many late-stage decision makers still misunderstand the moment at which those promises morph into real shares.

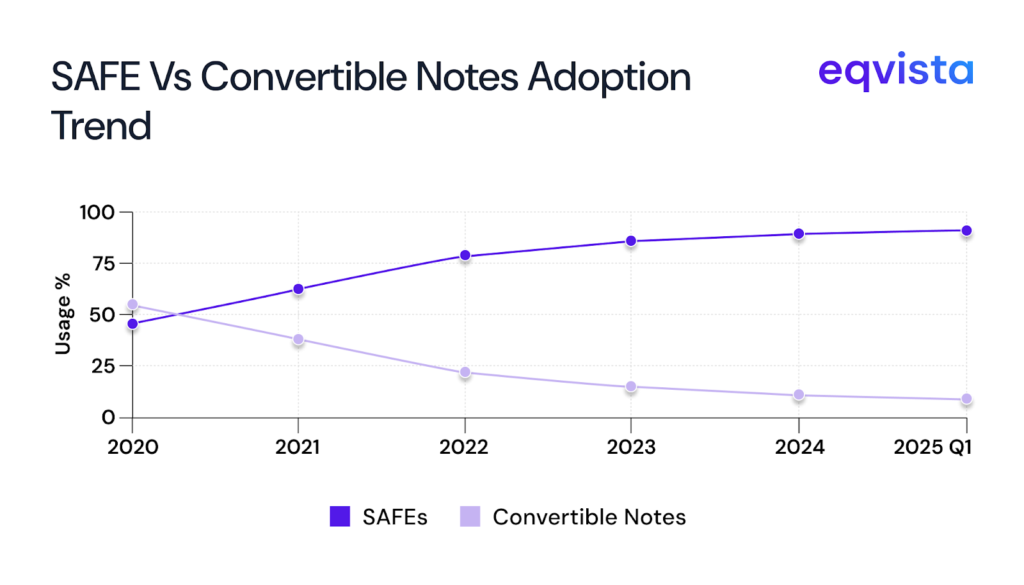

The investors and start-ups are increasingly favoring SAFEs in the pre-Seed investment ecosystem (which featured in 91% of Q1 2025’s pre-Seed deals) over notes. The vast majority of pre-Seed investments now utilize SAFEs over convertible notes.

A SAFE conversion triggers only when a contractually defined event occurs—no sooner, no later. Grasping the mechanics of those future events, and how different trigger pathways shape valuation, dilution, and exit economics, is therefore essential before investors wire funds or founders accept them.

SAFE Fundamentals at a Glance

A SAFE agreement is not debt and not equity; it is a contractual right to equity in the future. Unlike convertible notes, it carries no interest or maturity by default, simplifying documentation and slashing legal costs. Conversion math hinges on three levers:

| Lever | What it does | Typical ranges | Decision-stage question |

|---|---|---|---|

| Valuation cap | Sets a maximum price per share at conversion | US $3–$10 m seed caps | Does the cap fairly reward the early risk? |

| SAFE Discount rate | Gives a % reduction to the next round price | 10%–30% | Will the discount still be meaningful if the cap is high? |

| Pro-rata or MFN clauses | Preserve ownership or match later terms | Deal-specific | Am I protected against future dilution or better terms offered later? |

What Triggers Safe Conversion?

The moment your SAFE transforms from a promise into actual equity shares isn’t random—it’s contractually predetermined by specific SAFE conversion triggers written into the agreement. Understanding these triggers is crucial because each pathway leads to different ownership outcomes.

In the following sections, we will look at some of the key events that will trigger safe conversion.

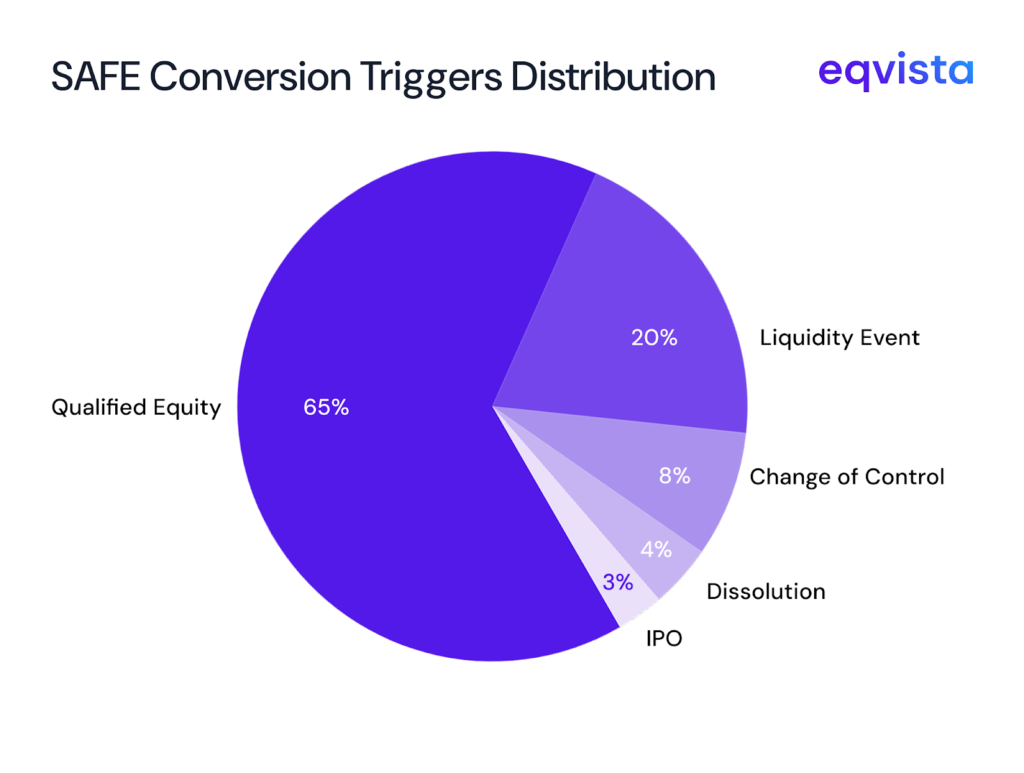

Qualified Equity Financing

The most common SAFE conversion trigger is the next priced round that meets a dollar threshold set in the SAFE (e.g., “≥ US $3 m”). Upon closing, it converts into the same class of preferred shares sold in that round, using the better of the valuation-cap price or the discount price.

Decision lens: Investors must ask whether the threshold is high enough to deter founders from engineering a tiny “priced round” merely to convert SAFEs cheaply, yet not so high that conversion drags indefinitely.

Liquidity Event

Liquidity events include mergers, acquisitions, and initial public offerings. In these cases the holder typically chooses between (a) cash equal to the purchase amount or (b) shares calculated at the liquidity price—often the cap divided by fully diluted capitalization. Post-money SAFEs contractually rank alongside non-participating preferred stock, junior to debt but senior to common shares.

Decision lens: In a high-value exit, conversion usually yields more upside; in a low-value fire-sale, cash-out may cap the downside. Negotiating clear payout elections upfront prevents misalignment at exit time.

Change of Control

A subset of liquidity, a change-of-control trigger kicks in when another entity acquires a controlling stake. Some SAFEs automatically cash out, others convert. Because control shifts can occur at values below venture-style exits, investors should model both pathways when assessing deal economics.

IPO

Although rarer for early-stage backers, an initial public offering is expressly listed as a trigger in standard YC templates. SAFEs usually convert into the class of common stock sold to the public, using cap-or-discount formulas. Investors lose liquidation preference but gain public liquidity.

Dissolution or Bankruptcy

If the company dissolves before any financing or liquidity event, SAFE holders become unsecured claimants entitled to whatever cash remains after paying creditors. Given that failed start-ups often have negligible assets, recovery rates approach zero.

Decision lens: Because this downside is non-trivial, professional angels often diversify or pair with redemption rights—though such add-ons blunt the “simple” spirit and may deter founders.

Optional Maturity Date

While classic SAFEs omit maturity, some issuers now add a hard-date conversion clause to placate institutional investors. On that date, the SAFE converts at a pre-set valuation (or the cap) even absent a priced round. This can unclog cap-table uncertainty but risks diluting founders unexpectedly if the company is still immature.

Pre-Money vs. Post-Money SAFEs

| Attribute | Pre-Money SAFE | Post-Money SAFE |

|---|---|---|

| Ownership clarity | Unknown until next round; each new SAFE dilutes earlier ones | Fixed ownership percentage locked on signing |

| Founder dilution after multiple SAFEs | Uncertain until conversion | Transparent upfront, but later SAFEs dilute founders only |

| Investor preference | Better for founders | Favoured by sophisticated angels & funds seeking certainty |

Decision lens: At the decision stage, founders must weigh transparency against dilution risk, while investors should align expected equity stakes with portfolio construction goals.

Strategic Implications for Decision-Stage Stakeholders

When SAFE conversion triggers finally fire, the numbers tell a story that spreadsheets alone can’t capture. Decision-stage stakeholders must look beyond theoretical scenarios to understand how trigger mechanics translate into real ownership.

Valuation Economics

- A low valuation cap or steep discount multiplies the equity stake when the trigger fires.

- Every additional SAFE agreement issued pre-financing chips away at founder ownership, particularly under pre-money forms. Tools like cap-table simulations on Eqvista can preview post-conversion scenarios before signing.

Control & Information Rights

Until conversion, SAFE investors hold no voting or board rights. Decision-stage buyers should therefore compare this with convertible notes or small-priced rounds if influence matters to their strategy.

Downside Risk

SAFEs lack debt-like seniority or interest; investor capital may evaporate in a dissolution. The SEC has repeatedly cautioned retail investors against assuming the word “SAFE” implies capital preservation.

Timing & Optionality

Absence of a maturity date keeps SAFEs off founders’ mental “clock,” which can postpone priced rounds and prolong ambiguity. Negotiating a conversion sunset or participation-rights side letter can rebalance incentives without reverting to full debt instruments.

Pre-Investment Checklist: Navigating SAFE Agreements with Confidence

Smart decision-makers treat SAFE agreements like complex financial instruments—because that’s exactly what they are, despite their deceptively simple name. This pre-commitment checklist helps ensure you understand not just what you’re buying, but exactly when and how it converts into actual ownership.

Making “SAFE” Decisions with Eqvista

For all their administrative elegance, SAFEs push genuine ownership into the future, and that future hinges on clearly enumerated conversion triggers. Decision-stage stakeholders must therefore look beyond the headline cap or discount and interrogate the contract’s trigger mechanics, liquidation waterfall, and cumulative dilution impact.

Eqvista helps with SAFE by providing an easy-to-use platform to create, issue, manage, and e-sign SAFE agreements digitally. Users can select shareholders, define note details, and assign executors to sign the agreements. The platform also allows users to see how SAFEs impact the cap table and dilution during funding rounds through its round modeling tool. This makes SAFE management streamlined, transparent, and integrated with equity and cap table management all in one place. Contact Eqvista Today to Learn more!