How do founders determine the valuation cap for SAFE notes?

Your convertible security’s valuation cap determines the highest price at which it can be converted into equity.

Founders often predict the maximum valuation for calculating the share price at which the investor’s money converts to equity is known as a valuation cap. While some exceptionally strong firms may be able to negotiate an uncapped SAFE or convertible note, one of the most compelling features of both types of notes is the valuation cap.

Valuation cap for SAFE notes

The most significant word for a convertible note or a SAFE is the Valuation Cap. In the subsequent fundraising, it entitles investors to stock valued at the lower of the valuation cap or the pre-money valuation. The value cap is a means for seed-stage investors to be rewarded for taking on more risk. Your convertible security’s valuation cap determines the highest price at which it can be converted into equity. To convert this to a share price, multiply the value cap by the series A valuation to convert this to a share price.

What is a valuation cap?

A convertible note cap sets the maximum value at which a convertible note investment can be converted into stock. A cap is applied to nearly all convertible securities. This is essential since the cap determines how much an investor’s shares are worth. If the valuation falls below the cap, the convertible note investment will convert to stock at the price of the priced round. If the valuation exceeds the cap, the convertible note investment will be converted to the amount stated by the cap. In this situation, the investor receives compensation for their earlier investment in the company.

How does the valuation cap work?

Convertible notes and SAFEs are subject to a valuation cap. A convertible note is a capital-raising instrument that functions as a debt in the form of a firm loan. When a trigger event occurs, it changes into shares in that company. A SAFE is a capital-raising vehicle in which an investor’s investment is converted into shares when a future financing round occurs. Convertible notes and SAFEs are both structured to convert to stock in the event of specified trigger events, most typically the next round of funding. Both instruments often have investor-friendly terms such as a discount and a valuation cap. If no valuation cap or markdown is offered, the instrument converts to stock at the current price.

Why does a business need a valuation cap?

A value cap also safeguards investors from receiving unduly low equity conversion percentages in future valuation rounds. Sophisticated investors usually require a cap; without one, their stake will be diluted if the company’s value begins to surge. Valuation caps encourage investors to invest in new enterprises early on. As previously stated, if the valuation cap, for example, is half the value of a startup or firm at the time of the next fundraising round, the investor will receive twice as much stock in exchange for their investment.

What is a SAFE note?

A SAFE (simple agreement for future equity) is a financial contract that a company can use to raise money during its early fundraising rounds. Some regard it as a more entrepreneur-friendly alternative to convertible notes. A SAFE is a type of investment contract between a startup and an investor that gives the investor the right to buy a stake in the company in the event of certain triggering events, such as additional equity funding or the sale of the company.

Important key terms of SAFE notes

Startups widely use SAFE (simple agreement for future equity) notes to raise seed capital. A SAFE note is simply a legally enforceable promise to allow an investor to buy a certain number of shares at a specific price at a later date.

- Valuation cap – A valuation cap is a limit on how much a SAFE can be converted to equity ownership in the future. It’s the maximum price at which an investor can convert a SAFE to stock: a predetermined amount that “caps” the conversion price once shares are issued.

- Discounts – The discount entitles them to convert their investment at a lower price than what the following round’s equity investors will pay. For example, if your next round’s price per share is $1, with a 20% discount, early investors will pay 80 cents for their shares.

- Pro-rata rights – If the company raises another round or rounds of financing, pro-rata rights allow the SAFE investor to buy more shares in the company. Only once the SAFE has been converted into preferred shares of the company during the equity financing may these rights be exercised.

- Most favored nation provision – A most favored nation clause (also known as a most favored customer clause or most favored licensee clause) is a contract condition in which a seller (or licensor) pledges to provide the buyer (or licensee) with the best terms it offers to any other buyer (or the licensee).

How do valuation cap SAFE notes work?

Simple Agreement for Future Equity (SAFE) is an acronym for Simple Agreement for Future Equity. It was founded by the Y Combinator team and has become a popular way to invest in startups at an early stage. Because there is usually relatively little data at the early stages of a startup, it can be difficult to assign a value to the company appropriately. That’s where a SAFE comes in: it’s a type of convertible security that allows you to defer the valuation process until later. There is no interest or maturity date on a SAFE, and it is neither debt nor equity.

Determine valuation cap for SAFE

The SAFE discount is derived by dividing the valuation cap by the typical equity financing valuation and then removing that value from one (representing no discount). In this case, $2 million / $4 million = 0.5 and 1 – 0.5 = 0.5 would be the mathematical representations.

How do founders calculate the valuation cap for SAFE?

Checks from interested investors can be easier to close with SAFEs. A SAFE is designed to let you close a deal on the spot, unlike traditional venture capital rounds, which need founders to recruit lead investors or potentially wrangle many VCs into the same round. The value cap is usually the only thing you’ll need to negotiate on a SAFE. Valuation caps can be established based on how much risk an investor is willing to take on with a SAFE—factors such as a proven product or incorporation can help to mitigate that risk.

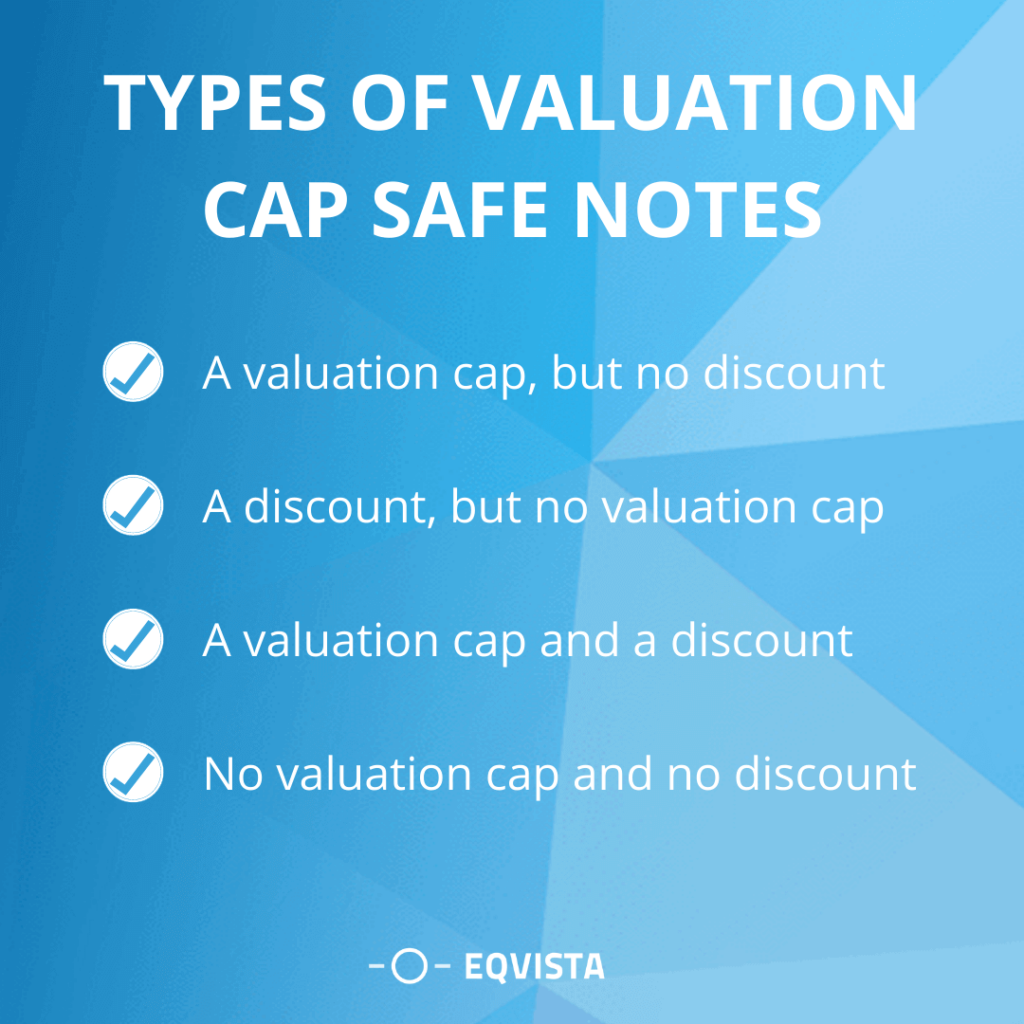

Types of valuation cap safe notes

There are various types of valuation safe cap notes which are used to analyze the capital market price and its use. They are further explained below:

- A valuation cap, but no discount – A safe was purchased for $100,000 by an investor. The Discount Rate is 85% and the Valuation Cap is $8,000,000. The company has agreed to offer $1,000,000 of Series A Preferred Stock to investors at a pre-money valuation of $10,000,000. The company’s fully-diluted outstanding capital stock, including a 1,000,000 share option pool to be adopted in connection with the financing, was 11,000,000 shares immediately prior to the financing.

- A discount, but no valuation cap – The deal terms are a convertible note or a SAFE with a 20% discount and no valuation cap. Any option that does not include a valuation cap is referred to as an uncapped note or SAFE. It has no bearing on early-stage investors. There might be a case where a discount might be there without any valuation cap.

- A valuation cap and a discount – When it comes time to convert, convertible securities usually carry a discount that can be applied to the future valuation. A value cap sets the highest price that can be utilized to set the conversion price. The investor can take advantage of either the discount or the value cap at the moment of conversion, whichever is more advantageous. A discount, a valuation cap, both, or neither can be included in a SAFE. However, it is unusual for any of them to be missing, as this would deter investment.

- No valuation cap and no discount – Valuation caps can be inconvenient since they add another layer of complexity to the process. One of the advantages of selling a convertible note rather than stock is that you don’t have to determine the company’s valuation. If the cap is designed to represent the company’s current value (a common, albeit inaccurate, investor viewpoint), the founders have failed to postpone the valuation negotiation at all. The founders will probably become bogged down in the process.

Pros and cons of SAFE notes

Both SAFE and convertible notes are viable solutions, and there are compelling reasons to utilize one over the other. When looking for seed money, it’s always advisable to go with the most popular alternative in your neighborhood so that investors feel at ease.

Pros of SAFE Notes

The following are some of the advantages of SAFE notes:

- A SAFE note is much easier to understand than a convertible note. It is a five-page document with no end date or interest. You might even be able to comprehend and draft one without the assistance of a lawyer. It will be basic, with obvious benefits and drawbacks.

- SAFE notes, unlike other investments, do not necessitate extensive negotiation. Valuation caps are mentioned from time to time, but that’s it.

- SAFE notes, like other convertible instruments, wind up on the capitalization table of a corporation.

- Early exits, changes in control, and even the collapse of a corporation are still covered by SAFE notes. Investors will benefit from provisions such as discounts and valuation restrictions.

Cons of SAFE Notes

There are certain dangers in using SAFE notes. Some entrepreneurs have attempted to raise funding via mini-rounds using this structure. The disadvantages, on the other hand, are a bit concerning:

- SAFE notes aren’t government-issued debt instruments. This indicates that there’s a probability they’ll never convert to equity and that payback isn’t necessary.

- To provide SAFE notes, a firm must be incorporated, and many startups are limited liability companies (LLCs). That means that before a company can issue SAFE notes, it must first go through the incorporation process, which may need the hiring of an attorney.

- Because SAFE notes are relatively new, lawyers and investors are unfamiliar with them. Convertible notes have a longer track record and may be more appealing to investors.

- SAFE notes may necessitate a proper assessment (409a). Professional services may need a portion of a company’s budget, leaving less money for product development.

How do businesses run SAFE rounds?

SAFE investors receive discounted future stock as a reward for investing in your company’s early potential. They also have the opportunity to negotiate a value cap, which is a ceiling on your startup’s worth that will be used to determine a SAFE investor’s future equity. Some founders assign a separate valuation cap to each SAFE investor based on the value they’re bringing, while others stick to a single valuation cap per round of SAFEs to make computations easier.

Importance of having the safe notes structured properly

A SAFE gives the buyer the option to buy a specific number of shares during the subsequent fundraising. The SAFE investors would pay less for their shares than the Series A investors because they are investing sooner and taking on greater risk than later-stage Seed or Series A investors. How much of a discount the SAFE investors receive is determined by the Valuation Cap and Discount Rate. While the discount and cap numbers provided above give an idea of the company’s worth, the startup can cut out the formality of valuation and expensive legal expenses to hasten the purchase negotiating process.

How do safe notes affect the 409a valuation?

A “valuation cap” allows note holders to convert the outstanding amount on the note into stock shares at the lower of I the valuation cap or (ii) the price per share in approved financing (or, if there is a discount in the note, then the discounted price per share). It is not a corporate value based on the firm’s present expectations or assets. Its purpose is to guarantee that an investor does not miss out on significant company appreciation between the sale of convertible notes and the qualifying financing.

However many founders don’t know a good estimate for their valuation cap, so they conduct an outside valuation to set the cap for their investors.

How does getting a Valuation help to negotiate with the investors?

The main factors influencing are:

- Investments – Before you start generating income, your most recent fundraising round and the price investors paid will frequently be a significant factor. Your valuation will increase when your business’s value rises.

- Industry – Industries with rapid growth will get higher value. Because firms in the fintech, biotech, and artificial intelligence sectors have such great growth potential, these sectors will demand substantially higher values.

- Projections – Since appraisals are meant to endure for a year, your valuation company should include information on your business’s financial projections, cash flow, and objectives for the following year. Your valuation will increase as your estimates become more accurate. Your projections are the only one of these three metrics that you can influence.

Get a Valuation to help set up a valuation cap for your SAFE notes with Eqvista!

Investing in convertible notes gives you the chance to convert the principal and accrued interest into equity at a later date. This gives the investors the same level of financial risk as an equity investment while allowing the first transaction to be executed more quickly and with lower legal costs for the company at the time. To put up a valuation cap for your SAFE notes, Eqvista can assist you with a 409a valuation.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!