Meta shareholders from Start to IPO

On May 18th, 2012, Meta, formerly called Facebook, was listed under the FB ticker. The IPO of Meta came at a time when networking companies were witnessing spectacular interest from the market at large. Case in point, LinkedIn was listed in 2011 and witnessed a stellar first-day move of 109% gain. Other social media players like Renren (a social media platform in China) witnessed strong investor interest as well.

Obviously, Meta was in a different league. It had reported 845 million monthly average users as of December 31st, 2011, a growth of 39% from the previous year. It was witnessing a 48% DAUs growth. Growth was firing on all cylinders, with advertising making up for 85% of its revenue and the other 15% comprising the payments platform, generated by users purchasing virtual goods in-game.

The Early Years: Foundation and Vision of FB (2004-2011)

Meta was incorporated in July 2004 and was quick to generate a lot of interest from VCs.

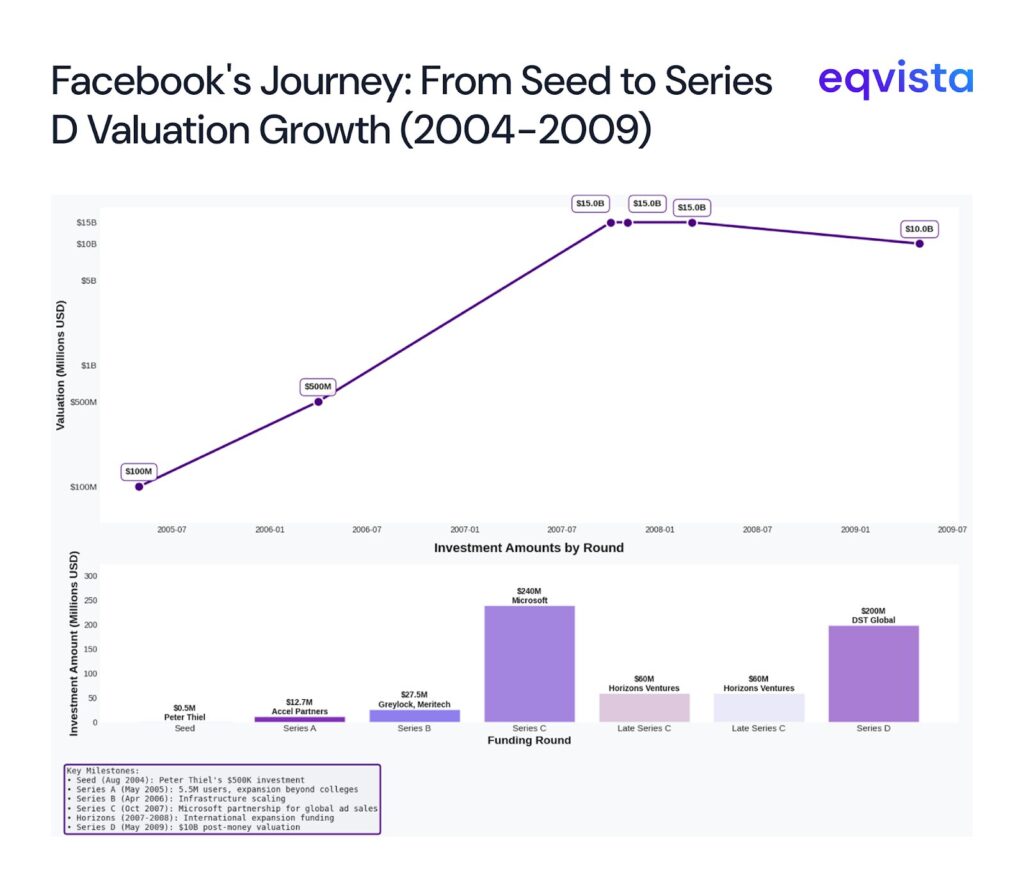

Funding Highlights of Meta (Source: Crunchbase)

Meta Funding Timeline

- Peter Thiel invested $500K in the seed stage (August 2004).

- Series A was raised in May 2005 for $12.7M by Accel Partners at an estimated valuation of $100M.

- Then Facebook had about 5.5 million users, and the funding allowed it to expand beyond the college crowd.

- Series B was raised in April 2006 for $27.5M by Greylock and Meritech Capital Partners, valuing the company at $500M.

- The funding was for scaling and funding infrastructure for growth.

- Series C saw Microsoft taking a 1.6% stake by infusing $240M (October 2007), valuing the business at $15B.

- Microsoft’s small equity stake came with an exclusive global ad-sales partnership.

- Li Ka-shing’s Horizons Ventures invested in two tranches — $60M in November 2007 and another $60M in March 2008.

- Funds were raised for international expansion.

- Series D was raised through DST Global at a $10B post-money valuation (May 2009).

Apart from this, Meta also raised $100M debt from TriplePoint in May 2008.

Going Public: The Historic 2012 IPO

Meta listed itself on the NASDAQ Global Select Market. It came out for an offer price of $38. It was then the largest tech IPO in US history, valuing the business at $104B. Upon listing, the stock rose 12% immediately but erased all the gains and ended up closing flat.

Key IPO Details

On Feb 1, 2012, Facebook, Inc. filed its S-1 registration statement. This IPO was underwritten by

- J.P. Morgan Securities LLC

- Morgan Stanley & Co. LLC

- Goldman, Sachs & Co.

- Merrill Lynch, Pierce, Fenner & Smith Incorporated

- Barclays Capital Inc.

- Allen & Company LLC

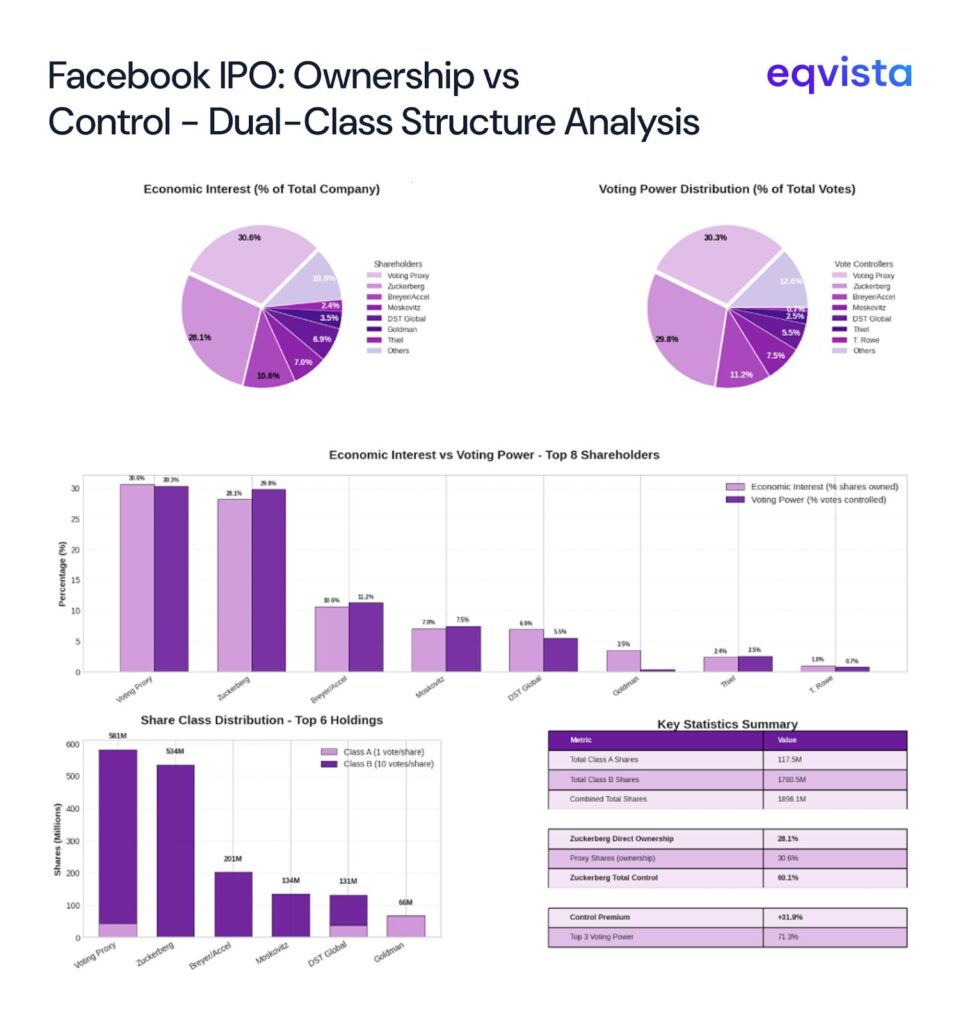

In March 2012, Meta’s ownership structure was as follows:

Meta Pre-IPO Ownership Structure (Source: S-1 Filing)

Zuckerberg owned the majority of the voting rights (60%) pre ipo despite owning 28% of the economic interest in the business.

Just before the IPO, there were a few transactions, as highlighted below, that resulted in outstanding shares reaching 2.1B.

| Stage | Class A 2012 (pre-IPO) | Class B Shares | Total Share Outstanding |

|---|---|---|---|

| Mar 31 2012 (pre-IPO) | 117.5 M | 1.780 B | 1.898 B |

| Zuckerberg exercise & conversion | +30.2 M | -30.2 M | — |

| Other holders converting to sell | +211 M | -211 M | 1.898 B |

| New Class A issued by company | 180 M | — | |

| Post-IPO total | 635.9 M | 1.502 B | 2.138 B |

Meta Post IPO Ownership Structure (Source: S-1 Filing)

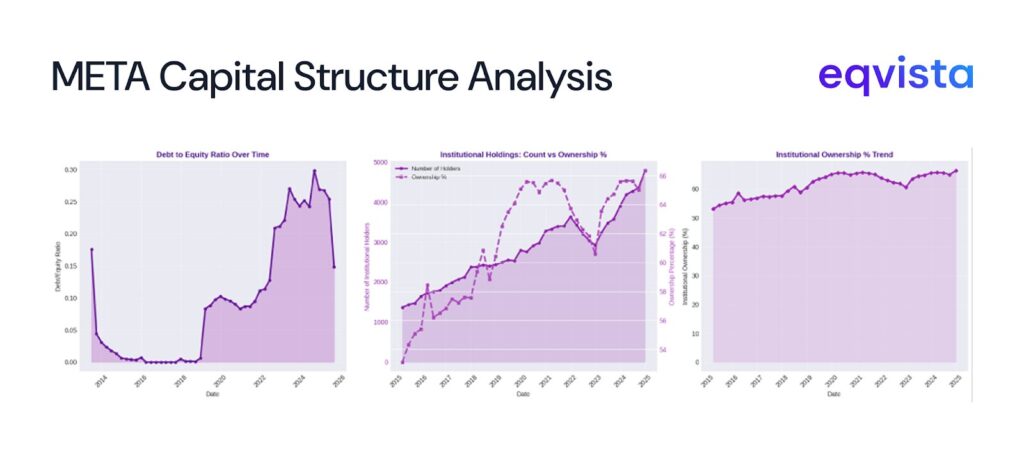

META Capital Structure

Debt to Equity and Institutional Holding (Source: Financial Modelling Prep)

In July 2013, Meta had a debt-to-equity ratio of 0.18 . This number is computed on a gross basis. On a net basis, Meta had negative debt (cash> debt). However, in the past few years, this has changed.

Since 2022, Meta has raised $66B in debt to rocket its AI endeavors. In August 2022, it raised $10B from QIBs, in August 2025 it raised $26B via SPV backed by PIMCO and $30B bond issuance in October 2025 underwritten by Citigroup Global Markets Inc and Morgan Stanley.

Top 20 Institutional Holders of Meta as of Q3 2025

Institutional Holders as of Q3 2025 (Source: Financial Modelling Prep)

Institutional holding in Meta has been on a steady uphill. In March 2015, the number was 53% and this has climbed to 66% by the end of last year.

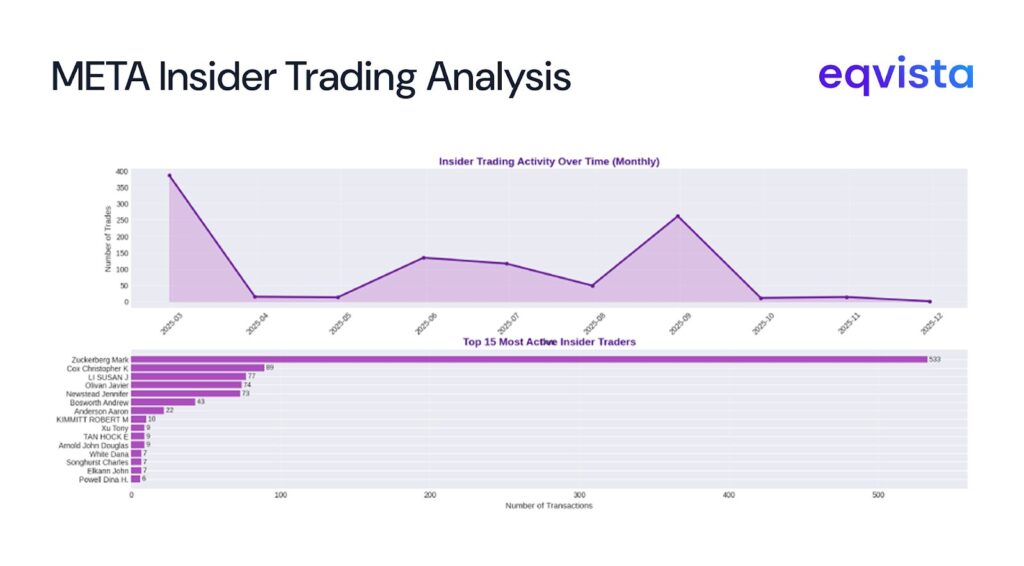

Insider activity over the past year (Source: Financial Modelling Prep)

Insider activity in Meta has seen some spikes in the past couple of months, showcasing that the company is going through an interesting time.

Current Market Position and Financial Performance

Meta reported a quarterly revenue of $51.2B up from $1.1B at the time of IPO, CAGR~35%. In the same time frame, the market value of the company rose CAGR~24% (absolute gain of 1500%+).

It currently earns 98% of its revenue from advertising and has been making heavy investments in the reality labs, where, to date, they have lost $73B.

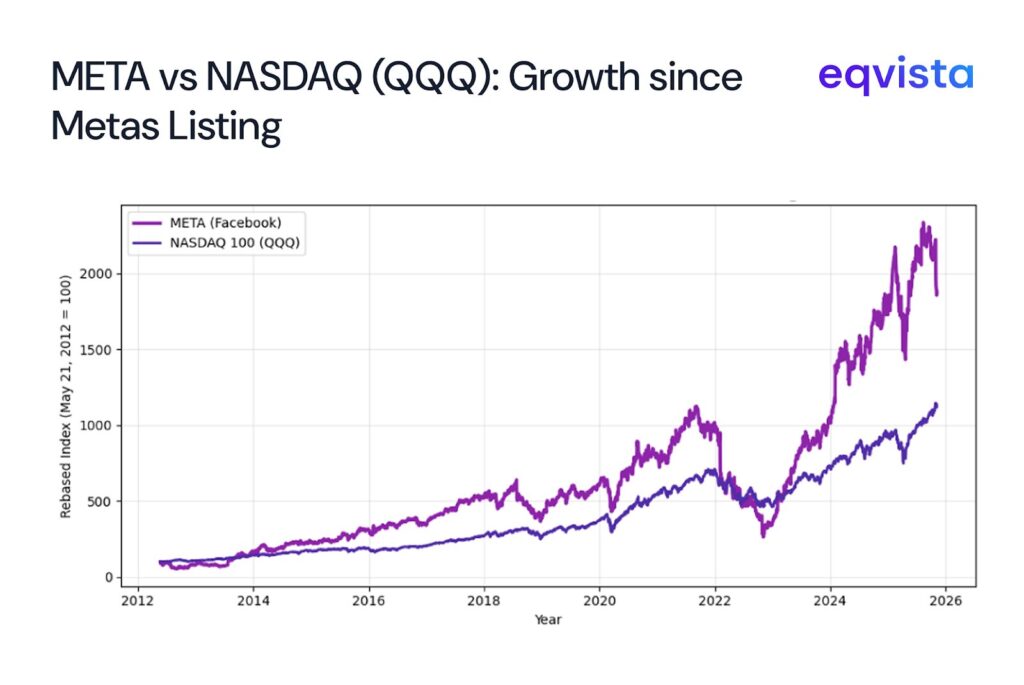

Relative growth of Meta vs Nasdaq (Source: Yahoo Finance)

If we compare with the Nasdaq 100 $QQQ, we witness that Meta has been a superior performer since its ipo days.

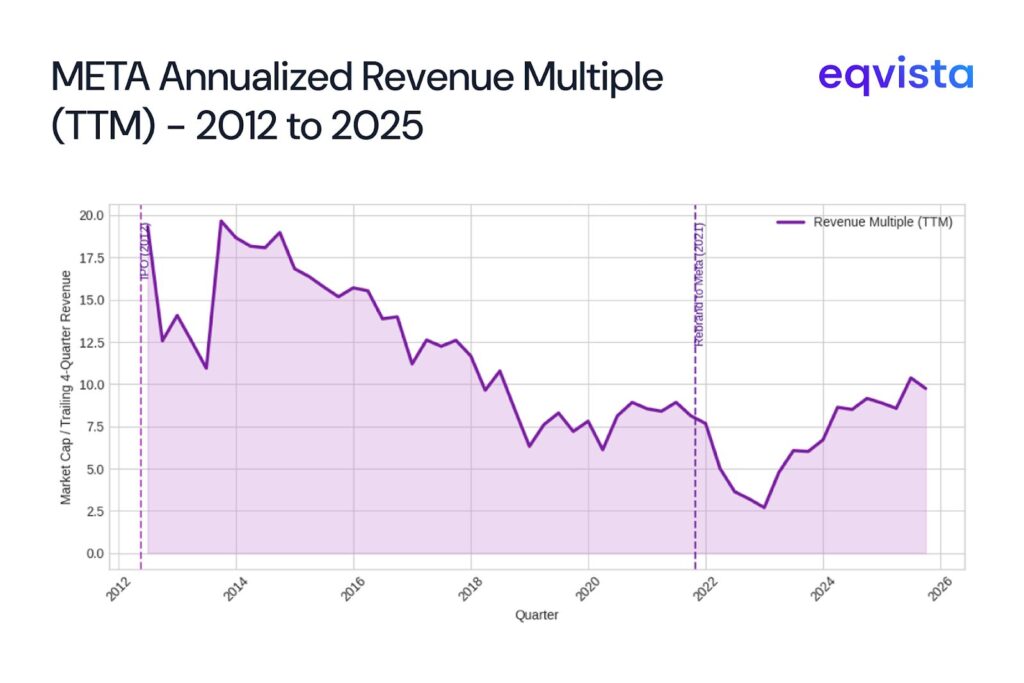

Meta Historical Revenue Multiple (Source: Yahoo Finance and Financial Modelling Prep)

Further, the faster revenue growth than market value explains why the revenue multiple over time has contracted. In fact, upon running a regression between the correlation of revenue and market capitalization, we find that the stock price movement was not explained at all by revenue growth.

Operating margin was the only variable that was able to showcase a statistically significant positive correlation with market capitalization. Meta currently boasts the highest operating margin in the global advertising industry — 43% — even while absorbing substantial losses from its Reality Labs division. Alphabet trails at 32%, while peers like Naver and Kakao lag far behind, and Snapchat remains unprofitable. Few comparisons capture the strength of Meta’s business model better than this.

Furthermore, it is fascinating to highlight that R&D spending is higher in Meta today than in its pre-ipo days. In 2011, Meta spent 10.45% of revenue on R&D; this number has grown to 29%!

Mapping the Dollars

At the year ending 2011, Meta reported 55% of its revenue from the US and 45% from the rest of the world. This has changed modestly.

Currently, 44% of Meta’s revenue comes from the US and Canada combined, 23% from Europe, 20% from the Asia Pacific, and 13% from the rest of the world.

Key Success Factors of Meta and what likely lies ahead

Meta continues to benefit from digital advertising via its apps (Facebook, Instagram, and WhatsApp Messenger). It enjoys strong user engagement and has improved its ad targeting efficiency. It has been able to demonstrate a strong moat in its business model. Recently, it raised its advertising prices, but user numbers have grown despite the same.

The risk to Meta is that if the AI investments fail to yield results, then it doesn’t have a very strong engine of growth propelling it ahead.

Take control of your cap table before the IPO

From a dorm room dream to a trillion-dollar empire, Meta’s trajectory reads like the poetry of modern capitalism- where attention became currency, and data the new divine. Yet its race in AI could test whether the company that has mastery over connections can conquer the frontier of cognition. In the past, Meta repeatedly tried to make physical and consumer-facing products but failed commercially or remained very niche.

Now, as it pours billions into AI and the metaverse, Meta is seeking to transcend the very boundaries that have long constrained it.

The question is no longer whether Meta can connect the world, but whether it can understand it — and if it succeeds, it may not just build another product but forge a creation that rivals the very idea of Facebook itself.

If you are planning a funding round, secondary transaction, or eventual IPO, book a free consultation with Eqvista’s team or create your account today to start managing your shares and valuations in one place.