What Are the Long-term Risks of Artificially Inflating or Skewing Ownership Percentages?

Priorities spiraling out of alignment is a reality that most business partners don’t anticipate or underestimate. When this occurs, stakeholders may consider buyouts as a solution. This helps preserve business relationships and avoid prolonged legal disputes.

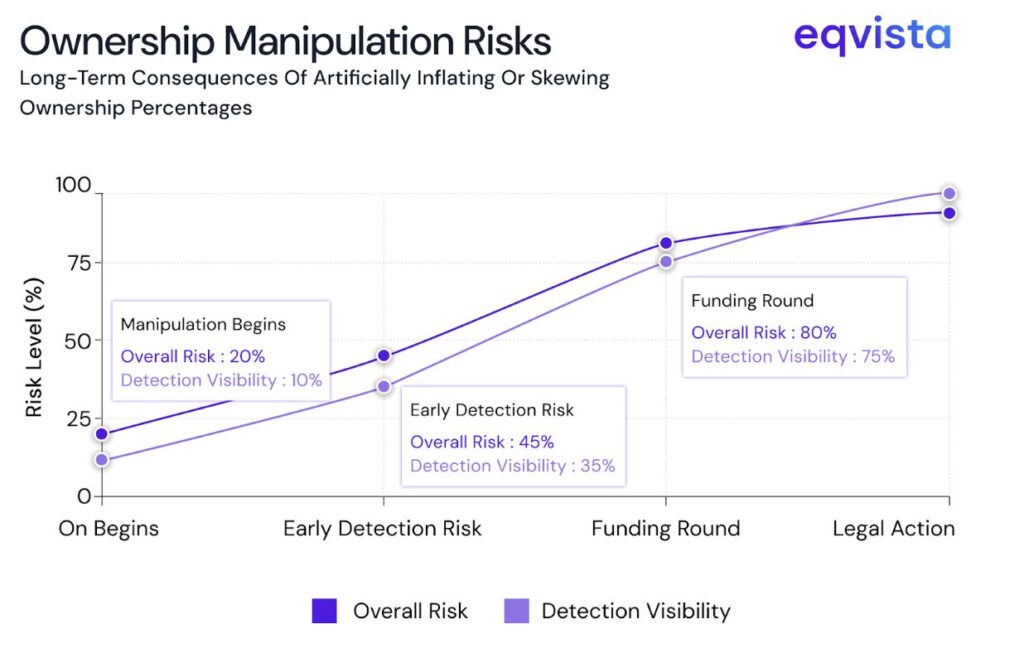

However, when buyouts are not feasible or excessive, some may resort to manipulation of ownership. From aggressive stock-based compensation plans and misuse of proxy voting rights to misrepresenting ownership structures, there are several ways to manipulate ownership.

However, these practices carry significant legal and regulatory risks. The fines can range up to hundreds of thousands of dollars, but the damage to reputation and relationships can often prove far more costly.

In this article, we will explore the long-term consequences of ownership manipulation from a cautionary perspective.

Key takeaway: Ownership manipulation may seem like a quick fix to alignment issues, but it creates cascading risks that become exponentially harder to manage over time. The reputational and legal damage far exceeds any short-term benefits, particularly when companies cross SEC registration thresholds.

The Importance of Accurate Ownership Reporting

Accurate ownership reporting goes beyond administrative necessity. While private companies often focus on maintaining internal harmony and growth, the consequences of ownership manipulation can quickly lead to compliance violations, reputational issues, and business setbacks.

Understanding the regulatory frameworks and risks tied to shareholder disclosures is essential for any founder or stakeholder seeking long-term success and credibility.

SEC scrutiny

Even if your company is private, it must register with the Securities and Exchange Commission (SEC) if its total assets are more than $10 million and it has more than 2,000 investors or 500 non-accredited investors. The 500 non-accredited investor threshold can be easily crossed by startups that leverage stock-based compensation and have high attrition.

Once you cross this threshold and register with the SEC, in addition to other reporting requirements, your beneficial owners will need to report their shareholding under Section 16 of the Exchange Act.

If you manipulate ownership and intentionally miss these filings, the SEC could impose sanctions ranging from $77,000 to $750,000.

Friction with other stakeholders

A party may engage in ownership manipulation when it knows that its priorities do not align with those of other stakeholders. Such parties would need to secure board positions to ensure that the company’s direction aligns with their needs.

However, such manipulation has a critical flaw. It is bound to be discovered during annual general meetings or any other opportunities for other stakeholders to request changes to board composition. When such manipulation is discovered, other stakeholders would want to remove the bad actor.

Taking advantage of the proxy voting rule is one way in which someone may try to manipulate board elections. In the context of startups, this may involve an investment advisor voting against the interests of its clients or some other party soliciting investment advisors to do so.

Back in 2009, the SEC imposed penalties of $350,000 on INTECH and David E. Hurley, the then COO and executive VP of INTECH, for violating a proxy voting rule.

Funding round complications

A startup whose ownership is being manipulated cannot afford to disclose its cap table in funding rounds. Existing investors who wish to reinvest may become enraged after discovering the manipulation.

Experienced investors will always be skeptical of a deal if the startup is not transparent about its ownership. They would know that the cap table holds insights about potential dilution, which impacts the overall return on investment.

To get around this roadblock, the startup would have to fabricate a cap table that aligns with the presumptions of the existing and incoming investors. Also need to revisit its prior communication with all the stakeholders to understand if such a fabrication is even possible in the first place.

If such startups decide to continue with ownership manipulation, they will simply be inviting lawsuits in the future.

Inability to hire talent

Founders can manipulate ownership by paying themselves extremely high amounts of stock-based compensation without stakeholder approval. When this practice comes to light, other stakeholders are bound to have a negative view of stock-based compensation.

This will create opposition to the adjustment of stock option pools, directly affecting a startup’s ability to attract top talent. Since startups often rely on stock-based compensation to remain competitive with organizations that can offer higher cash packages, limiting such pools would significantly weaken their ability to recruit key talent.

Another disadvantage is that, once the existing grants are exhausted, the startup will not be able to issue new grants, limiting its ability to retain key employees.

Eqvista- Facilitating accountability through transparency!

The best way to combat ownership manipulation is to maintain equity-related data centrally. However, this often increases the risk of leaking sensitive information. Hence, companies need a cap table solution like Eqvista that maintains ownership data centrally while also allowing you to control viewing and editing access.

In addition to access control, our platform offers various tools and services, such as round modelling and 409A valuations, that can significantly lighten your governance and compliance burden. Contact us to know more!