Implications of Rule 701 for ESOP Administrations and Cap Table Management

Rule 701 allows companies to issue stock-based compensation without triggering the need to register with the Securities and Exchange Commission (SEC) under the Securities Act of 1933. This is a very important exemption since the US regulatory framework places immense reporting responsibilities on registered companies.

As an ESOP administrator, to qualify for Rule 701 benefits, you must ensure compliance with certain requirements related to plan eligibility, value of securities issued, and disclosures to recipients and investors.

In this article, we will review all Rule 701 requirements and suggest relevant ESOP management best practices.

How should ESOP administrators ensure compliance with Rule 701?

The following four factors form the cornerstone of Rule 701 compliance:

Managing the value of securities sold

To qualify for Rule 701 benefits, you must ensure that the maximum value of compensatory securities in any consecutive 12-month period does not exceed the greatest of:

- $1 million

- 15% of your total assets

- 15% of the outstanding securities of the class being issued

So, effectively, you can issue a minimum of $1 million worth of stock-based compensation in any consecutive 12-month period.

Disclosure requirements

You must share a copy of the compensation plan with your investors. Also, once the aggregate sales in any 12-month period exceed $10 million, you must provide the following disclosures to investors:

- Plan description: If the Employee Retirement Income Security Act (ERISA) covers the plan, you must share the summary plan description. If not, you must share a description of the material terms of the plan.

- Risk information: Explain the risks of investing in the securities being offered through the compensation plan.

- Financial statements: You must share up-to-date financial statements no older than 180 days. If you rely on your parent company’s assets to calculate the sales limit, then you must also provide your parent company’s financial statements. If your company is a foreign company, its financial statements must be reconciled to US GAAP standards unless they are already being prepared as per US GAAP or IFRS standards.

- Timing of disclosure for special securities: For stock options or other derivative securities, you must make the disclosures reasonably prior to exercise or conversion. For deferred compensation or similar plans, you must make the disclosures reasonably before the irrevocable election to defer is made.

Managing plan eligibility

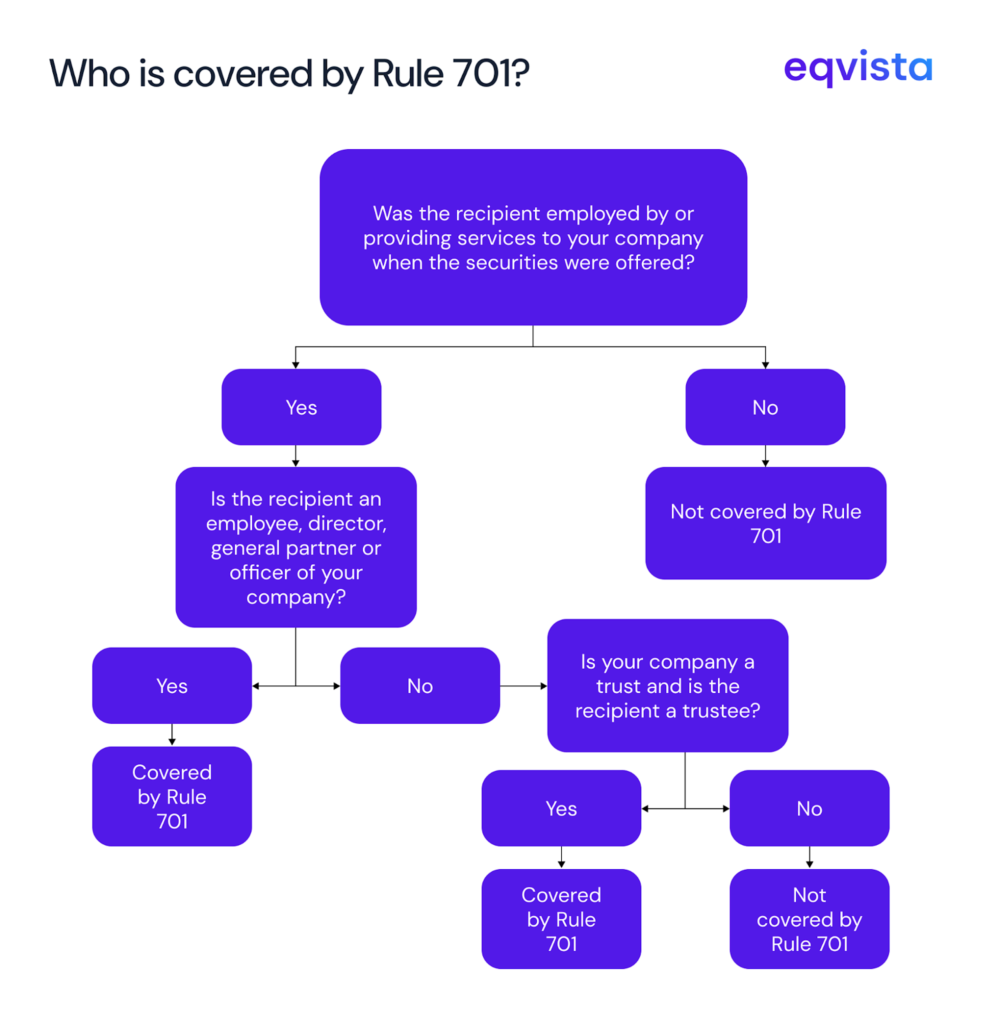

You can use the Rule 701 exemption to issue securities to employees, directors, general partners, officers, or consultants and advisors. Certain special provisions of this rule are as follows:

- Trustees: The exemption is applicable to trustees if the issuer is a trust.

- Family members:Family members of the abovementioned parties are covered if they receive such securities via gifts or domestic relations orders.

- Parties formerly associated with the company: The exemption applies to parties formerly associated with your company if they were employed by or providing services to your company when the securities were offered.

- Eligibility requirements for consultants and advisors: Securities offered to consultants and advisors qualify only if the recipient is a natural person who provides bona fide services unrelated to capital-raising or promoting the company’s securities.

- Exclusive insurance agents: Exclusive insurance agents of the company or its affiliates who earn more than half of their annual income from these entities are also covered under the exemption.

You can refer to the following decision tree to understand if Rule 701 would cover a particular recipient or not:

Calculation of aggregate sale price

To understand if you qualify for Rule 701, you must calculate the aggregate sale price in accordance with the following principles:

Non-cash considerations should be valued as per genuine transactions of said consideration, or its fair market value (FMV).

Options must be valued as of the grant date based on the exercise price.

Other securities must be valued as of the sale date.

Deferred compensation must be valued as of the date on which the irrevocable election to defer is made.

The value of services exchanged must be measured based on the value of securities issued.

Calculation of outstanding securities must include all currently exercisable or convertible options, warrants, rights, and other securities.

Calculate the amount of securities sold as shares or units that people would receive if they exercised or converted their options, warrants, rights, and other exercisable or convertible securities, including those issued under Rule 701.

Under the existing regulatory framework, amounts issued under Rule 701 don’t reduce the limits available under other exemptions, and amounts issued under other exemptions don’t reduce the limits available under Rule 701.

ESOP administration best practices for Rule 701 compliance

The following ESOP administration best practices will help you qualify for Rule 701 benefits:

- Use your cap table software to monitor securities sold in the past 12 months and set automated alerts to stay informed as you approach the Rule 701 threshold.

- Limit participation in compensation plans to employees, directors, officers, certain consultants, advisors, and trustees, and qualifying family members.

- Leverage the software or 409A valuation services to automatically calculate and update the aggregate sale price.

- Maintain updated copies of the compensation plan in the cap table data room.

- Begin preparing recipient disclosures before the $10 million limit is crossed.

Eqvista- Swift and simplified compliance support!

As an ESOP administrator, in the context of Rule 701 compliance, your primary responsibility is to confirm which classes of equity qualify for the exemption and whether the company itself is eligible. At Eqvista, you can easily review your eligibility criteria and determine the maximum number of securities that may be issued under Rule 701. Contact us to know more!